- Charts of the Day

- Posts

- All signs point to a US government shutdown starting on Wednesday.

All signs point to a US government shutdown starting on Wednesday.

The Bureau of Labor Statistics said that it would not release labor data at all during a shutdown, including Friday’s unemployment figure.

Subscribe to receive these charts every morning!

1. American 2Q GDP just got revised up to a robust +3.8% to underscore signs of economic resilience.

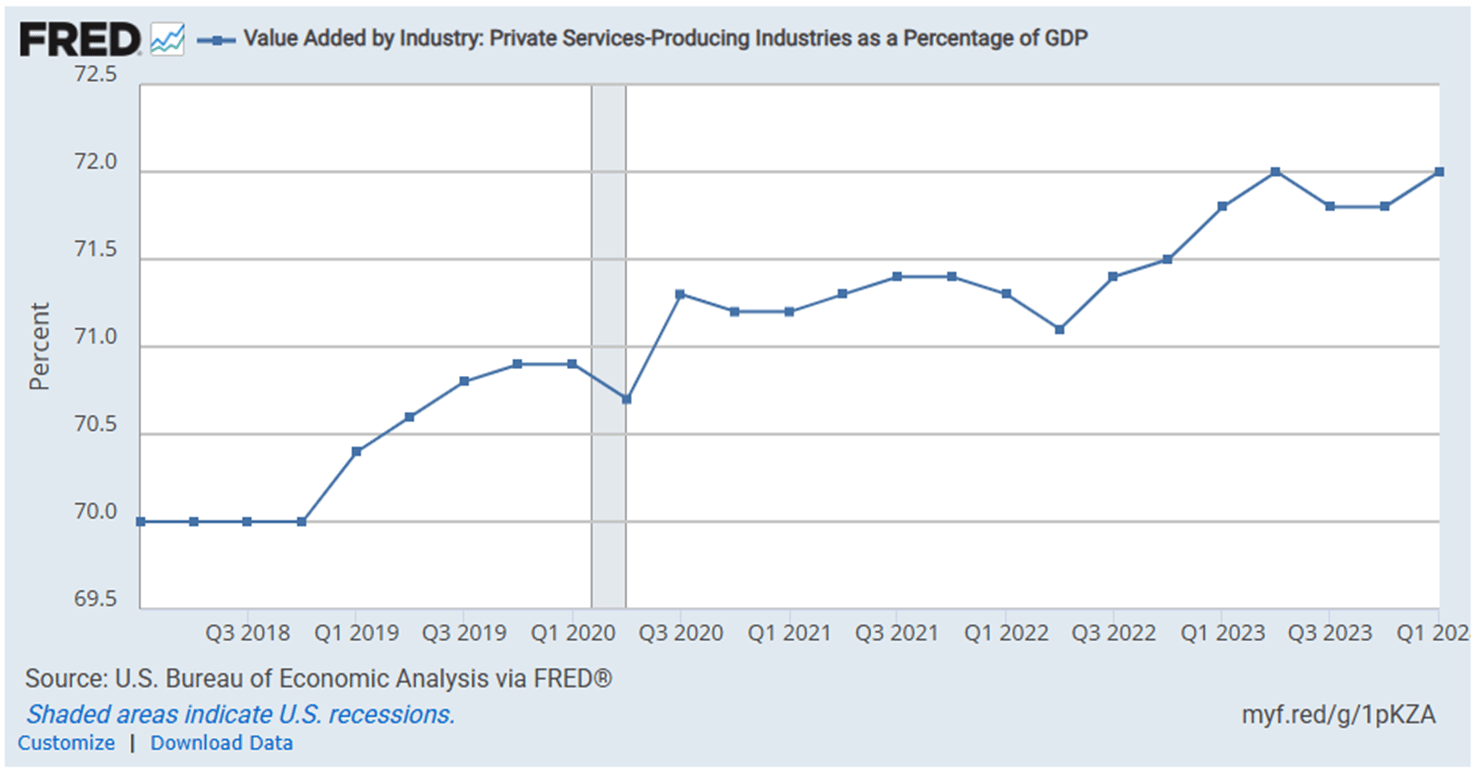

Tariffs are everywhere today, but most of the US economy has been unaffected so far…How come?

The U.S. is a service-based economy. The U.S. generates most of its world-dominating dollars by selling services, ranging from financial to big tech subscriptions.

Below: The rise of services in the US Economy.

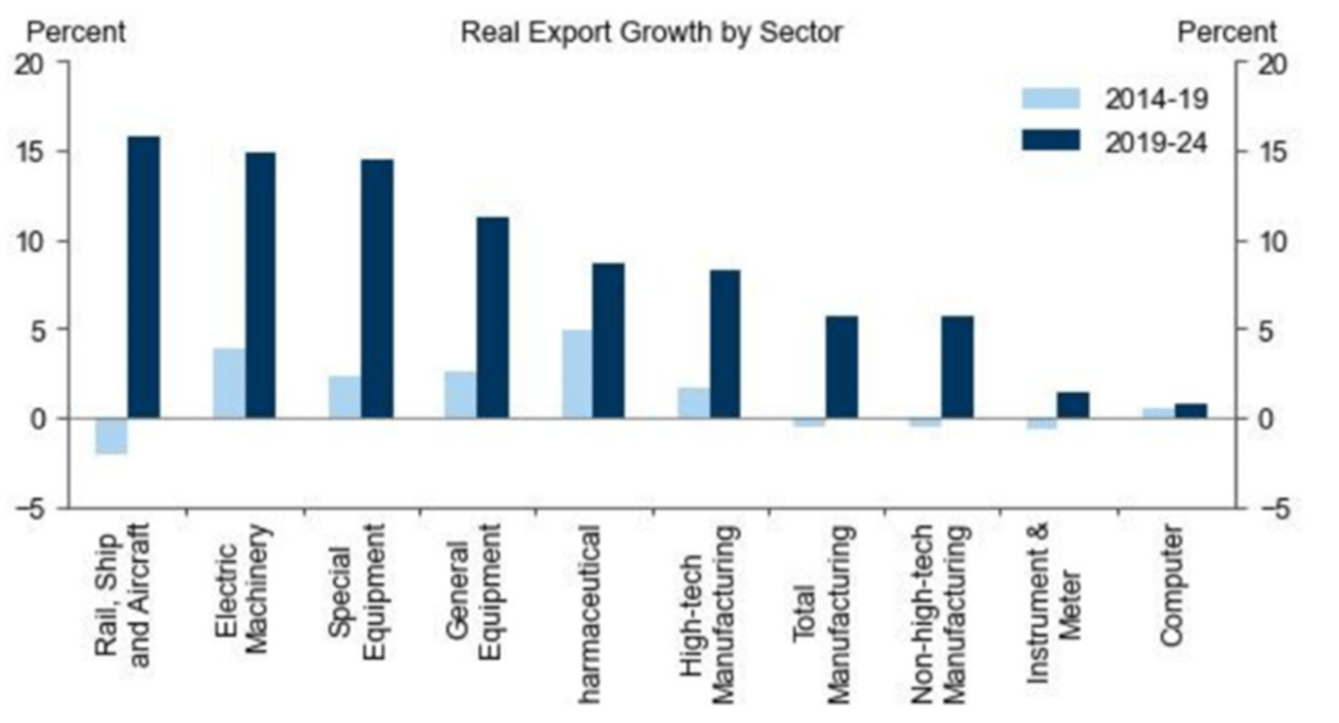

2. Goldman warns a second “China Shock” is coming.

After China joined the World Trade Organization in 2001, a flood of cheap Chinese goods harmed America’s factories.

Now, a similar shock may wreak havoc as Beijing flexes its muscle in high-tech manufacturing sectors, according to Goldman Sachs.

Instead of crumbling under the US tariffs, Chinese exports are rerouting to other countries, squeezing out local manufacturers, including those in Europe.

Why is it so hard to beat Chinese exporters? China has massive cost advantages thanks to cheap capital, competitive energy prices, immense production capacity and an undervalued currency, according to the economists. In addition, China has made significant strides in AI and industrial automation. Beijing has the ambition to move up the supply chain and dominate the high-tech manufacturing sector.

Compared with two decades ago, China is no longer the world’s factory for shoes and toys. Rather, its exports are increasingly dominated by autos, batteries, semiconductors and solar panels, things that directly compete with the West.

Below: China exports of High Tech goods are rising. (Source BoA)

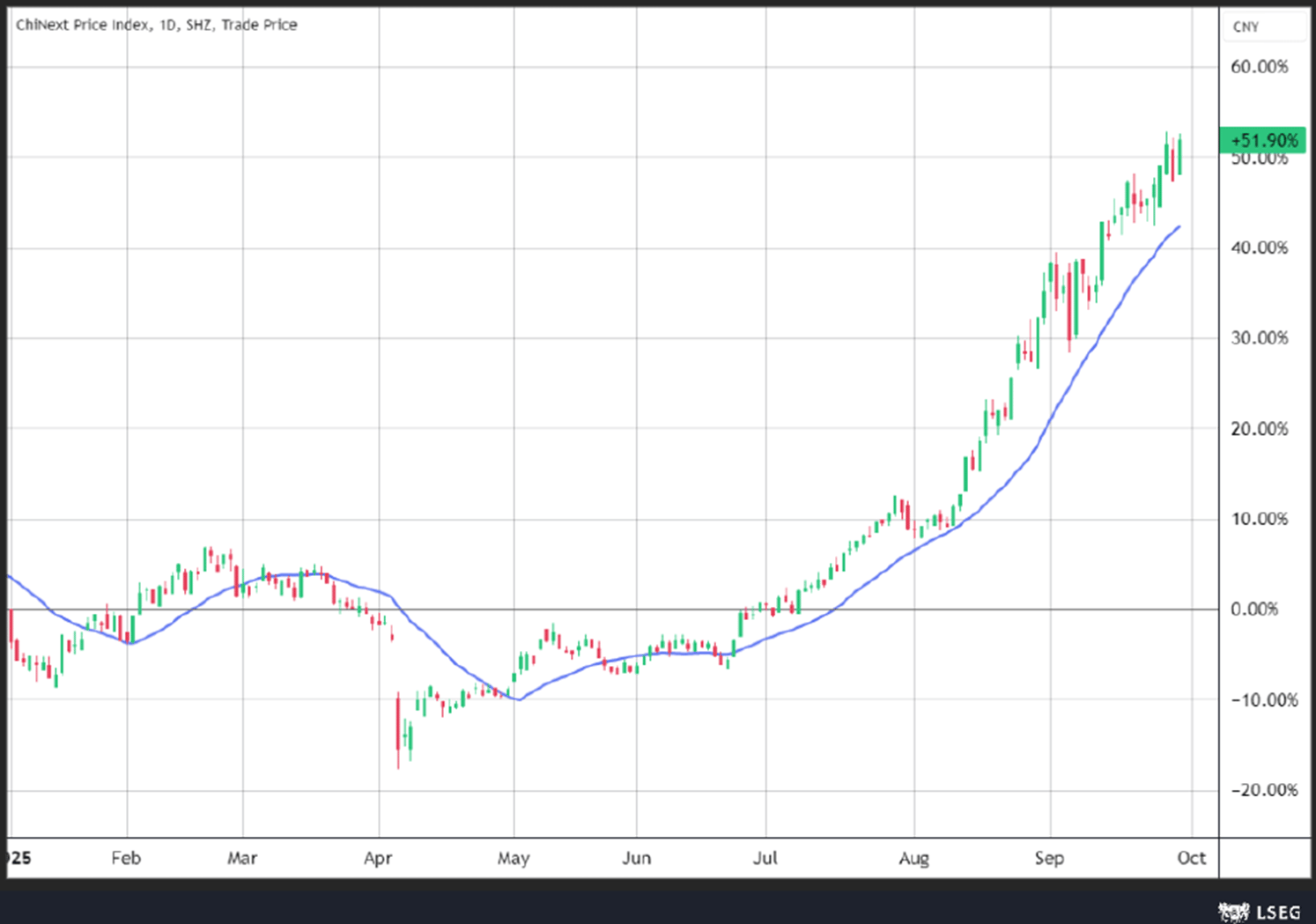

3. China’s tech and growth stocks extend their strong run.

The AI theme remains hot and Alibaba Group Holding Ltd. was on top of investors’ minds last week after announcing its planned hike in AI spending and a new partnership with Nvidia Corp. Up nearly 44% in September, it is among the top-performing stocks on the Hang Seng Tech Index. Also, a slew of good news linked to US-China relations added to the positive momentum ahead of a potential meeting between the presidents.

Below: ChiNext is a NASDAQ-style subsidiary of the Shenzhen Stock Exchange which aims to attract innovative and fast-growing enterprises, especially high-tech firms.

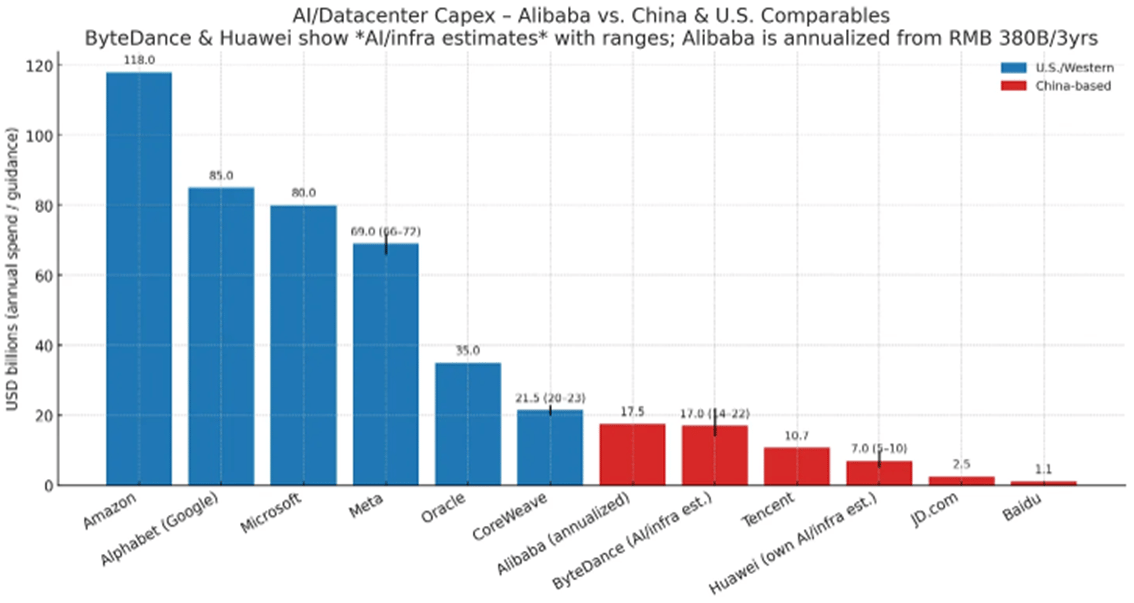

4. Alibaba, China’s biggest AI spender, pales in comparison to the western hyperscalers’ buildouts.

Below: AI capex estimates for 2026

5. Time to take a (new) look at Deutsche Telekom.

Networks: DT owns the 'Best Network' across its footprint, primarily in both Germany & the US.

Growth: Estimated EPS growth of +16% pa, Dec 2024a-27e…this is best-in-class in the European / Global Telco sector.

Cash returns: First, we see DPS increasing by +15% pa, from €0.90/sh (2024a) to€1.40/sh (2027e). Second, we expect share re-purchase programmes to scale up, from €2.0bn (2024a) to €3.5bn (2027e).

Valuation: As we approach Q4, we believe investor focus will soon/increasingly switch to 2027 metrics. Our forecasts imply that DT is trading at 11.0x 2027e P/E.

Technicals: DT has been going through a correction, is oversold (RSI bottom indicator) and looks ready for a serious rebound.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply