- Charts of the Day

- Posts

- ECB expected to hold rates as economy withstands tariffs.

ECB expected to hold rates as economy withstands tariffs.

Oracle becomes a data center operator with a massive $300B deal with OpenAI for cloud computing power.

!!!We will be on vacation for the next couple of weeks!!!

This is a fundamental shift in its business model towards Data Center Operator.

Part of the news was of a massive $300B deal with OpenAI for cloud computing power, according to a WSJ exclusive. The deal made up 90% of the new forward sales added in the quarter.

The contract is due to start in 2027, and it’s not a sure thing. OpenAI burns through money, pulling in only about $10B a year, and its bill to Oracle will be $60B annually. Oracle said it expects annual cloud infrastructure revenue to reach $18B next year, and double to $32B, then $73B, and so on to $144B in the next four years.

Oracle is now trading around 48 times forward earnings.

2. AI sustainability.

Analysts expect AI data centers to drive annual water consumption for cooling and electricity generation to more than 1 trillion liters by 2028 – an 11x increase from 2024 estimates.

The World Resources Institute (WRI) projected that an additional 1 billion people are expected to live with extremely high water stress by 2050 even under an optimistic scenario.

3. Job revisions spell trouble.

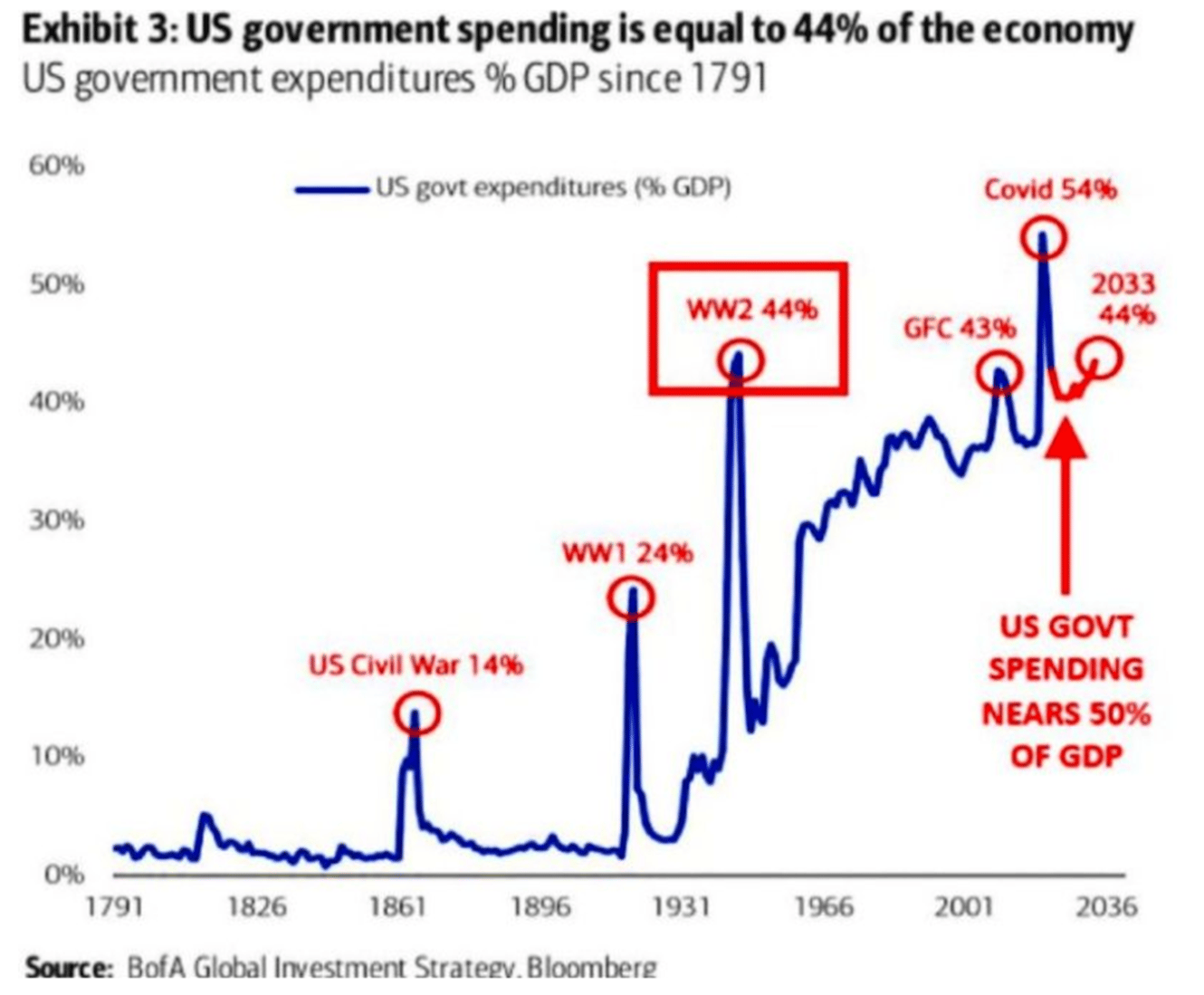

4. The US government is spending at levels we used to only see during wars or crises like 2008 and Covid.

5. Secondary watch prices continue to decline.

The main brands (Jaeger-LeCoultre, Piaget, Vacheron Constantin, IWC, etc.) are posting some of the worst declines in value (both YoY and QoQ) in the secondary market, as can be seen below - as nearly every model is now trading below retail (this was not the case 18 months ago).

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply