- Charts of the Day

- Posts

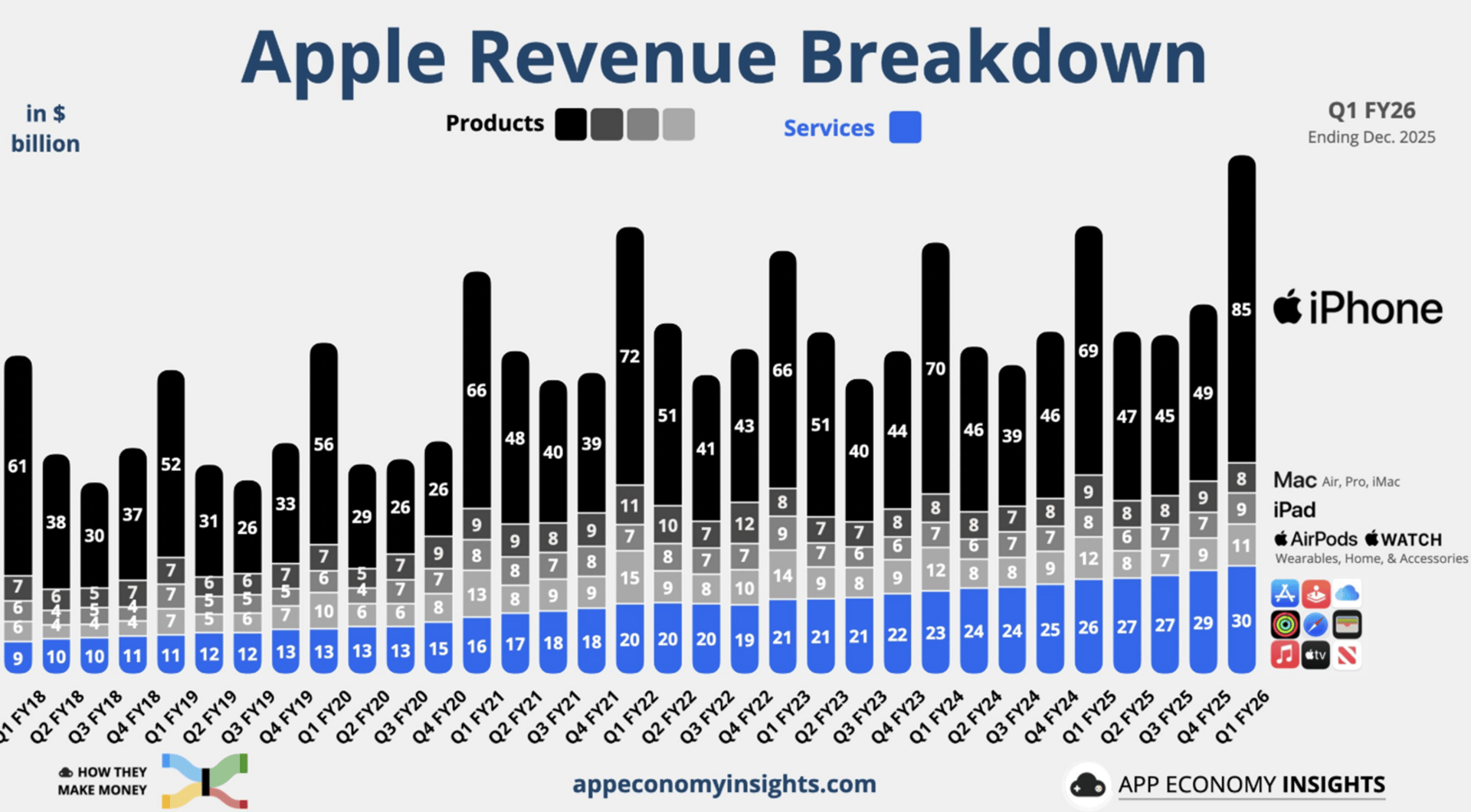

- Apple delivered record sales.

Apple delivered record sales.

Microsoft already owns 27% of OpenAI.

1. Everyone is buying iPhones.

Apple delivered a blowout quarter as the iPhone 17 cycle triggered a massive replacement wave, particularly in premium Pro models.

The company set all-time revenue records in every geographic segment, pushing the active device base to over 2.5 billion.

2. A 10% rise in the euro against the dollar could trim European EPS by about 2%.

Internationally exposed stocks face a renewed threat from a weaker dollar, as that reduces the value of their overseas business.

Commodities, food and beverages, health care, luxury goods and autos are among sectors with the highest exposure, she says.

That raises the bar for Europe’s stock rally to continue.

Worryingly, analysts have downgraded European earnings estimates since early December, a Citi index shows.

But the longer-term outlook remains intact (white line).

3. SAP missed expectations.

SAP shares dropped as much as 16%, the biggest intraday decline in more than five years, after the software firm reported 25% growth in current cloud backlog on constant-currency basis. That missed investor expectations. Growth for the key metric, which represents contracted revenues for the next 12 months, is guided to “slightly decelerate” from 4Q levels.

With investors already questioning the software business model amid competition from AI coding tools, growth numbers are ultimately what investors are looking at.

At these levels it is technically oversold. When the panic sellers have left the building, we can go for the bounce.

4. Tesla is no longer a car company.

Musk gave the Model S and X an “honorable discharge,” announcing that production of the flagship vehicles that built the brand will end next quarter. Their assembly lines will be converted into a massive production hub for the humanoid robot Optimus, with a target of 1 million units per year.

Tesla’s $1.5 trillion valuation is now:

• 400 billion car business

• 600 billion robotaxis

• 300 billion humanoids

• 300 billion batteries

In other words, over two-thirds of Tesla’s valuation rests on businesses that are early, unproven at scale, or not yet meaningful revenue drivers.

Below: Tesla delivered 418K vehicles in Q4, a sharp 16% decline.

5. Everyone wants to invest in OpenAI.

A handful of companies are looking to invest in OpenAI, the same day that Microsoft was hit with one of its worst trading days since Covid for its data center spending.

OpenAI is reportedly in discussions to raise a historic funding round that could reach $100 billion, anchored by its primary infrastructure providers. The massive capital injection aims to fund an ambitious $1 trillion AI infrastructure build-out as the company scales to compete with Google.

Microsoft already owns 27% of OpenAI. Microsoft Word is what people think of when they think Microsoft, but it has become the major cloud provider player aside from AWS. Bloomberg reported that AI startup Perplexity signed a $750 million cloud infrastructure deal with MSFT, moving away from Amazon.

The deal highlights MSFT's strategy of becoming the universal foundry for the AI era, diversifying its exposure across multiple model builders.

6. European Defense stockpicking.

Recent geopolitical events and US administration policies reinforce the need for Europe to take more responsibility for its own sovereignty and reduce its security dependencies. This supports forecasts for Europe raising defence spending to ~3% of GDP by 2030. As such, we look for higher defense budgets to drive order momentum and upside to earnings estimates.

Here are the bear/base/bull scenarios for some defense stocks from MS.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply