- Charts of the Day

- Posts

- Gold climbs to record on weaker dollar.

Gold climbs to record on weaker dollar.

Inflation remains stubbornly sticky, with the Fed’s preferred PCE gauge holding at 2.8% year-over-year.

1. “The commodities rally is only just beginning, as countries shift toward greater self-reliance while becoming more indebted.”

Even after the “deal” over Greenland, the message is clear that countries can no longer rely on the US, prompting a shift to more self-sufficiency in defense, finance, resources and supply chains. Increased competition for resources will cost more and put extra strain on raw materials.

Markets are beginning to price this in through higher commodity prices and government yields.

The rally in commodities is broad-based, across precious metals, industrial metals and gas, and is now spreading to soft commodities and non-exchange-traded raw materials.

2. Rising commodity prices are the symptom of exploding debt-to-GDP ratios.

The recent selloff in Japanese Government Bonds is a reminder that Japan, with its debt at a dizzying 236% of GDP, is the crack in the developed-market dam most likely to fracture first.

Gold was first to get the message. It’s the ultimate real asset: portable, durable, divisible and fungible. It has functioned as a form of money for millennia, and has been tested through a litany of crises. Bitcoin’s lacklustre performance onderlines that when it comes to insurance, one doesn’t take any chances.

Gold has been outperforming financial assets, especially bonds, in a world rediscovering the importance of physical assets.

Below: Developed markets debt-to-GDP ratio has exploded after covid, in stark contrast to the restraint seen in emerging countries.

3. OpenAI's request for proposals for US manufacturing capability.

Physical AI (humanoids) is a manufacturing problem and OpenAI is aiming to re-establish US manufacturing leadership that has diminished over decades.

From their website: “OpenAI has a long-term ambition to establish U.S.-based hardware manufacturing and assembly that reflects U.S. values, supports resilient supply chains, and fosters national innovation leadership. OpenAI is making these investments to accelerate US capability building in these critical sectors. Over the next 10 years, OpenAI seeks to localize significant portions of the manufacturing for its hardware devices and data centers, including key components, modules, and final assembly.”

“Convergence”. Get used to hearing this word. Convergence between digital and physical. The sim and the real. The data and the manufacturing. The human and machine. As the technologies emerge, the strategies converge.

Below: from the website of OpenAI

4. Elon Musk at Davos: “There will be billions of humanoid robots”.

Sure, but the tasks facing humanoid robots are exponentially more complex than those addressed by robotaxis.

The two platforms differ significantly in kinetic demand, mobility, perception, adaptability, and error tolerance. The complexity ratio defines the theoretical capability required for full autonomy.

Source: ARK

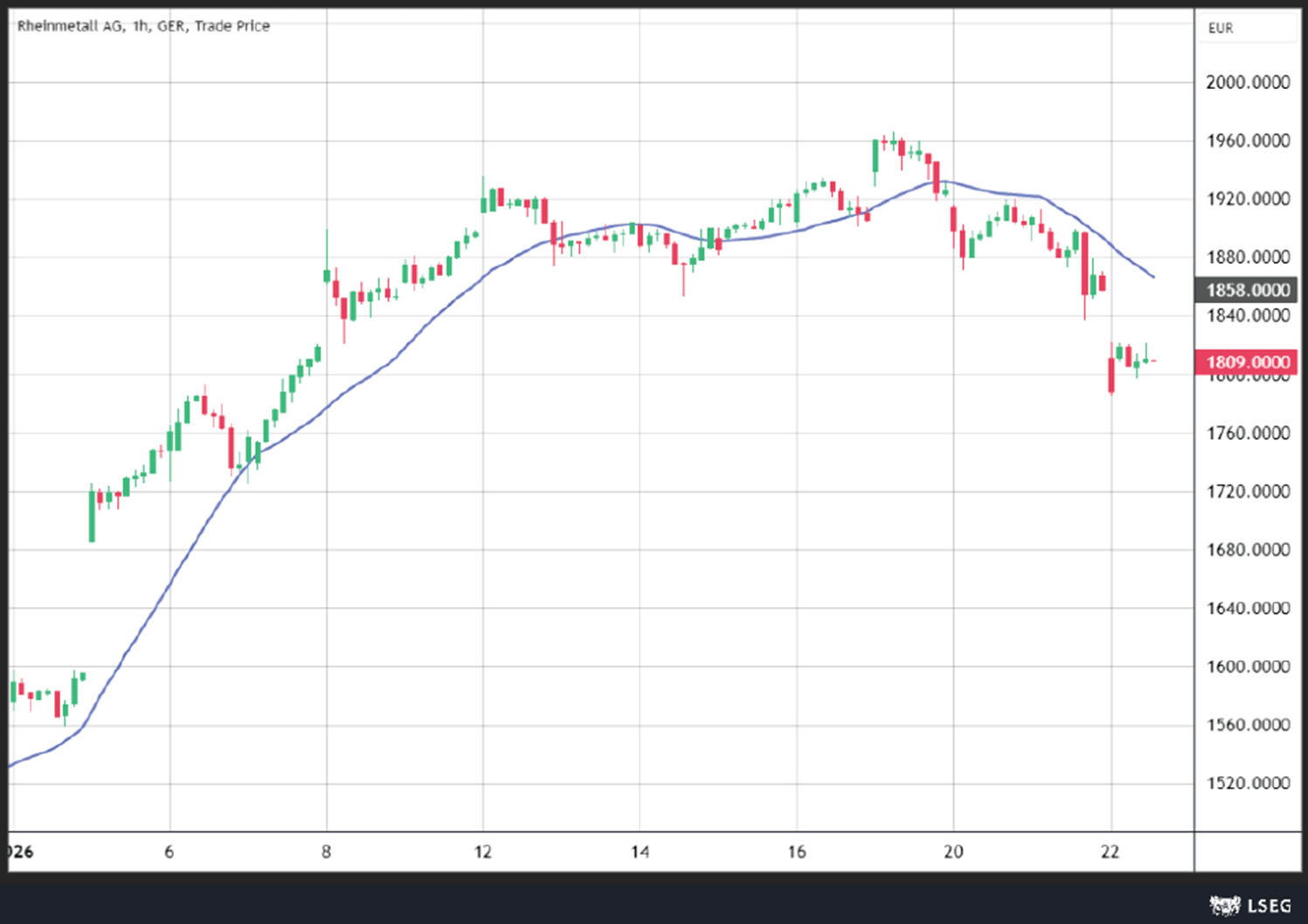

5. JPMorgan says buy the dip in European defense stocks after Greenland “deal”.

“Mr Carney’s (Canada) speech reinforced our view that we have entered a new world order and that we are in the very early stages of a global defense spending upturn that could last for another decade. Defense stocks fell on the Greenland deal but we disagree with the reaction. We continue to recommend that investors buy any weakness in European Defense stocks.”

Stocks we like: Rheinmetall, Leonardo, BAE Systems, Babcock, Thales.

Here is Rheinmetall year-to-date.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply