- Charts of the Day

- Posts

- A weak job number and disappointing tech earnings.

A weak job number and disappointing tech earnings.

The data spells a pretty dramatic slowdown.

Subscribe to receive these charts every morning!

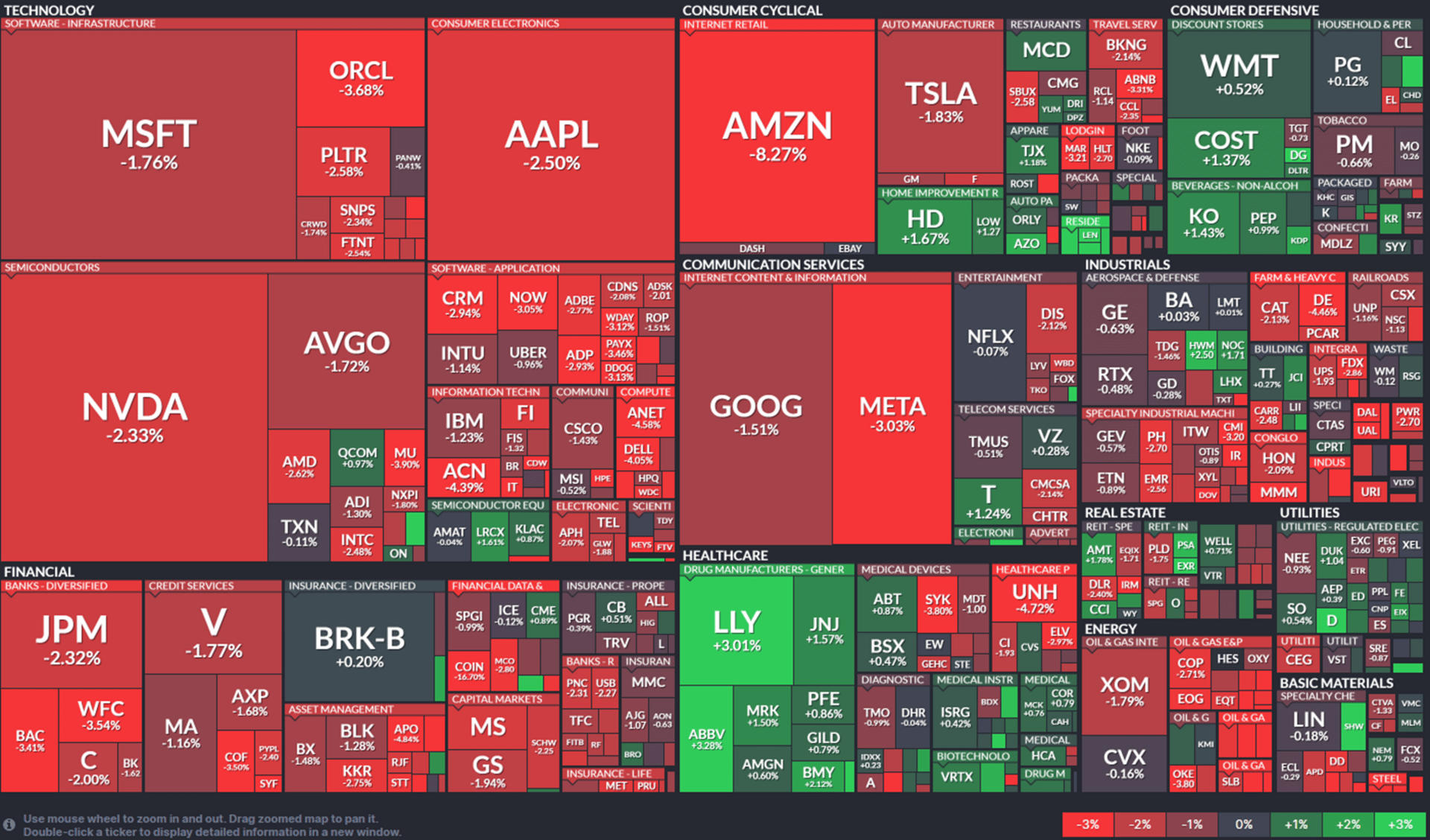

1. The job market is much weaker than expected and Amazon earnings failed to excite investors.

Huge drops in tech sent the Nasdaq lower, and yields fell in the short term.

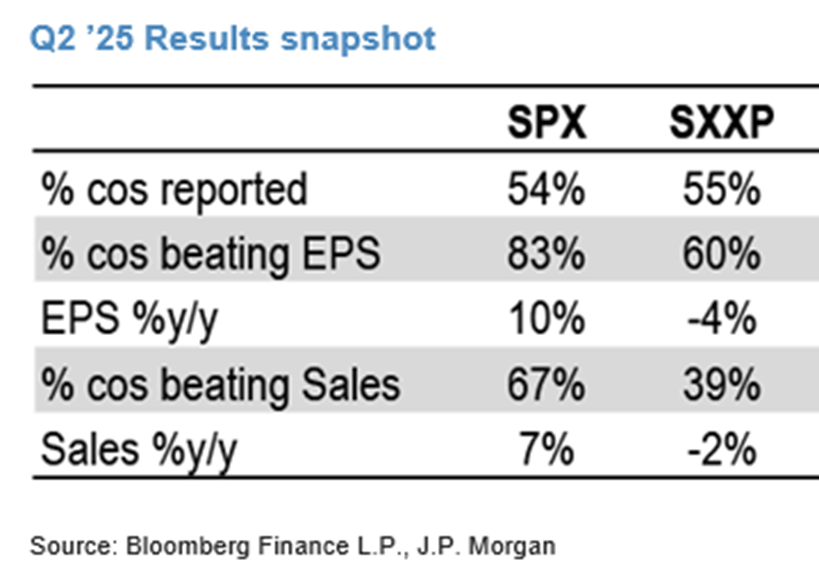

2. More than half of the companies have reported in the US and in Europe.

Earnings growth is coming in stronger than consensus expected, at +10% y/y in the US, and -4% y/y in Europe, with a positive surprise factor of 7% and 3%, respectively.

However, this was expected given the low hurdle rate entering the reporting season.

3. August-September is typically the worst stretch in the calendar for European stocks, based on average moves going back 30 years.

4. No surprise, the S&P 500’s high P/E is skewed by a bunch of megacaps.

5. The state of the cloud infrastructure market.

Google Cloud (GCP + Workspace) grew 32% Y/Y (vs. 28% Y/Y in Q1).

Microsoft Azure grew 39% Y/Y (vs. 33% Y/Y in Q1).

AWS (Amazon) grew 17% Y/Y (unchanged).

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply