- Charts of the Day

- Posts

- Investors are anxiously looking toward the December FED meeting.

Investors are anxiously looking toward the December FED meeting.

Futures and bets are now 50/50 that the Fed will cut rates.

Subscribe to receive these charts every morning!

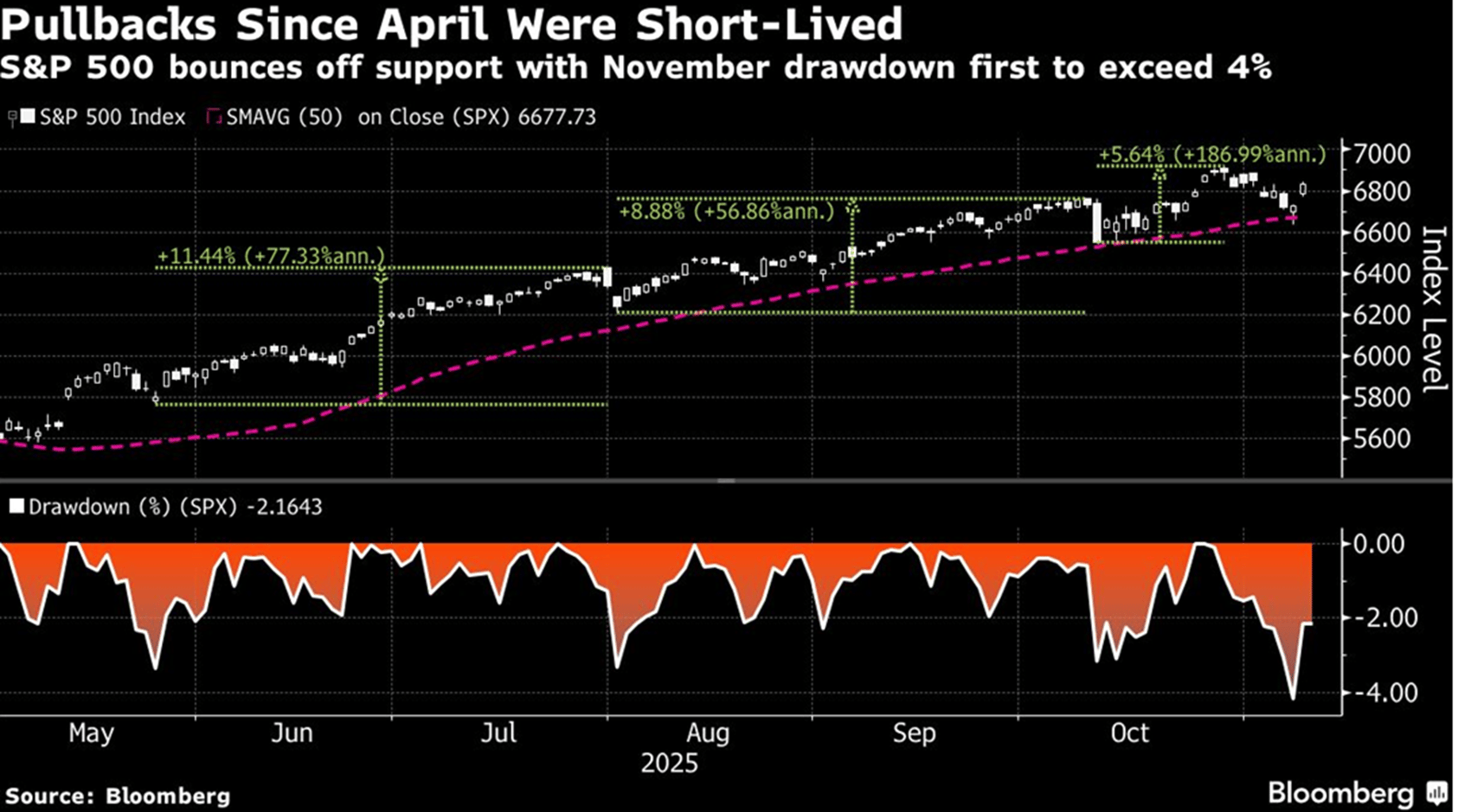

1. “We are buyers of this dip and maintain our tactical bullish call,” says JPMorgan Market Intelligence team.

“Whatever risks confront this market, the downside looks protected by fiscal, monetary and retail supports, with seasonal flows and buybacks adding to the positive mix.”

Nvidia’s earnings next week have the potential to assuage concerns around the AI theme, as well as supporting evidence of revenue and EPS growth outperformance this quarter, the team says.

Meanwhile, the Fed is more likely than not to cut again in December, while buybacks are restarting after the earnings blackout period. JPMorgan would move away from their bullish call in the event of an Nvidia earnings miss, combined with the shutdown lasting into year-end (the government shutdown is apparently ending), lower-than- expected buyback execution, or a spike to bond volatility or yields.

2. S&P 500 equal weight is not expensive.

Just like market performance, stretched valuations are heavily concentrated in one area of the market: AI and tech.

Valuations across the rest of the S&P 500 actually look reasonable, just as they do in Europe. The equal weight version of the US benchmark now trades near a record discount of 25% to the actual index.

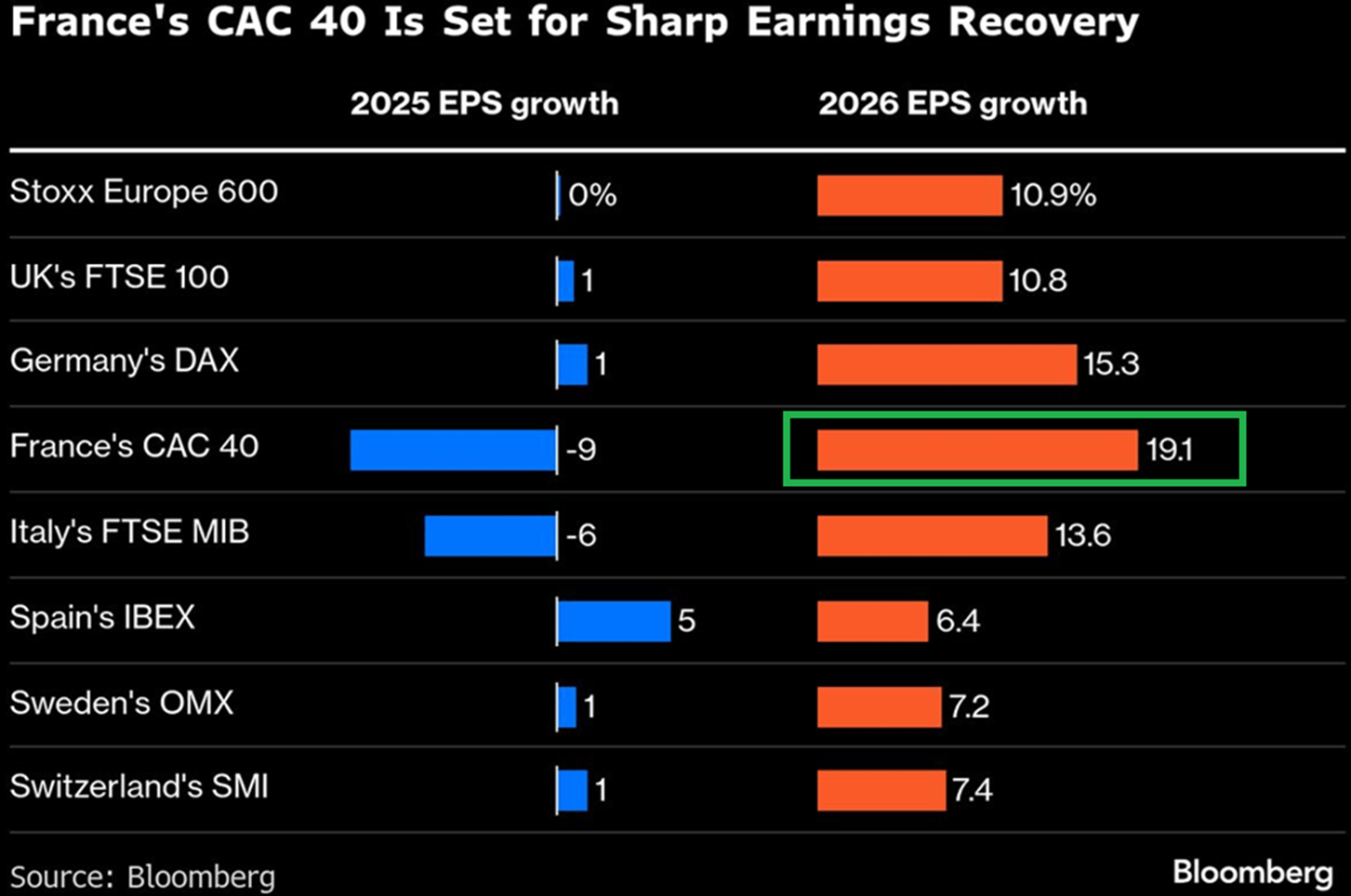

3. French stocks anyone?

The CAC 40 index has climbed 12% this year, a lot less than the 21% rally in Germany’s DAX or the 43% surge by the Ibex 35 in Spain. In fact, French stocks, despite being mostly cyclical and primed for good news on the economy, have acted more like defensives. Underperforming luxury-good manufacturers, carmakers and technology shares have held back the Paris benchmark. Political instability hasn’t helped either.

Next year looks like it could be different. The CAC 40 is projected to notch up the fastest earnings-per-share growth of all major European indexes. A key factor will be whether China can shake off a slowdown in consumption growth that threatens to become the longest in four years. Makers of pricey handbags and jewelry will be keen to see confirmation of early signs that demand in the key Asian market is improving.

Meanwhile, earnings growth for industrials – a group that makes up 30% of the index and includes defense-exposed names Thales and Airbus, as well as data center infrastructure providers Schneider Electric and Legrand – is expected to reach 16.2% in 2026, after a tepid gain of 2.1% in 2025.

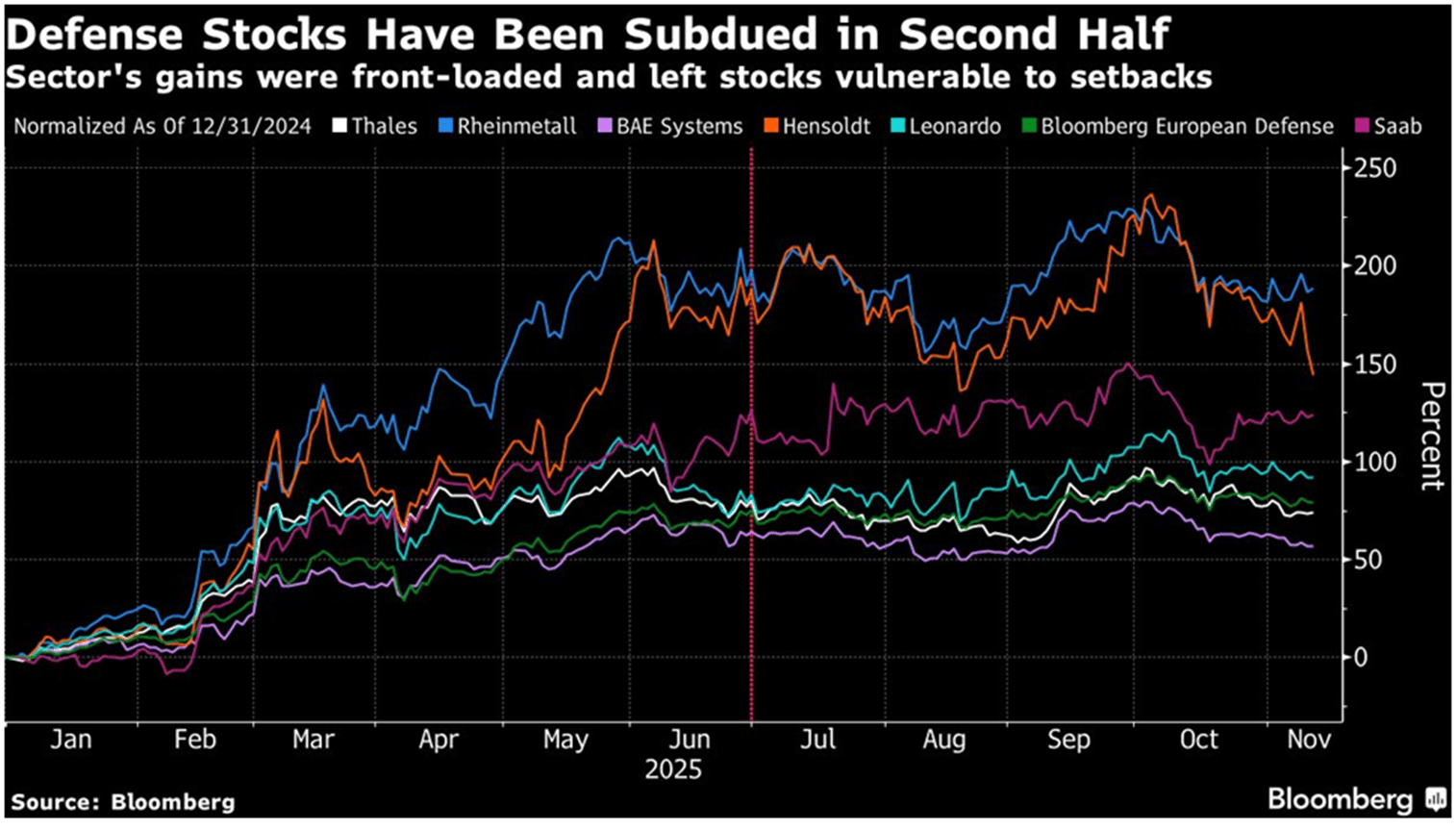

4. Be patient with European defense stocks.

“Defense spending remains a multi-year theme, but sector valuations are elevated and positioning is crowded,” say UBS strategists led by Gerry Fowler.

“There has been an understandable pullback in defense stocks given they have surged while it takes time for government spending to hit their order book,” says Delphine Arnaud, a portfolio manager at Edmond de Rothschild. “So it’s normal to see some profit taking from time to time.” NATO has set a target for military outlays to reach 3.5% of GDP by 2035 and Germany is well ahead, planning to increase annual defense spending to more than €160 billion by 2029. Arnaud says investors should position for a boost to earnings arriving in the second half of 2026. “This is the right moment to get back into European defense,” she says.

5. Amazon stays ahead.

Amazon’s market share in the worldwide cloud infrastructure market amounted to 29 percent in the third quarter of 2025, ahead of Microsoft's Azure platform at 20 percent and Google Cloud at 13 percent.

Together, the "Big Three" account for more than 60 percent of the ever-growing cloud market, with the rest of the competition stuck in the low single digits.

For Amazon, AWS has been a key driver of profitability and the perfect addition to its low-margin core retail business. In the first nine months of 2025, Amazon's cloud business accounted for 18 percent of the company's total sales but for 60 percent of operating profit. At more than $100 billion in annual revenue and $40 billion in operating profit, AWS is a key and sometimes overlooked component of Amazon's success.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply