- Charts of the Day

- Posts

- Market is taking a chill pill.

Market is taking a chill pill.

To cut or not to cut...Fed officials split over how to read economic signals.

Subscribe to receive these charts every morning!

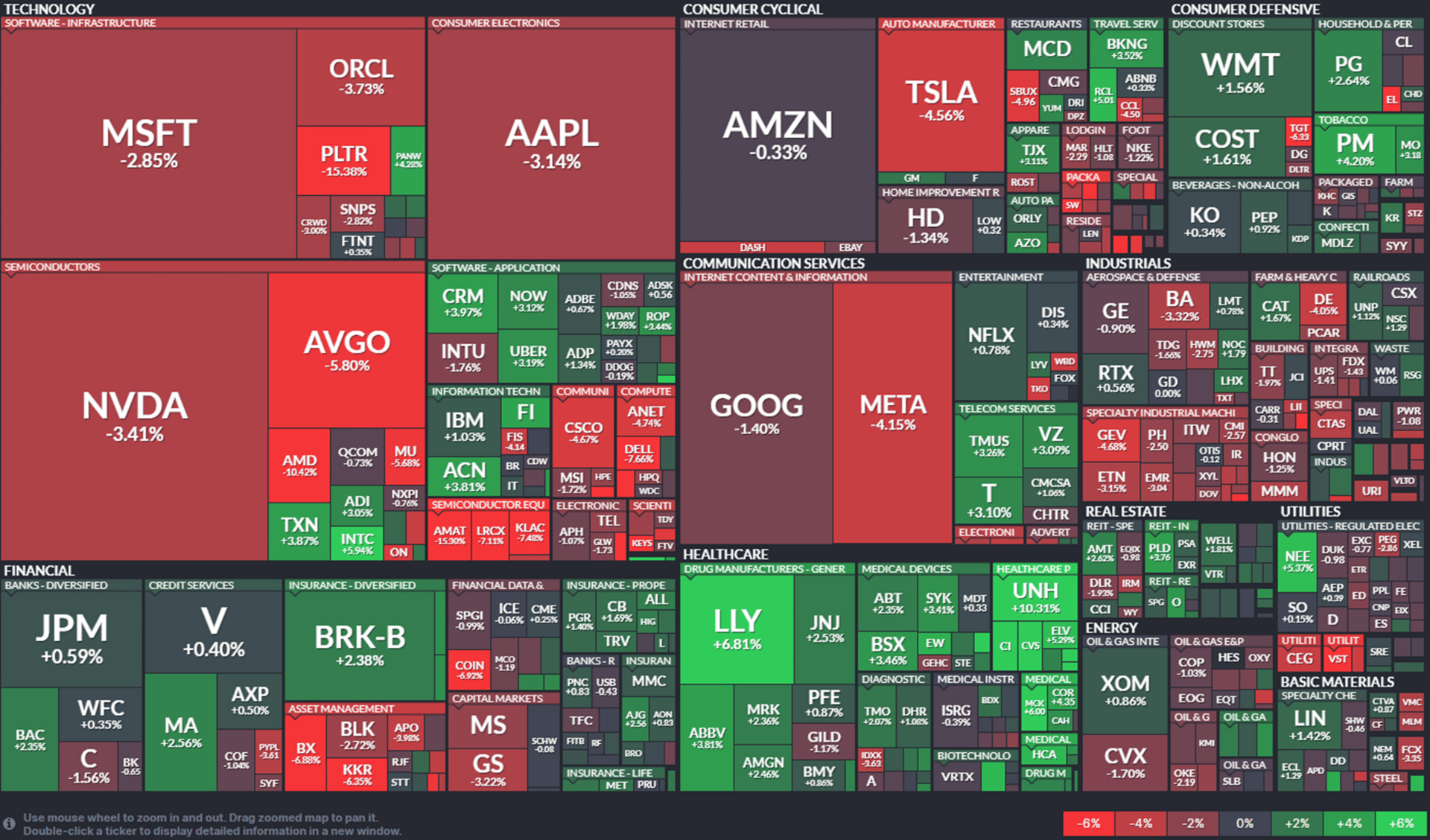

1. Market is taking a chill pill after a record run pushed by retail investors that had not stopped buying since April.

Bloomberg data showed the S&P 500 has lost $1Trillion, mostly from tech names like Nvidia, Broadcom, Meta, Microsoft, and the like.

An MIT study last week cast doubt on AI’s use in companies, finding 95% of firms found no return from AI spending, according to the Financial Times.

Here is the performance since last week.

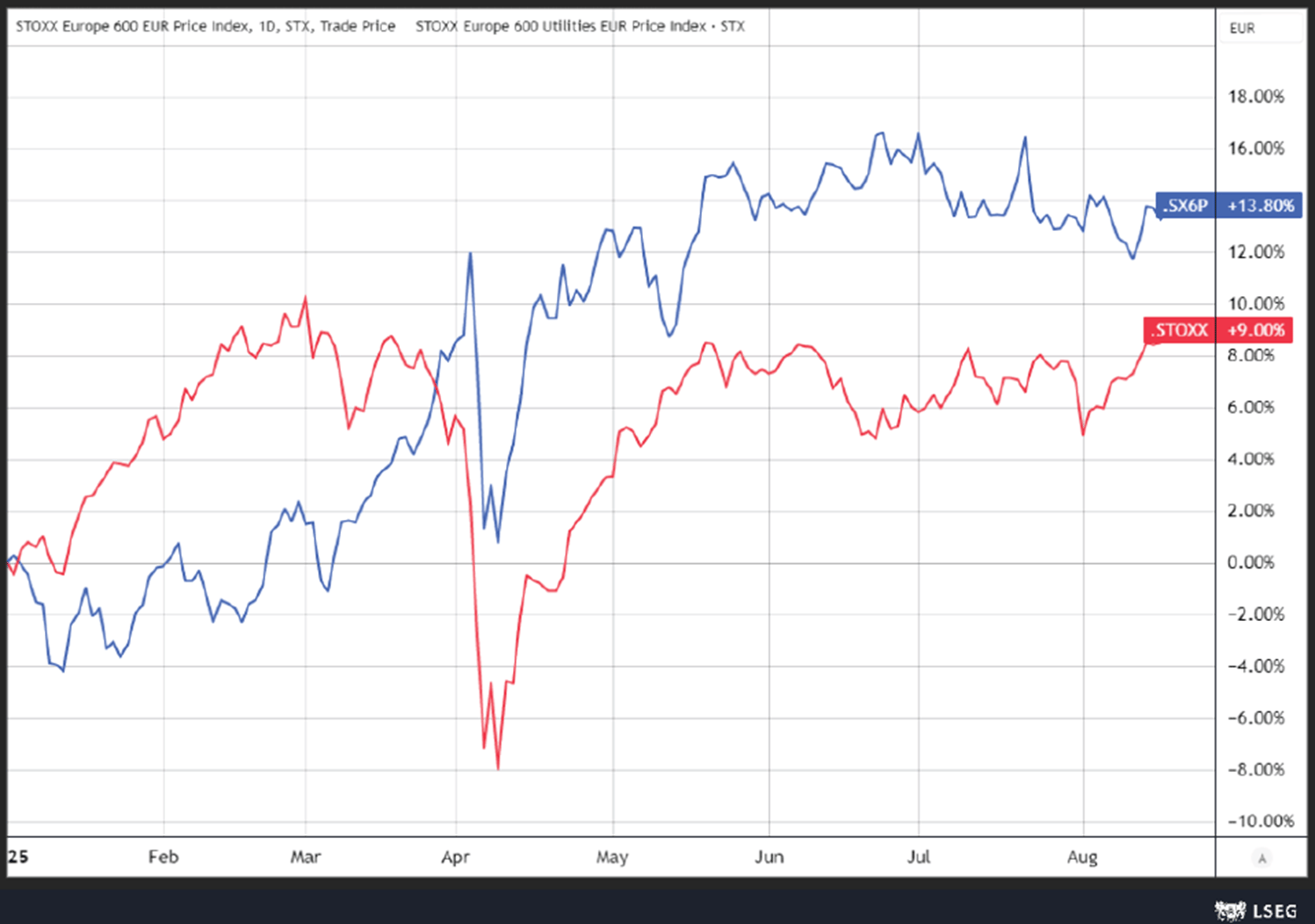

2. “Global funds are pivoting back to the utilities sector, but are still 30% underweight versus sector benchmark weights.”

The outperformance of the utilities sector year-to-date can continue as funds increase their weights in defensives.

Source: BoA

Outperformance Utilities year-to-date versus Index

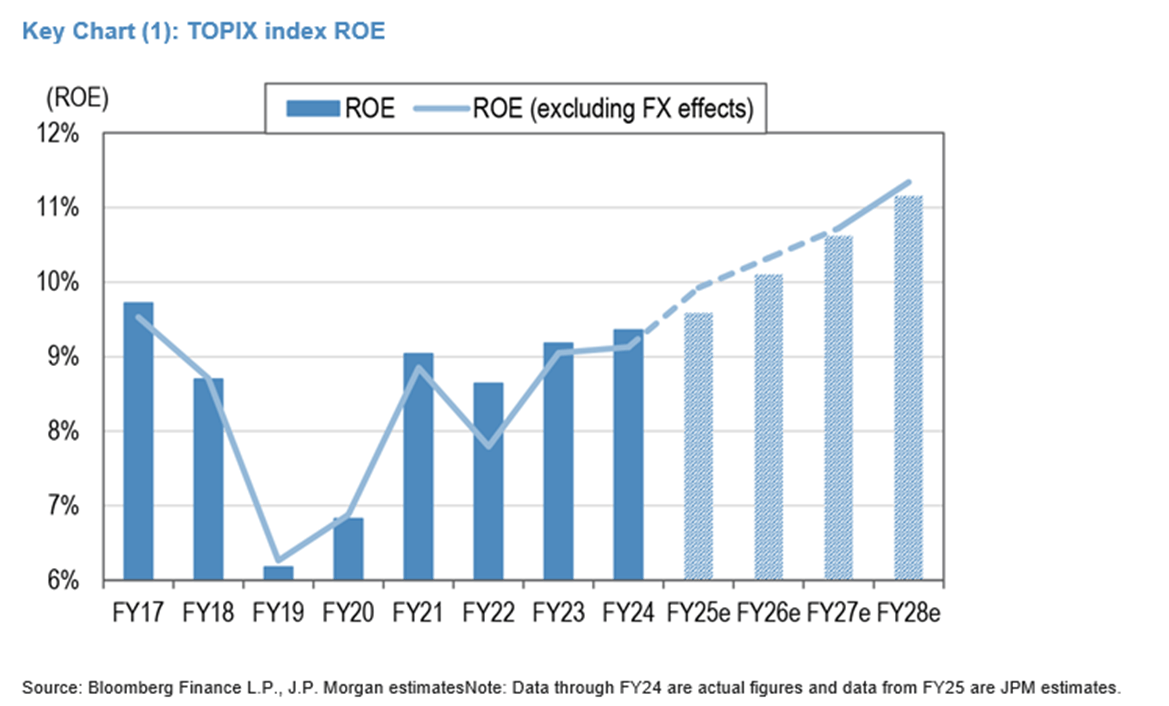

3. JPMorgan remains (very) bullish on Japan.

“We view corporate reform as a medium-term structural change and a solid investment theme that supports Japanese equities beyond the near-term uncertain global economic cycle.

With ROE rising substantially, we expect the revaluation of Japanese equities to materialize, the market’s P/E to reach 17-18x and the Nikkei 225 near 60,000 in FY2028.”

Below: Expected growth in return on equity.

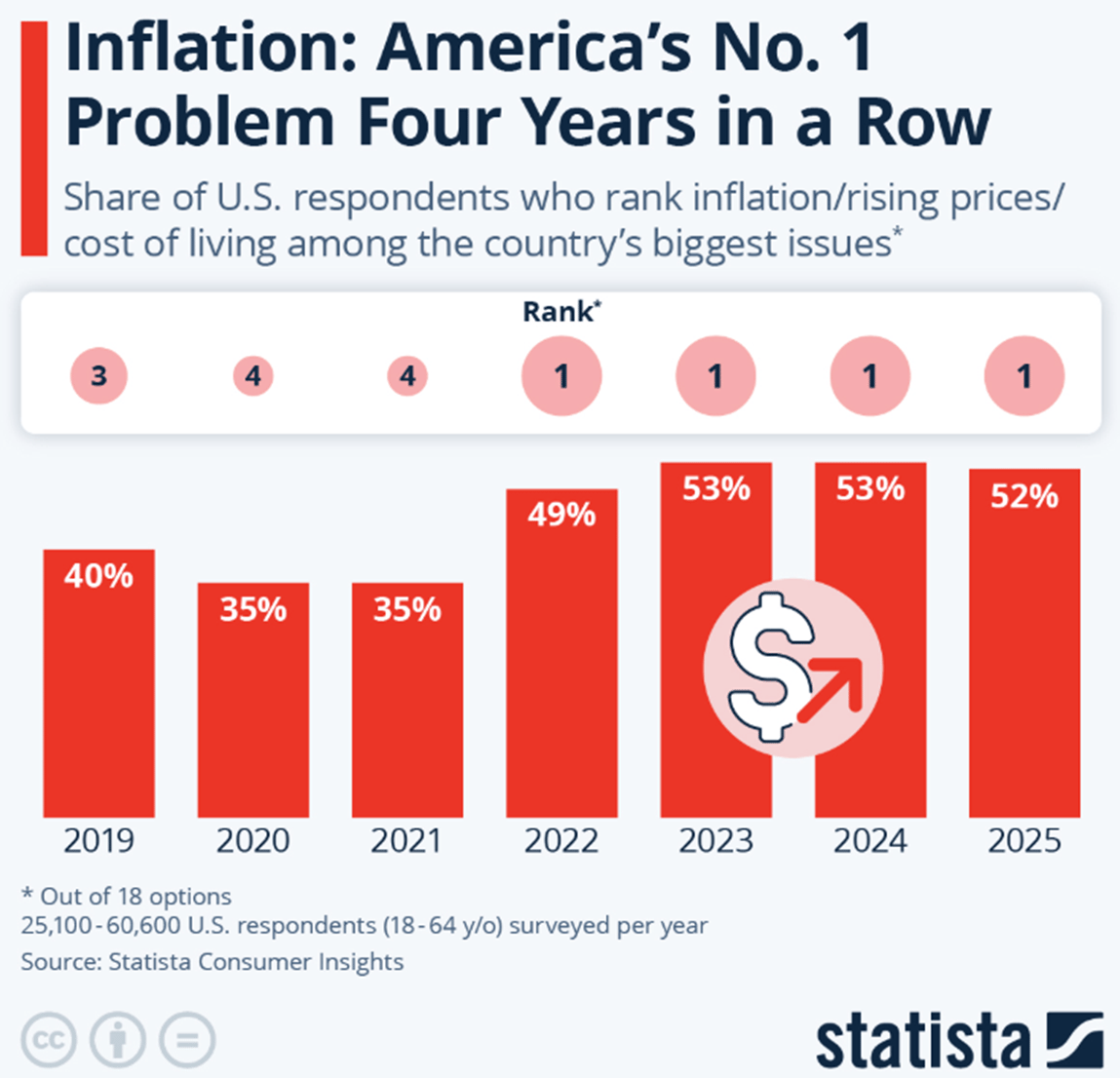

4. To cut or not to cut...Fed officials split over how to read economic signals.

Meanwhile, concerns about inflation remain high.

The United States is among the countries where cost of living is the one domestic issue most people can agree on - this applies to Republicans and Democrats alike and holds true across generations.

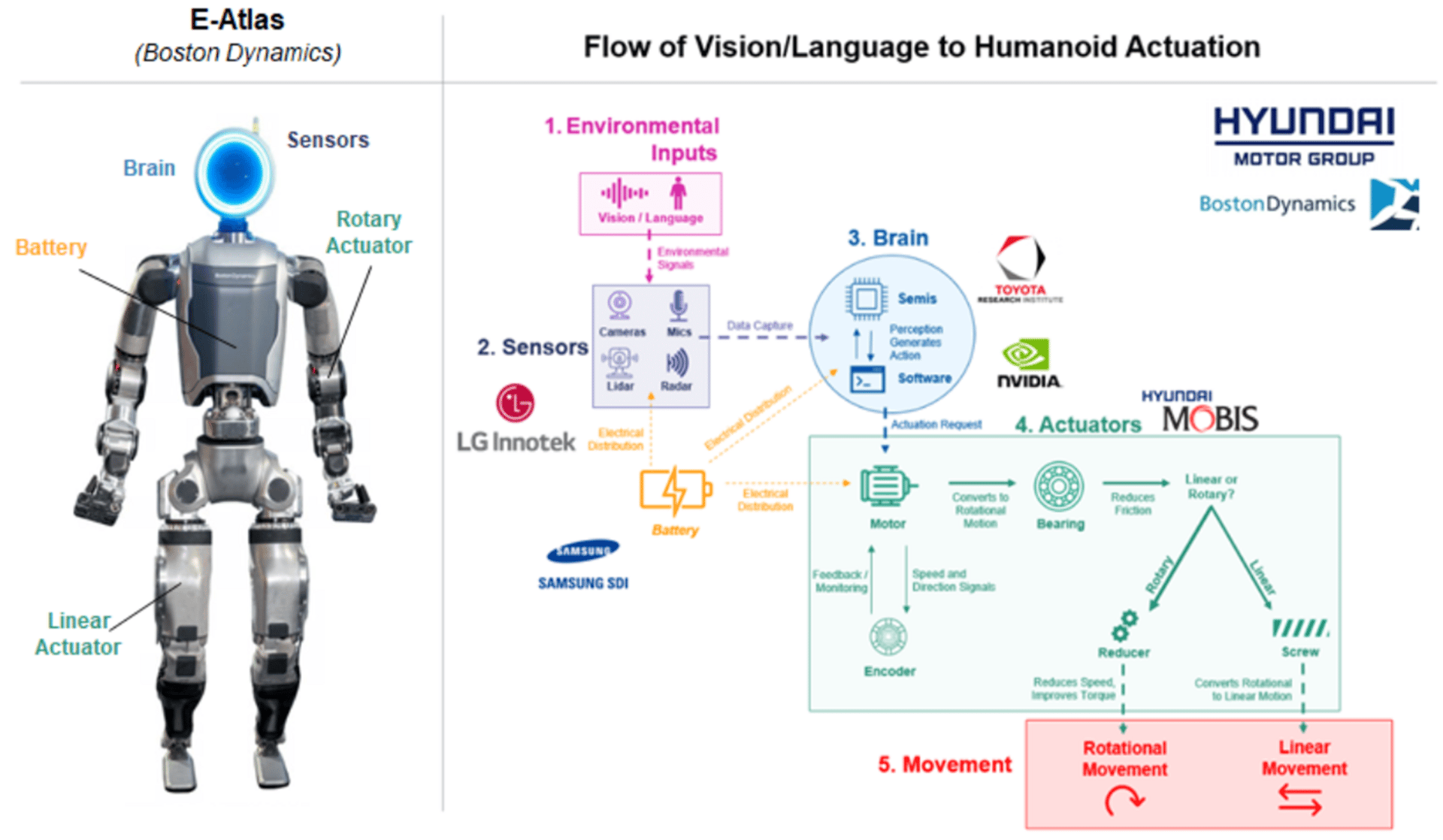

5. Hyundai has big robotic ambitions.

In 2020, Hyundai Motor Group took a major step into the robotics business with the acquisition of a controlling stake in Boston Dynamics (BD) while also initiating a dedicated robotics lab as part of its dual track strategy.

Since the acquisition, Hyundai has steadily expanded its inroads into the humanoids/robotics field through multiple collaborative initiatives, spanning technology developments, product integration, manufacturing and research.

BD plans to refine “Atlas” with a small group of customers – starting with Hyundai – over the next few years. Pilot testing is expected to begin at the end of 2025, with Atlas deployed in Hyundai’s production sites in a proof-of-concept capacity. Hyundai plans to test Atlas in its auto manufacturing lines, possibly beginning at its Singapore and US plants, for tasks such as material handling, machine tending, and intra-logistics (e.g., transporting parts between stations).

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply