- Charts of the Day

- Posts

- Asian stocks and currencies supported by "Powell pivot".

Asian stocks and currencies supported by "Powell pivot".

Price action reflects a sigh of relief that a Fed rate cut is finally underway.

Subscribe to receive these charts every morning!

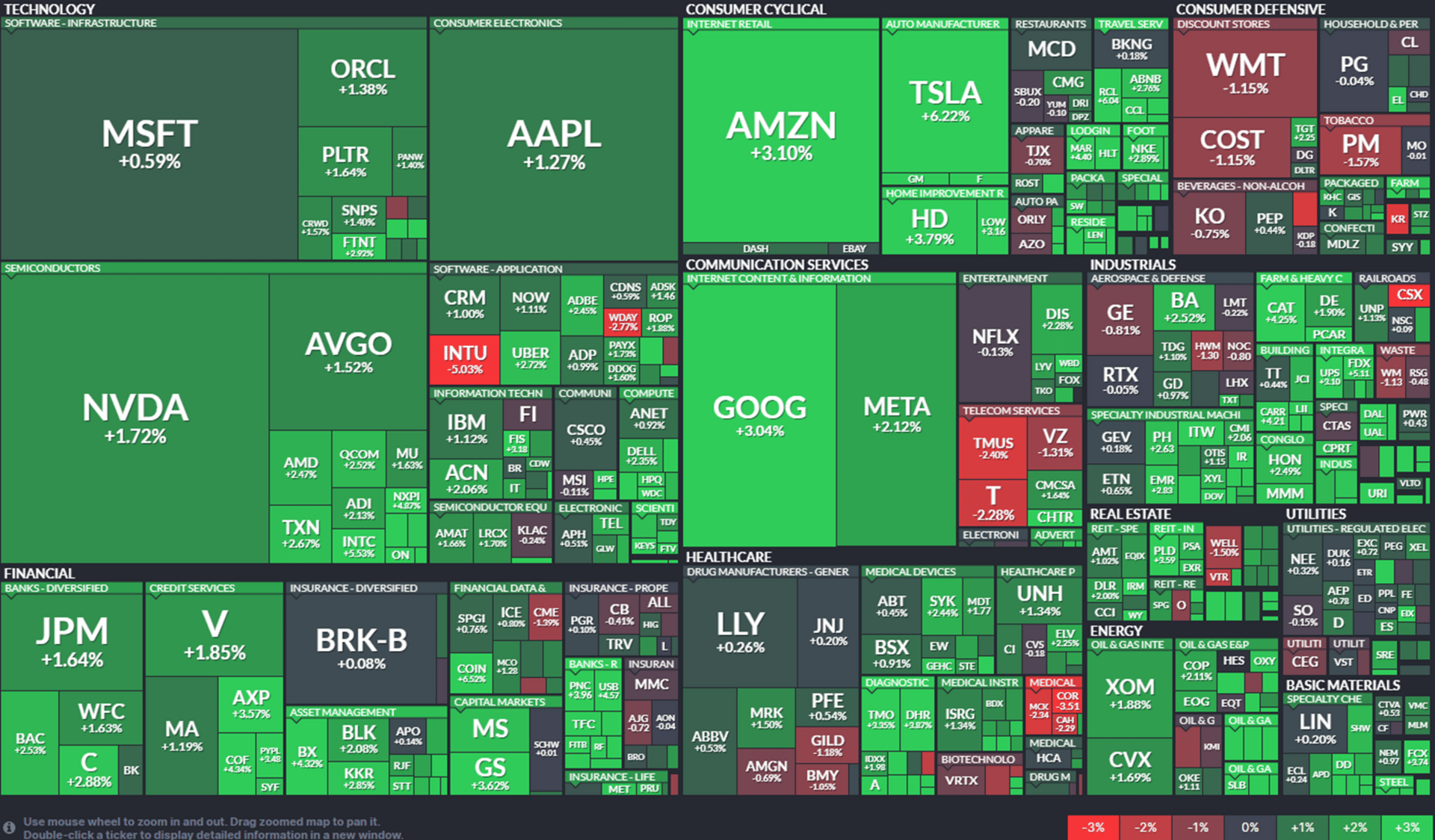

1. The market closed higher on Friday after Jerome Powell’s Jackson Hole monetary policy speech.

Powell admitted to a crowd of reporters that trade and immigration changes have added to rising downside risks to employment, which “may warrant adjusting our policy stance.” Powell has basically vowed to keep the economy from falling into a stagflation environment.

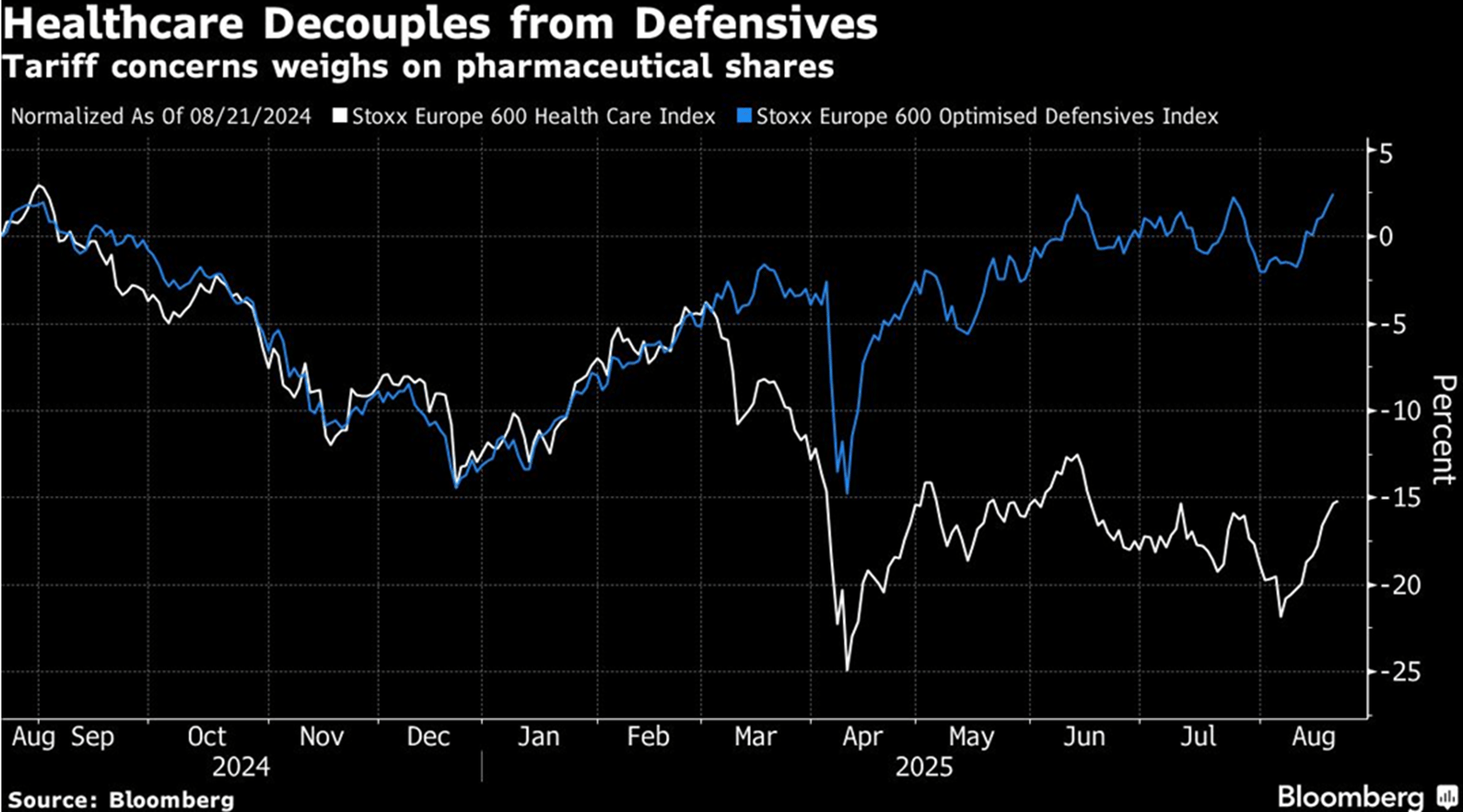

2. European healthcare shares are even underperforming defensives.

These stocks have already discounted the headlines. Time to move to second-level thinking.

“By applying second-order thinking, you can uncover opportunities that others miss, and make more thoughtful, strategic decisions that lead to better long-term outcomes.”

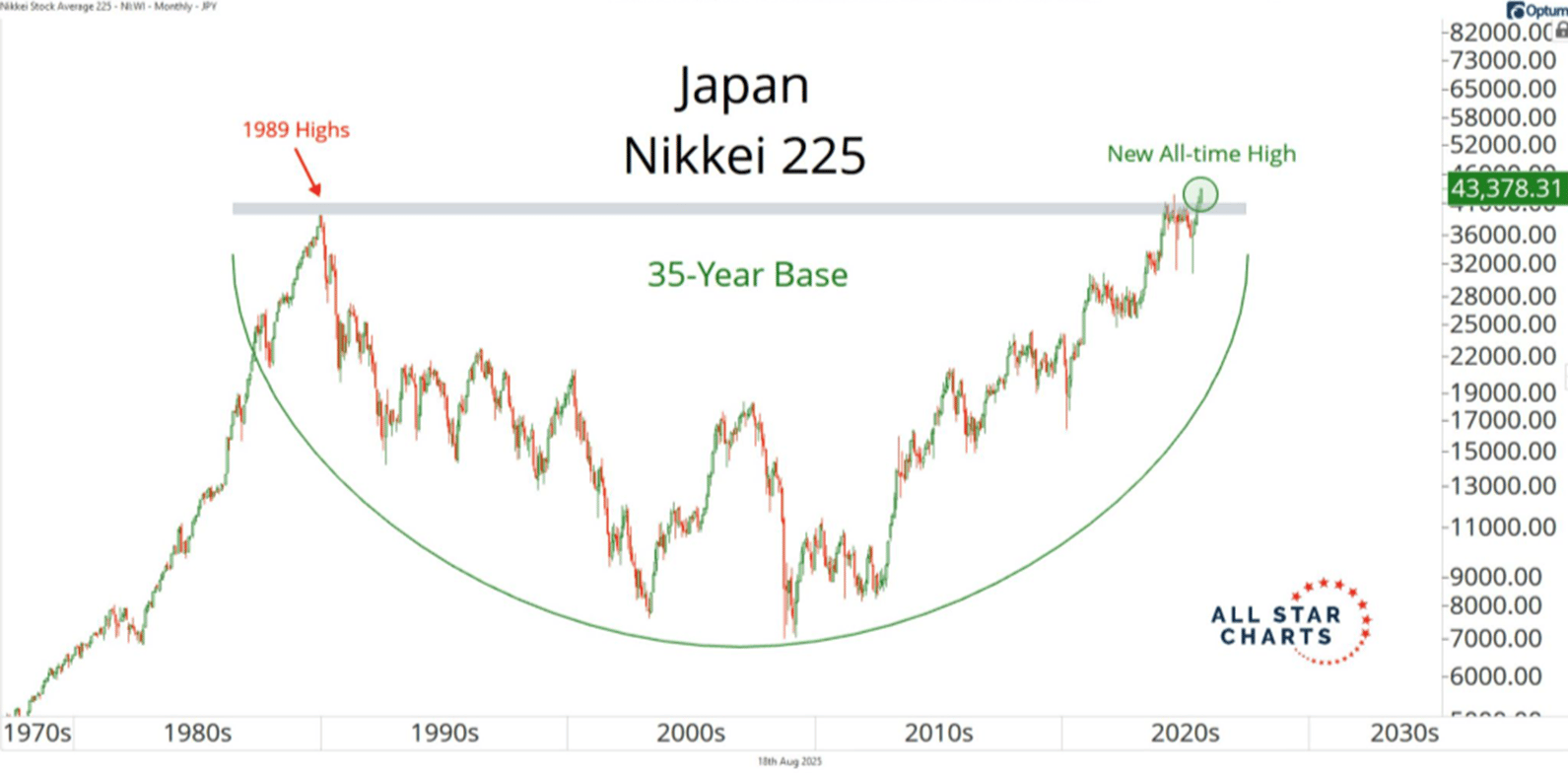

3. Japan’s Nikkei 225 made a new all-time high.

It took 35 years to surpass the 1989 highs.

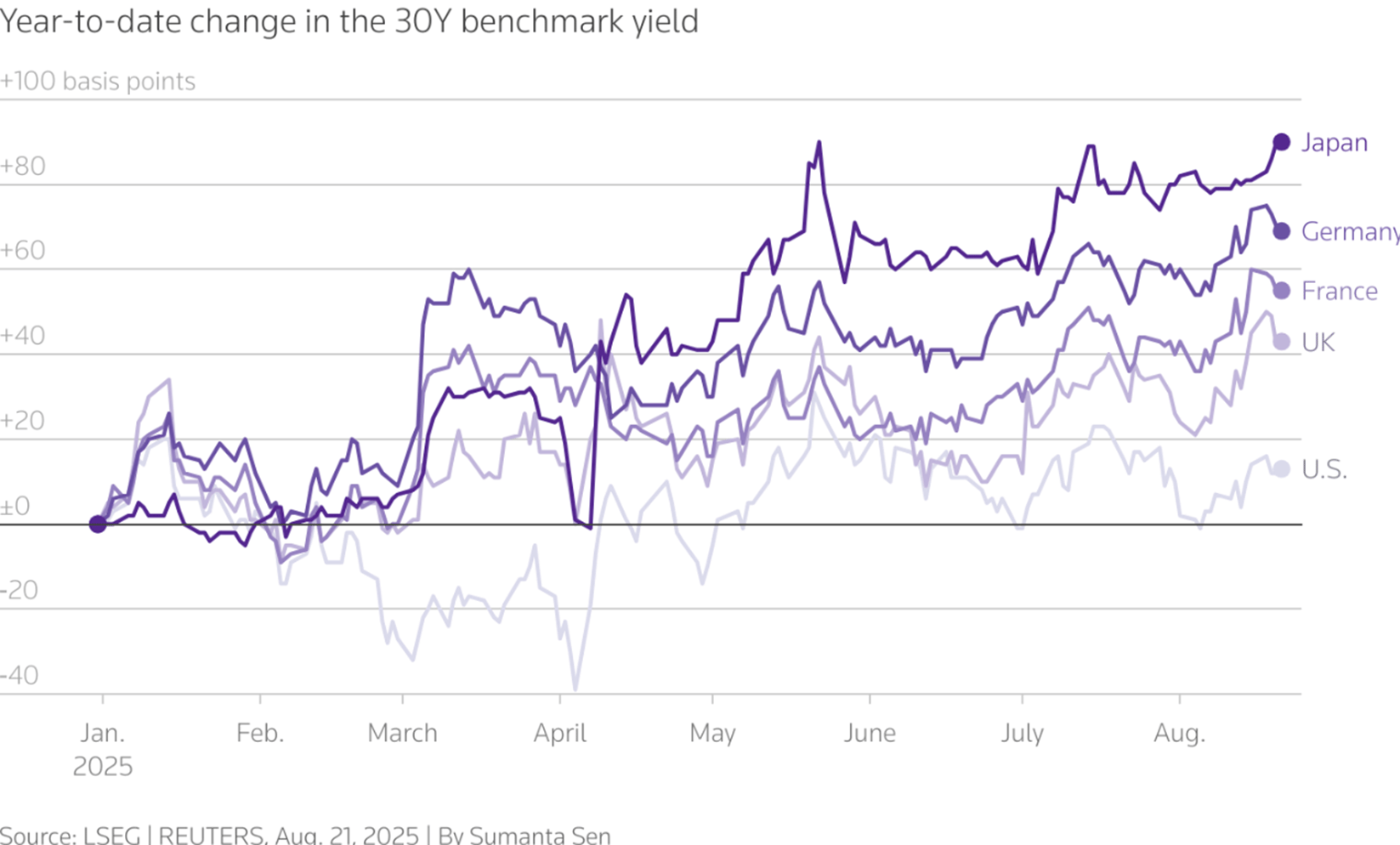

4. Renewed pressure in bond markets went a little under the radar.

German and French 30-year bond yields this week rose to their highest since 2011, Japanese yields are at their highest in years, UK long-dated bonds sold off again and U.S. 30-year yields are hovering near 5%.

Sure, the reasons behind the selling are well established: debt levels are rising, so governments need to sell more bonds. Some such as Japan need to hike rates, others including the U.S. and UK face still sticky inflation.

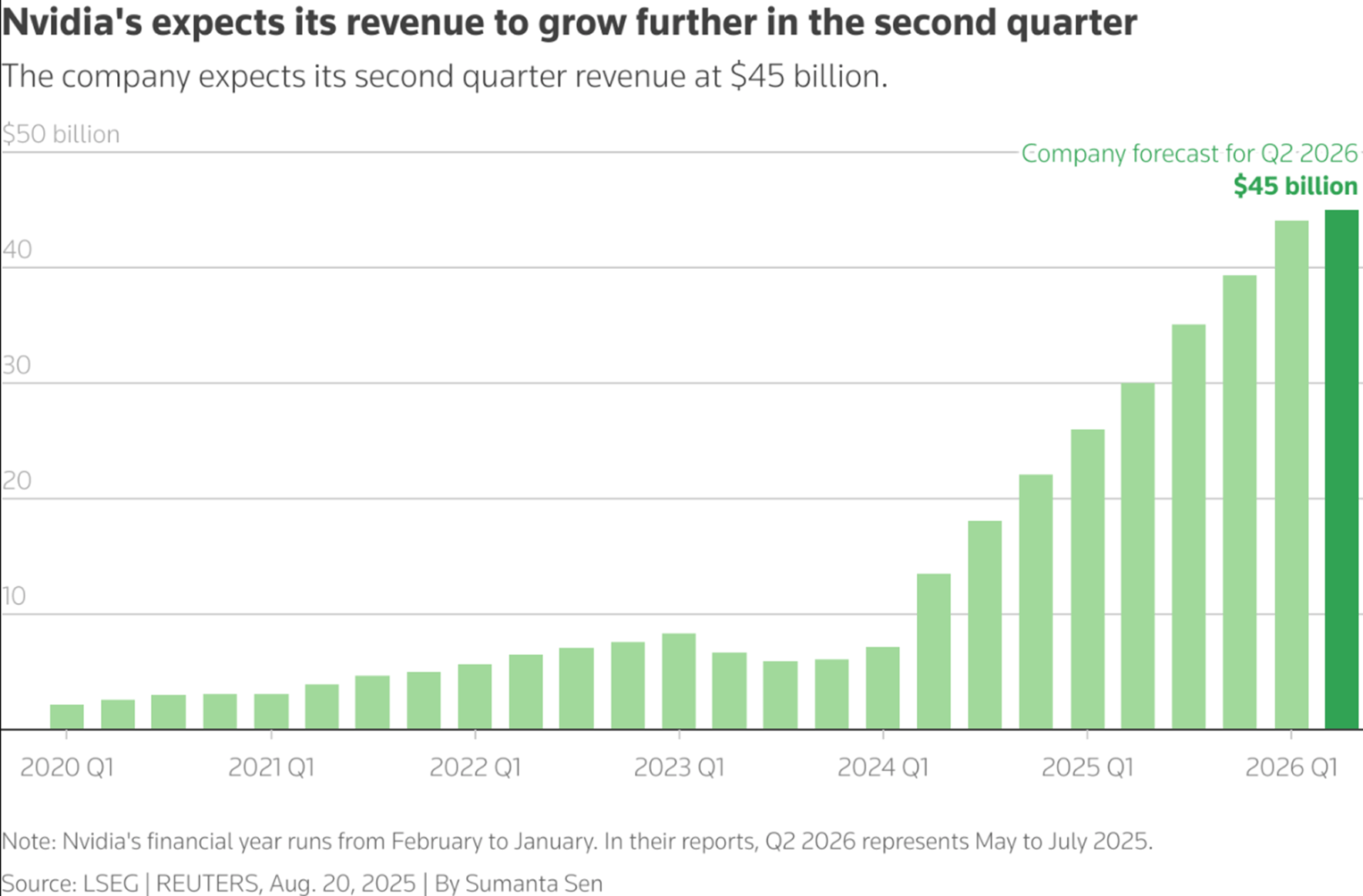

5. Nvidia's August 27 earnings report takes on greater significance after last week’s doubt on the AI boom.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply