- Charts of the Day

- Posts

- Bears retreat as tech reignites rally.

Bears retreat as tech reignites rally.

Bubble concerns seem to have been pushed back further by the latest set of earnings.

Subscribe to receive these charts every morning!

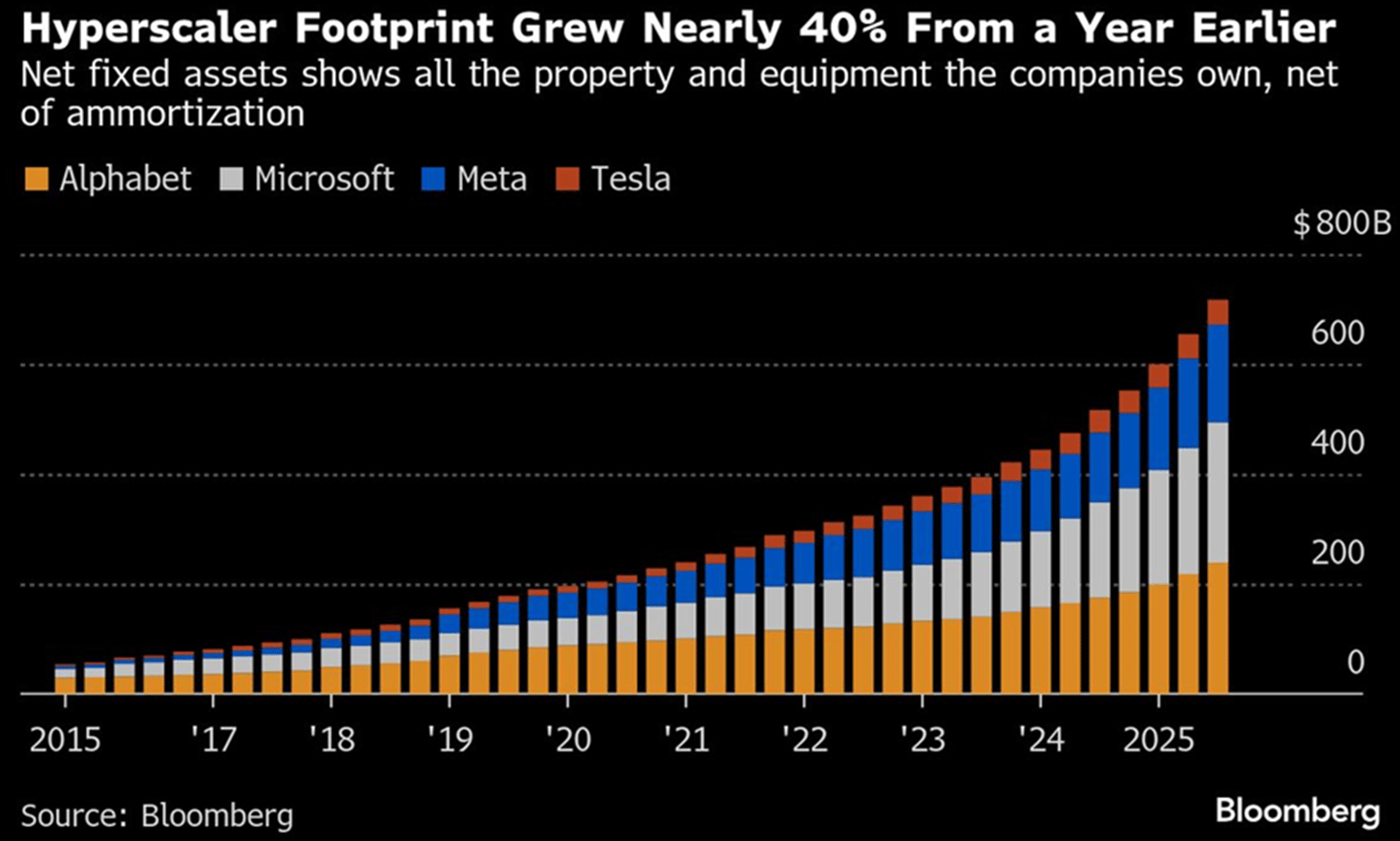

1. Bears retreat as tech reignites rally.

Apple forecast a major surge in sales for the holiday season, while Amazon’s cloud division notched its best quarterly growth in almost three years.

Bubble concerns seem to have been pushed back further by the latest set of earnings — the AI theme is where investors look for signals regarding global equities. It’s the Magnificent-7’s wonderful world.

Amazon shares jumped 12% and added $300 billion in market value.

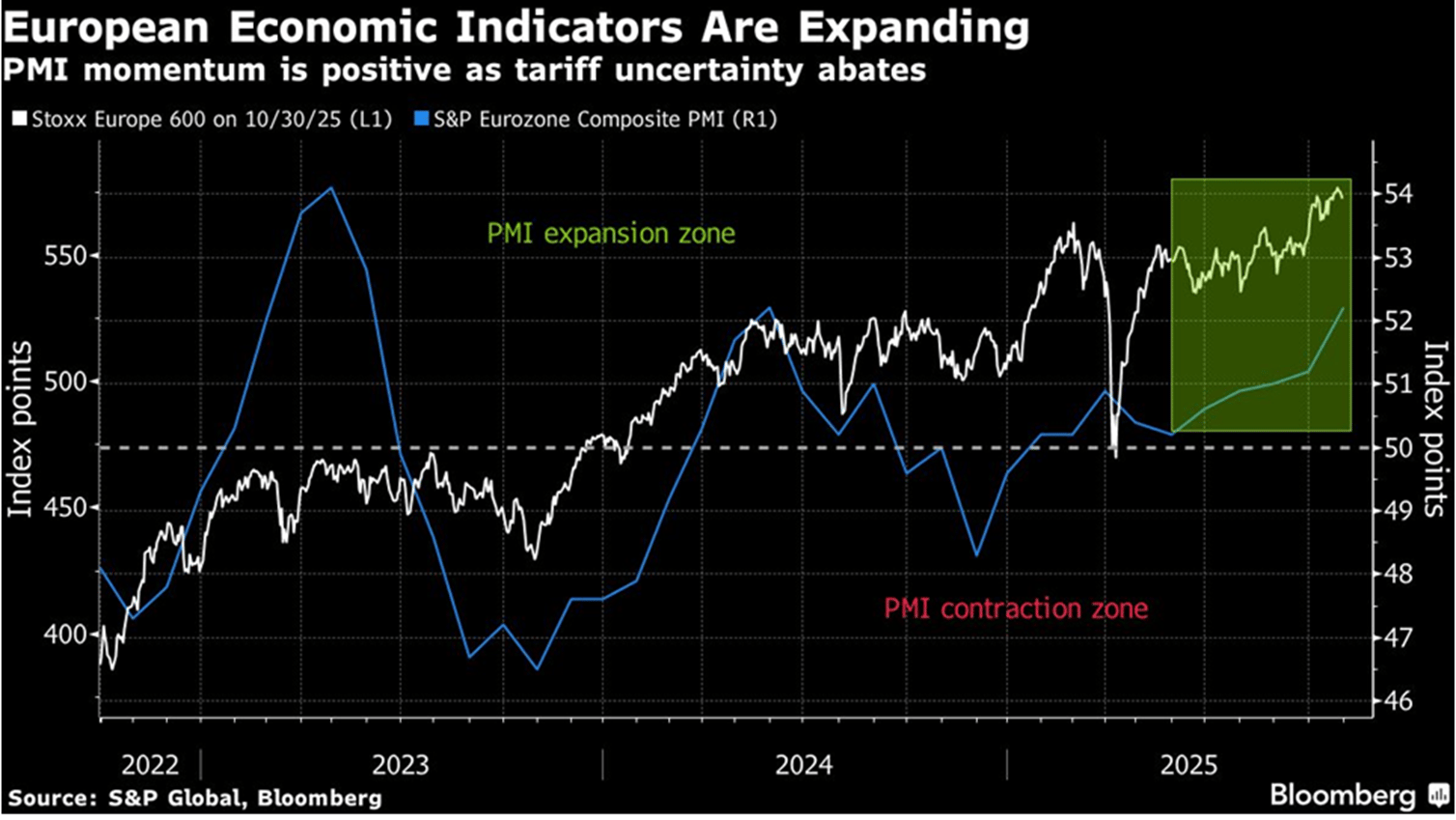

2. European economic data are supportive.

PMIs (Purchasing Manager’s indices) are edging higher, showing strong activity momentum, while GDP readings have just surprised to the upside, displaying resilience to higher US tariffs.

“Third-quarter Eurozone GDP came in a little higher than expected, with Spain looking strong and France doing surprisingly well,” says Neil Birrell, CIO at Premier Miton Investors. “While the wider economy is far from booming, it was interesting that the economic confidence index also came in better than expected, and perhaps the impact of trade tariffs on the region is not as bad as feared.”

With the economy improving, interest rates already low, and fiscal stimulus likely to start making a real difference in the next few months, tailwinds are gathering for European earnings.

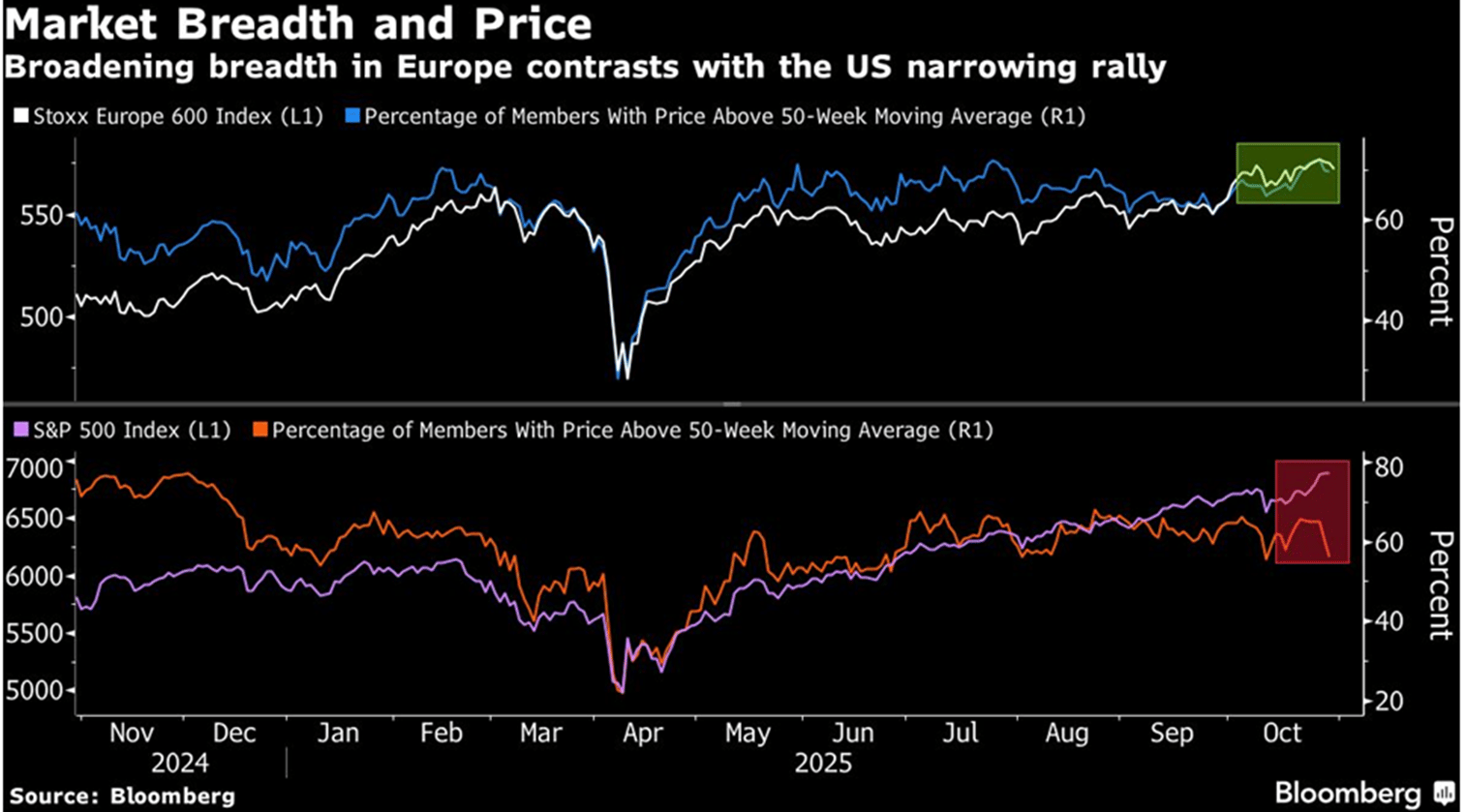

3. Bullish forces are aligning for a year-end rally in Europe.

Barclays strategists note that November and December are not only the best months for European equity returns, they’re also the strongest for inflows. The team sees evidence of that this year, with US investors returning and a pause in outflows from Germany.

Meanwhile, hedge funds look ripe for regional rotation, with their exposure very high to the US and extremely sparse in Europe. “With EU positioning quite low and activity surprising positively, the set-up has improved for the region,” the Barclays team says.

In contrast with a US market increasingly reliant on tech, Europe’s rally is broadening. Sectoral rotation is at full throttle, especially given how severe the polarization between well-owned European domestics and shunned exporters was after the summer. Now, exporters are staging a rapid recovery as this earnings season shows a milder impact from tariffs than most feared.

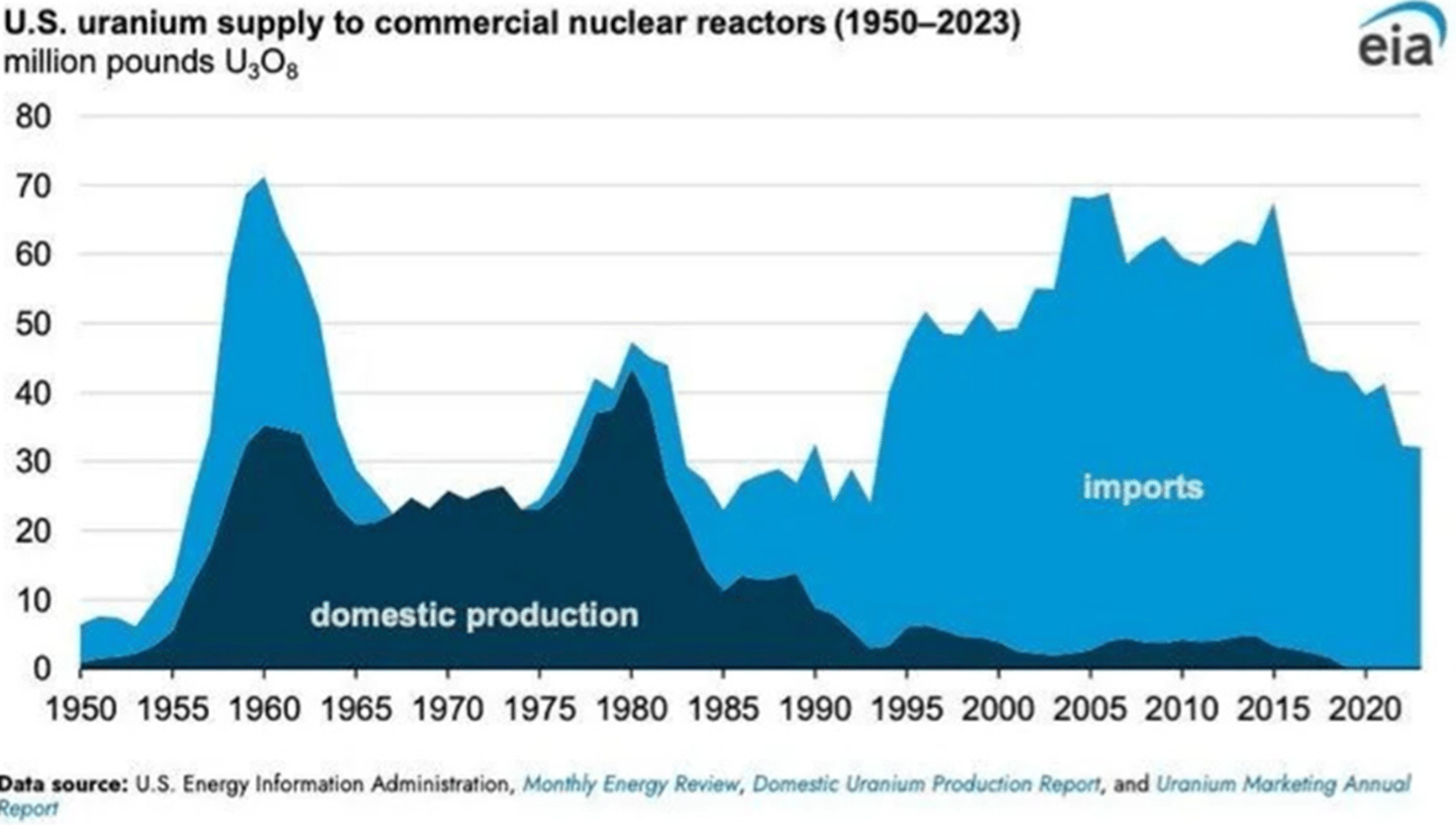

4. Make nuclear great again?

There is no AI supremacy without abundant energy.

Enter nuclear energy.

Nuclear is the only sector Trump hasn’t pumped yet. US domestic uranium production was strong until 1980, then collapsed. Today, US nuclear generators depend on imported uranium — mostly from unfriendly nations.

5. META is “all-in” on their smart-glasses partnership with EssilorLuxottica.

“The new Ray-Ban Meta glasses and Oakley Meta Vanguards are both selling well as people love the improved battery life, camera resolution, new AI capabilities, and the great design.” “And there's our new Meta Ray-Ban Display glasses -- our first glasses with a high-resolution display and the Meta Neural Band to interact with them. They sold out in almost every store within 48 hours, with demo slots fully booked through the end of next month. So we're going to have to invest in increasing manufacturing and selling more of those. This is an area where we're clearly leading and have a huge opportunity ahead.” “I think that there’s some revenue that we get from basically selling the devices and then some that will come from additional services and from the AI on top of it. So I think that there’s a big opportunity. Certainly, the investment here is not just to kind of build a -- just the device. It’s also to build the services on top.”

Below: Each pair of AI glasses comes with its own Meta Neural Band, an EMG wristband that translates the signals created by your muscles (like subtle finger movements) into commands for your glasses.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply