- Charts of the Day

- Posts

- Markets now await the Personal Consumption Expenditure data later today.

Markets now await the Personal Consumption Expenditure data later today.

While the PCE report is unlikely to yield a major surprise, it’s likely to suggest there’s stickiness in inflation.

Subscribe to receive these charts every morning!

1. Ownership of EU Luxury has steadily declined and is now near an all-time low.

EU Luxury’s YTD underperformance versus the market is the worst in at least 15 years, suggesting limited downside from here.

The sector is also among the most shorted in Europe: based on external custodian data, short interest stands at 3.7% of free float, in the 98th percentile vs the past five years. We estimate that short sellers are currently down ~3% on recent performance, leaving them vulnerable to further losses should the sector rally.

2. India tax reform could offset hit from Trump tariffs.

Under the proposed changes, the goods and services tax will be simplified and the average tax rate reduced. It should boost private consumption. "Depending on the details, this boost could be enough to cancel out the tariff drag", BMI says. For now, it lowers India's growth forecasts, seeing growth at 5.8% in FY 2025-2026.

3. The rally in Europe can survive the French crisis.

“It’s easy to say another political crisis means ‘sell Europe,’ but the fundamentals are already pricing in bearish scenarios,” says Beata Manthey, a strategist at Citigroup.

“The case for Europe has always been based on Germany, which remains intact, while French assets are pricing in some political risk premium.”

Goldman strategist Sharon Bell says the bank’s economists see no immediate impact on growth from the developments in France. “There doesn’t seem to be a big concern within the context of the European market,” she says. “This is certainly within the scope of people’s expectations. The vulnerability of France was always there.”

Data showed the euro area’s private sector grew at the quickest pace in 15 months in August as manufacturing exited a three-year downturn.

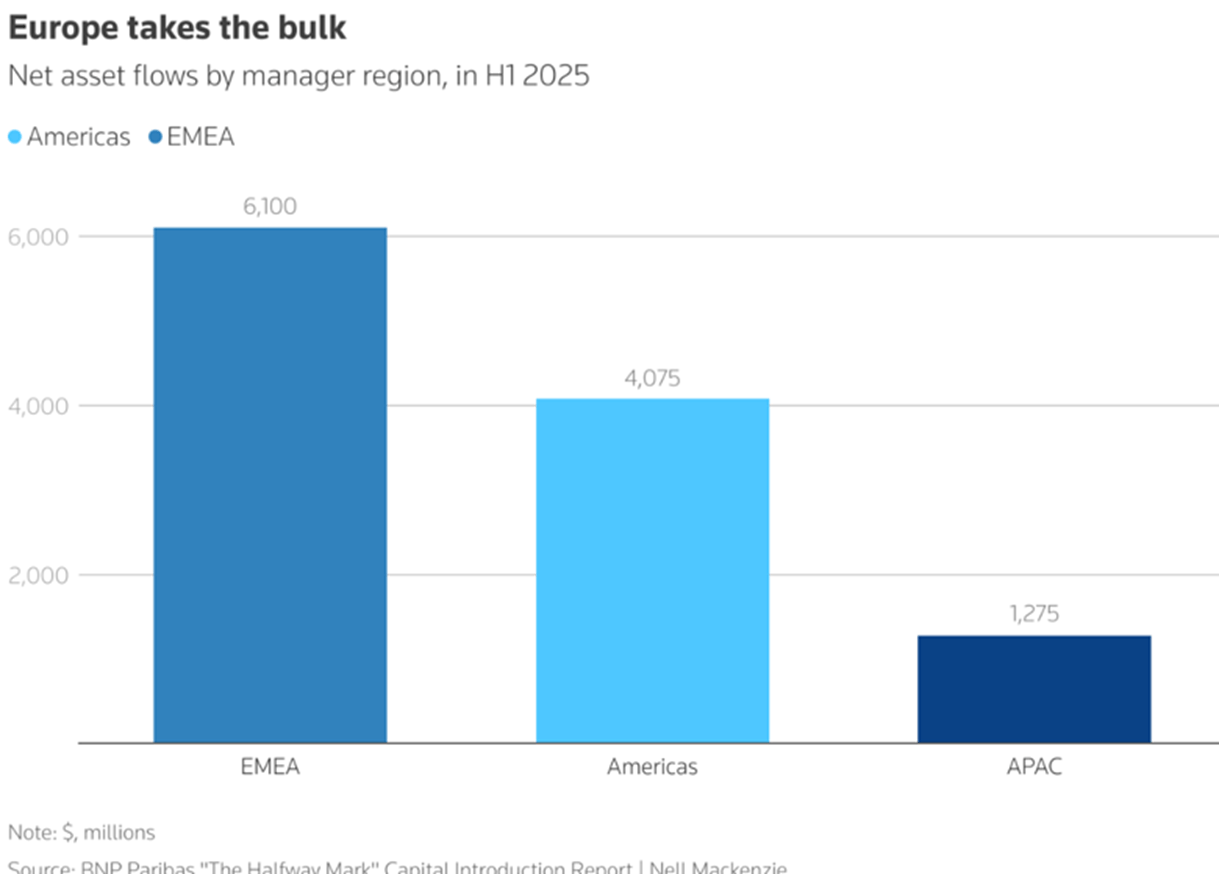

4. Hedge funds in Europe gain favour as investors steer away from US, says BNP Paribas.

Investors plan to increase their hedge fund exposure to prefer Europe and Asia over the U.S. for the first time since 2023 as wealthy financiers diversify away from the United States, a BNP Paribas survey sent to clients on Thursday showed.

Heightened U.S. policy uncertainty and tariffs have prompted investors to move away from U.S. markets this year, with Europe also benefiting as Germany ramps up fiscal stimulus to boost long-term growth prospects.

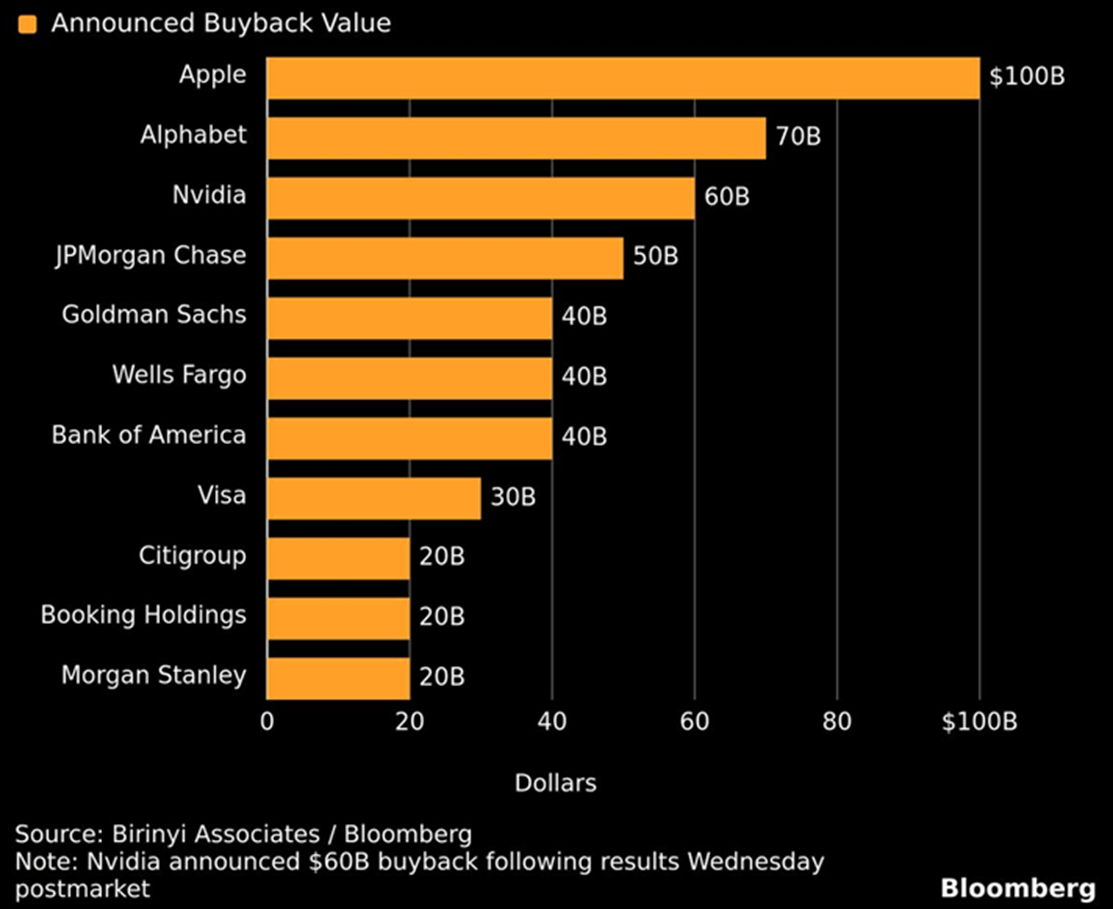

5. Record buybacks are supporting the S&P.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply