- Charts of the Day

- Posts

- Equities overcome precious-metals crash to trade higher.

Equities overcome precious-metals crash to trade higher.

"Cool" market reaction suggests equity markets are resilient.

1. Equities overcome precious-metals crash to trade higher.

Although sharp falls in gold and silver could hypothetically spark a more sustained downturn, the “cool” market reaction suggests equity markets are resilient. "Contagion doesn't appear to occur in equity markets at the moment. It's remarkable."

Nevertheless there was plenty of sector rotation from commodity linked equities into defensive sectors.

Here is the European Telecom ETF.

2. Deutsche Bank maintains $6,000 target for gold.

The bank says the adjustment looks tactical, not strategic, reinforcing its view that moderate gains are more sustainable over six and 12 month horizons.

Deutsche also stresses that gold’s thematic drivers remain intact and contrasts today’s backdrop with the environments that drove prolonged weakness in the 1980s and again in 2013.

It added that China has been a key driver of precious metal investment flows and that if the rise in Shanghai Gold Exchange premiums late last week is sustained, this will be an important sign and one that is correlated to Chinese gold import flows.

JPMorgan’s Commodities Research team remains also structurally bullish on gold, viewing the recent sharp correction as a "healthy reset" rather than a trend reversal.

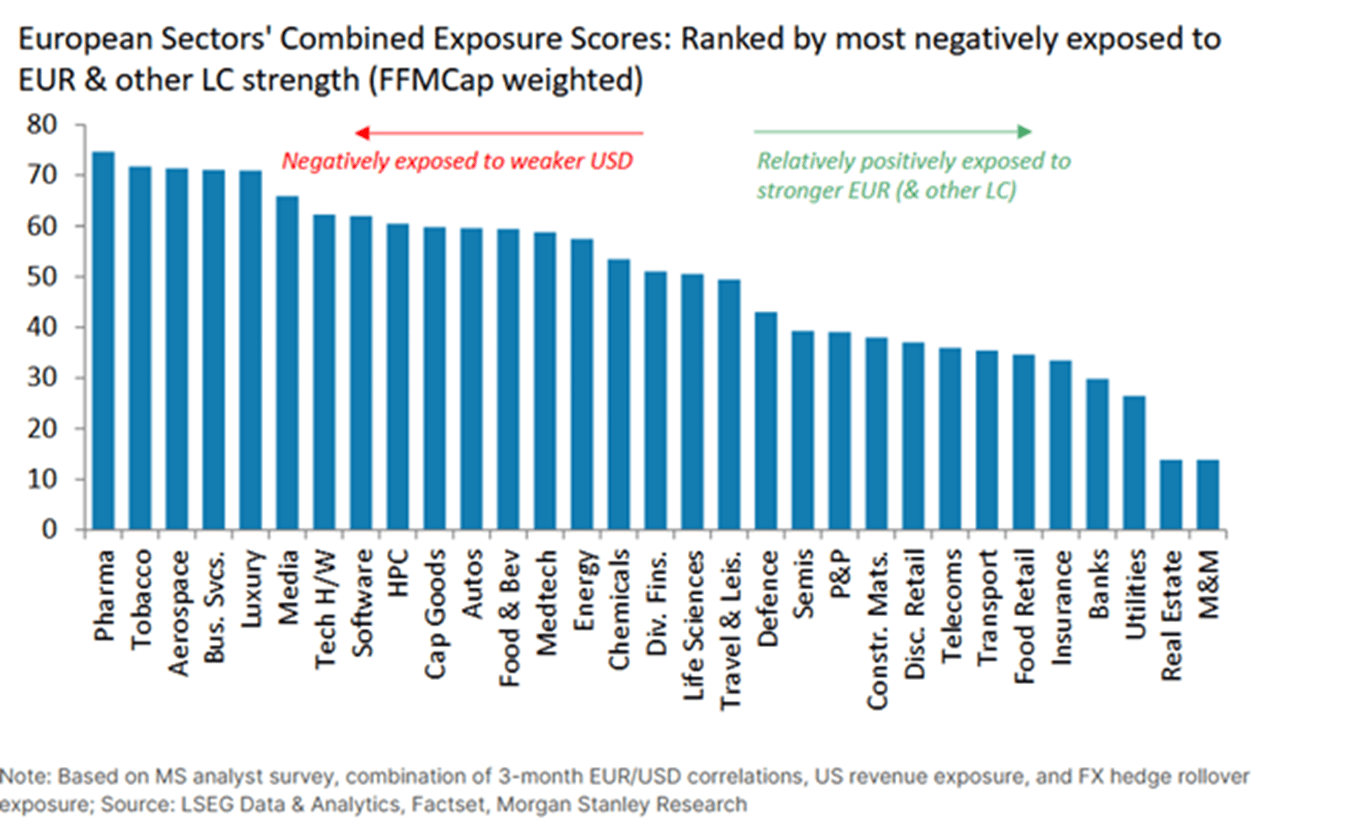

3. If you want to avoid sensitivity to dollar fluctuations, stick with “domestic” sectors such as banks, utilities, real estate and telecoms.

4. European software: More fear than fundamentals.

SAP’s earnings last week offered the latest example of how concerns over AI disruption are dominating the narrative.

UBS argues the move reflects fear rather than fundamentals, with many software firms continuing to post solid results and defining AI as an opportunity, not a threat.

"While there are certainly examples of AI-native market entrants succeeding at the expense of software incumbents, they have yet to land a real punch in terms of validating investor fears," UBS writes.

The sector's forward PE ratio has fallen 31% since the peak to roughly 22 times, below its 10-year average of 34, with current prices implying materially slower long-term sales growth than analysts forecast for names such as SAP, Sage, Dassault Systemes and Amadeus, UBS says.

5. Korean economy is firing on all cylinders.

While the majority of gains since September 2025 have been driven by Samsung and Hynix (as persistent supply tightness drove memory prices sharply higher since early September), other drivers of the market are delivering as well.

Long-term industrial growth spaces (defense, shipbuilding, power equipment, etc.) continue to show 20%+ EPS growth.

All this in a context of investor positioning that has not substantially caught up, driving the potential for further outsized gains despite occasional pullbacks (like yesterday) from overbought levels.

Here is JPMorgan’s projected path for the Kospi.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply