- Charts of the Day

- Posts

- Another gigantic deal from OpenAI.

Another gigantic deal from OpenAI.

Buys gigawats of AMD chips to support build out.

Subscribe to receive these charts every morning!

1. Nikkei hits new record high.

Japanese markets jumped as pro-business leader Sanae Takaichi's victory in the ruling Liberal Democratic Party leadership race stoked bets on a revival in big spending and loose monetary policy.

The Nikkei average jumped 4.75 percent to a record high of 47,944.76.

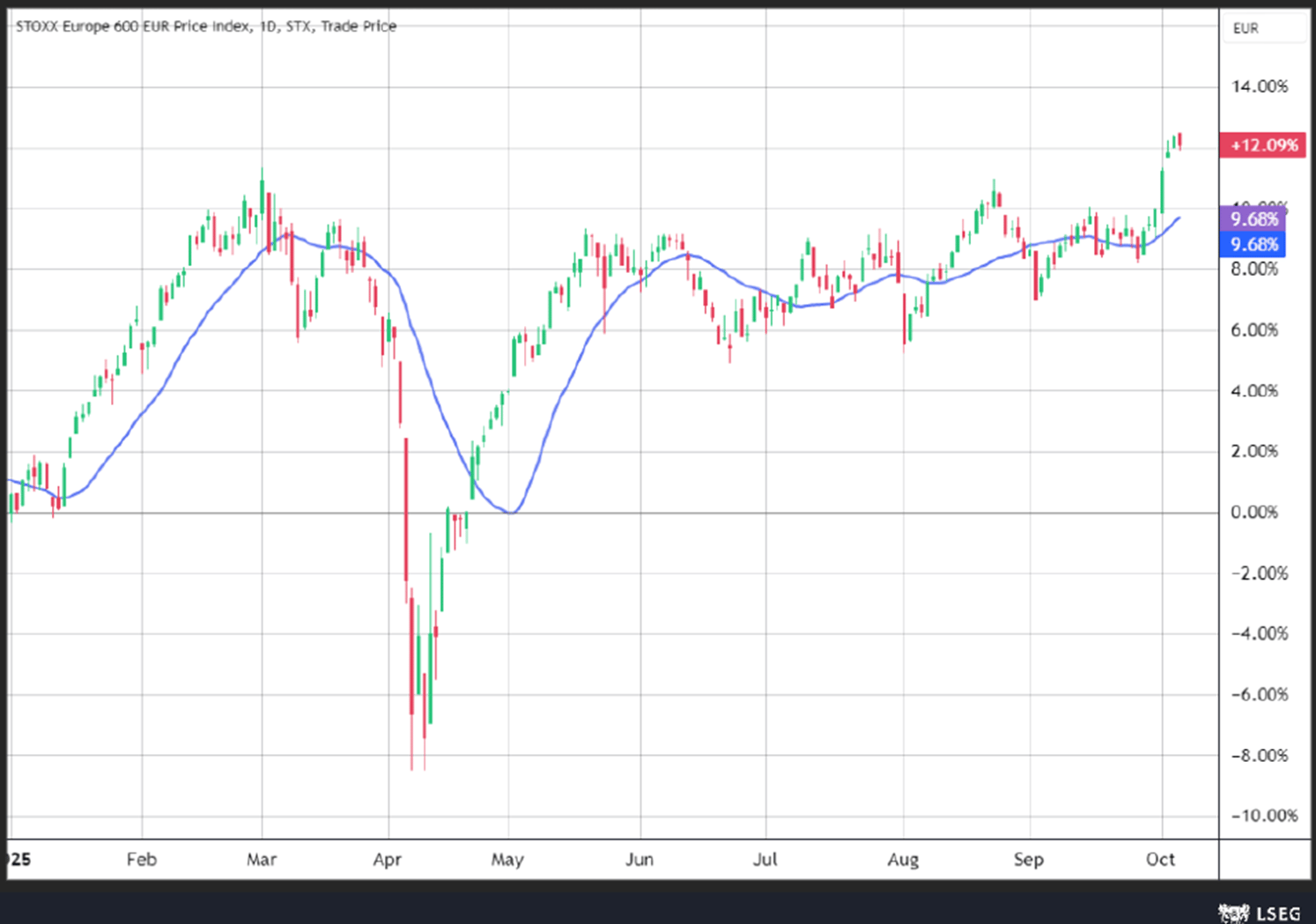

2. "Time to turn bullish on Eurozone equities," J.P. Morgan said.

J.P. Morgan upgraded its stance on the euro zone to "overweight" from "neutral" on Monday, noting that the equities in the region have become more attractive after several months of underperformance and policy support.

Euro Stoxx has trailed the S&P 500 by nearly 18% since a strong first-quarter rally, but this relative underperformance could be used as a buying opportunity, Matejka said. The strategists noted that with relatively cheaper valuations than their U.S. counterparts, and potential catalysts such as German stimulus, and improving euro zone credit impulse, could renew sentiment in the region.

The 15% tariff on European Union goods has also put to rest one of the major overhangs on the region's equities, J.P. Morgan said.

The brokerage also retained its positive stance on European defense stocks, as it expects capital expenditure to be constructive and boost parts of industrials, construction materials and utilities.

While the uncertainty in France could create an overhang, Matejka said, "We would use the weakness to buy, as we believe that any pressure will not be long-lasting."

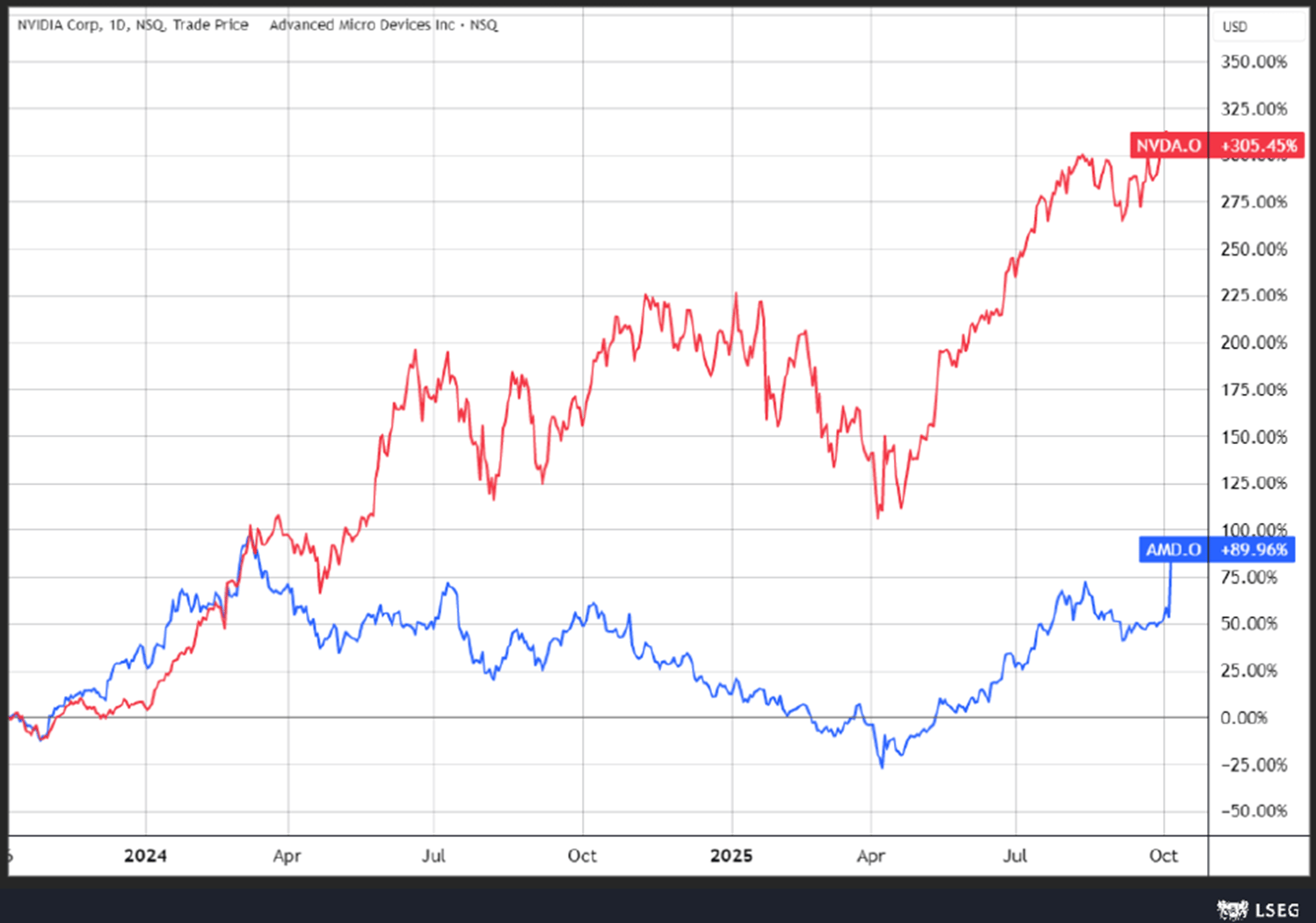

3. Another gigantic deal from OpenAI….this time with AMD.

OpenAI is soaking up a ton of computing power from AMD over the next couple of years.

Two weeks ago, OpenAI dropped a $100B equity and data supply deal with Nvidia, but yesterday’s news left the king of chip makers feeling high and dry.

AMD sais the company now has a major buying partner, setting AMD’s growth at the center of a 10-year AI growth path.

OpenAI will use AMD's chip for inference in order to cope with skyrocketing demand. "It’s hard to overstate how difficult it’s become... We want it super fast, but it takes some time." OpenAI's Sam Altman said to WSJ.

Below: Nvidia versus AMD the last two years.

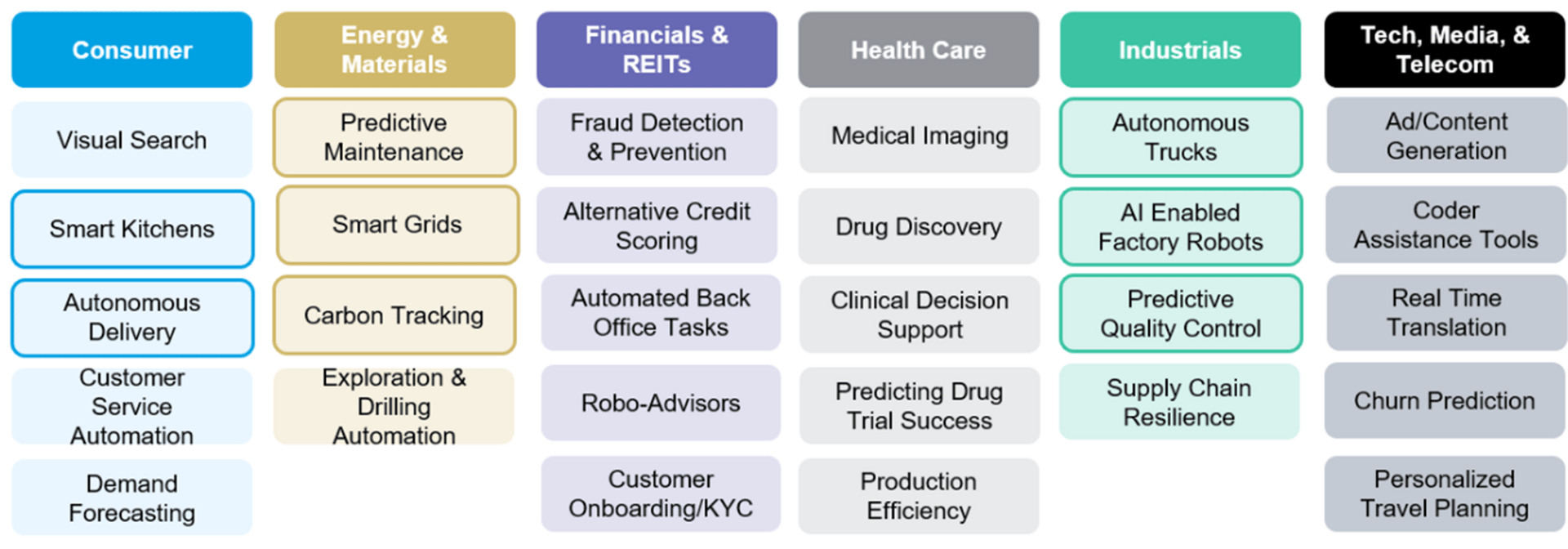

4. AI adoption can take many different forms across industries.

On the digital side, AI is powering dynamic pricing in consumer sectors, enabling real-time adjustments based on demand signals, inventory levels, and competitor behavior.

Meanwhile, on the physical side, AI-enabled robots are enhancing precision and productivity on factory floors, while autonomous delivery systems ranging from drones to sidewalk robots are redefining last-mile logistics.

Together, these advances are blurring the lines between digital intelligence and physical execution, and bringing about a new era of operational agility.

A list of examples of AI use cases by industry is shown below.

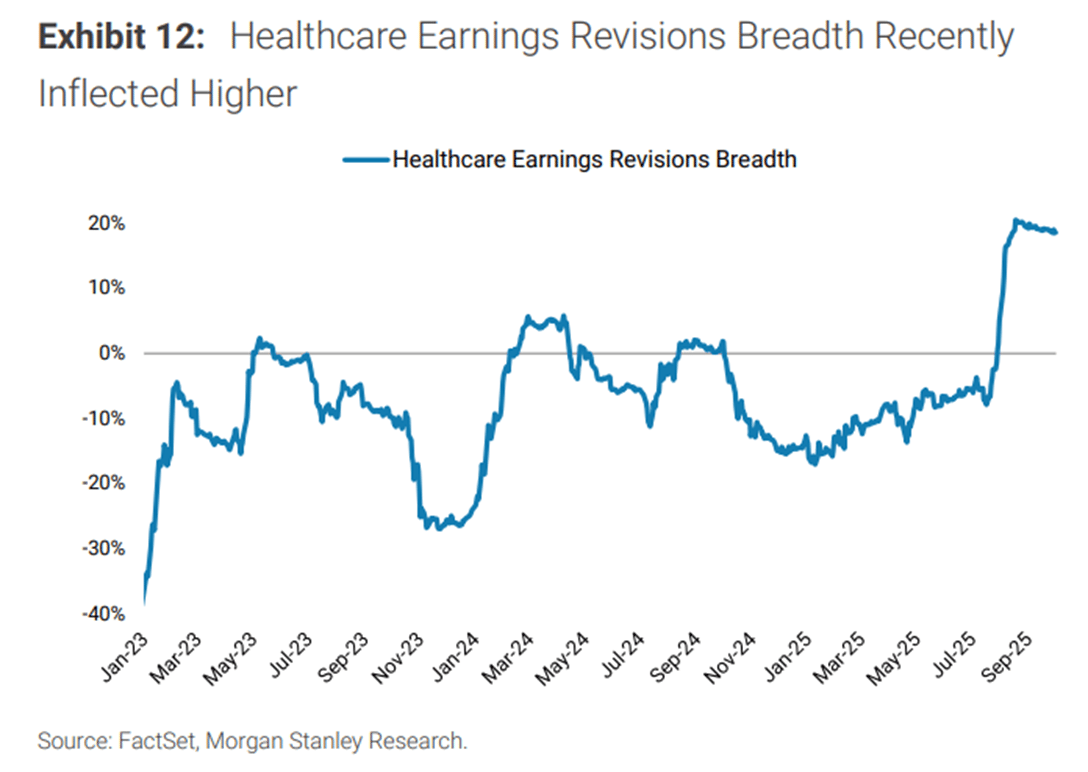

5. Morgan Stanley reiterates its bullish stance on Healthcare.

“The Healthcare sector offers an attractive risk/reward opportunity.

Accelerating earnings revisions across Pharma/Biotech and Equipment/Services coupled with historically cheap relative valuation reinforces our view. We also highlight that Biotech is historically a strong outperformer during Fed rate cutting cycles, and the space tends to benefit from lower back-end yields as well. Last week, the sector saw its strongest weekly performance since 2022 (+7%) as the Trump administration’s MFN/drug pricing announcement with Pfizer catalyzed a relief rally.

The passage of key clearing events (MFN and pharma tariffs) has brought generalists back into the Healthcare trade after an extended period of muted sentiment. We think outperformance can continue and note that relative valuation for the space remains in the bottom 5th percentile of historical levels back 30 years.”

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply