- Charts of the Day

- Posts

- Gold at $5.000 as "hard-asset" trade gathers pace.

Gold at $5.000 as "hard-asset" trade gathers pace.

The US dollar’s selloff accelerates as foreign investors increase their diversification away from US assets.

1. Ray Dalio sees ongoing diversification away from US assets.

Precious metals are expected to remain in demand should investors continue to diversify away from US assets in response to erratic US policy and heightened geopolitical risk.

Investors pulled a net $16.8 billion from US-focused equity funds in the week ended Jan. 21, according to strategists at Bank of America, citing EPFR Global data. The quiet-quitting of US assets will intensify, with Donald Trump’s latest threats of 100% tariffs on Canada again emphasizing the policy risks of economic dependency on America.

Below: The US dollar’s selloff accelerates as foreign investors increase their currency-hedging.

2. More gains expected for European stocks in 2026.

“With signs that stimulus is coming through for infrastructure, Europe’s growth acceleration is imminent,” says UBS.

The European economy can count on heavy fiscal support, with more than €2 trillion in grid and clean-power investment, along with Germany’s €500 billion off-budget infrastructure fund and rising defense commitments.

Yet, with valuations near their highest level in four years and the region expected to generate about 10% earnings growth this year, the possibility of negative surprise is also high.

3. US interest payments are rising relentlessly.

“All that is solid – gold, copper, iron, food, weapons – once again becomes preferable to the air of fiat currency and financial assets.”

4. Software meltdown.

The market is reassessing how enterprise software should be valued in an AI-driven world.

Since the release of ChatGPT in late 2022, the Nasdaq 100 has more than doubled. Software stocks, by comparison, are up just 19% over the same period.

SaaS valuations relied on a simple assumption. As customers hired more employees, they purchased more software seats. Revenue scaled with headcount. Agentic AI weakens that relationship. We are moving toward a world where outcomes scale without adding humans. If an AI agent can perform the work of an entire marketing team, the buyer is no longer focused on the number of licenses. The focus shifts to the result delivered.

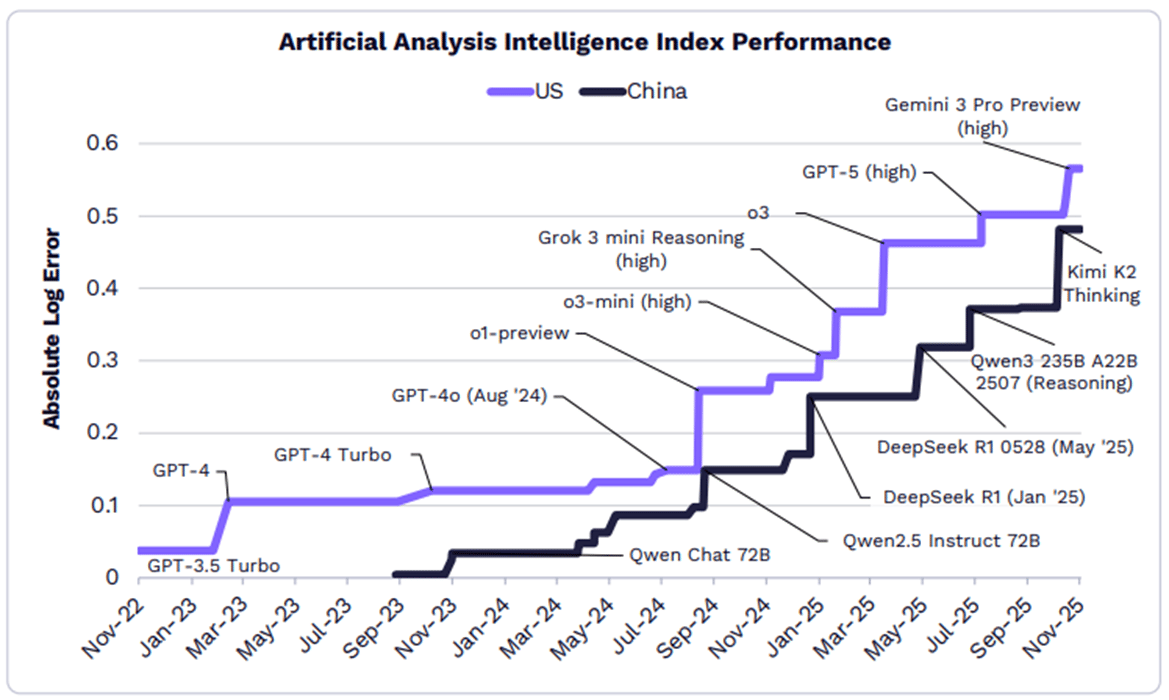

5. Chinese models now trail the performance of American models by only six months.

While the performance of their frontier models continues to lag, China dominates the “open” landscape with eight of the ten most performant open models on the market, all eclipsing the once-dominant Meta.

To remain competitive, China must access more compute capability, a tall task as Taiwan Semiconductor Manufacturing Company (TSMC) is producing 38x more compute than Semiconductor Manufacturing International Corporation (SMIC), China’s leading chip manufacturer.

Source: ARK

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply