- Charts of the Day

- Posts

- Chinese stocks slide on renewed trade tensions.

Chinese stocks slide on renewed trade tensions.

Trump said he would put an additional 100% tariff on China from Nov. 1, as well as place export controls on critical software, after Beijing unveiled curbs on the export of rare earths earlier last week.

Subscribe to receive these charts every morning!

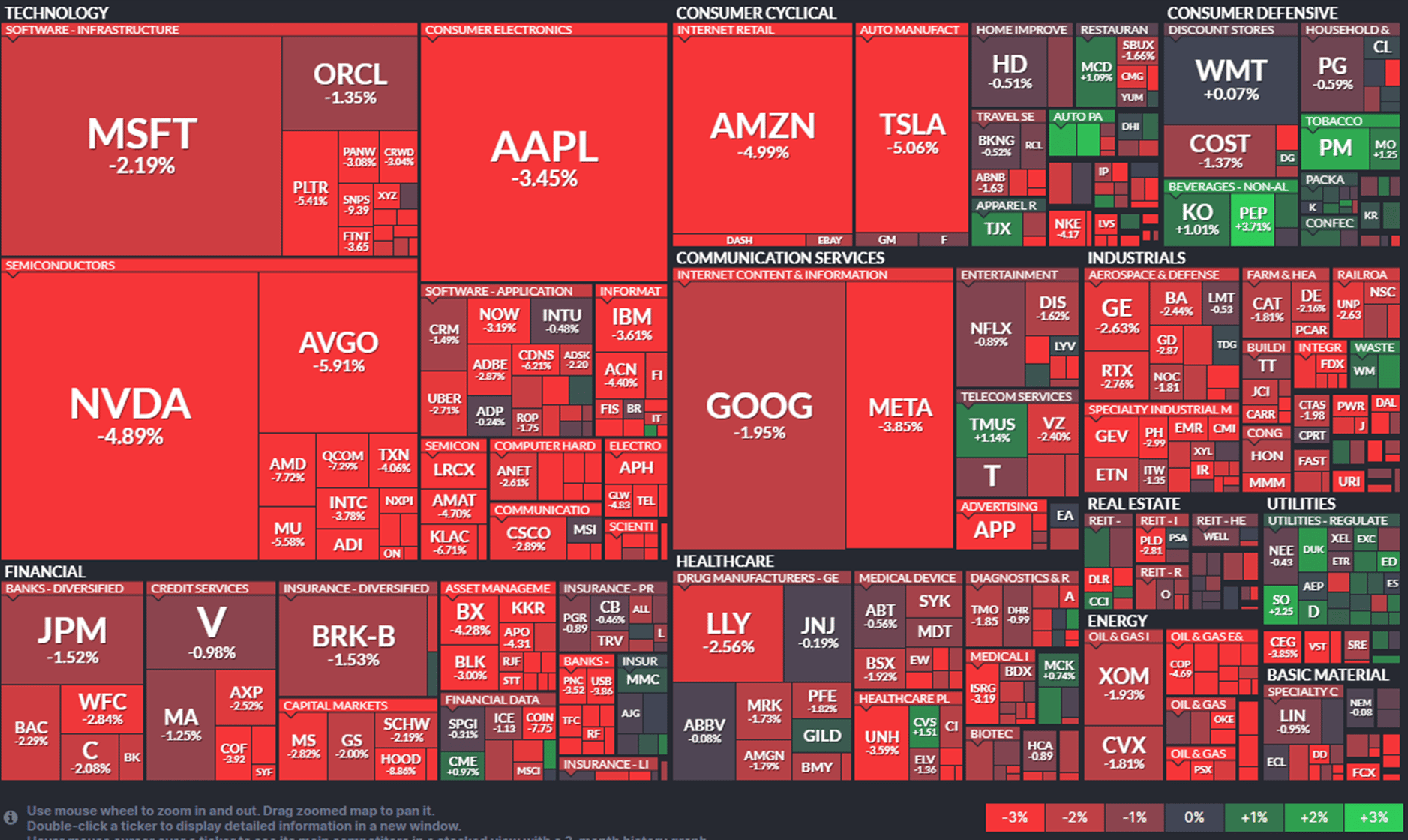

1. The market tanked Friday, the first correction in weeks, and ended nearly 3% down.

Trump announced plans to impose an additional 100% tariff on Chinese goods, effective November 1, which would bring the total tariffs to 130%. Tech got hit the hardest.

China controls 70% of rare earths, and this week started to require licenses for U.S. firms to export products containing rare earths or using Chinese refinery equipment starting Dec. 1.

Tom Keene, managing editor of Bloomberg News, said there is a difference between risk and uncertainty. Risk is quantifiable and can be priced in, but uncertainty is frightening to markets.

Katie Greifeld, Bloomberg Reporter, said this could be a hopeful revival of the ‘Trump Always Chickens Out’ Taco Trade, and that this is just part of a negotiation strategy.

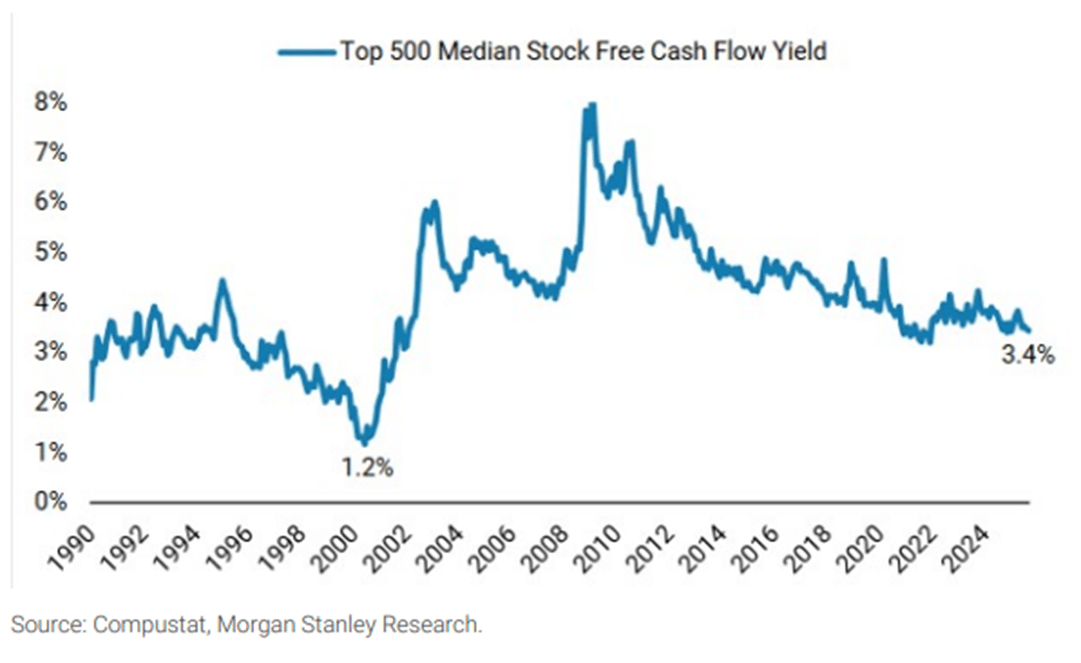

2. Are US valuations justified?

There’s a growing debate about whether valuations are in a late-1990s style bubble.

Free cash flow yield for the median large cap stock is materially higher than it was in 1999.

3. “Don’t dream of getting rich on gold, especially after its latest epic run above $4,000 an ounce.”

The latest “gold rush” has been dubbed “the debasement trade”, which is a growing fear of central banks losing inflation discipline, eroding currencies’ value.

But not every investor thinks so: Years ago, Warren Buffett pointed out the absurdity: “Gold gets dug out of the ground…then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

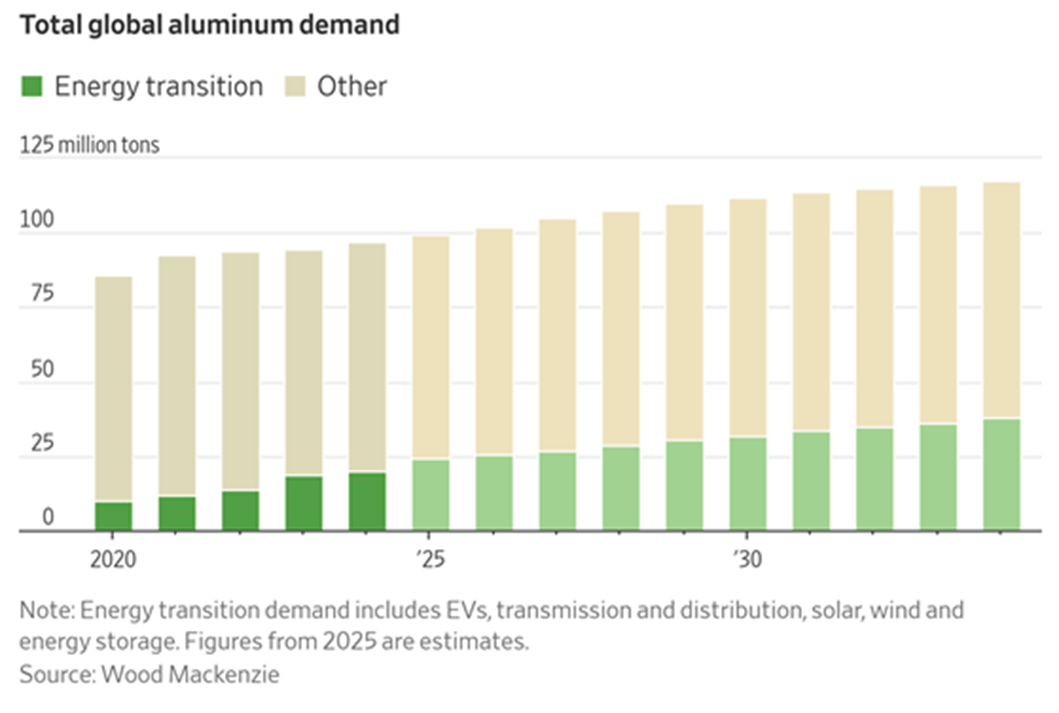

4. Aluminum could become the next “Copper”.

Metals are having their moment. Aluminum could be the next to shine.

Aluminum has applications across several fast-growing sectors.

Alongside copper, lithium and steel, it is one of the four key metals needed for the transition to new energy sources.

5. Who is active in Aluminum?

Rio Tinto's business is diversified across several commodities, with aluminum (including bauxite and alumina) making up approximately 25-27% of its revenue. Rio Tinto was the third-largest producer of aluminum globally in 2024.

Alcoa's Aluminum segment generated about 65% of total revenue in 2024.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply