- Charts of the Day

- Posts

- Global Trade on Edge

Global Trade on Edge

Trump said 150 countries will receive tariff letters, escalating global trade tensions and signaling a more aggressive stance on U.S. economic policy.

Subscribe to receive these charts every morning!

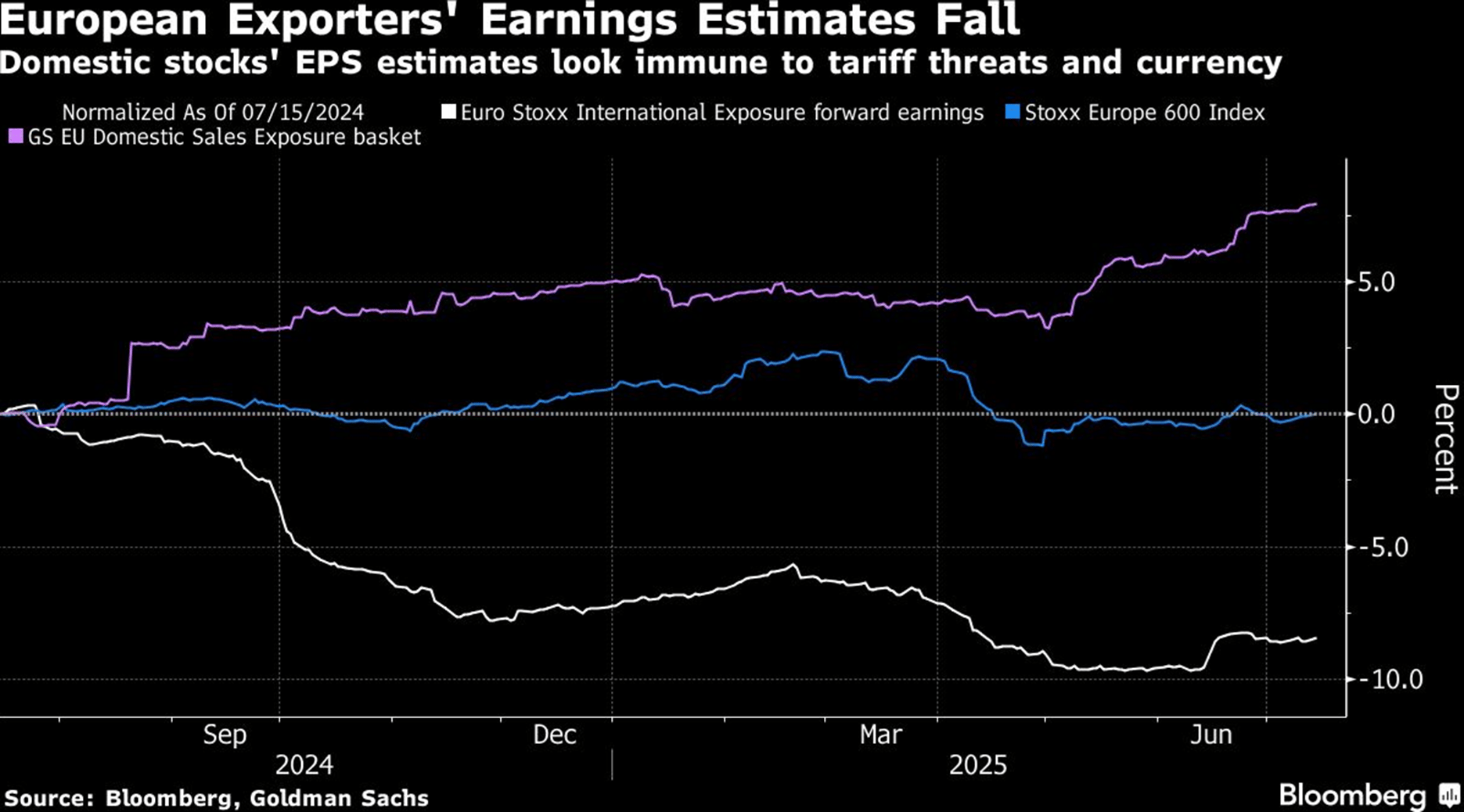

1. Currency headwinds favour domestic stocks.

A 10% rise in the euro-dollar spot rate could trigger a drop of about 2% in European earnings, according to Citigroup analysis.

While the dollar has steadied in recent days, many expect further weakness.

Goldman Sachs strategists led by Peter Oppenheimer foresee a prolonged depreciation path for the currency, bringing headwinds for European earnings with it. “A weakening dollar has weighed on European stocks — and it is here to stay,” the team writes in a note.

2. Global data center capacity is set to increase sixfold by 2035.

The biggest bottle neck is not the availability of chips but power generation, grid connections and supply of electricity hardware.

3. Data centers electrical system suppliers by market share.

4. “The market is underestimating the long-term growth of renewable energy.”

“We remain confident in the long-term outlook for renewables growth given power demand growth and data center load, along with the supply chain limitations in building new gas plants.”

5. Pharma has outperformed the index since Trump suggested a 200% tariff.

That outperformance may seem puzzling, but for Wall Street, the size of the tariff matters less than the timing.

Trump said he would announce tariffs on pharmaceuticals imported into the United States, probably at the end of the month, starting with what he called a low tariff rate to give companies time to move manufacturing to the United States before imposing a “very high tariff” in a year or so.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply