- Charts of the Day

- Posts

- After black Friday comes red Monday.

After black Friday comes red Monday.

Nvidia was falling after another "circular" spending splurge on a strategic partner.

Subscribe to receive these charts every morning!

1. Europe’s lower exposure to the artificial intelligence trade is interesting at a time when there’s chatter about a US technology bubble.

“Europe is in a very nice place at the moment,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers. “Whenever there are doubts about the US rally, Europe is here to protect you because basically it’s not loaded with tech.”

Also, Europe remains relatively cheap even after this year’s rally. The Stoxx 600 trades at a 35% discount to the S&P 500, so even a small rise in earnings after near zero growth in 2025 could be enough to carry the market to fresh peaks.

2. Barclays is upgrading mining stocks.

The metal demands of the energy transition and tight supplies have turned mining stocks into a “must-hold” for investors. Demand for metals key to the energy transition — such as aluminum and copper — is becoming structural, making these commodities less correlated to the economic cycle than they used to be. That has the knock-on effect of making the mining sector less cyclical too.

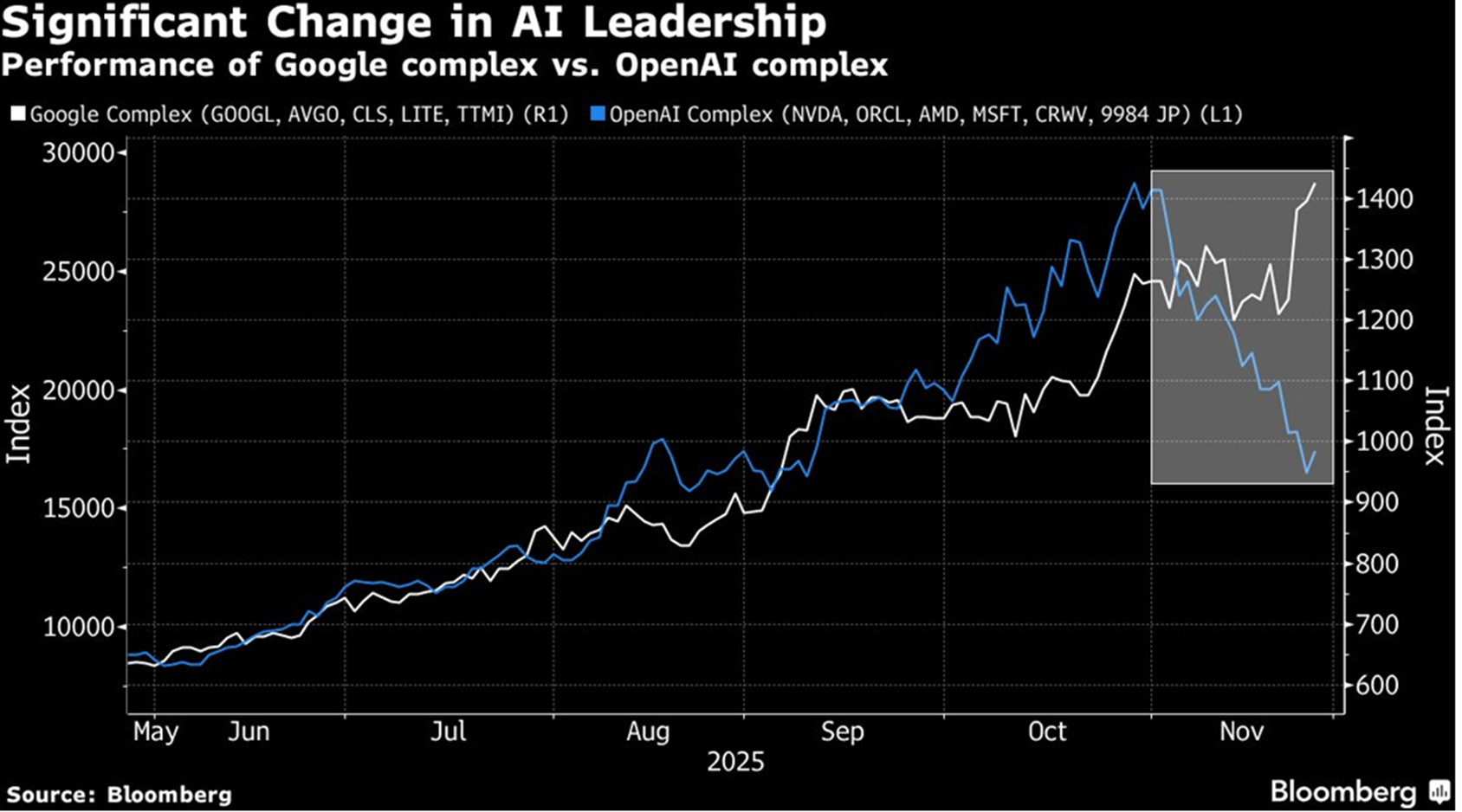

3. Google versus OpenAI.

Public companies exposed to the AI supercycle are now being repriced based on execution risk.

A popular chart making the rounds is the stock price performance of the Google universe (including Google and Broadcom due to Broadcom’s role in manufacturing Google’s TPU chips) compared to the OpenAI universe (Nvidia, AMD, Oracle, Microsoft, and Coreweave benefiting from demand from the AI startup).

4. The biggest backlog in software history.

Oracle’s latest quarter showed a stunning $455 billion in remaining performance obligations (RPO). These are long-term AI cloud deals with OpenAI.

5. Michael Burry reveals short bet against Tesla.

Burry, who correctly bet against the housing market during the 2008 financial crisis, said Tesla shares are “ridiculously overvalued”. Tesla shares are priced at nearly 200 times profits projected over the next 12 months.

However, Tesla is not an investment, it’s a religion and betting against it could be dangerous.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply