- Charts of the Day

- Posts

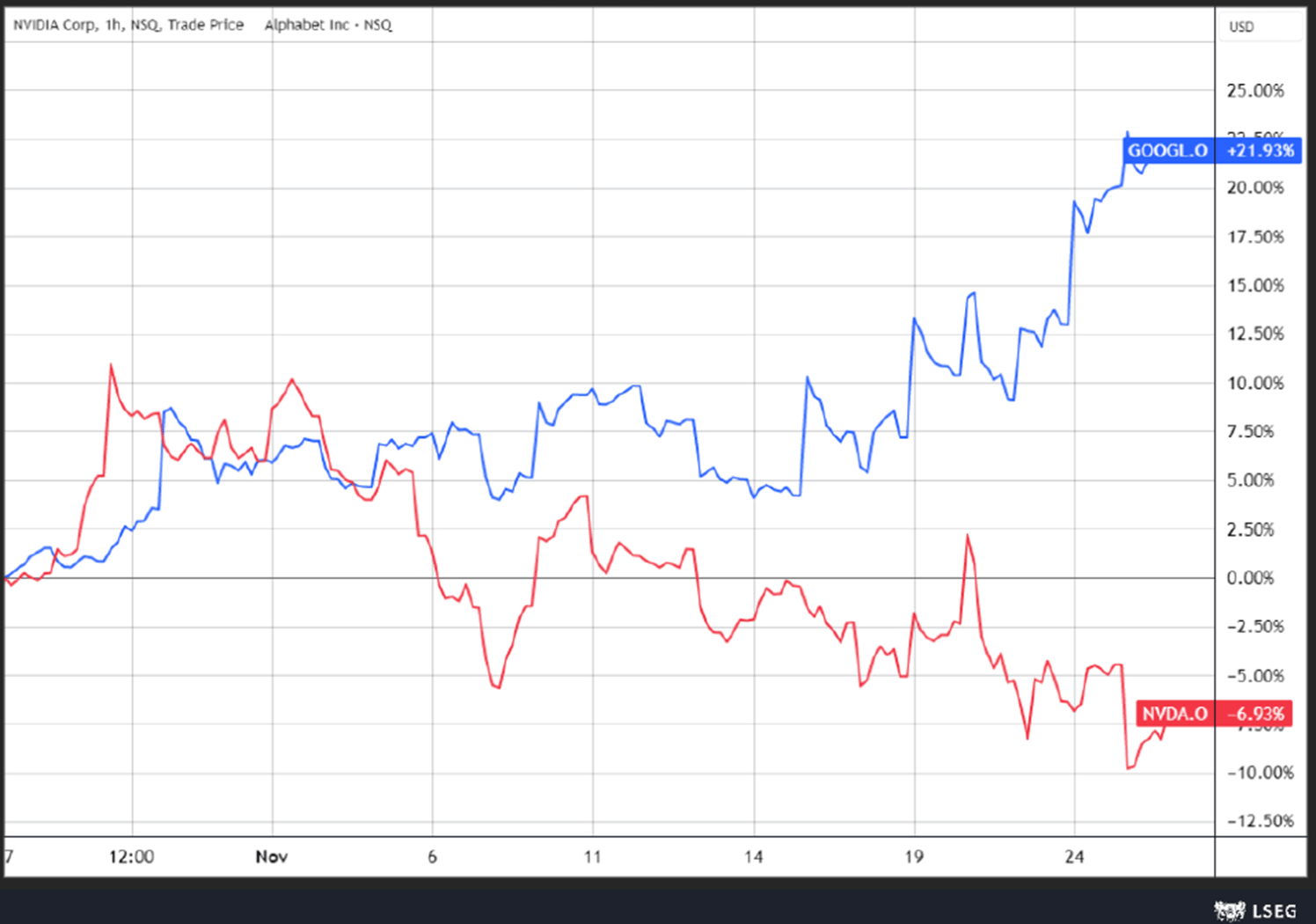

- Black Friday chip deal from Google.

Black Friday chip deal from Google.

The S&P 500 sitting nearly 2% from all-time highs even without Nvidia.

Subscribe to receive these charts every morning!

1. “Near-term weakness offers an opportunity to add long exposure”, says Morgan Stanley.

“Although the S&P 500 saw several days of selling last week, we remain highly convicted in our updated, bullish outlook for the S&P 500 and our 12-month price target of 7,800. Our out of consensus view that we are now in an early cycle backdrop (consensus thinks late-cycle) is reflected in our robust earnings outlook (we estimate 17% EPS growth in 2026e vs. bottom-up sell-side consensus at 14% and buyside consensus below 14%, based on our investor conversations).”

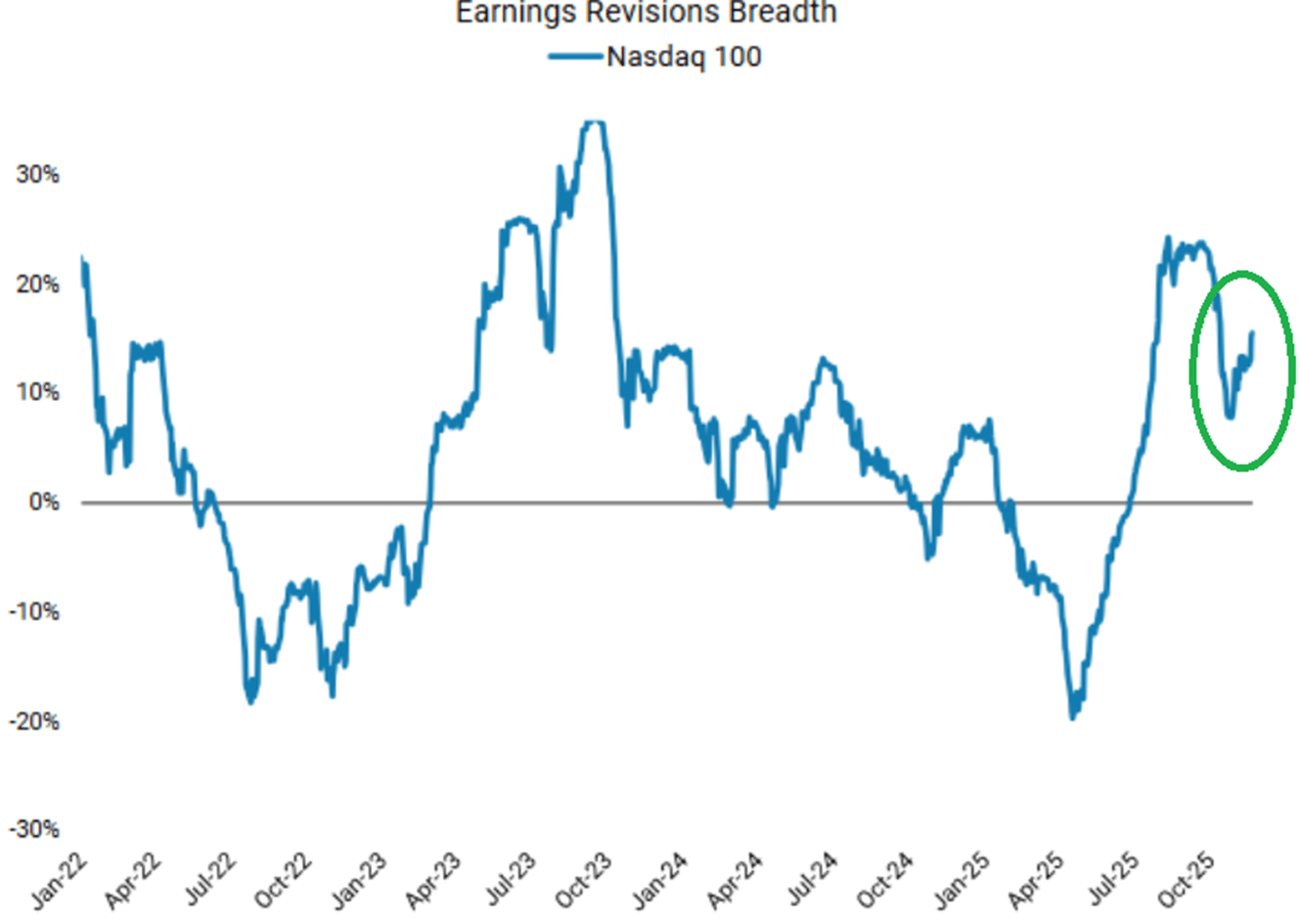

Below: “Earnings revisions for the Nasdaq have turned higher once again. This is a constructive sign.”

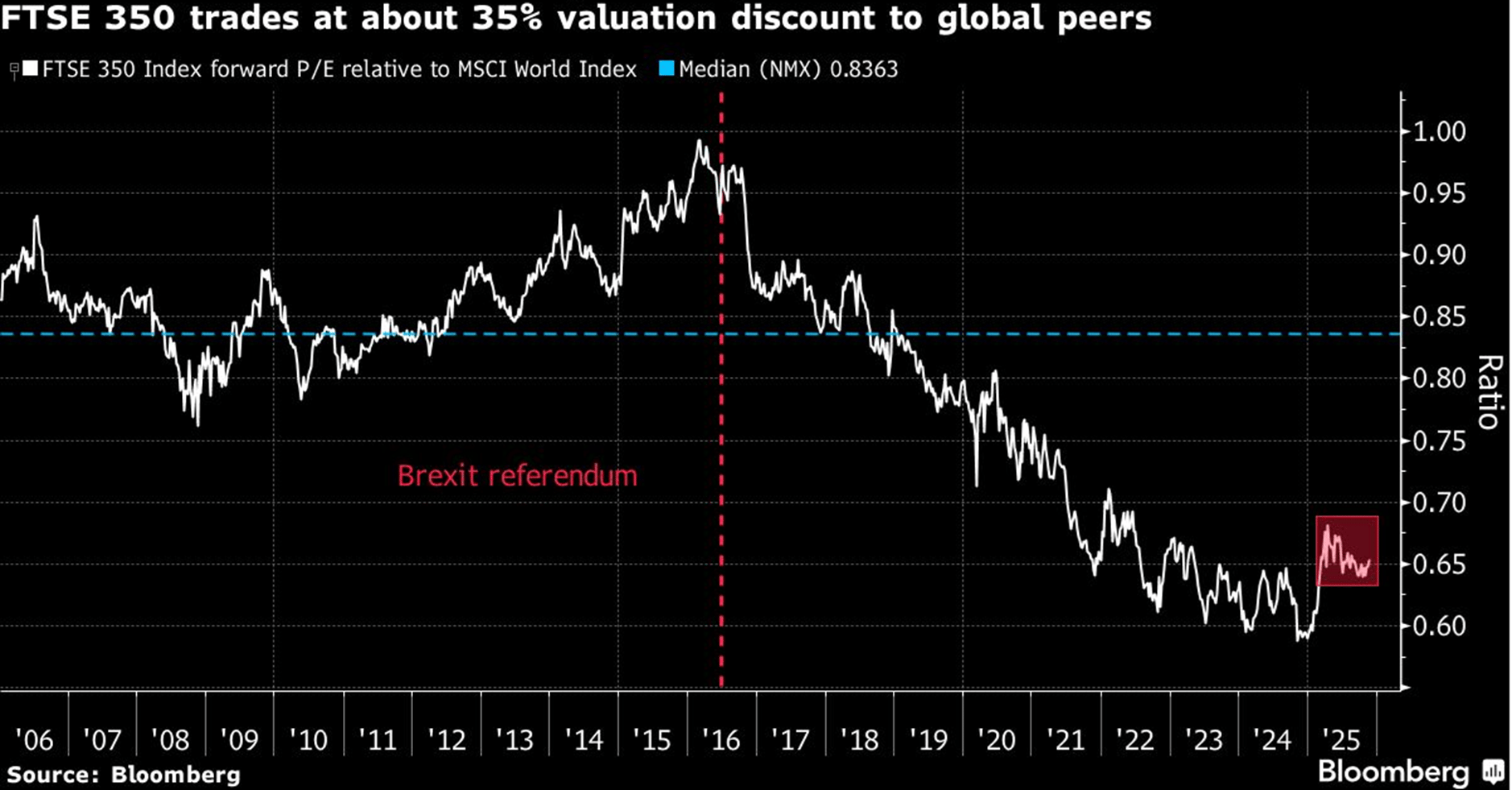

2. The upcoming UK Budget could potentially present a clearing event to restore investor confidence in UK equities.

“With UK equities continuing to trade at a material discount compared to global peers, a more benign and pro-business fiscal package could serve as the necessary clearing event for investors to reconsider if the discounts are warranted.” “Measures that stimulate investment, such as spending on infrastructure and AI, along with pronouncements that boost financial transparency and stability, would be key”. “Such a move could trigger a long-due reappraisal of the UK market, thus potentially unlocking substantial value for investors”.

UK stocks have plunged relative to the rest of the world since the Brexit referendum, making them among the cheapest out there. The FTSE 350 offers a 35% discount to global stocks, a gap that largely holds even on a sector-adjusted basis.

3. Google versus Nvidia.

Alphabet was climbing yesterday, nearly reaching the $4T market cap milestone.

The story goes that Meta is planning to buy billions in Google AI chips for 2027 data center build-outs. The news brings competition to Nvidia in the AI data center industry. Facebook would spend an estimated $50B on Tensor processing unit chips with Google next year, Bloomberg estimated.

Jim Cramer, CNBC’s guy, said in a tweet that Broadcom was the ultimate winner of the possible deal. Google’s TPU chips are sourced from Broadcom, Cramer said, and they would fulfill the contract. Unlike Nvidia’s do-everything Blackwell chips, Google’s TPU chips are made for specific tasks at Google, but CNBC reported Google lets other companies rent them through Google Cloud.

And who bought Alphabet a couple of weeks ago? Warren keeps winning up to the last trades before he steps down this year.

4. Alibaba is becoming a big AI player.

The stock surged already in the previous sessions after Alibaba revealed its AI chatbot (“Qwen”) notched more than 10 million downloads in the first week. Revenue from its cloud unit jumped 34% year over year, while AI-related product revenue achieved triple-digit growth for the ninth consecutive quarter. Alibaba plans to invest some $53 billion into the technology in the next three years. It already looks to be paying off.

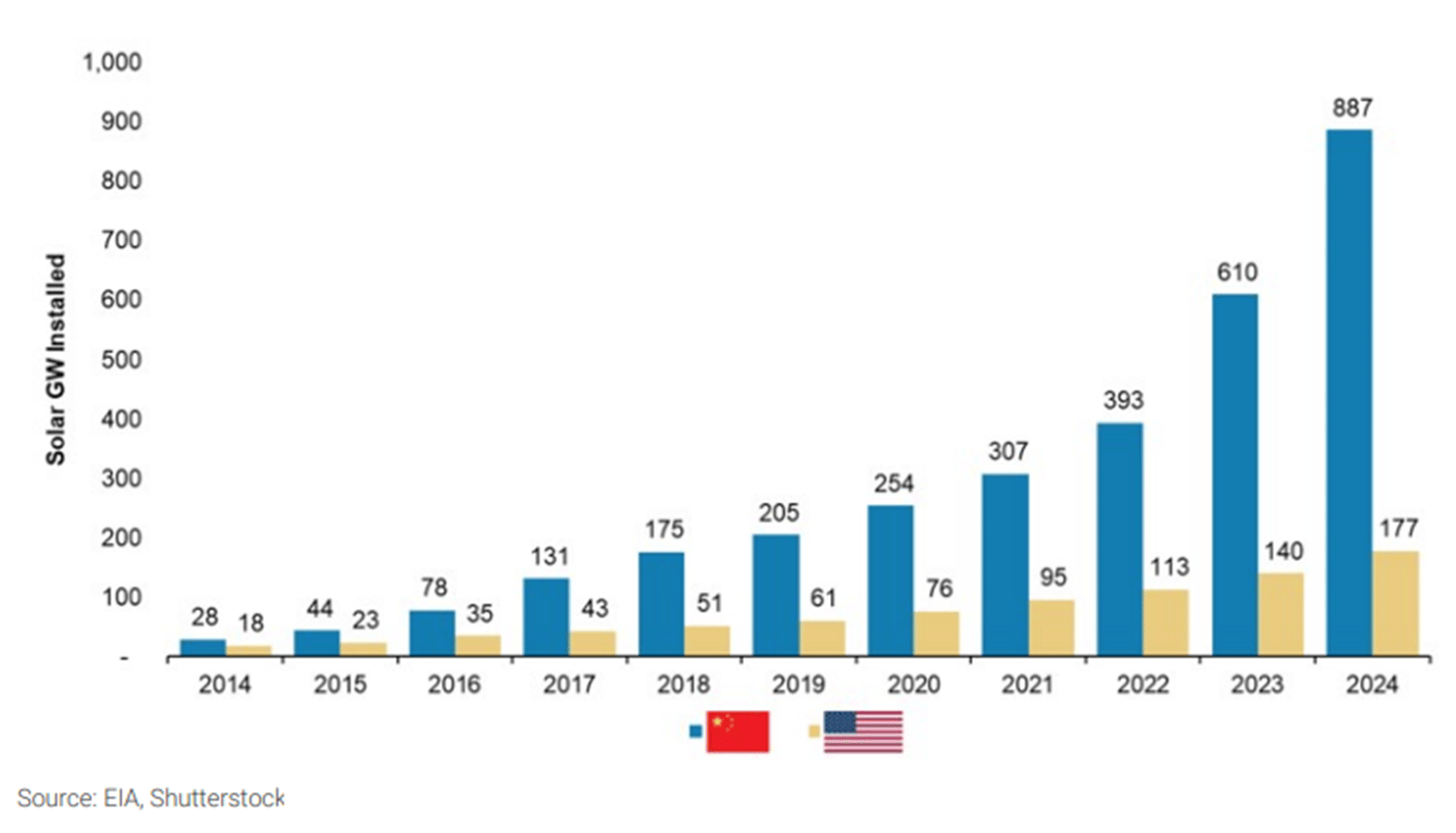

5. In just one year, China installed more than 1.5 times the total installed solar capacity of the US.

Let that sink in!

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply