- Charts of the Day

- Posts

- Global equities are down on AI bubble fears.

Global equities are down on AI bubble fears.

The Fed is cutting now, but will they even cut at all next year?

1. Nasdaq retreats on AI bubble fear.

Broadcom slid 11% after the chipmaker warned of slimmer future margins on its AI system sales, despite projecting strong quarterly revenue. This sharpened worries about the profitability of surging AI investments.

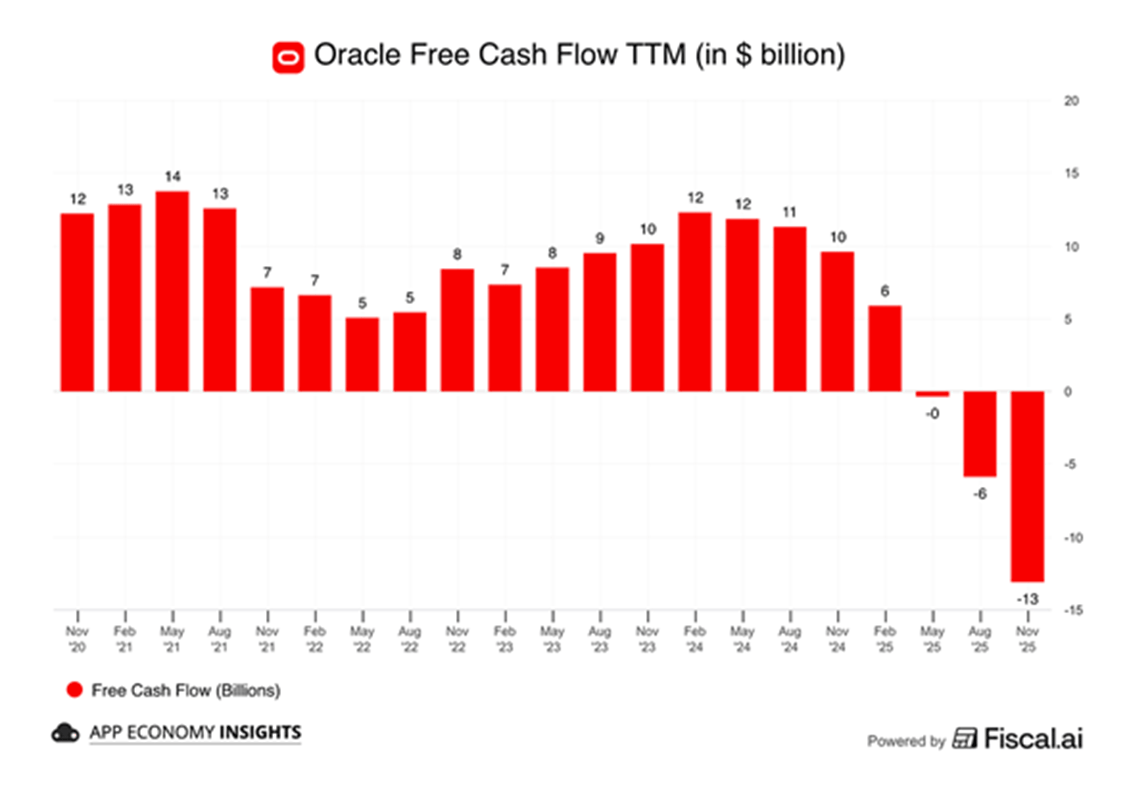

Oracle lost another 5%. With this latest drop, shares are now over 45% below their September peak.

So what to make of all this? The $523 billion backlog is real, but you can’t bill for a data center that isn’t finished. Meanwhile capex forecast increased to $50 billion, fueling fears about debt and cash burn as free cash flow declined to negative $13 billion over the past 12 months.

Combined with a debt-fueled spending spree, Wall Street is demanding near-term execution over long-term promises.

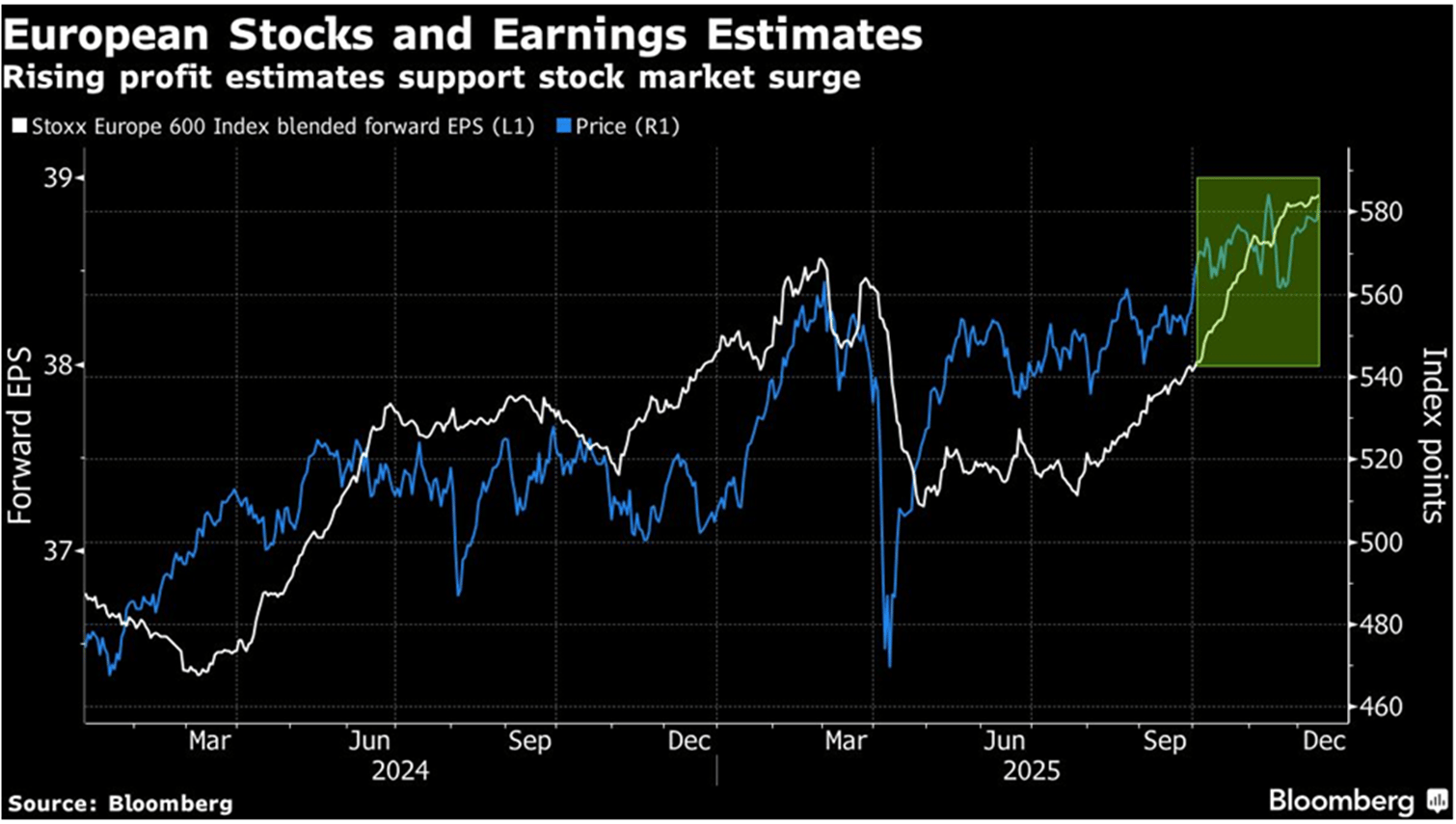

2. Strategists are seeing more gains for European stocks in 2026.

Four strategists, including those at UBS and Deutsche Bank, see a surge of nearly 13% from Wednesday’s close.

“This is a good entry point in European stocks,” says Mislav Matejka, head of global and European equity strategy at JPMorgan, who has a target of 630. “Earnings can rebound much more meaningfully next year, and there will be some stimulus follow through, especially if China picks up.”

3. Europe has seen the best improvement in economic data around the world, says Citigroup.

Earnings revisions are net positive and improving (white line). In Europe, fiscal stimulus and relaxed monetary policy will fuel an impact.

With more than €2 trillion ($2.3 trillion) in grid and clean-power investment, along with Germany’s €500 billion off-budget infrastructure fund and rising defense commitments, the European economy is expected to be supported for years to come.

Valuations remain attractive, with the Stoxx 600 still trading at a 35% discount to the S&P 500, based on the forward price-to-earnings ratio.

4. An estimated $25 Trillion in global robot revenues by 2050.

5. As battery prices have fallen, battery installations are surging.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply