- Charts of the Day

- Posts

- Limited tactical downside to EU equities from “Greenland tariffs”.

Limited tactical downside to EU equities from “Greenland tariffs”.

Stick with domestic bond proxies.

1. Limited tactical downside to EU equities from “Greenland tariffs”.

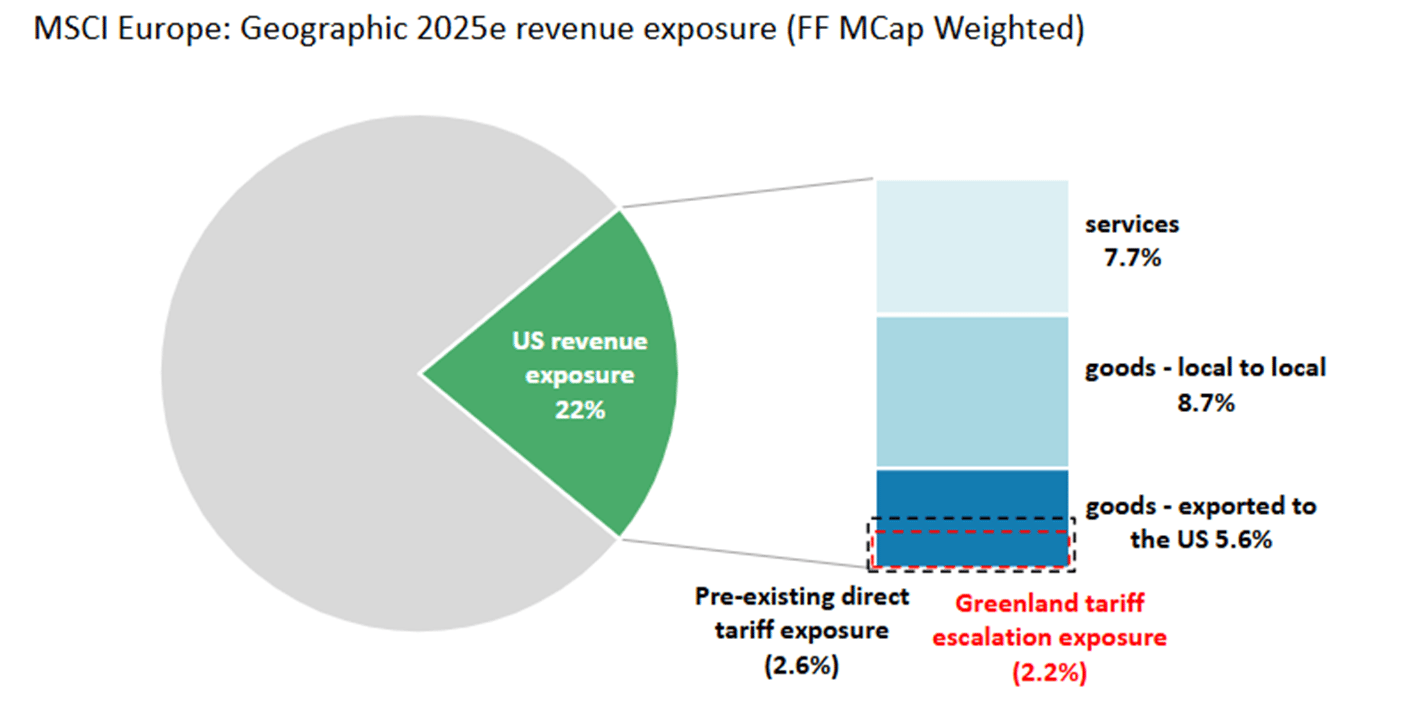

Only c. 2.2% of MSCI Europe's revenue could be directly exposed to new Greenland-related tariffs.

Any reaction might be short-lived until there’s more clarity on the situation. The prevailing so-called ‘TACO’ mindset amongst investors may prevent a repeat of the post-Liberation day drawdown, according to the strategists.

“An increasingly erratic US policy set-up raises the risk of reinforcing the slow-building ‘sell America’ bias among global allocators and could prompt more international diversification via EU, Japan and EM equities,” they say.

2. Domestic bond proxies.

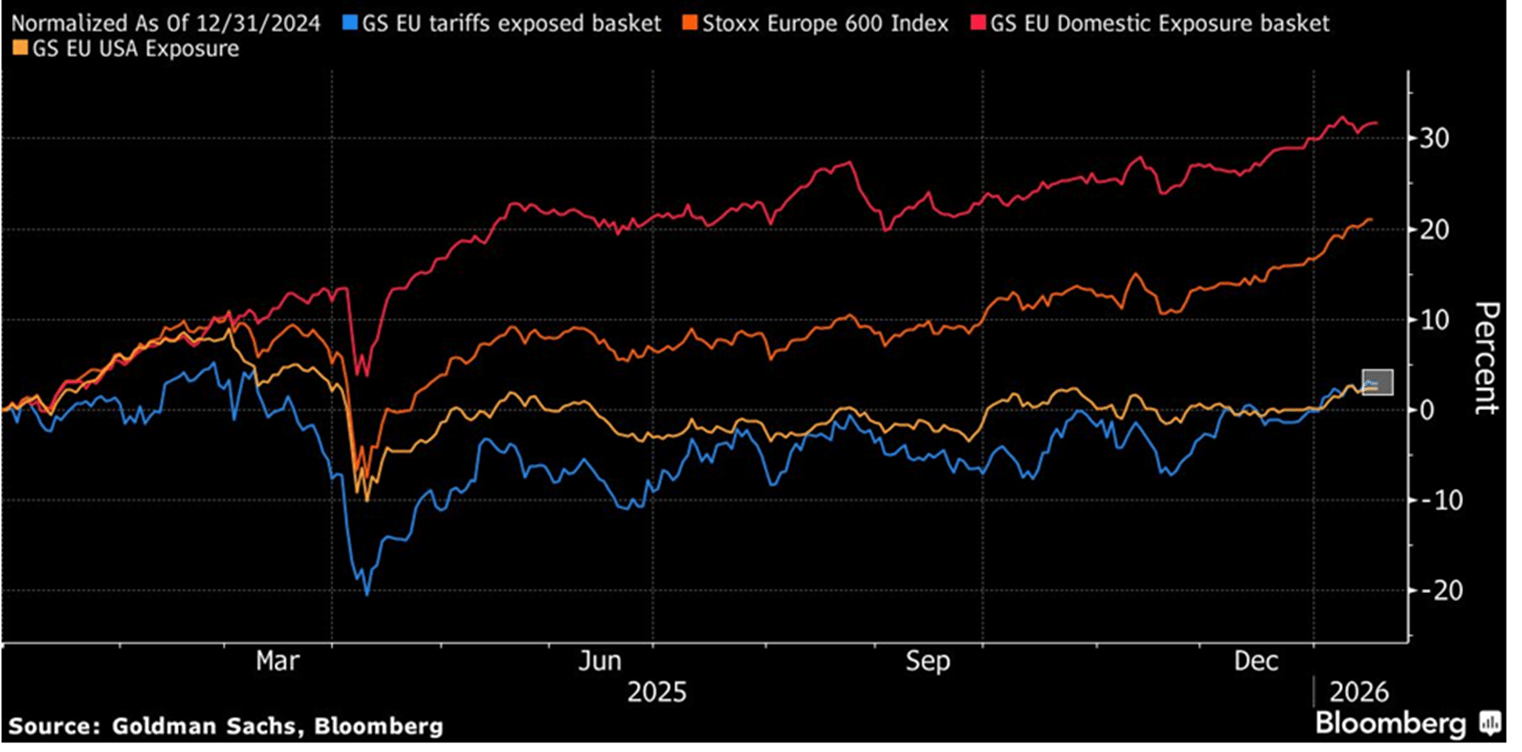

A basket of EU Trump “tariff losers” is down 2.5% with autos, tech, consumer, drinks and luxury stocks among the groups under pressure. “European equities at all-time-highs are vulnerable to profit-taking and a repricing in risk-premia in the very near term, particularly the trade proxies and the high beta outperformers, like Banks and Miners,” say Barclays strategists.

“In contrast, Defense sector and domestic bond proxies like Utilities, Telcos and Real Estate may be seen as relative safe havens.”

Below: Domestic stocks have been outperforming the exporters by a big margin.

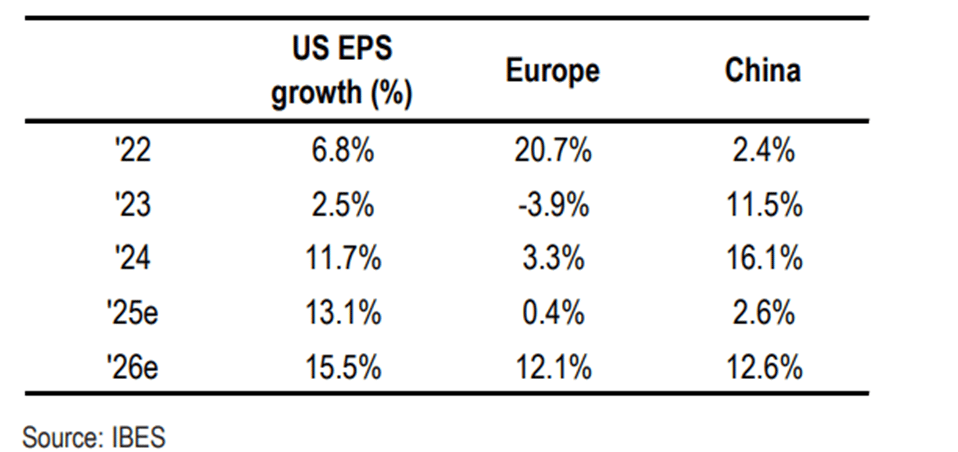

3. The big picture…global earnings could broaden, with laggards like Europe and China catching up.

The weekend tariffs headlines offer an excuse for some derisking, and could weigh on sentiment for a while, but the fundamental equity backdrop is a constructive one, and we’re expecting reassuring earnings results.

“After 3 years where Eurozone earnings always underwhelmed the sell side projections, this year Eurozone will deliver strong earnings growth, and this should aid our bullish view on the region, it argues for continued breakout from the last March-September’s sideways movement. Beyond likely better operating leverage and stronger topline growth, we look for less FX headwinds to support European earnings this year.” Says JPMorgan.

“Big picture, global earnings delivery over the past few years has been US and AI centric. Key international markets like Europe and China delivered little to no earnings growth last year. We expect the laggards to catch up.”

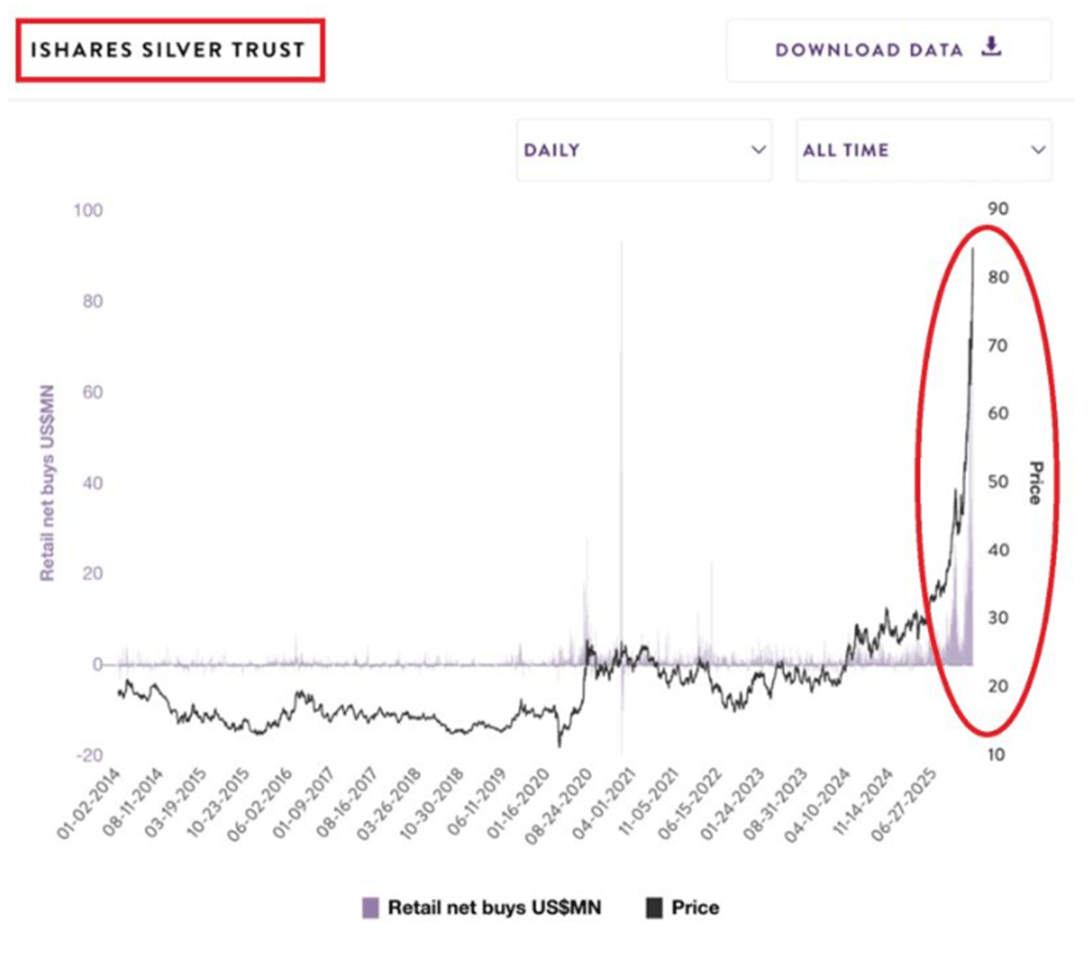

4. Retail investors are joining the silver rally at a record pace.

It will end in tears.

5. Not all bubbles are the same.

Some bubbles form around real technological inflections, while others are built almost entirely on financial excess.

AI clearly fits the inflection-bubble category. Its potential is real, and its impact is hard to dispute. But that doesn’t make every investment tied to AI sensible, or every valuation defensible. The dot-com era left behind dark fiber, massive infrastructure built for internet traffic that didn’t yet exist. It was a gamble on future demand that arrived too late.

AI looks different. We aren’t building ahead of demand. We are chasing it. GPU capacity is heavily utilized, and supply is constrained. Unlike fiber in 2000, today’s compute isn’t sitting idle. High utilization acts as a floor. It reduces the risk of near-term write-downs and confirms that today’s CapEx is responding to genuine, cash-paying demand.

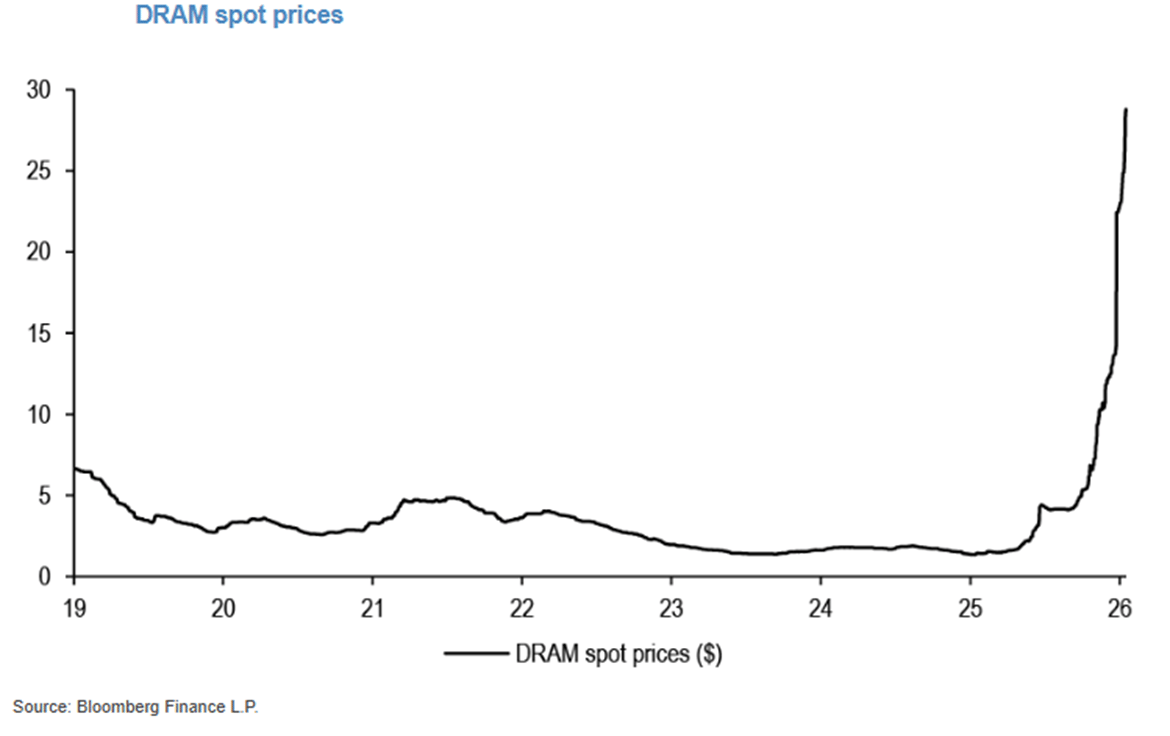

Below: Memory prices are just catching up with demand.

6. French budget drama nears end.

Be ready to buy the dip.

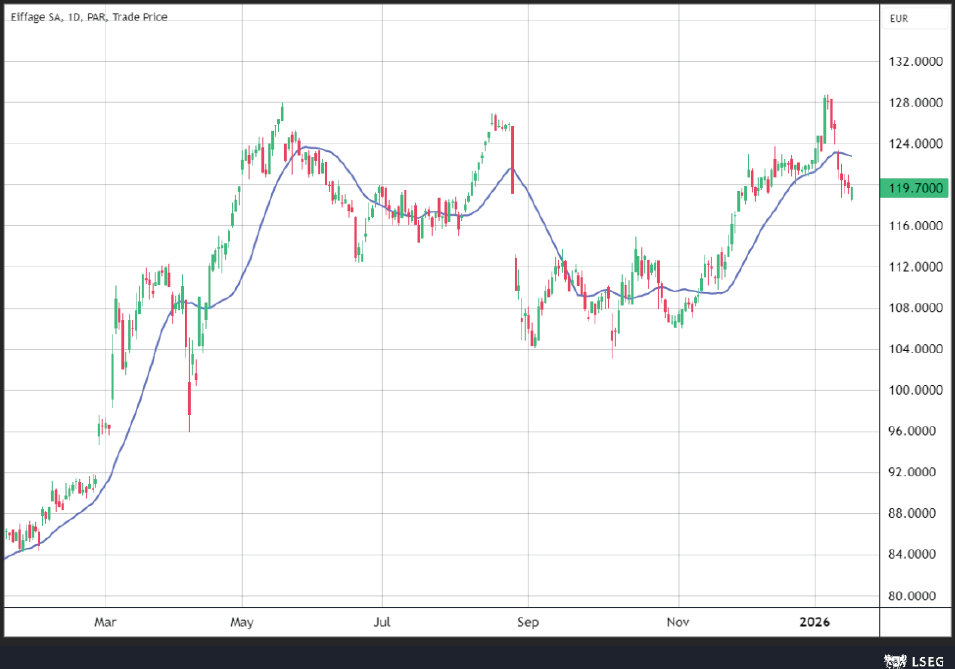

Eiffage is our favourite French infrastructure play.

Eiffage has a generous valuation buffer, offering downside protection even in the event of unfavourable French tax outcomes. Eiffage trades at a ~36% discount to NAV.

Eiffage's Contracting business (~€21.2bn 2025e revs / ~€942m EBIT) continues to offer an attractive combination of visible revenue growth on German infrstructure stimulus and a solid backlog (resilient flow orders + large contract ramping up into 2026/27/28e).

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply