- Charts of the Day

- Posts

- Federal Reserve holds interest rates unchanged, as expected.

Federal Reserve holds interest rates unchanged, as expected.

Policy remains in a "wait-and-see" mode, while markets now look toward June for a potential next move.

1. The European earnings season has started.

Sector rotation and stock picking is the name of the game.

Here are the earnings per share growth expectations per sector.

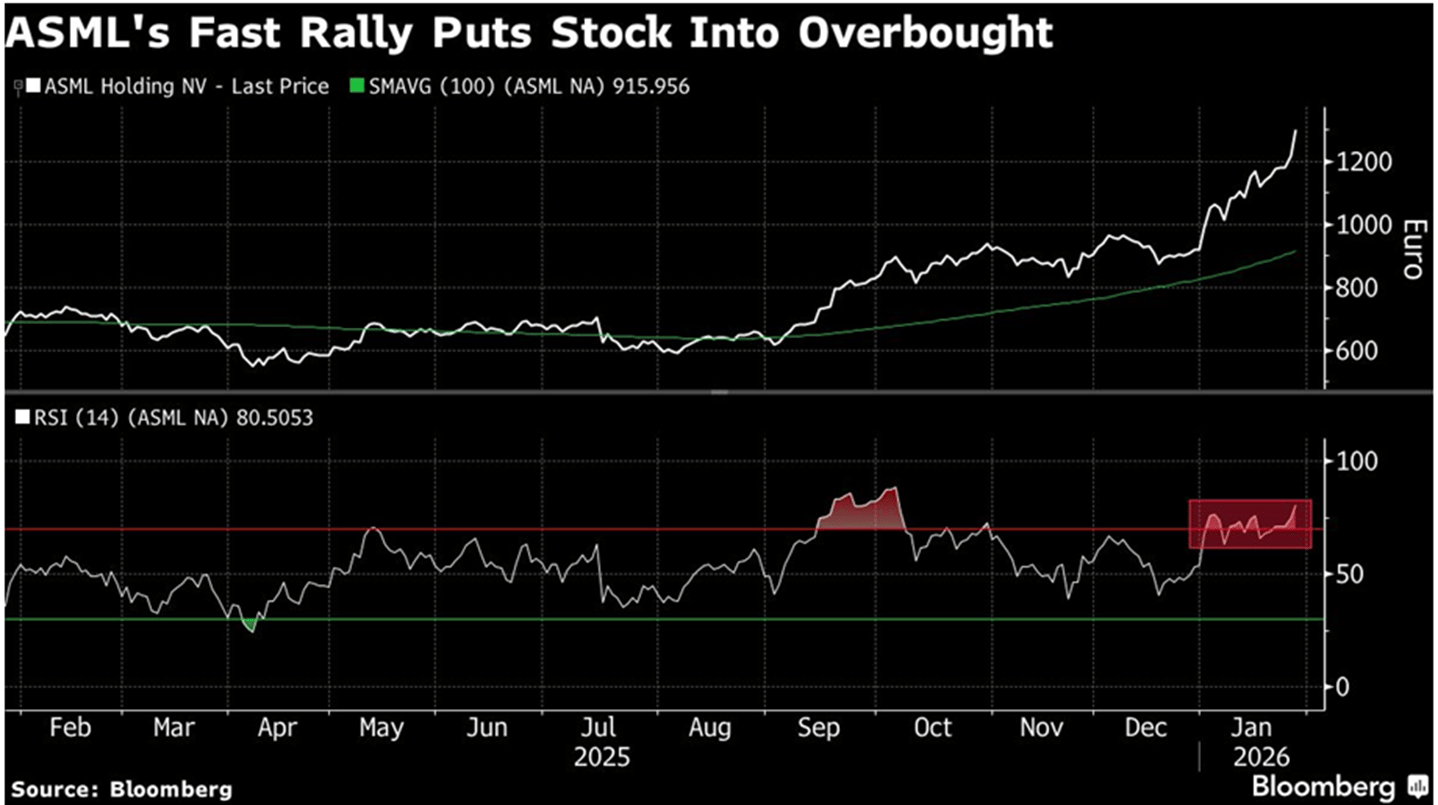

2. ASML’s record orders blew away expectations.

3. Microsoft beat earnings expectations but was down 7% after-market on higher-than-expected Capex.

MSFT sees a light operating margin because it’s spending nearly $40B a quarter on AI.

The narrative centers on whether cloud growth can keep pace with an unprecedented investment in AI infrastructure.

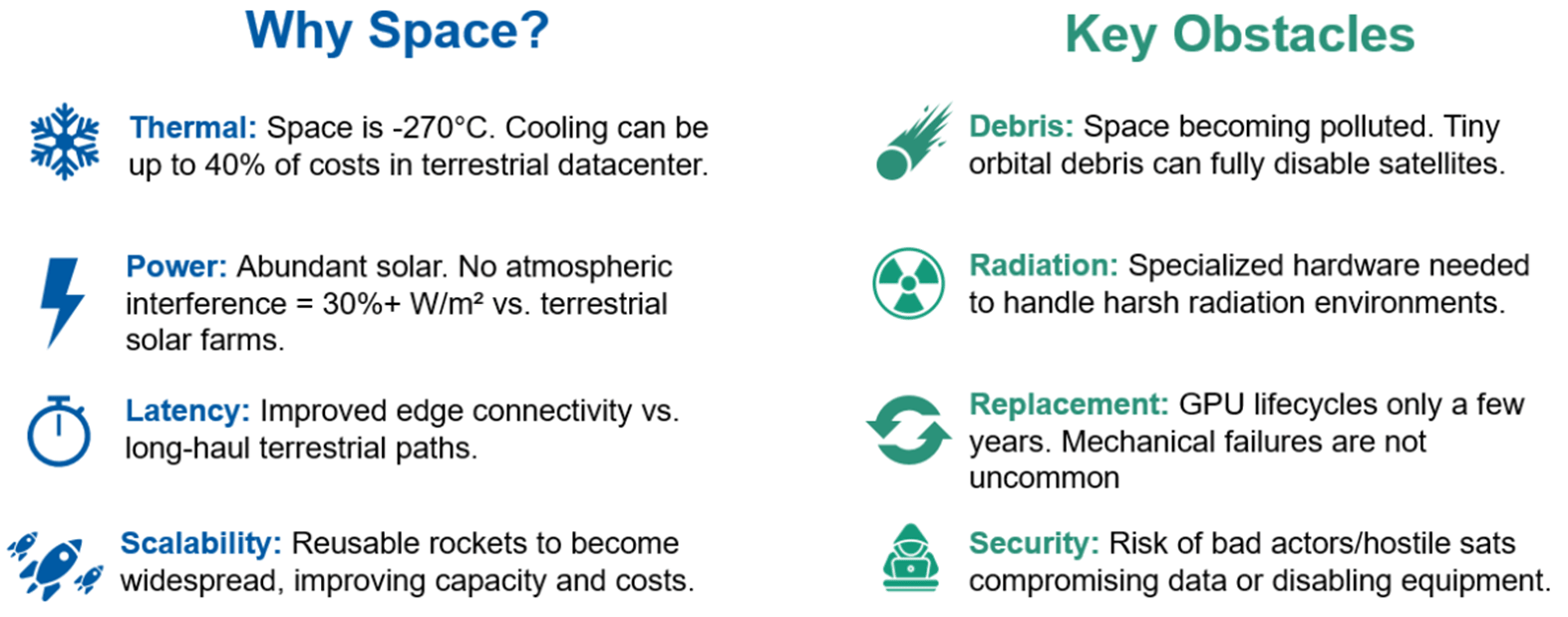

4. Data centers in space is a “no-brainer” for Elon Musk.

But other companies are also exploring space-based AI infrastructure: Google, NVIDIA, Blue Origin/Amazon, OpenAI, SpaceX, and more.

Today, one of the biggest constraints to scaling US AI compute capacity is energy.

Analysts estimate that ~9% of 2026 US power demand would come from data centers, rising to ~20% by the mid 2030's, which could lead to rising cost of electricity for the average American.

Everything in space then? And how?

Do not to think of a 1 million square foot (shopping mall sized) data center assembled in LEO (low earth orbit) but rather thousands (tens of thousands) of distributed 'nodes' of megawatt and sub-megawatt scale satellites that are interconnected through optical intersatellite links, optimized for thermal performance.

How to invest in the sector? The Space Innovators ETF.

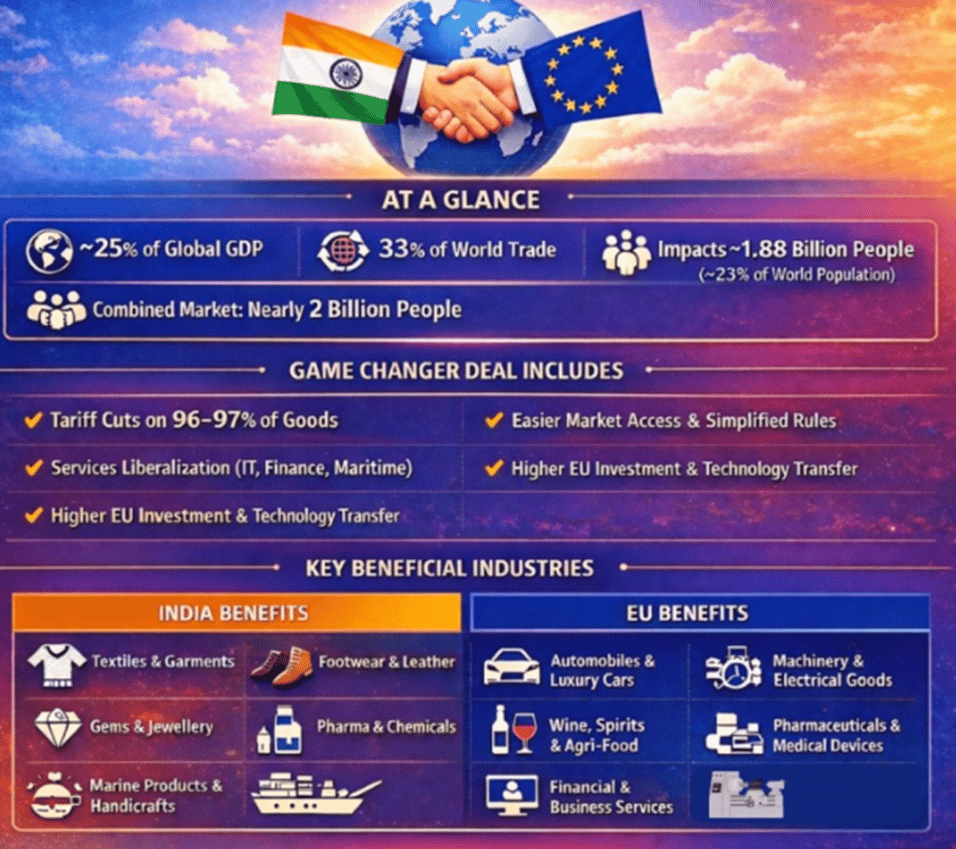

5. The EU-India Free Trade Agreement.

The long-awaited EU–India FTA could boost bilateral trade by 41–65%, raise real incomes on both sides, & reduce reliance on riskier markets - linking economies that represent 21.1% of global GDP.

With an expected GDP growth of 7-8% over the next 10 years, investing does not have to be rocket science.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply