- Charts of the Day

- Posts

- LVMH sales fall again after demand slumps in Japan, China

LVMH sales fall again after demand slumps in Japan, China

ECB leaves interest rates unchanged for now.

Subscribe to receive these charts every morning!

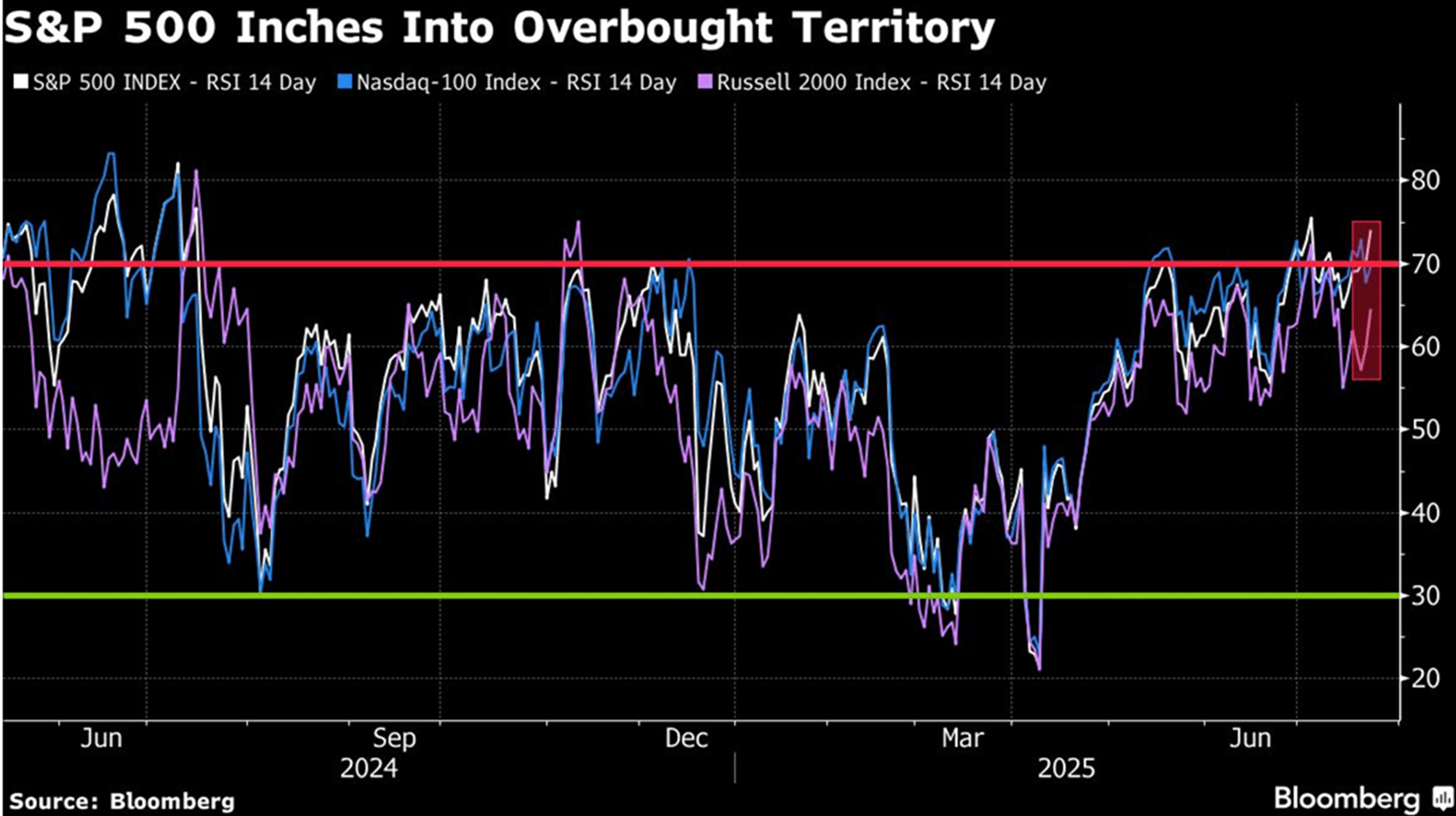

1. Some technical signals may be ringing alarm bells about equity gains getting stretched.

After a 28% gain from its April low, the S&P is now in overbought territory. The Nasdaq posted its 63rd consecutive day above its 20-day moving average — the longest streak since 1999 — suggesting investors are all-in on tech.

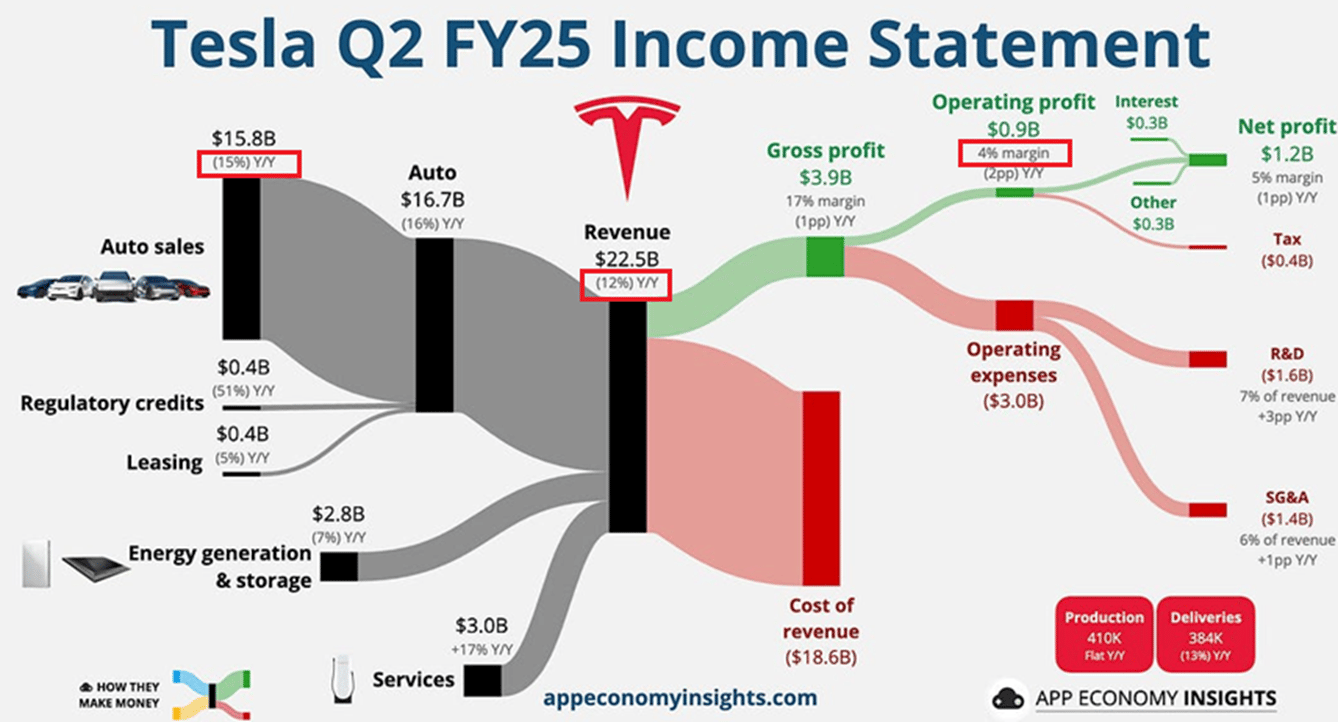

2. EV pain versus robo gain?

Tesla is crossing the chasm to autonomy while absorbing slower volume, EV incentive elimination, tariffs and investing in new initiatives that may not make margins for years.

In Musk’s own terms during the call: “autonomy is the story.”

But even if the moonshots in robotaxi and robotics succeed, they’re years away from offsetting collapsing vehicle demand (-15%) and face regulatory hurdles.

Yes, Tesla’s robotaxi program could unlock tremendous value. But at what point does mounting evidence of brand erosion start to undermine even the most ambitious upside?

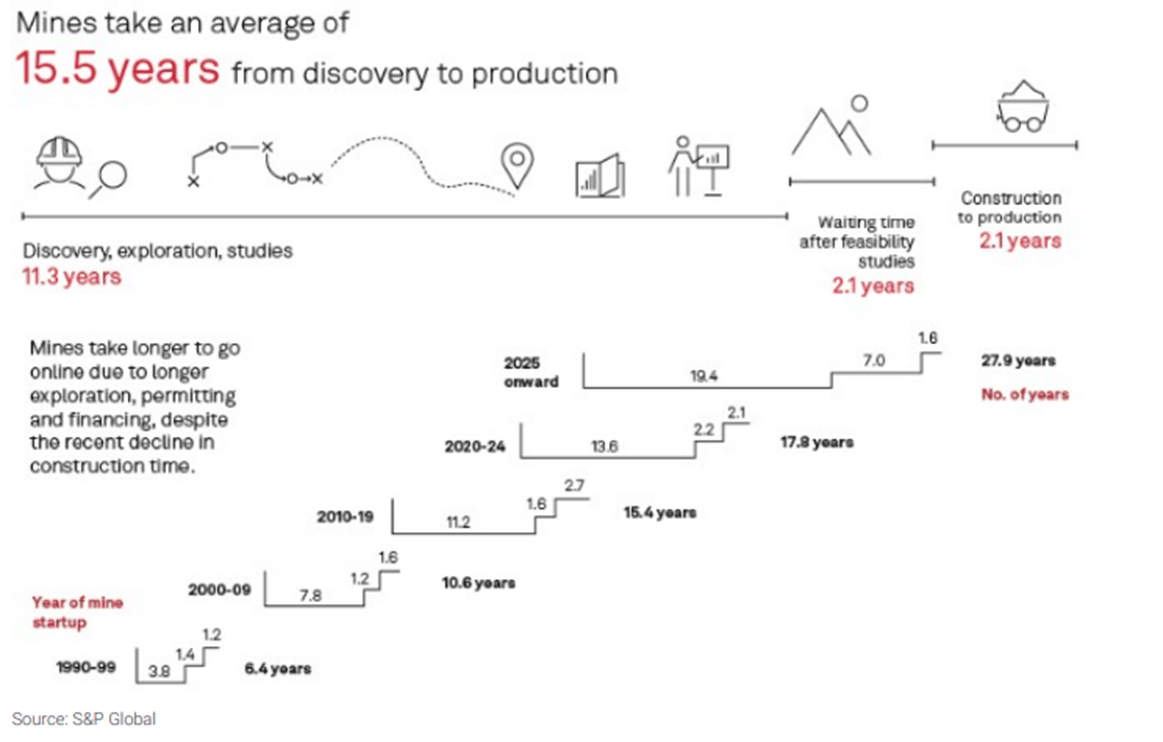

3. The average lead times for new mines continues to rise, which could pose challenges for meeting the rising demand for critical minerals.

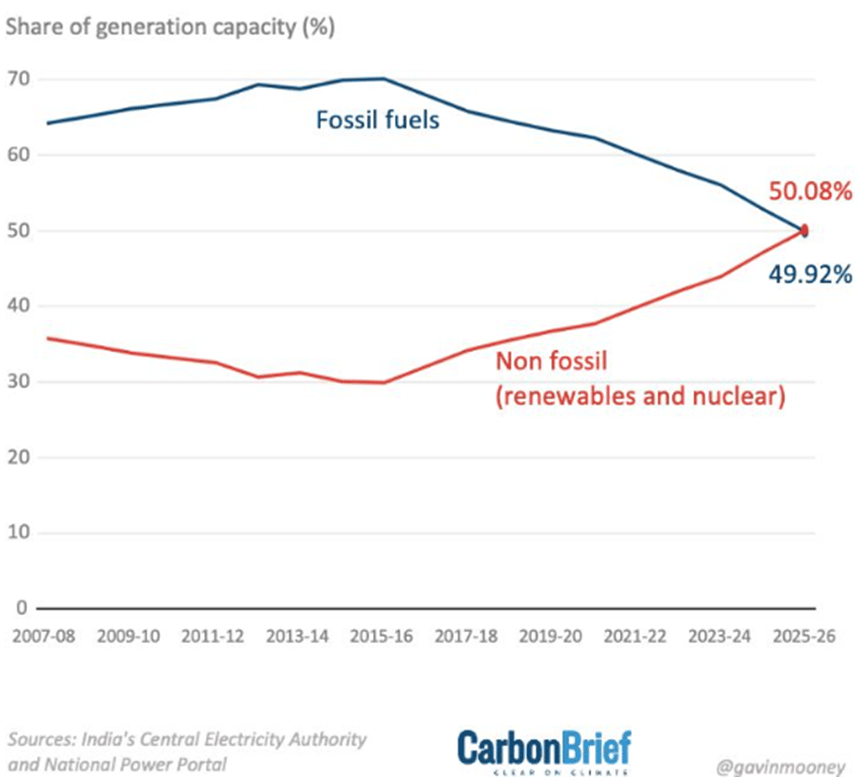

4. India has reached 50% clean power capacity.

In the first half of this year India added a record 22 GW of renewable energy, mostly wind and solar. India also has a target of installing a cumulative 500 GW of renewable energy (and nuclear) capacity by 2030.

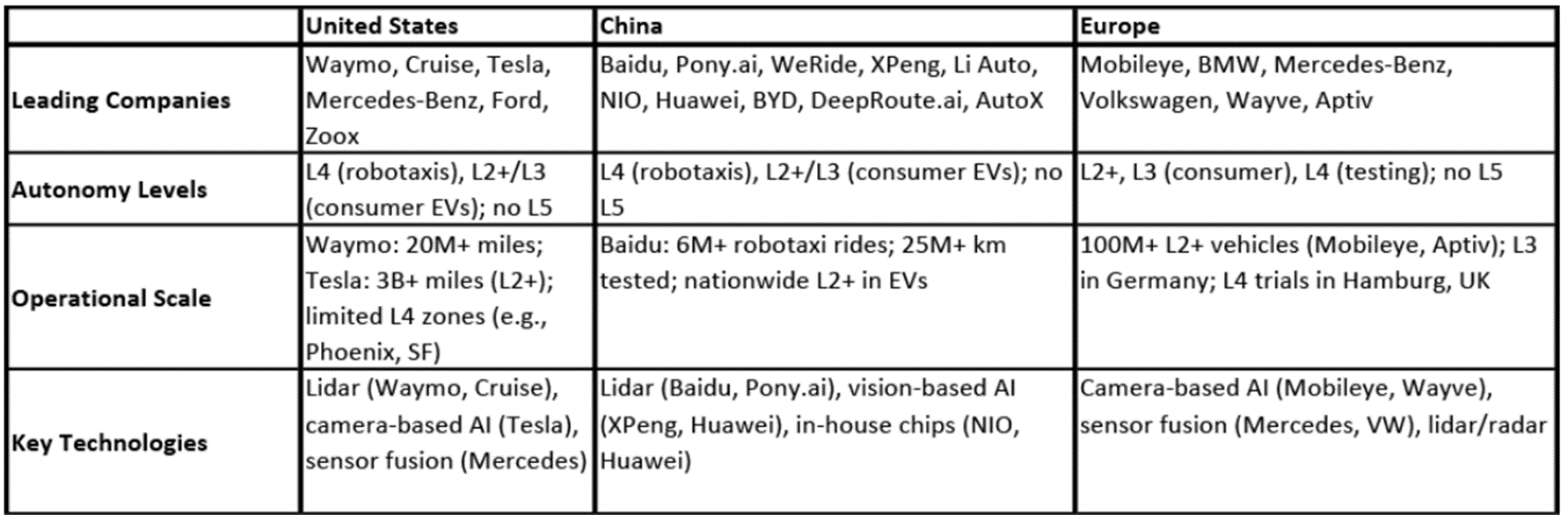

5. Comparison between Europe, China & USA autonomous driving landscape.

Source:JPMorgan

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply