- Charts of the Day

- Posts

- Gold above $3,900 with haven assets in demand.

Gold above $3,900 with haven assets in demand.

Japanese stocks sharply higher after Takaichi election win.

Subscribe to receive these charts every morning!

1. Japan is cool.

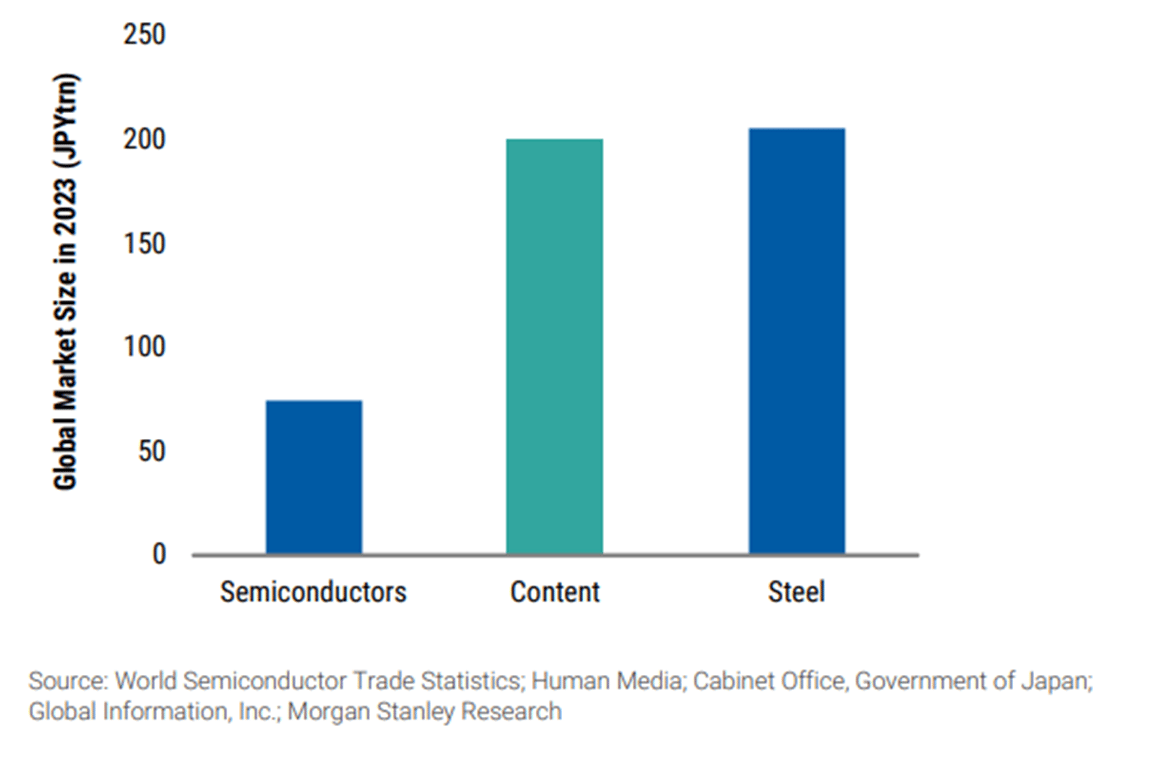

Overseas revenues from Japan-origin content are now nearing the scale of the country’s major export industries. Successfully developing and leveraging global IP can generate significant value, with some companies seeing market caps rise more than 10x in just a few years. This underscores the exceptionally strong brand power and earnings potential of Japanese IP in global markets.

Below: Overseas sales from Japanese content have reached ¥5.8trn, quadrupling in the past decade and now comparable to Japan’s steel and semiconductor exports.

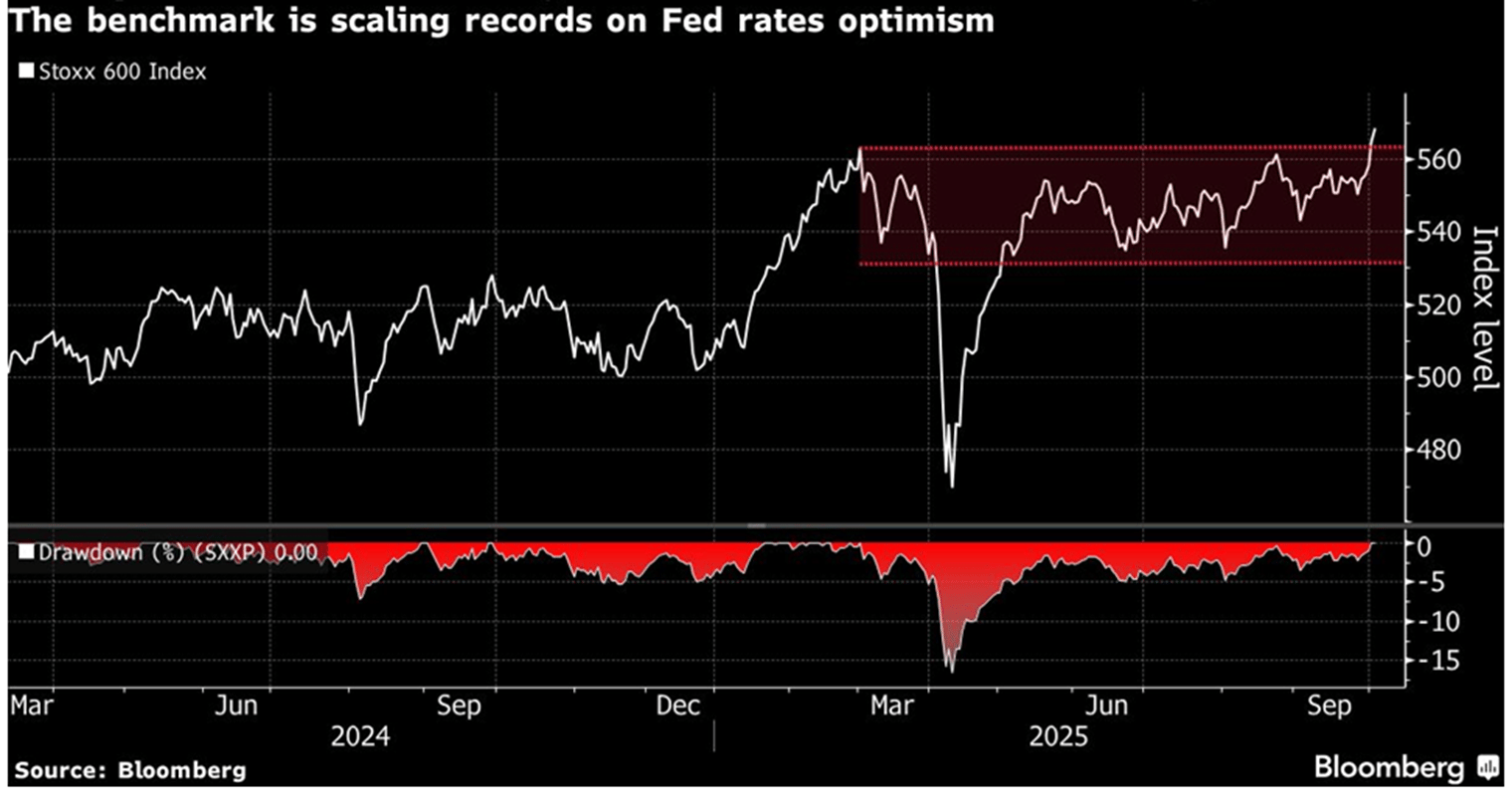

2. European stocks breaking out of the range.

The Stoxx 600 and Euro Stoxx 50 both finally topped their March highs, breaking free of the narrow range they’ve plowed for months. More gains look possible.

A slate of indicators suggest the rally is likely to build into the year end. For one thing, traders now almost fully price another rate cut from the Federal Reserve this month after downbeat economic data. And exposure to European stocks is still moderate, implying investors have room to buy into a rising market. There’s potential for corporate results starting in a couple of weeks to deliver a further boost.

“Fresh catalysts are emerging for a European equities breakout, with the third-quarter earnings season poised to lift both earnings estimates and investor sentiment,” Bloomberg Intelligence strategists Kaidi Meng and Laurent Douillet say. “The macro backdrop in Europe remains broadly resilient, with France the only major economy showing weakening business activity.”

3. Surprisingly, global auto sales are up +5.7% year-to-date.

Below: Big shifts in market share

4. The telecom sector is maybe not as cool as AI, but it’s shielded from tariffs and the dollar.

Here is another interesting sector pick….British Telecom.

The shares are trading on a March 2027e P/E of 11x, 9% free cash flow , 5x EV/ EBITDA and a 4% dividend yield.

Below: After years of heavy capex in fibre, the infrastructure is getting monetised.

5. Artificial intelligence is doing your shopping.

OpenAI said this week that it was adding a payment feature to ChatGPT, to start enabling users to essentially deputize the chatbot to do their shopping. Not only can ChatGPT help you figure out what you want, and where to get it, you’ll be able to tell it to make the purchase for you, too. This is what is known as “agentic” commerce. “Many shoppers might see this as a terrific convenience, taking away the hassle of navigating a retailer’s website or app and dealing with its carts and checkout screen. “

Is this then the killer app we have been waiting for??? More shopping?

In the U.S., ChatGPT users can now buy from U.S. Etsy sellers.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply