- Charts of the Day

- Posts

- Investors show little sign of worry over geopolitical risk following Venezuela.

Investors show little sign of worry over geopolitical risk following Venezuela.

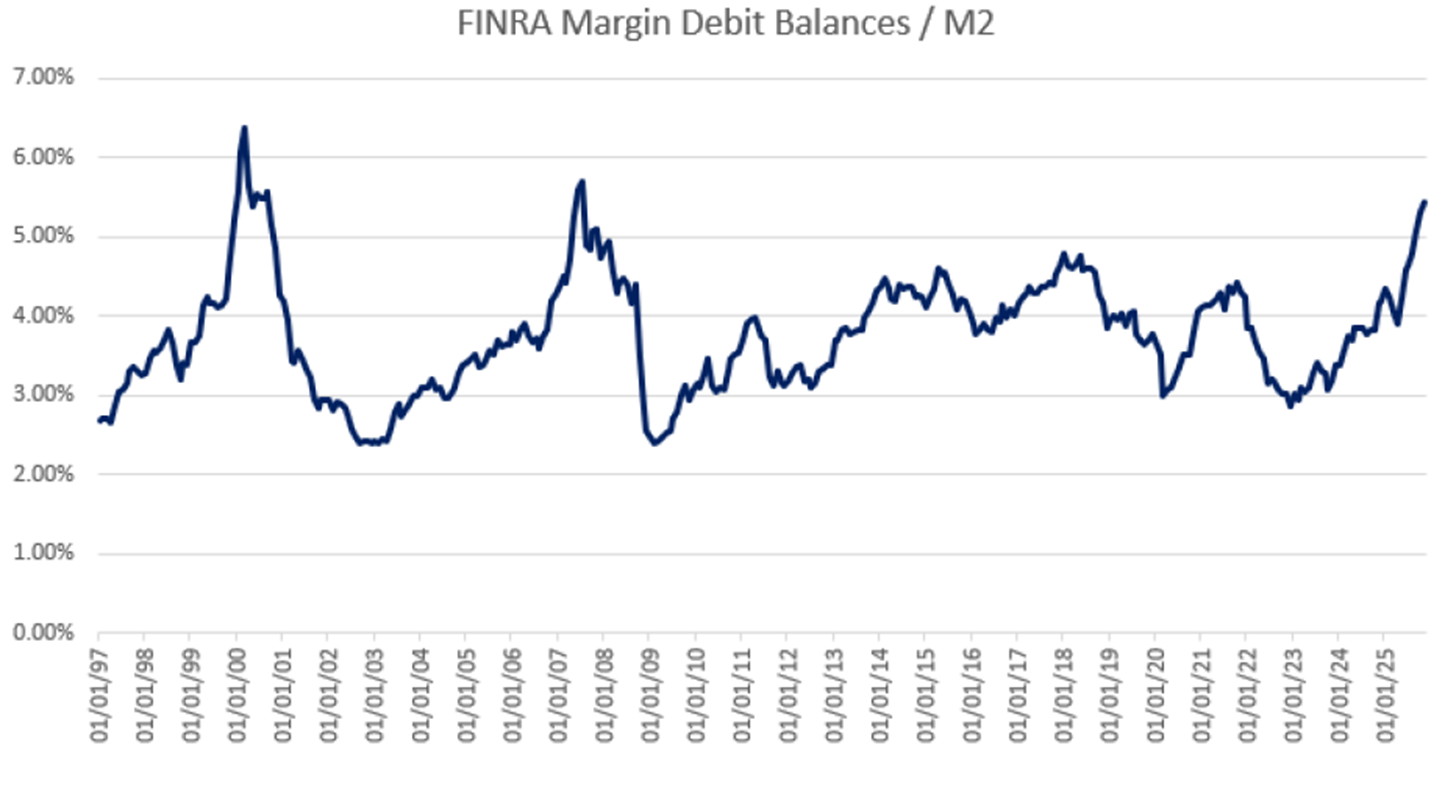

Retail leverage is at historic levels.

1. Retail leverage is at historic levels.

Individual investor leverage is quite high which creates risk.

The chart below shows margin balances as a percent of M2 money supply.

Based on this metric, leverage is the highest since 2008.

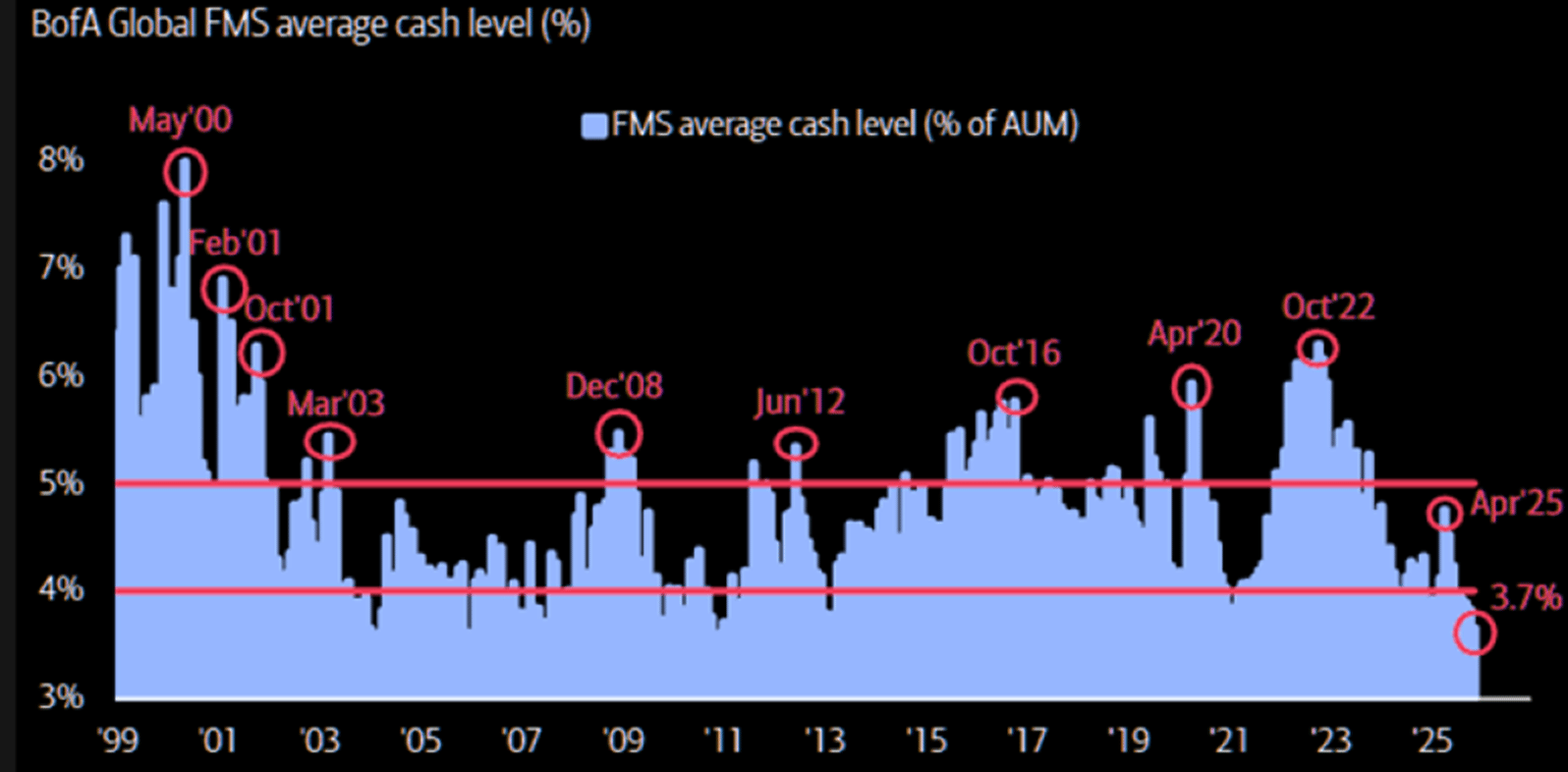

2. Institutional cash levels also at record lows.

And not only is the individual investor have historic high equity allocations and historic leverage, but institutions have the lowest cash levels in 20+ years.

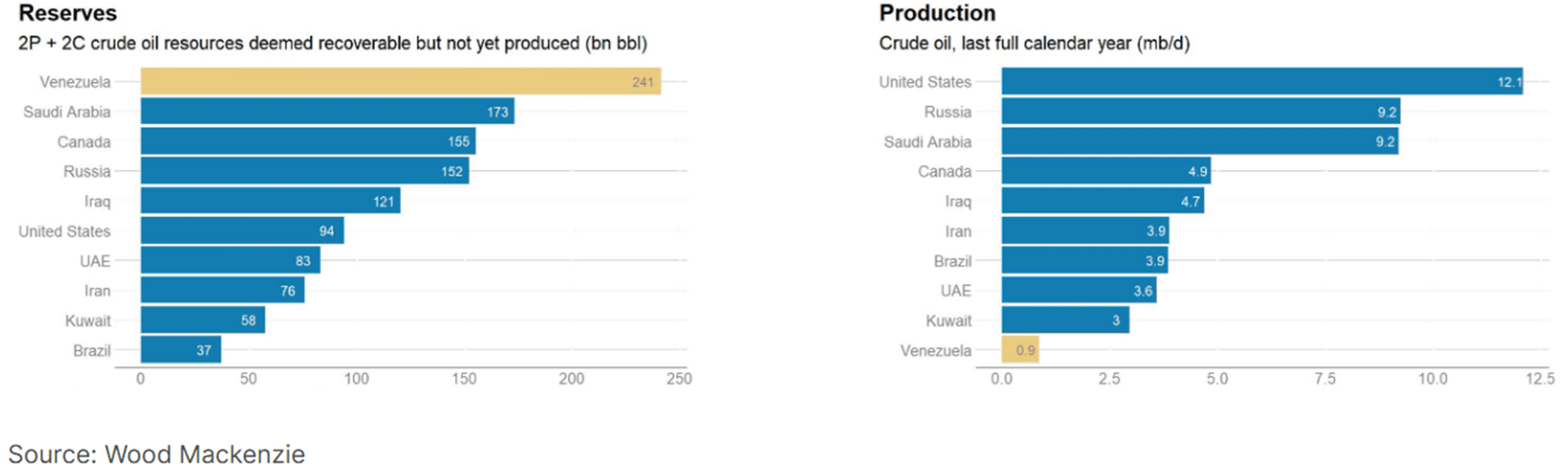

3. Venezuela holds one of the largest oil reserves globally but relative to those reserves, it is under-producing substantially.

Venezuela sits on top of 17 percent of global oil reserves but its one-time world-leading production has been cut into thirds after decades of neglect.

For these oil fields to ever come back online, analysts estimate it would take a years-long endeavor with an astronomical cost of anywhere from $10-$100B, or $1T depending what twitter expert you read. Francisco Monaldi, director of Latin American Energy Policy told Bloomberg it would cost $10B per year for ten years, compared to $27B in CapEx planned by Exxon Mobil for 2026, the largest oil company in the U.S.

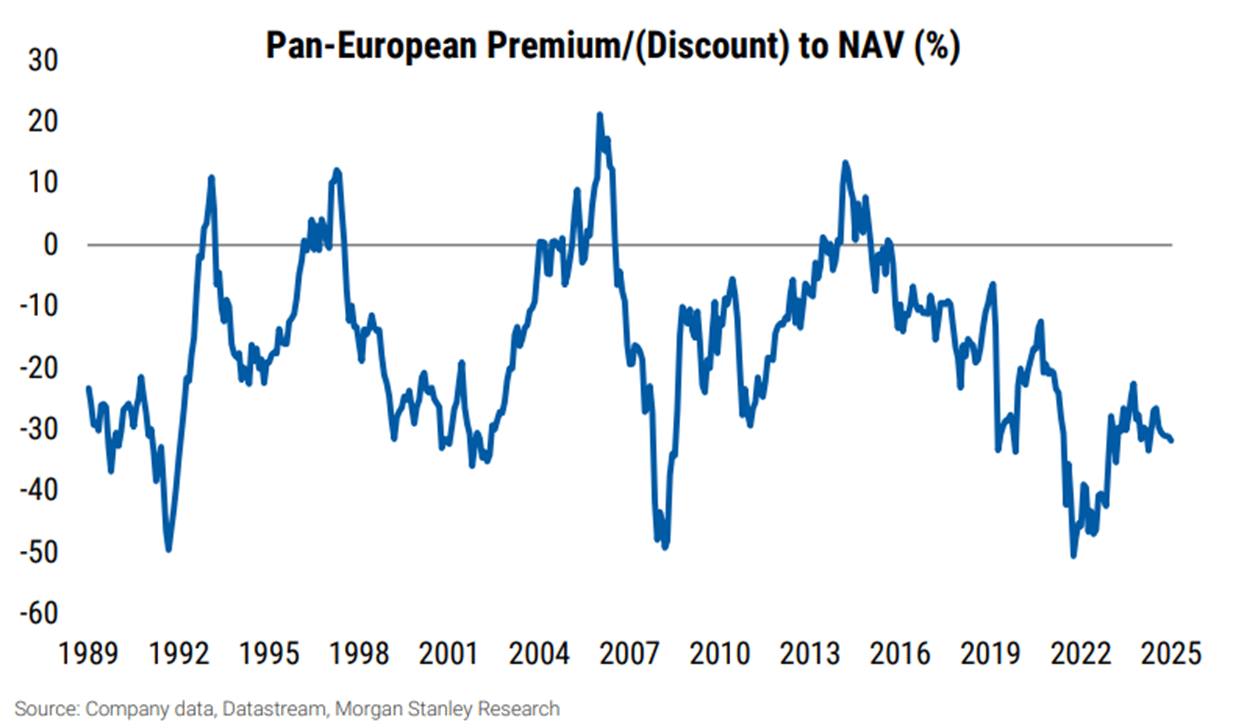

4. The European property sector is cheap and the risk/reward is compelling.

The sector is trading at a 32% discount to NAV. We are buyers at these levels.

Also, positioning is extremely underweighted with more than half of European long only funds having no exposure to European real estate, while c.80% of Global long only funds have no exposure to European real estate.

Moreover, any change in market appetite for 'new economy' sectors (e.g. AI) could put more of a spotlight on the valuation opportunity in 'old economy' sectors such as real estate.

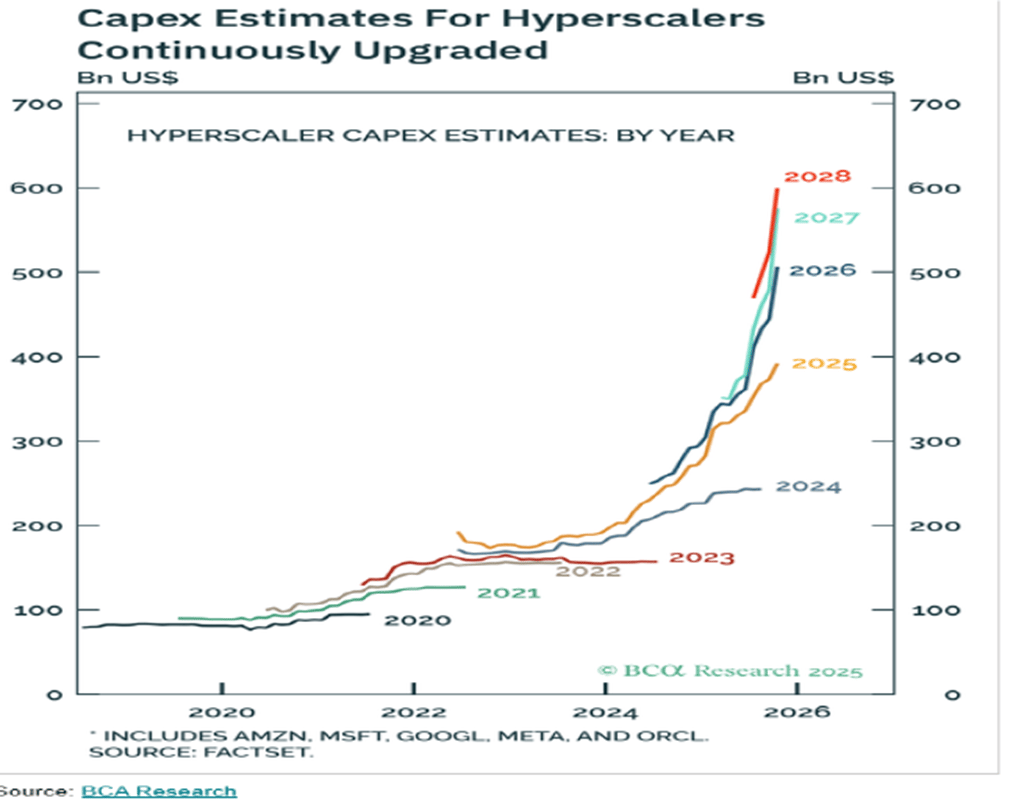

5. AI capex buildout.

The biggest risk for equities is the pace of AI capex buildout.

The chart below shows the continued upward revisions and growing expected capex forecasts.

If this continues at this pace, this will be a continued powerful driver of earnings. But if these estimates bend lower, earnings forward estimates will get hit as will equities.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply