- Charts of the Day

- Posts

- AI winners tumble again.

AI winners tumble again.

Fed’s Waller said he could see up to 100 basis points of cuts next year.

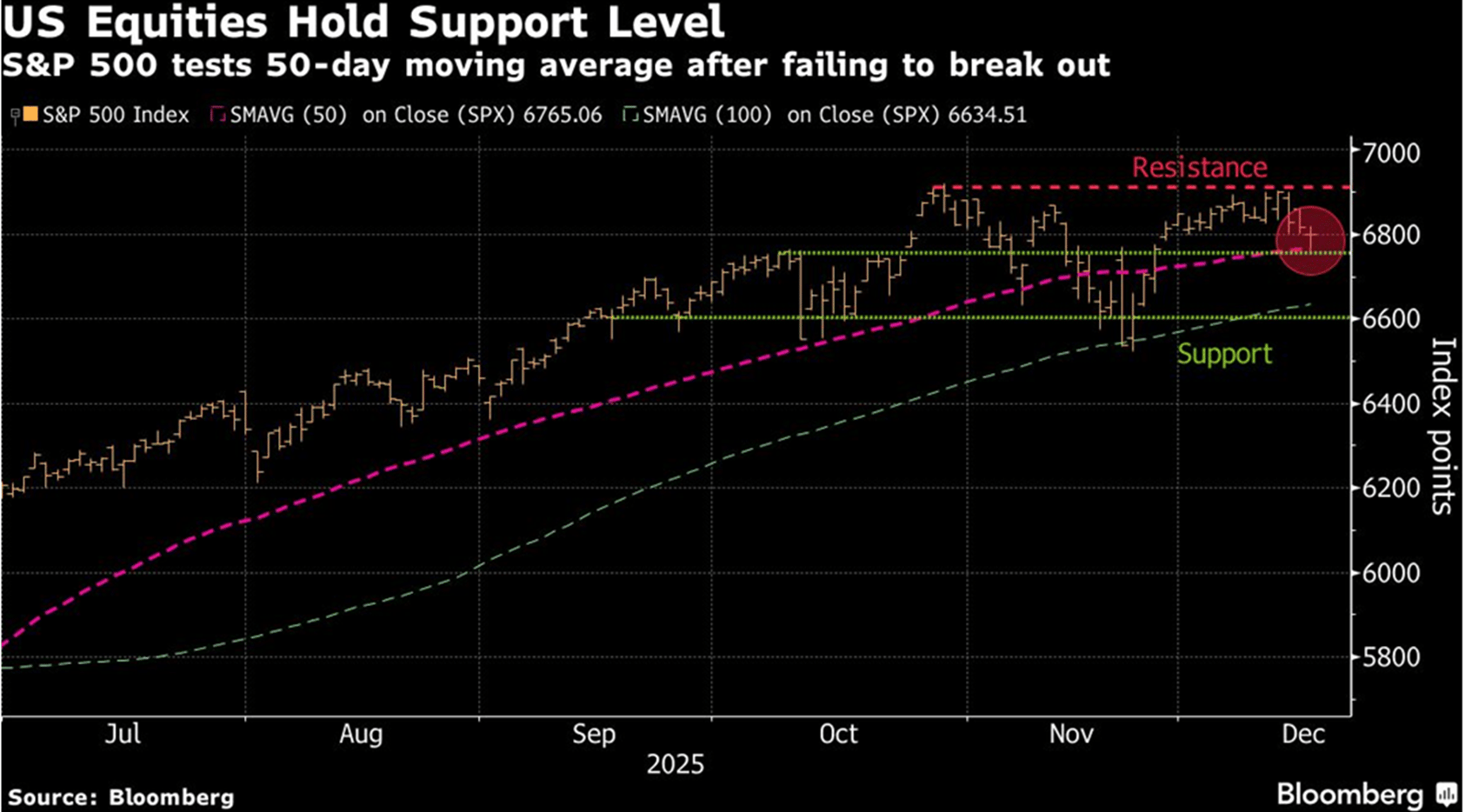

1. Where is our Christmas rally?

A festive rally seems increasingly elusive, with traders struggling to find catalysts.

The S&P 500 tested a key technical level, coming close to breaking below its 50-DayMovingAverage. The payroll figures signaled a cooling jobs market, but wasn’t weak enough to prompt major changes to rate-cut bets in the near term. Inflation data due today will be the last major steer of the year. Still, investors seem to be awaiting that report mostly with a sense of apathy.

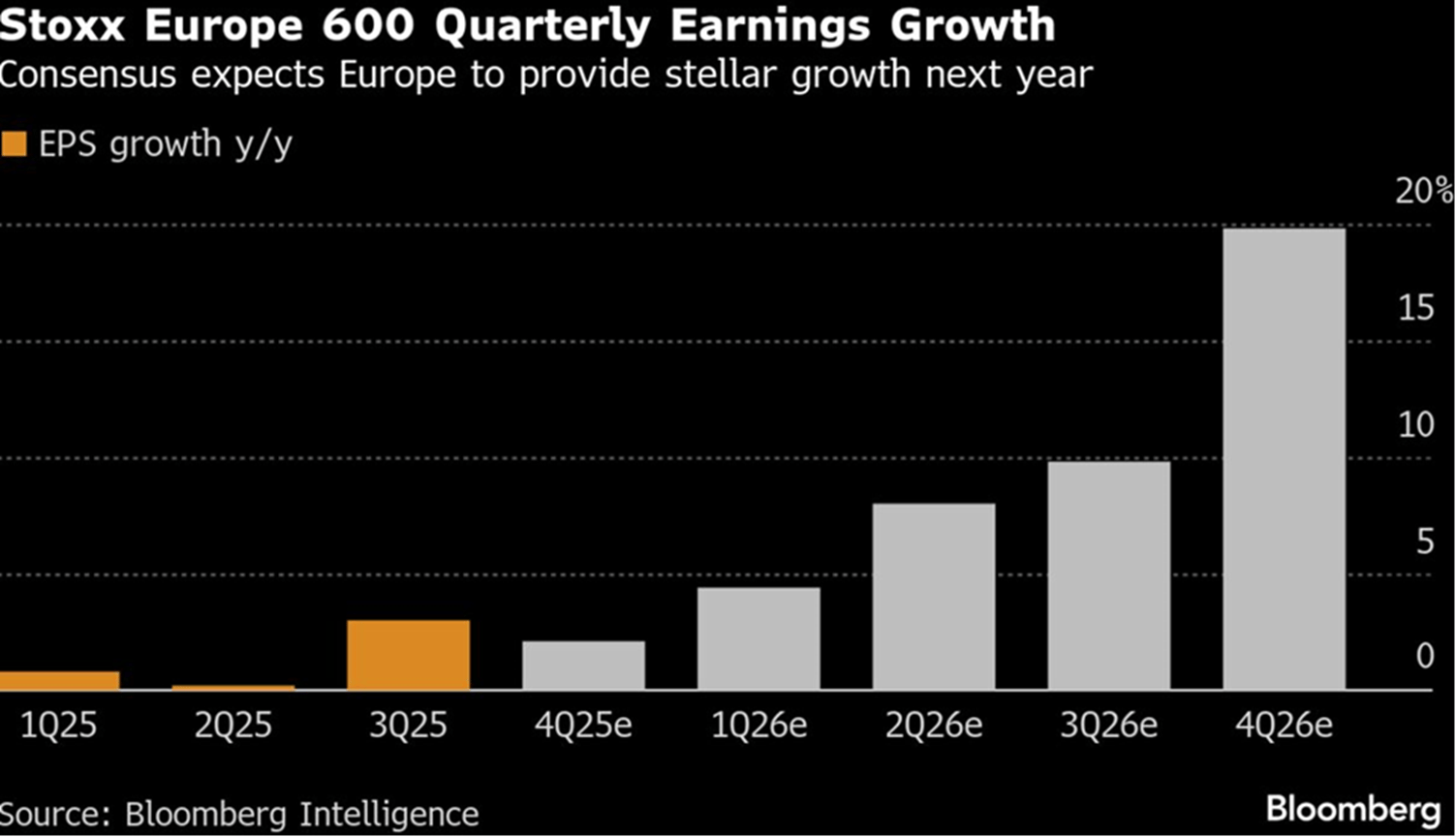

2. Is the consensus on Europe too optimistic?

For one thing, there is a big question mark about how European fiscal spending will feed into earnings growth.

What’s more, an acceleration in Chinese growth looks highly uncertain. “Consensus calls for 11% Stoxx 600 EPS growth in 2026 look optimistic, with second half estimates of 15% hard to justify amid limited visibility,” say Bloomberg Intelligence strategists Laurent Douillet and Kaidi Meng. “Our base case points to a more moderate 5-7% gain, supported by a broader recovery across industrials, tech and financials as fiscal outlays and AI adoption lift activity.”

JPMorgan remains confident that Germany’s recovery is underway and “we expect the economy to expand by 1.5%ar in Q4 2025, and 1.3%ar in 2026 as a whole (with the lower annual number reflecting weak carry-over). However, business sentiment and activity may remain volatile in the near term until fiscal spending and reforms gain momentum.”

3. Silver has decoupled from gold and hits another record high.

4. China will maintain its dominance in global manufacturing.

China will sustain its dominance for three reasons:

(1) the scale, scope, and long-term strategic intent of its manufacturing ambitions

(2) its integrated supply chain strategy

(3) its large talent pool of STEM graduates.

Below: China's share of STEM graduates is the highest globally at 41% and is double that of the US at 20%

5. Is this realistic?

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply