- Charts of the Day

- Posts

- Gold and silver hit record highs.

Gold and silver hit record highs.

The "de-dollarization" trade is accelerating.

1. Mining stocks are up 90% year-to-date.

The rally is showing little sign of easing as demand from robotics, electric vehicles and AI data centers pushes metals prices higher. Copper, key to the energy transition, has climbed 50% while gold is expected to keep benefiting from US policy concerns and geopolitical risks after a run of record highs.

For some, the pace of the rally is a reason for caution. BofA downgraded the sector to underweight, citing risks from negative economic surprises. Bloomberg Intelligence sees copper remaining in deficit this year, with supply shortfalls possibly worse than in 2025. On gold, analysts say bullion could push over $5,000 an ounce, while Goldman Sachs expects it at $5,400 by end-2026 — about 8% above current levels.

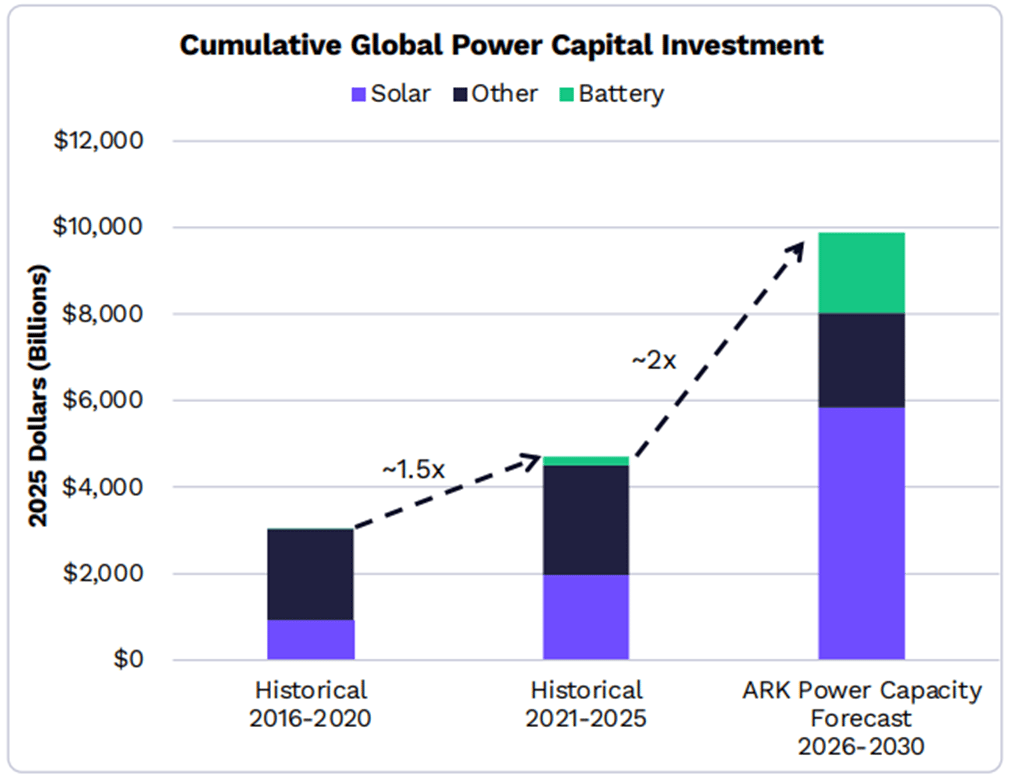

2. Cumulative investment In global power needs to increase to ~$10 Trillion by 2030!

ARK Invest forecasts capital expenditure in power-generation must scale ~2× to ~$10 trillion by 2030 to meet global electricity demand.

As a result, deployments of stationary energy storage will have to scale another ~19×.

3. Tesla versus Waymo: LiDAR vs. Vision only debate.

Hardware on an L4 Waymo Robotaxi: $30k of sensors and compute...

Hardware on a Tesla Y : $3k of sensors and compute…

Below: Being the first mover isn’t always an advantage.

4. Danone touched its lowest in a year on recalling specific baby formula batches in certain markets.

At the request of the Singapore Food Agency, Danone has, as a precaution, blocked the batch of products specifically manufactured for Singapore. Danone is collaborating with the Singapore authorities and strongly reiterates that all of its products are manufactured with strict quality and safety standards and undergo rigorous testing before leaving factories.

All in all, today's share price reaction seems overdone and presents a buying opportunity.

5. J&J: Growth acceleration.

Johnson & Johnson’s Q4 revenue rose 9% Y/Y to $24.6 billion ($440 million beat). The results validated management’s declaration of 2025 as a “catapult year,” as robust performance in Innovative Medicine (+10%) and MedTech (+7%) helped the company successfully bridge its patent cliff.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply