- Charts of the Day

- Posts

- Glass looks half full again, on earnings and positive US jobs numbers.

Glass looks half full again, on earnings and positive US jobs numbers.

Longest government shutdown costs US economy about $15 Billion each week.

Subscribe to receive these charts every morning!

1. The market climbed again, after a new round of earnings, and positive US jobs numbers.

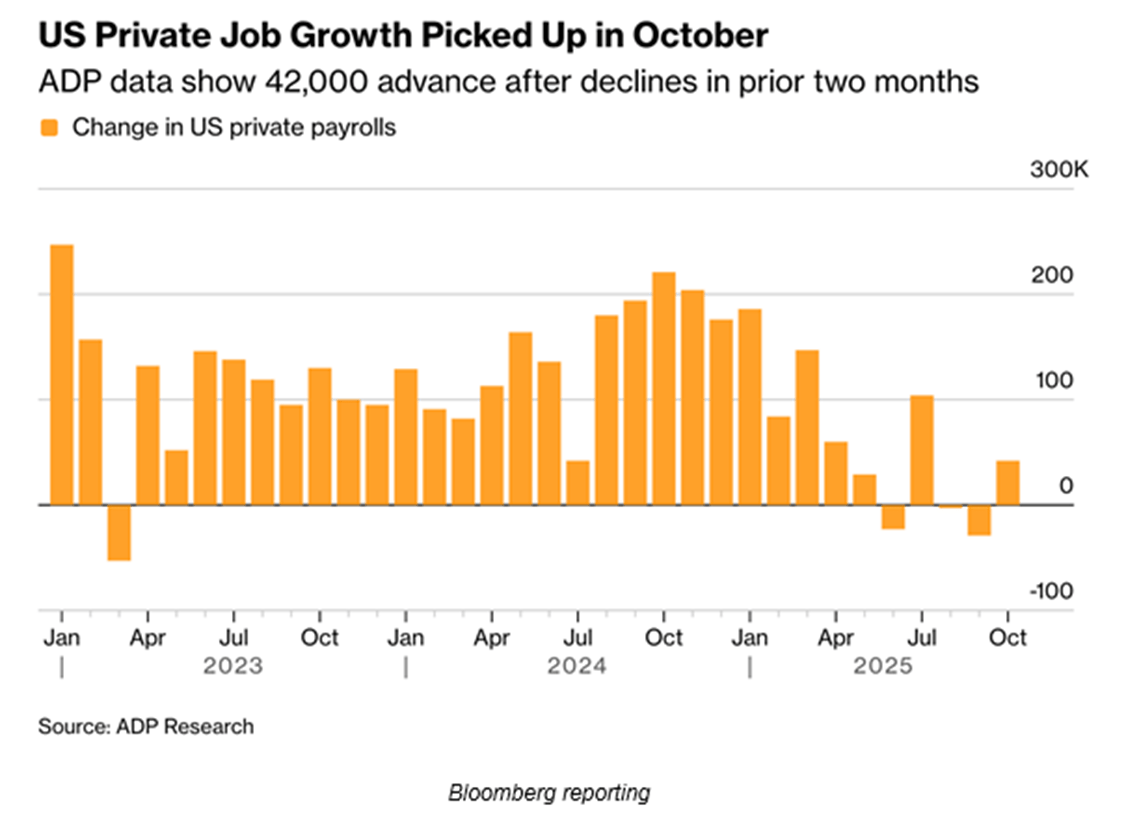

ADP data shows U.S. companies added 42,000 jobs in October, a breath of fresh air for one of the only data points investors have while the government remains closed for business. ADP is the largest private employer data collector, a huge human resources firm that collects data on 26 million employees across the U.S.

Fed’s Stephen Miran, a Trump rate cut loyalist, told Yahoo Finance it is a welcome surprise to see labor numbers recovering for now. Still, it’s time to cut rates in December, he said. “All of that to me is an indication that rates could be a little bit lower than where they are now.”

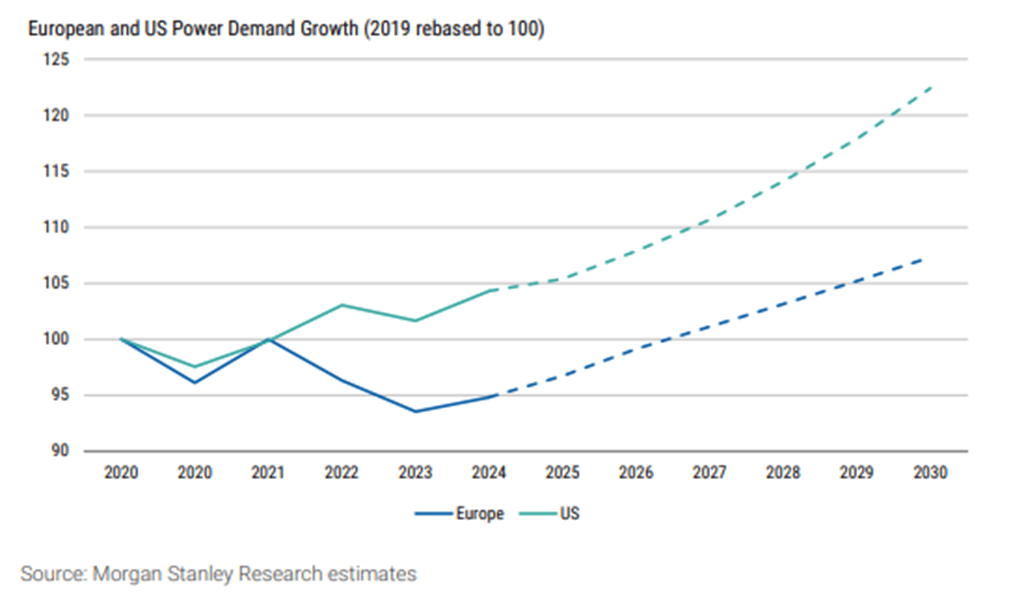

2. Data center demand for electricity is predicted to double by 2030.

It will be a key driver for increasing power demand but not the only one.

Utilities analysts' AlphaWise survey of industrial companies in Europe and the US points to a more positive outlook for industrial energy demand growth than they think is expected by the market.

Below: Forecasts for rising total power demand in the US and Europe.

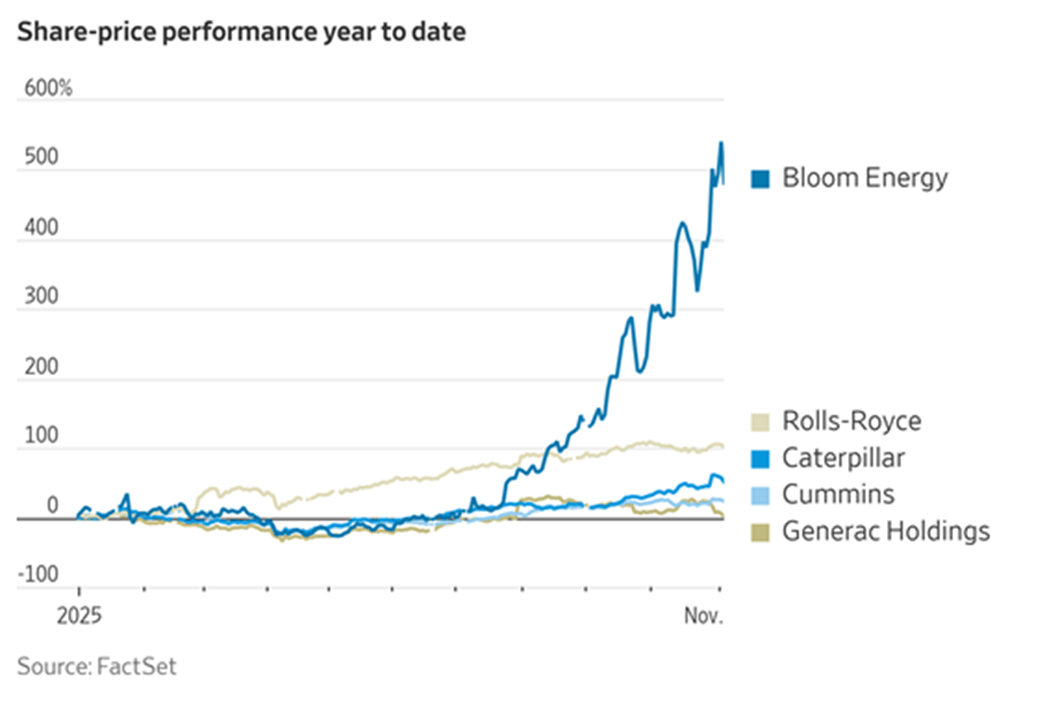

3. Tech companies working on artificial intelligence are in a rush to get electricity.

Large natural-gas turbines are a natural fit for data centers with huge power needs, but these face yearslong wait lists and lengthy construction schedules.

Data centers have thus turned to more expensive off-grid solutions that are nevertheless more readily available. These include Bloom Energy’s solid-oxide fuel cells, which use natural gas as fuel. Data centers are also using smaller natural-gas turbines and reciprocating engines—the piston-and-cylinder type that cars use—from companies like Caterpillar, Wartsila, Cummins, Rolls-Royce and Generac.

In a recent report, Morgan Stanley estimated that U.S. data centers face a shortfall of 45 gigawatts of power, through 2028.

Below: Investors are bidding up stocks in makers of everything from small turbines to fuel cells, sometimes to euphoric levels.

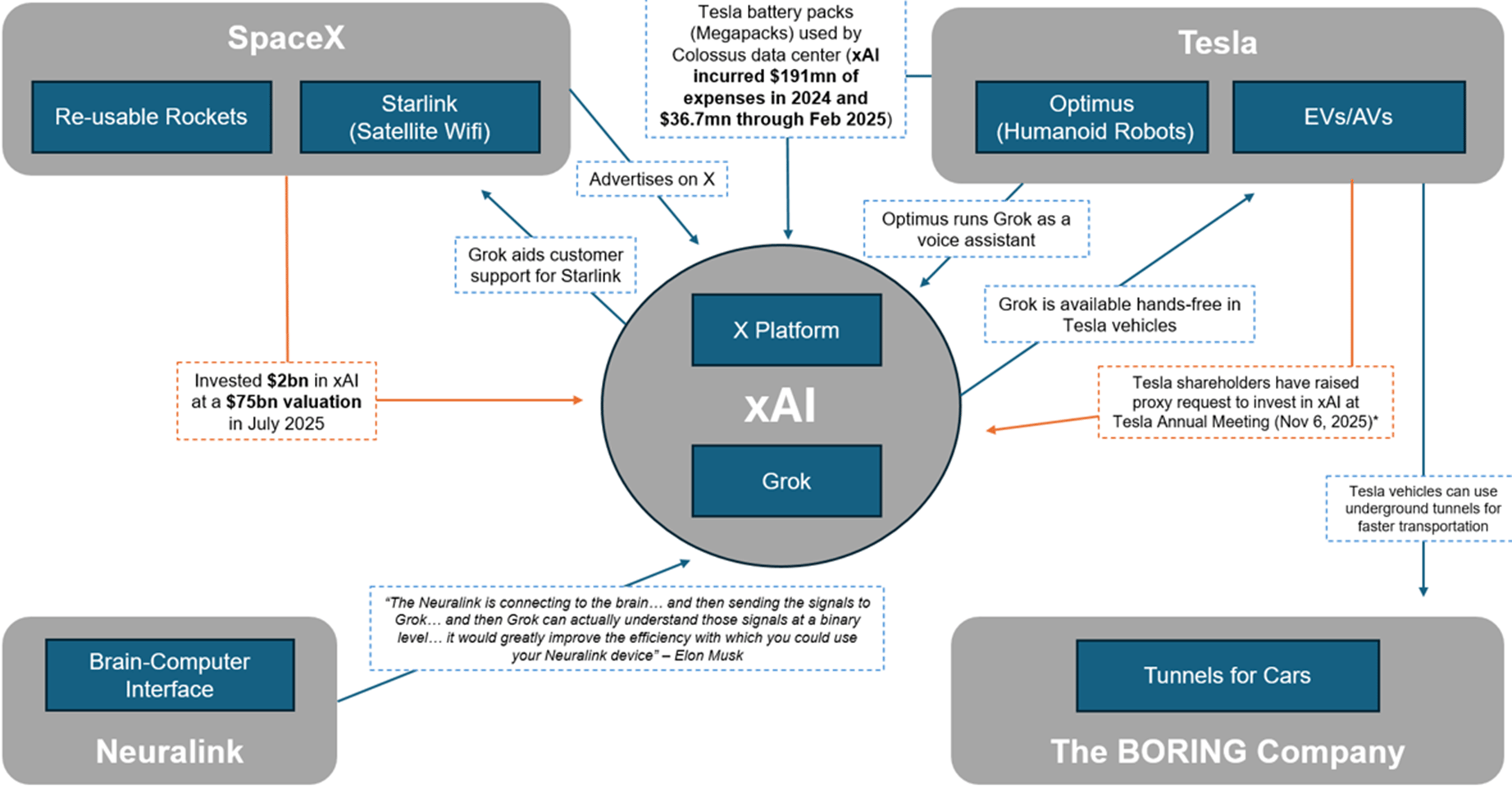

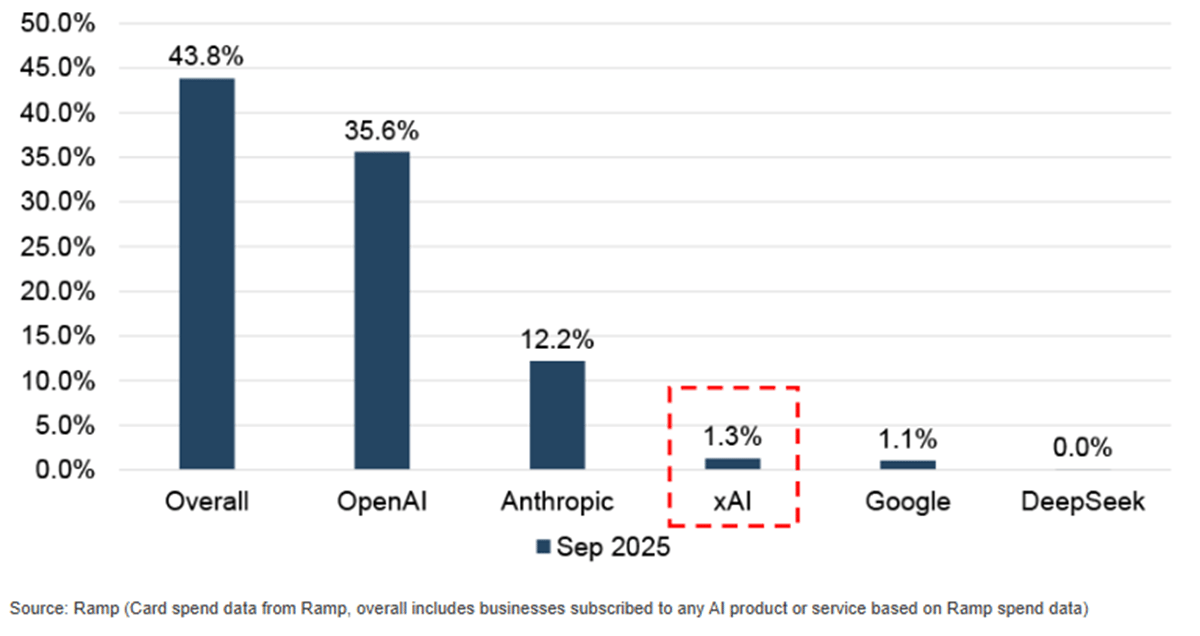

4. xAI, Grok and the Elon Musk ecosystem.

The X platform serves as a key distribution channel for Grok (600mn MAUs on X) alongside a traditional app (64mn MAUs) and API-driven strategy. Embedded synergies related to AI-driven advertising seek to change the trajectory of advertising on X, which has struggled as advertisers have left the platform due to concerns around brand safety.

Simultaneously, the company continues to focus on developing more powerful AI models, with the Colossus cluster reaching 200,000 GPUs, the Colossus II cluster expected to reach >1 GW of power, and CEO Elon Musk commenting that “Grok 5 will be out before the end of this year and it will be crushingly good.”

5. Among the “big 3” private AI model developers in the U.S., Grok is the slowest to monetize and is now playing catch up.

Growth will come from Grok’s integration across apps (chatbots, social feeds), in agentic software development tools (coding, gaming, scientific discovery), and into physical AI forms (Optimus humanoid).

The company’s heavy investment in AI infrastructure, compute resources, and proprietary data will also be increasingly pivotal as the AI industry transitions from mainly generative AI to agentic and physical applications.

Below: Share of U.S. businesses with paid subscriptions to AI models, platforms, and tools (Sep 2025)

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply