- Charts of the Day

- Posts

- Big Bank earnings have been good but...

Big Bank earnings have been good but...

...prices and expectations have gotten a little high, and some of the excess steam is coming out.

1. Profit expectations are (very) optimistic.

There are significantly high expectations for global earnings growth this year, leaving little room for error as stocks are already priced for perfection.

Consensus among analysts is for double-digit earnings growth across the US, Europe and emerging markets. While there’s still time for lofty expectations to get trimmed, they do look particularly optimistic. Given current valuation levels, downgrades might not be taken well by stocks that are in a “run-it-hot” mode as they extend last year’s rally.

There are reasons to be cautious, even with a strong economic outlook: geopolitics, the feud between the US administration and the Federal Reserve, as well as a cooling job market in the US. On top of that, the European stock market looks hot, triggering overbought signals at the index, sector and stock level. The earnings season could be the catalyst that flips the narrative.

“Sector rotation or stock picking is becoming a bigger theme this year,” says JPMorgan.

2. Big Banks speedbump.

Bank Of America CEO Brian Moynihan said, “With consumers and businesses proving resilient, as well as the regulatory environment and tax and trade policies coming into sharper focus, we expect further economic growth in the year ahead…” and “While any number of risks continue, we are bullish on the U.S. economy in 2026.”

Overall, on the consumer side, smaller loan loss provisions suggest that loan quality and the overall health of consumers remain intact. For these bank stocks (and U.S. economy) that are levered to the consumer, that’s music to investors’ ears.

Unfortunately, it just seems that prices and expectations have gotten a little high, and some of the excess steam is coming out.

Below: Volatility was a headache for dealmakers but a goldmine for traders. JPMorgan (+40%) and Bank of America (+23%) posted massive jumps in equity trading revenue, helping offset weakness elsewhere. However, those reliant on Fixed Income (like Citi) saw less upside.

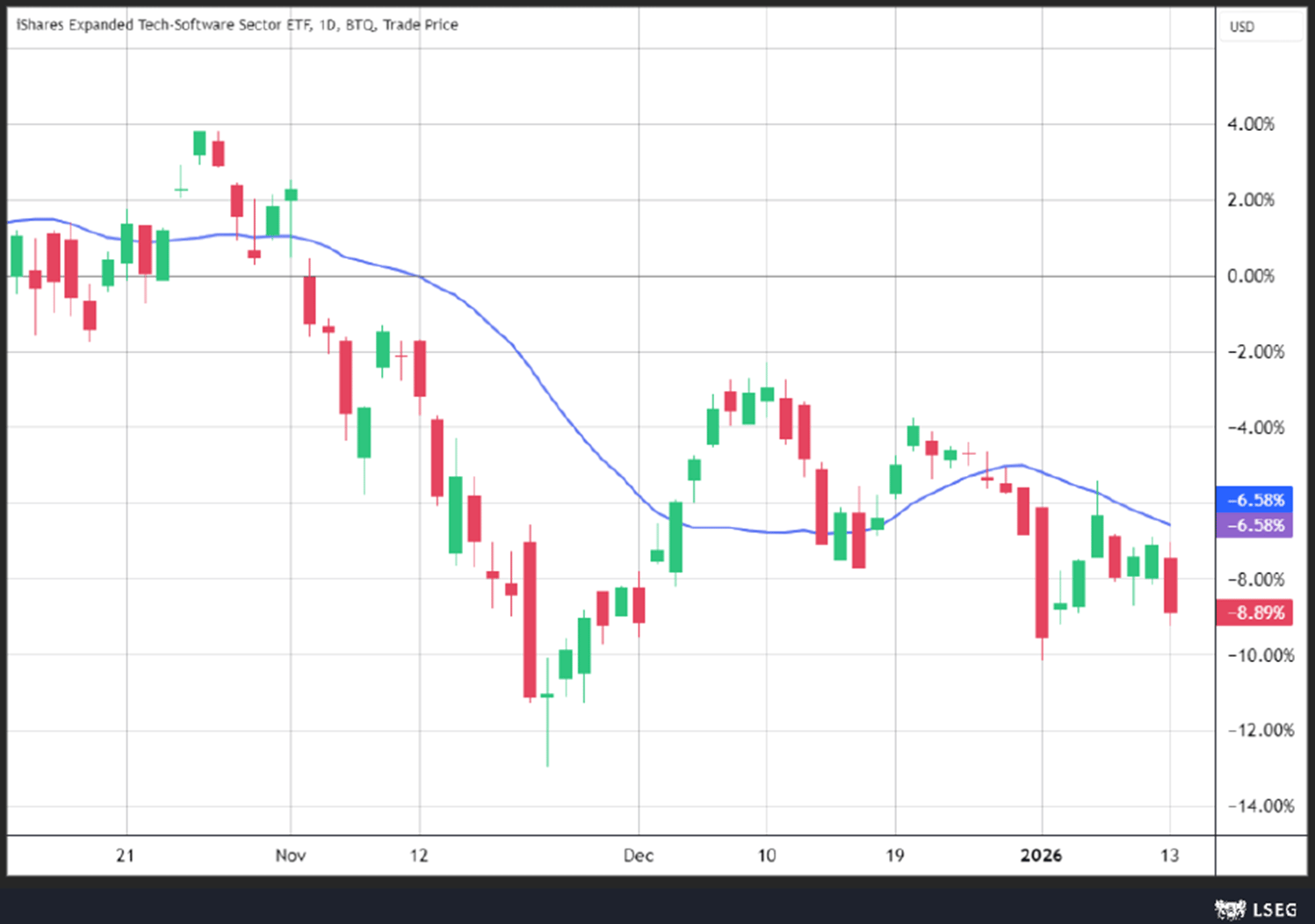

3. The artificial intelligence trade continues to put pressure on software stocks.

Some of the largest players like Adobe, Salesforce, and UiPath were falling after Oppenheimer’s downgrade of Adobe.

Here is the US Software ETF.

4. Meta wants to double Ray-Ban AI-glasses production to 20 million.

A Bloomberg report says that Meta Platforms and EssilorLuxottica are discussing potentially doubling production capacity for AI-powered smart glasses by the end of this year due to surging demand. EssilorLuxottica, which is responsible for manufacturing, is already near its current capacity target of 10 million pairs by the end of 2026.

The stock is ready for another up-move.

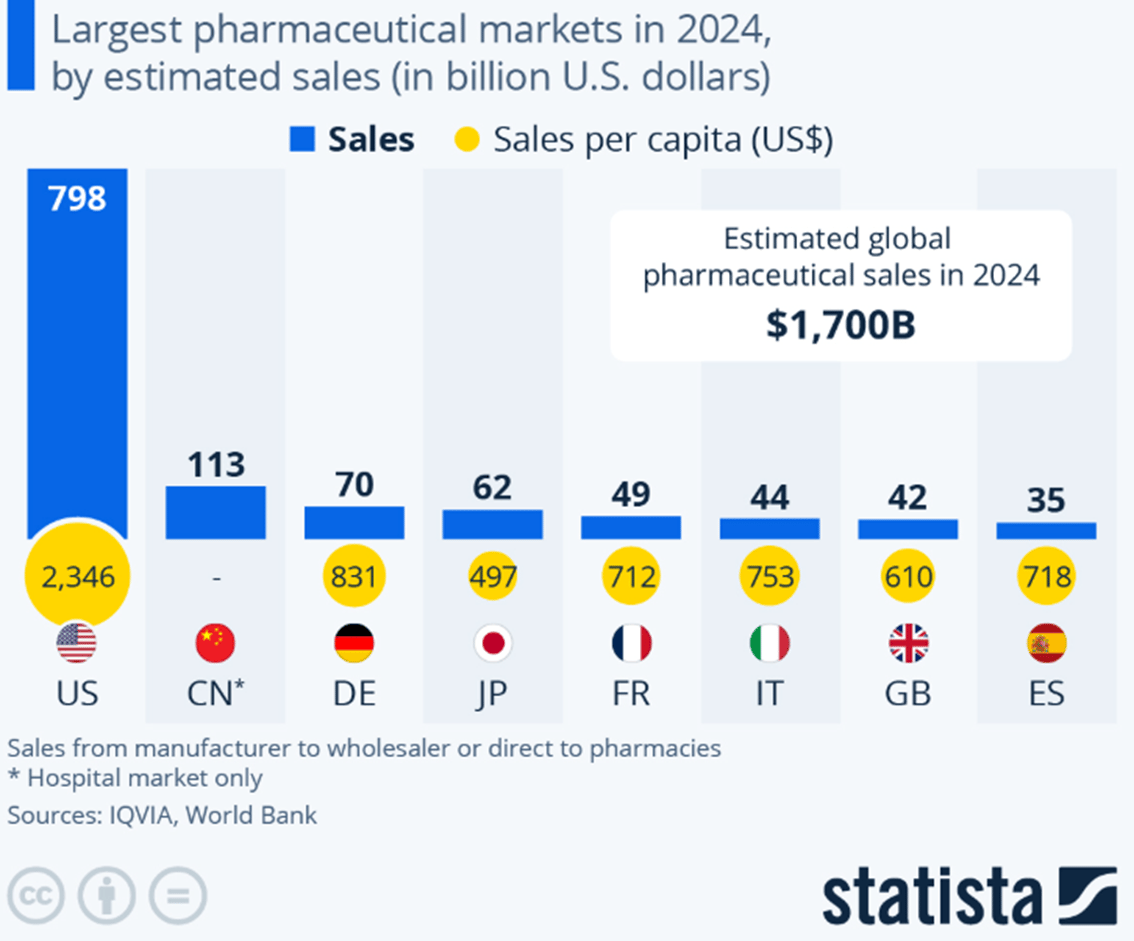

5. U.S. accounts for half of the global pharma market.

According to the healthcare intelligence company IQVIA, the U.S. alone accounted for nearly half of all worldwide prescription drug sales in 2024, generating almost $800 billion in revenue, within a global pharma market estimated at $1.7 trillion.

More importantly, the disparity persists when accounting for population size. In 2024, pharmaceutical sales exceeded $2,000 per capita in the United States, one of the highest rates in the world. In contrast, this indicator was significantly lower in many European countries: approximately $800 per capita in Germany, $700 in France and Spain, $600 in the United Kingdom. These differences partly reflect the lack of drug price controls in the U.S. and its role as the primary revenue engine for global pharma giants.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply