- Charts of the Day

- Posts

- Earnings season has started.

Earnings season has started.

Remember, expectations remain far more important than past results!

1. US inflation came in a touch lower than expected.

While today’s consumer price index (CPI) report indicated that core inflation continues to trend slowly in the right direction (or at least stagnate), affordability remains a key issue for the Trump Administration ahead of the midterm elections.

That’s why today he added to his latest “policy moves” by flagging electricity prices and promising to bring them down. How he plans to do that is by targeting tech giants, saying they must bear the cost of data centers so average Americans don’t pay more for energy.

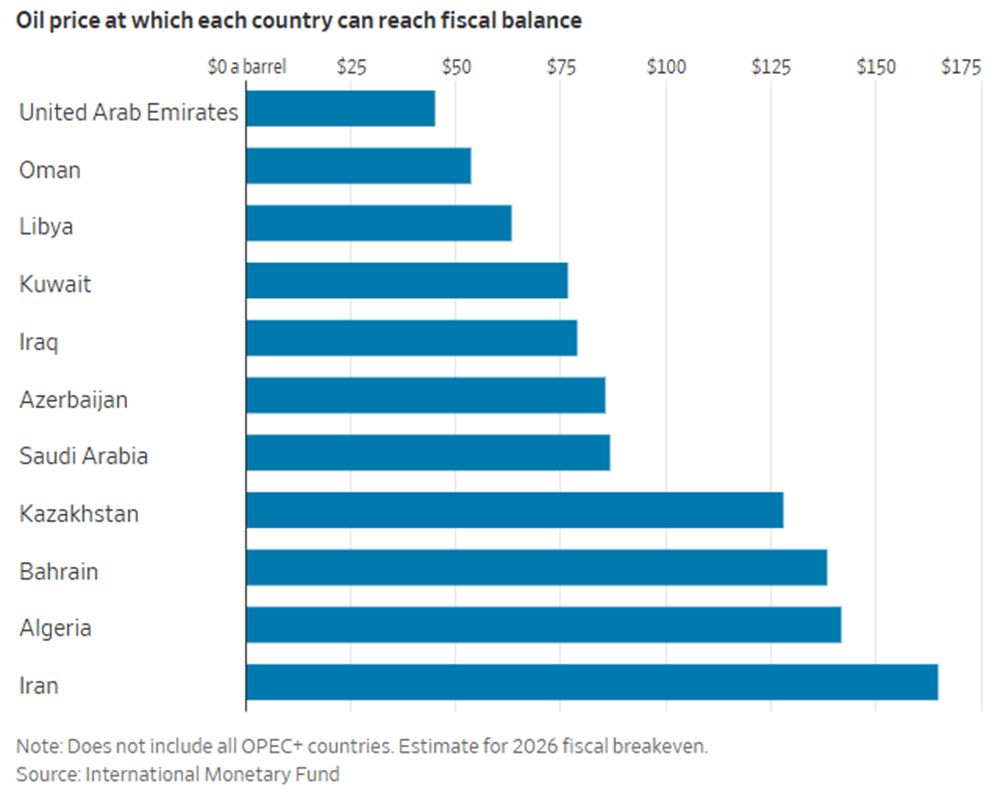

At the same time, lower oil prices are also on the White House agenda and Trump wants to drive down oil prices to $50 a barrel. However, most OPEC countries require oil prices well above $60 a barrel to balance their fiscal budgets.

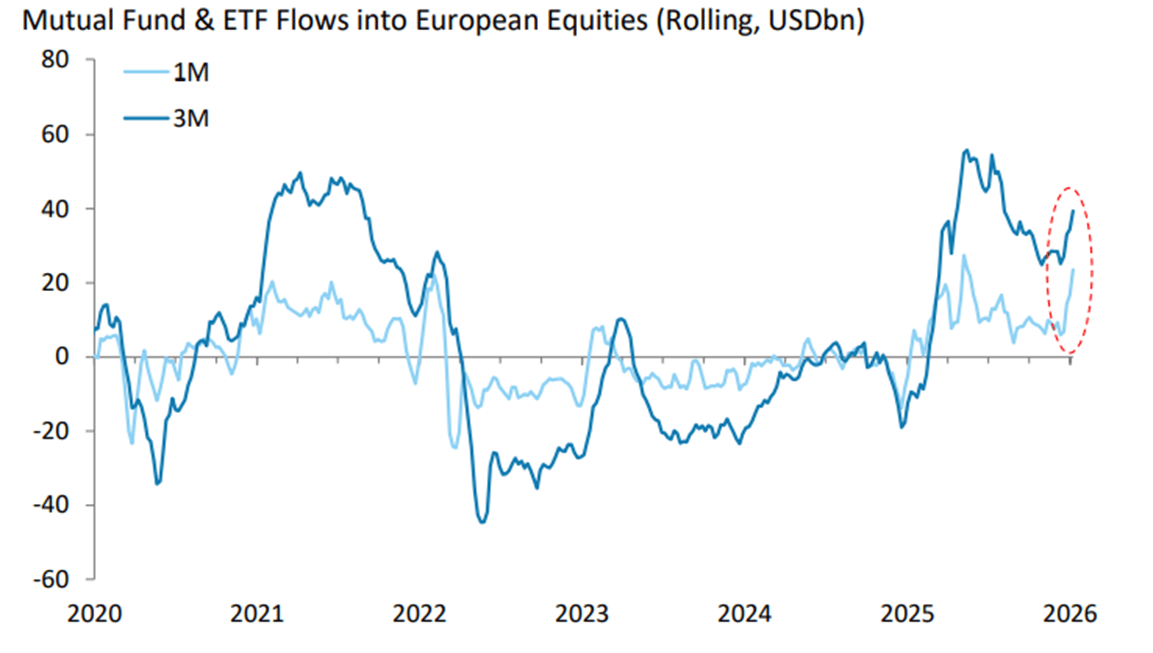

2. Diversification flows into EU equities are back (just like early 2025...)

We are seeing a pick-up once again in global investor diversification flows into European equities. Investor interest in Europe began to pick-up in selective sectors and is now broadening. Citi’s Manthey sees more investors diversifying out of US stocks in 2026. “Of course with this overbought level you always have the risk of a pullback,” says Thomas Zlowodzki, head of equity strategy at Oddo BHF. “It’s quite clear that European markets can’t continue climbing at that pace.”

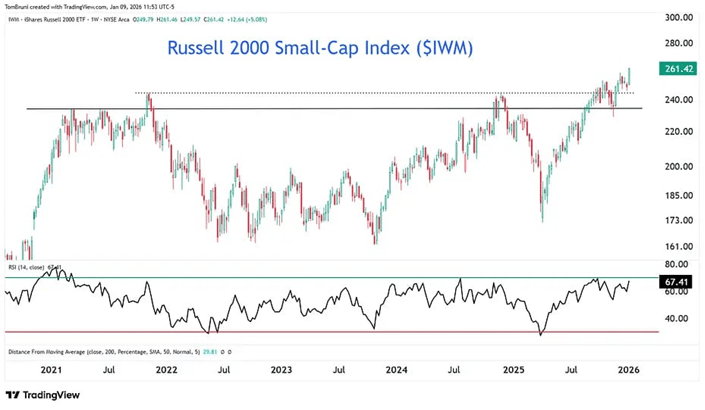

3. US Small-Caps surge as market breadth expands.

For the last four years, small-caps have frustrated investors with their underperformance and lack of direction, but with last week’s close at all-time highs, analysts say any doubt about the Russell 2000’s trend has been eliminated.

4. Defense offers the highest EPS growth of any EU sector…

Also, EU Defense sector multiples are not stretched on an EPS growth adjusted basis vs other sectors.

5. China’s rally is based on strong earnings.

The MSCI China Index is expected to rise 22% over the next 12 months, based on bottom-up consensus price targets compiled by Bloomberg. That’s expected to be supported by 14% growth in aggregate profits for index companies, higher than estimates for India and Japan - Asia’s two other major economies.

Equity valuations remain supportive despite last year’s run. At 12 times one-year forward earnings estimates, the MSCI China gauge is trading at a 36% discount to the MSCI All Country World Index. “This provides a compelling diversification aspect for investors to unwind underweight positions in China.”

6. Baidu and AliBaba breaking higher.

Both stocks are showing a clean breakout of their recent consolidation zone.

Investors and traders are putting it on their radars for the days and weeks ahead.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply