- Charts of the Day

- Posts

- Daily Newsletter - December 19, 2024

Daily Newsletter - December 19, 2024

Daily newsletter for Financial Advisers by Financial Advisers.

1. No Santa Claus rally as Powell signals fewer rate cuts in 2025.

The slow and steady decline most stocks have been experiencing throughout December accelerated into a full-blown selloff after the Fed reduced its rate cut outlook amid rising inflation risks.

Bottom line: Higher rates are here to stay as long as the economy holds up and inflation remains sticky.

The S&P 500 dropped 2.95% and had its worst one-day decline since March 2020.

Here’s the S&P 500 heatmap.

2. And who's going to buy the dip?

Fund managers were already 36% overweight US Equities in the latest BofA survey, the highest level on record (note: survey began in 2001).

3. Less than one third of stocks in the S&P 500 are outperforming the benchmark this year.

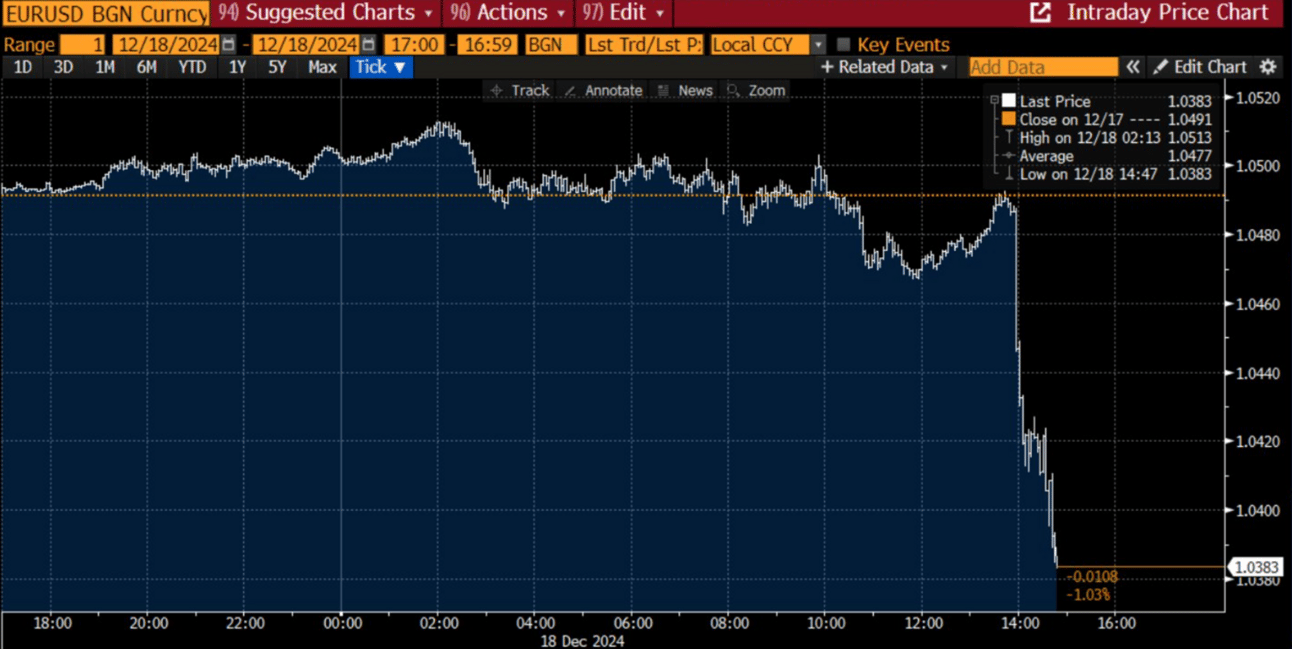

4. The Euro is heading toward parity with the Dollar.

After the Fed's "sticky inflation comments”, the Euro has dropped below $1.04.

The interest rate gap between Eurozone and the US is expected to grow even wider.

5. Green energy could be a smart contrarian trade.

On the face of it, 2025 is shaping up to be a stinker for renewable energy.

The planet seems ever further from restricting global warming to a manageable 1.5 degrees Celsius level, and the election of Donald Trump as U.S. president means that the world’s biggest economy will visibly retreat from the collective fight against climate change.

The iShares Global Clean Energy ETF fell 10% in the two weeks after the U.S. election. (-23% year-to-date, see chart below)

But Trump is focused on low-cost energy and solar and onshore wind are cheaper than gas-fired electricity, according to Lazard.

As Republican states received 70% of clean energy investment in the IRA’s first two years, a wholesale scrapping of the act would also be bad politics. More likely, Trump will accelerate permitting for new fossil fuel projects, but also for solar and onshore wind.

Meanwhile, hyperscalers like Microsoft and Amazon need loads more energy to train their artificial intelligence models. This should underwrite demand both for solar and for grid expansion.

McKinsey says that the build-out of U.S. data centres could require over 400 terawatt hours of extra electricity by 2030 – roughly France’s entire annual consumption.

6. Tech-Loving hedge funds have a crush on electricity stocks.

Old-school power companies have become darlings among hedge-fund firms thanks to their starring role in the artificial-intelligence boom.

Such companies command the scarcest resource in the generative-AI supply chain: the extra electricity that fuels the data centers needed to train large language models and answer prompts from users of AI chatbots such as ChatGPT.

Coatue, Lone Pine and Third Point are placing big AI bets on power and have been piling into the sector.

However, broad hedge-fund indexes are up (only) 10% year-to-date. The “smart money” has been underperforming the indexes by a lot.

The ETF iShares US Utilities

7. Meta’s Ray-Bans hint at the future of smart glasses—sleek, stylish and truly wearable.

A menu floats in front of you, apps hover in your space and your eyes become the cursor. Just look at something, then pinch your thumb and index finger to select it.

Instead of using cameras for finger and hand navigation, a sensor wristband detects electrical signals generated by muscle contractions.

Soon enough, our golf putting might improve when glasses guide us to make the perfect shot.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply