- Charts of the Day

- Posts

- Broad selloff in U.S. assets.

Broad selloff in U.S. assets.

US stocks, bonds and the US dollar lower on "loss of trust".

1. Trump makes global stocks great again as US lags world markets.

Trump’s threat to impose tariffs unless a deal is reached for the purchase of Greenland has sparked speculation that European countries could dump US assets (easier said than done).

The latest drama comes in a backdrop of extreme bullishness. Investors are the most bullish in nearly five years, while protection against an equity correction is at the lowest since 2018, according to Bank of America’s latest fund manager survey. With BofA’s indicator showing the market at a “hyper-bull level,” it’s time to increase risk hedges and havens, strategist Michael Hartnett said.

2. Could the Fed stay on hold through 2026?

US yields are now at the highest level since September.

Analysts at Nordea believe the Fed might actually hold off from further rate cuts through 2026 as the labour market continues to hold up.

The stock market is discounting two rate cuts and does not like uncertainty.

3. Europe’s rising power demand and electrification needs are propelling its utilities stocks.

In the wake of new tariff threat by the US administration over Greenland, the domestic attributes of utilities also make them relatively immune.

The sector jumped 28% in 2025, and they outpaced the Stoxx 600 index by 11 percentage points, the only defensive category to beat the benchmark, and are extending their lead in the new year.

“The 10 years that we have ahead of us could be golden years for the sector,” says BNP Paribas. “Growth used to be elusive in the sector, but the electrification of the economy is changing that fast.” Utilities shouldn’t even strictly be described as defensives any longer — a defensive growth label might be more accurate. “When I look at the sector, I see, adding nominal growth and dividends, something between 10% and 15% per year of equity appreciation”.

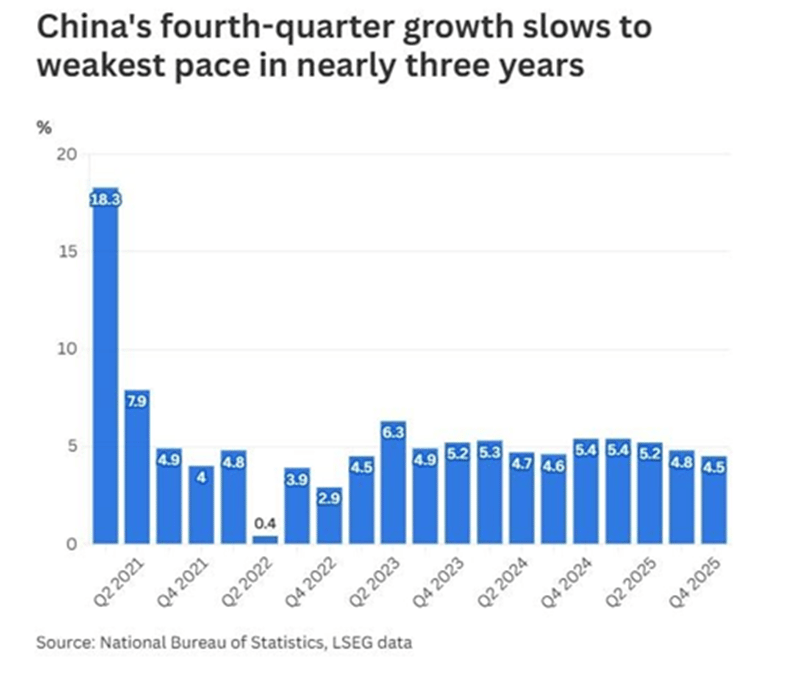

4. China’s GDP grew 4.5%, the weakest in nearly three years.

Industrial output is still going strong but domestic consumption remains weak.

And that’s bad news for the European luxury sector.

5. The most valuable media company of all time beat earnings estimates but its shares tumbled more than 4% in after-hours trading.

At eight times sales and 325 million subscribers, Netflix shares are discounting rapid growth and sustainably high returns. That gets harder when you’re already huge—especially in a fast-evolving industry.

But guess who has the greatest share of U.S. viewers across all platforms? Not Netflix: It’s Alphabet’s YouTube. Netflix co-founder Reed Hastings once said that sleep is its main competitor. It has managed to keep occupying the world’s waking hours with bingeworthy original shows. But crowdsourced content is pretty hard to compete with on volume and price.

Netflix wants to expand its live sport events such as Mike Tyson versus Jake Paul, but those aren’t cheap.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply