- Charts of the Day

- Posts

- All eyes on tech reports to come.

All eyes on tech reports to come.

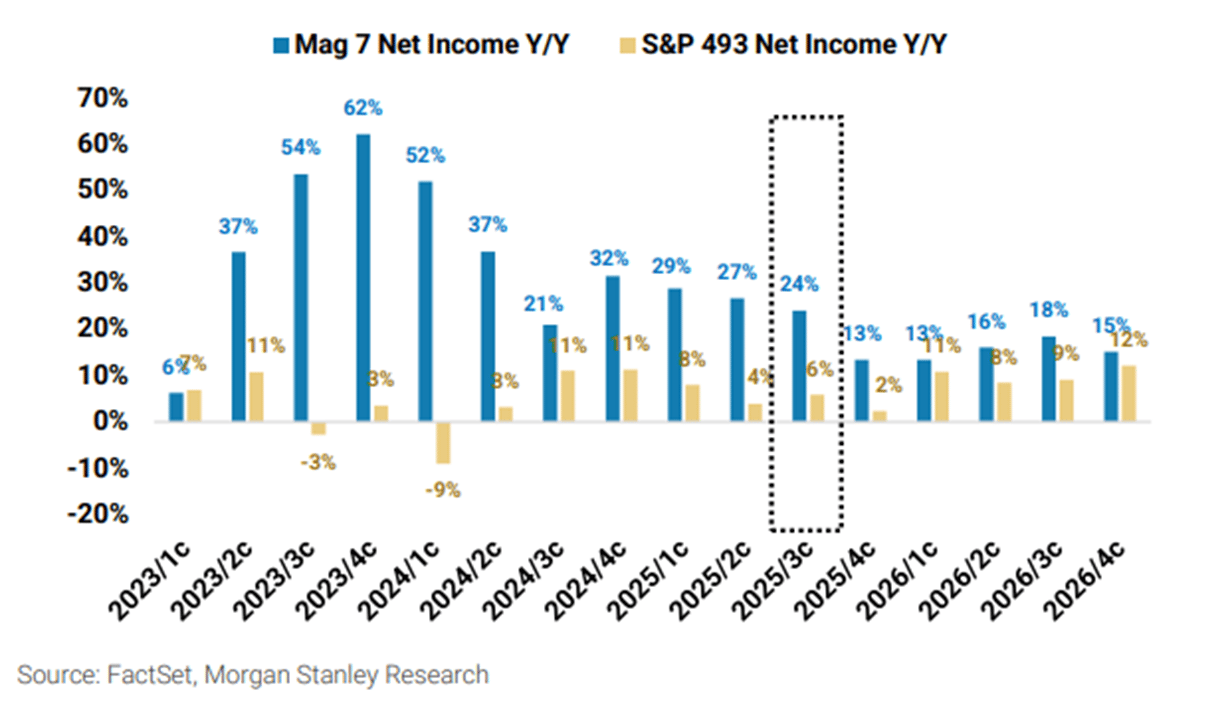

The AI story that has been a key driver of the rally will face a big test this week, when five Mag 7 names report earnings.

Subscribe to receive these charts every morning!

1. Focus om megacaps earnings this week.

The busiest part of the U.S. earnings season is upon us, with megacaps Microsoft, Apple, Alphabet, Amazon and Meta Platforms all due to report results this week.

Analysts warn that mere earnings beats won't cut it — investors are looking for clear signs that their outsized bets on artificial intelligence are still fueling long-term growth.

Below: Mag 7 is expected to see stronger earnings growth than the 493 over the coming quarters.

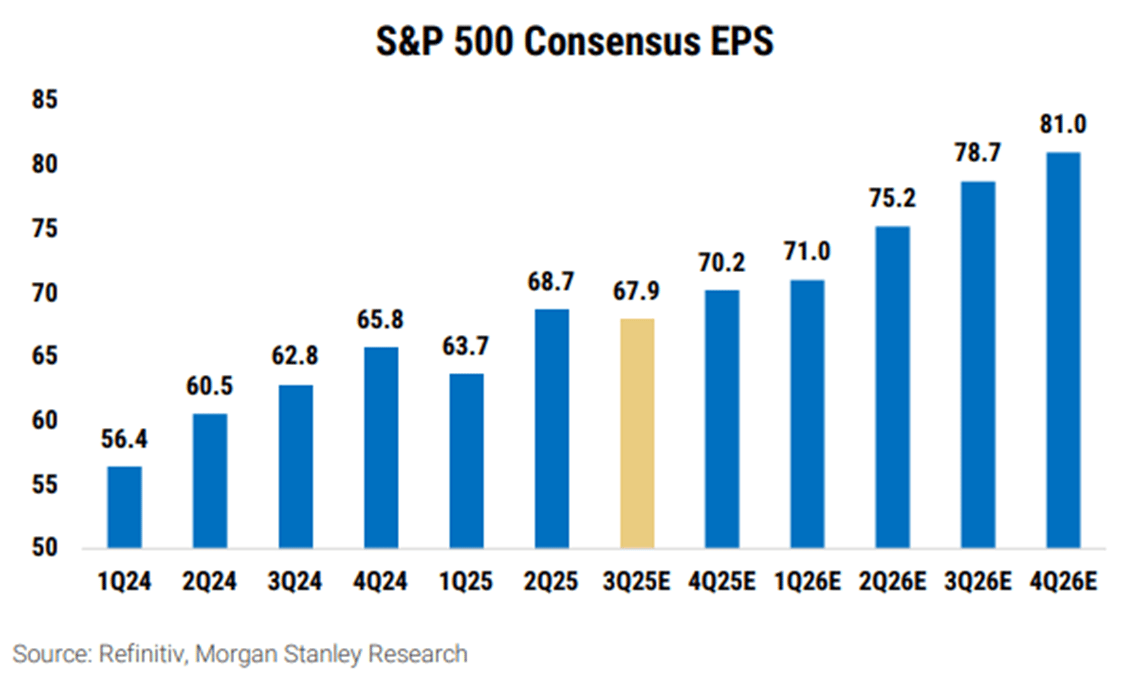

2. Morgan Stanley sees positive earning revisions widening in 2026.

Equity analysts are expected to broaden their earnings revisions to more stocks toward the end of the year and into 2026, according to Morgan Stanley strategists. “We have high conviction in our rolling recovery thesis”.

Below: High expectations for 2026

3. The US and China are closing in on a trade deal but any disappointing outcome could trigger wild swings.

“While our economists expect US growth to pick up in 2026, our equity asymmetry framework suggests that the probability of a selloff is higher than that of a large rally,” say Goldman Sachs strategists including Andrea Ferrario. “

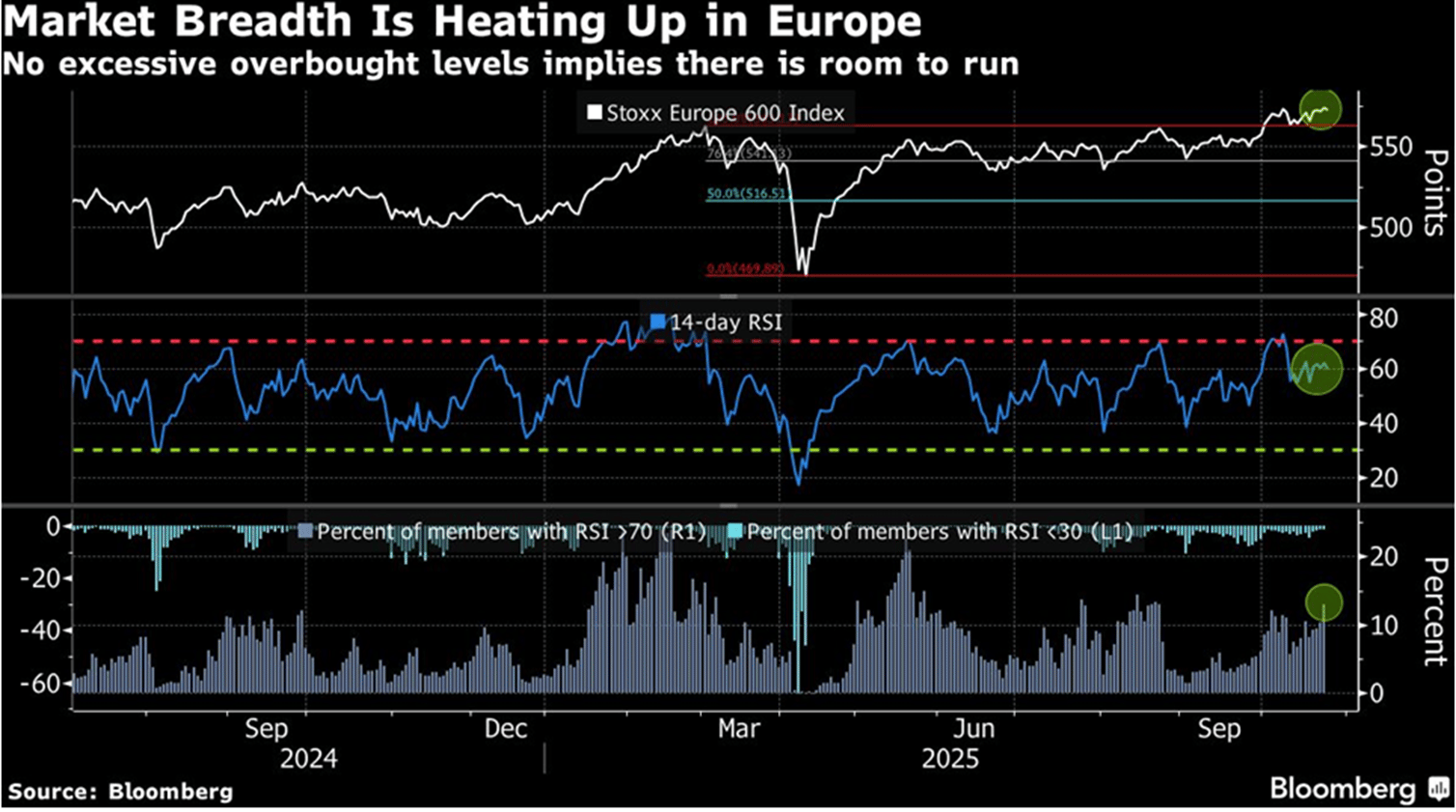

“While the US market has reached very expensive levels, Europe remains relatively cheap, which should provide a cushion to some extent.” Europe could also receive a lifeline from supportive economic and earnings data. Business activity in the euro area has just unexpectedly hit the highest level since May 2024 as outperformance by Germany helped offset weakness in France.

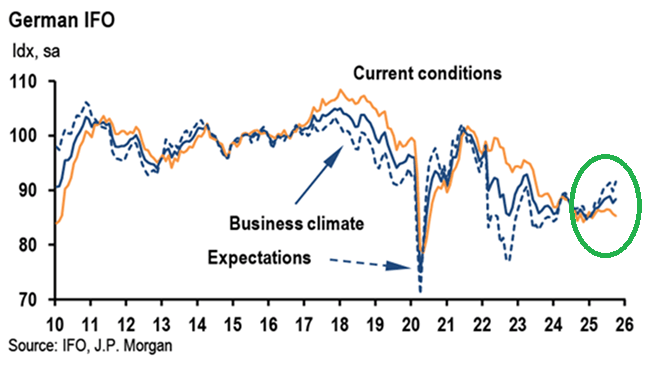

4. Euro area: Data support shifts from resilience to strength.

Latest IFO readings suggest German growth is running at 1.7%ar at the start of 4Q25. In fact, the details of today’s increase lend further support to the PMI’s signal that growth in Germany may be starting to accelerate.

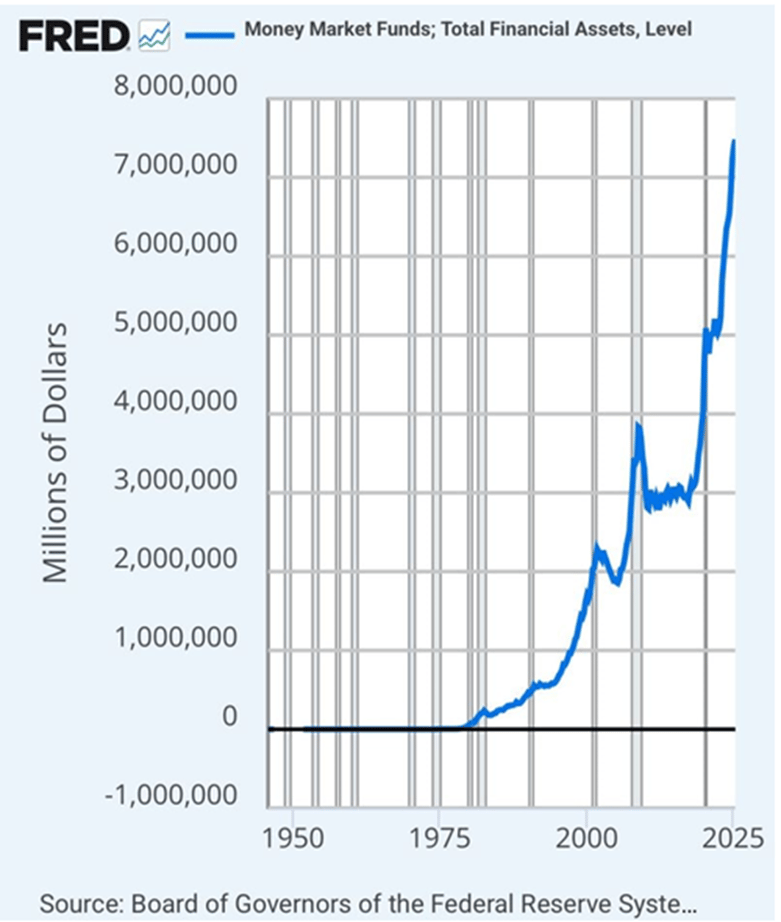

5. There is now 7 trillion USD sitting in money market accounts.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply