- Charts of the Day

- Posts

- Equity bulls seem to agree that the S&P 500 will surge past the 7,000 level.

Equity bulls seem to agree that the S&P 500 will surge past the 7,000 level.

Fed will cut rates, but is flying blind without government data.

Subscribe to receive these charts every morning!

1. Equity bulls seem to agree that the S&P 500 will surge past the 7,000 level.

The most crucial reports of the season are still to come, but so far things are looking good. Almost 70% of S&P 500 members to have reported so far have exceeded sales estimates, according to Bloomberg Intelligence — the highest proportion of positive surprises in about four years. And 85% of benchmark companies have managed to beat on earnings, while just 14% have missed.

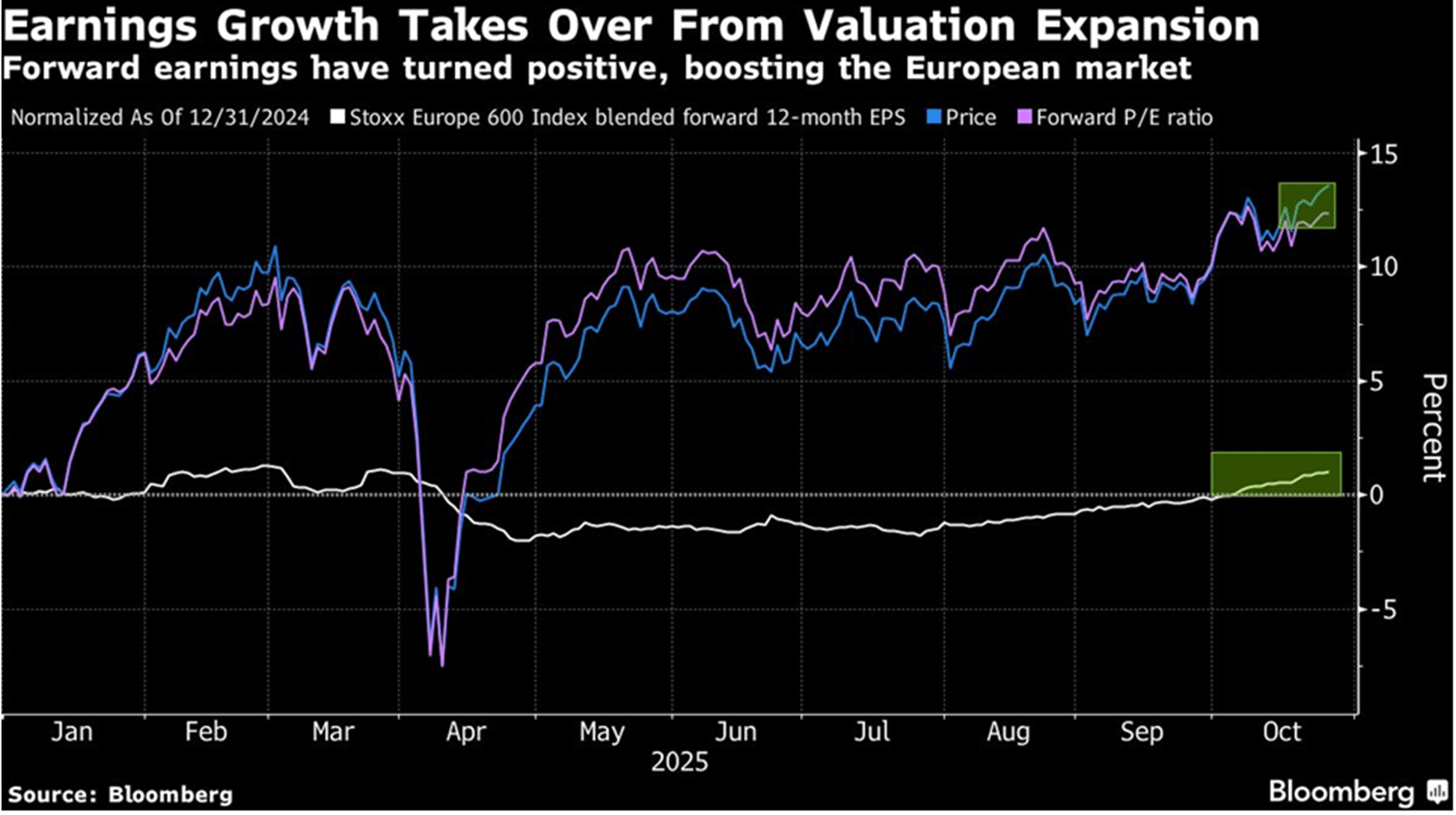

2. A reassuring start to the earnings season in Europe suggests that analysts may have been too cautious about profit growth this year.

Domestic stocks, financials and cyclicals like materials and tech are faring well, despite consensus expectations for zero profit growth this year in Europe. “We continue to see earnings resilience offering equities a key backstop against macro and geopolitical uncertainty,” they say.

The Stoxx Europe 600’s 14% advance this year has been largely driven by valuation expansion. That’s changed a little in October, with the forward P/E ratio stabilizing around the 15 handle.

The benchmark is now being carried higher by earnings estimates that are finally on the rise.

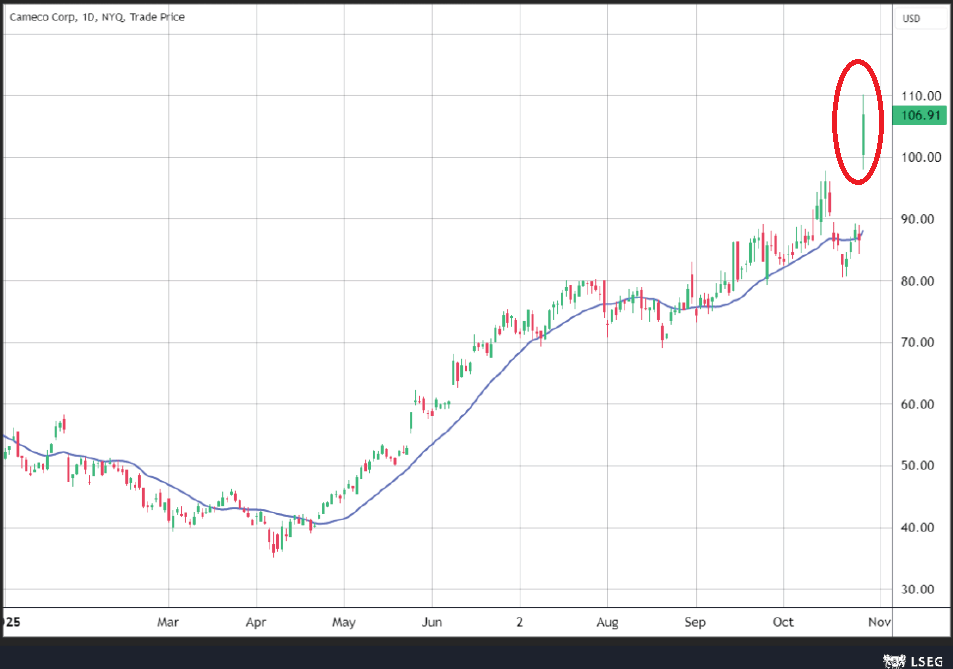

3. Electricity is the new oil.

The U.S. government signed an $80 billion agreement with Westinghouse Electric Company to construct nuclear reactors.

This move aims to meet the growing power demands driven by artificial intelligence. The strategic partnership also involves Brookfield Corporation and Cameco Corp.

Every gigawatt of data center capacity added contributes to the imbalance of energy supply/demand as well as imbalances in the efficacy of the electric grid. Now we have AI leaders such as OpenAI's Sam Altman raising concerns about the United States' ability to keep up with China in AI due to lack of electricity supply - pointing out how China has added 8x more incremental electrical capacity than the US did last year.

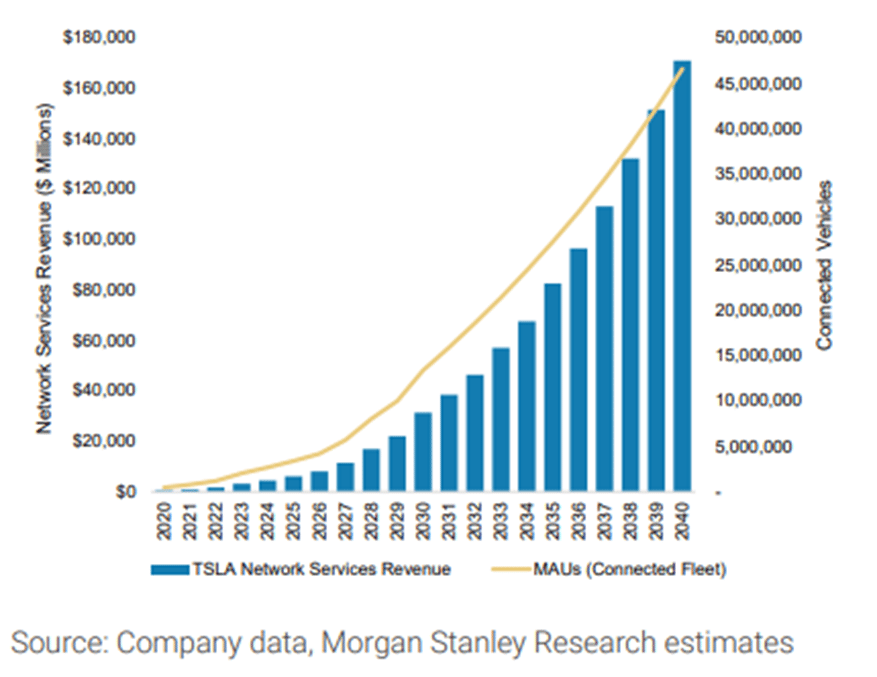

4. “Autonomous cars are solved.”

Tesla will have around 8 million vehicles in the global 'parc' by year-end.

Full-Self Driving penetration is soon expected to be at 12% of Tesla's global installed base.

“This will be highly profitable, highly reoccurring.”

Morgan Stanley calls it a “steam engine” moment that changes transportation forever.

Below: Estimated TSLA network services revenue through 2040

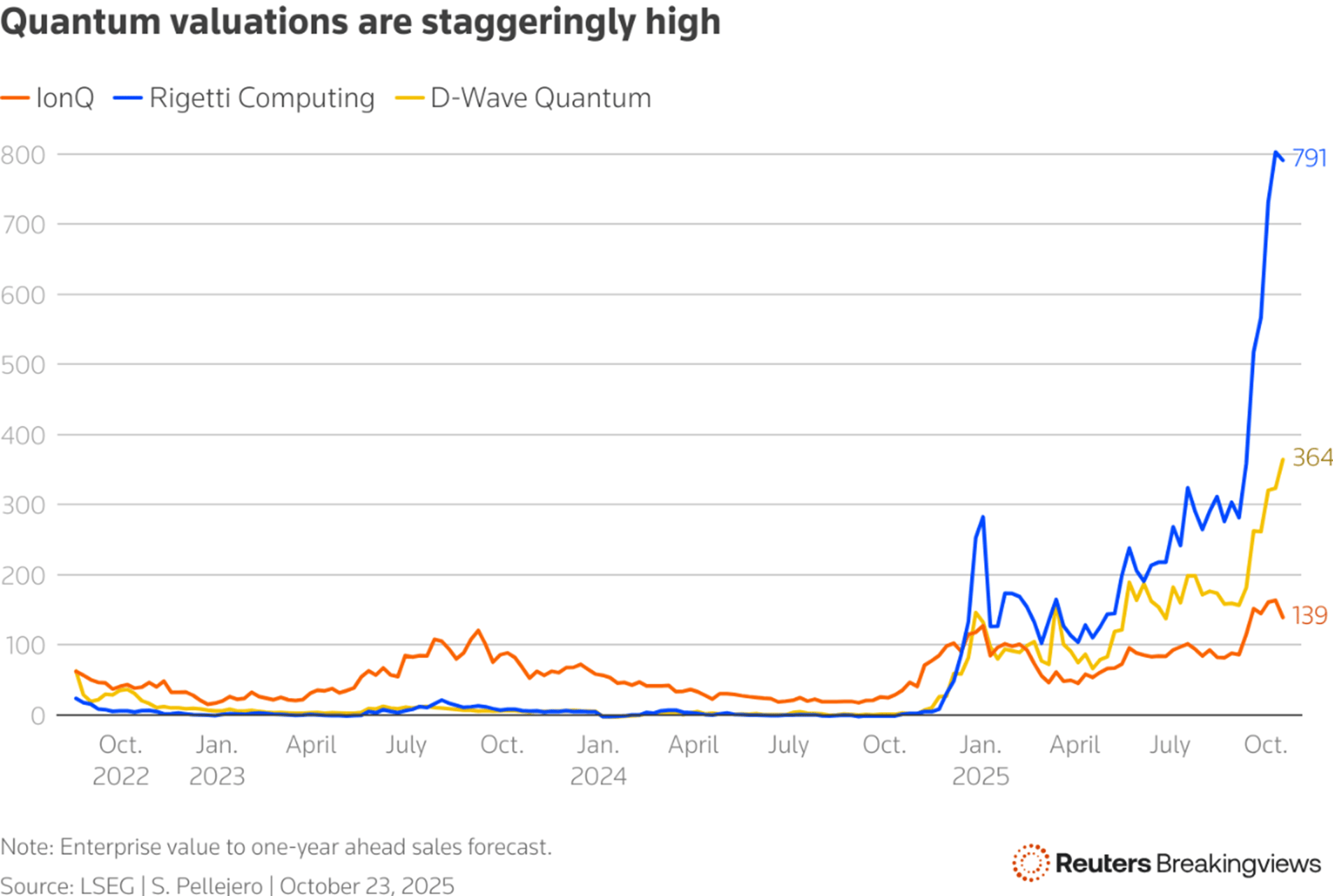

5. The “quantum limit” of expensive.

The clutch of startups including IonQ, Rigetti and D-Wave have collectively lost over $1.4 billion between 2020 and 2024, with more expected this year. The trio’s shares entered October up more than 1,200% since 2022, only to decline between 23% and 39% since October 15, overshadowed by advances from Alphabet’s quantum chip, Willow.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply