- Charts of the Day

- Posts

- New tariff drama.

New tariff drama.

Trump plans to impose blanket tariffs of 15% or 20% on most trade partners.

Subscribe to receive these charts every morning!

1. Goldman Sachs warns against loading up on stocks.

“The equity market appears to be pricing an optimistic outlook for the US economy, but we believe there are risks in both directions and investors should not be clearly cyclical or defensive,” strategists including Ryan Hammond said.

Within defensives, Goldman recommends investors own utilities and real estate, which typically benefit most from lower bond yields.

In terms of cyclicals, the strategists favor basic materials versus energy on the expectation of lower oil prices.

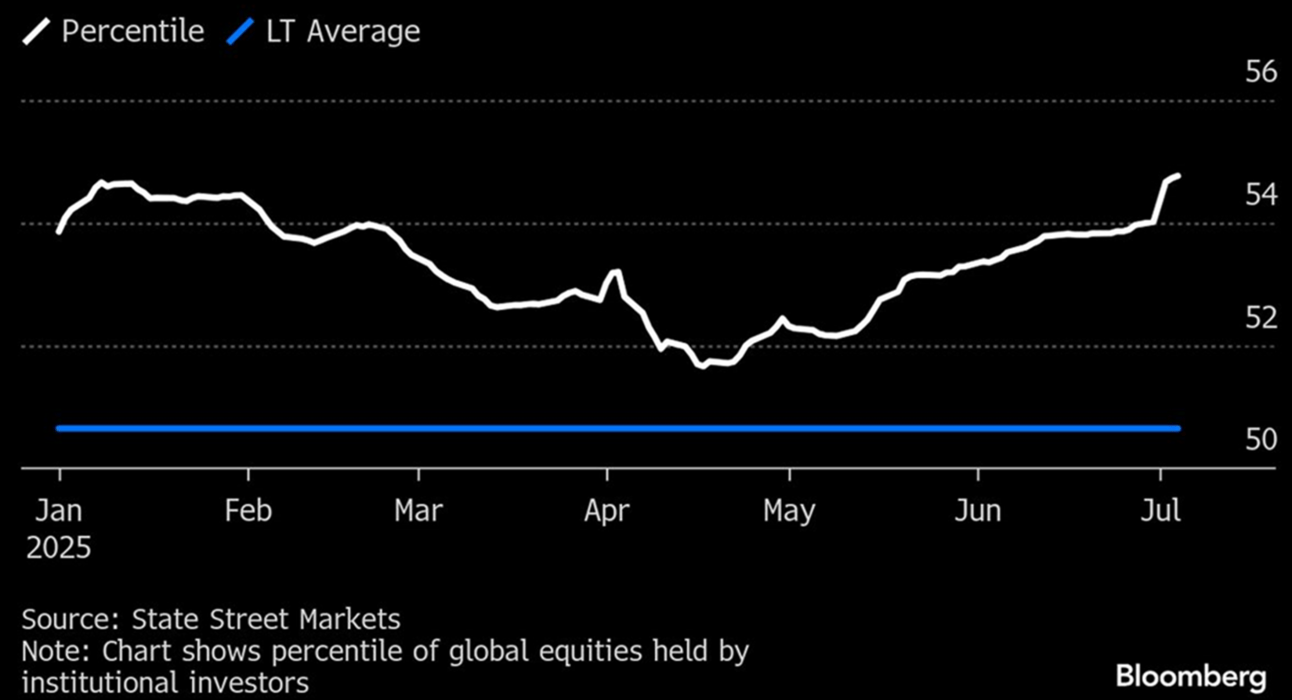

Below: The average stock holding climbed to 54.76% on July 4, a sign of extreme bullishness.

2. There’s a creeping sense that the near-term setup is ripe for a euro pullback.

The bullish euro story isn’t broken, but the market has just run out of fresh catalysts.

Both the European Central Bank and the Federal Reserve are in wait-and-see mode, keeping policy optionality alive into September.

3. Europe’s struggling luxury stocks are showing signs of a turnaround as enough negativity is now priced in for the sector.

Since their peak in March 2024, a basket of luxury goods stocks has tumbled 20%.

It’s “time to be less negative” on luxury stocks, according to UBS strategists led by Andrew Garthwaite. They upgraded the sector last week, citing tactical and fundamental reasons.

Garthwaite and his team note that luxury stocks are nearly three standard-deviations oversold relative to the market. That’s a rare occurrence which was followed by them outperforming 76% of the time over a three-month horizon.

4. Lots of moving parts in the hardware space.

Taiwan Semiconductor might be an even bigger AI chip winner than Nvidia, says Barron’s. Sales were up 39% as it rides a wave of demand for AI chips. And while Nvidia has to work hard to maintain its lead over a raft of competitors, TSMC dominates high-end chip manufacturing and there is little to suggest it will face much competitive threat in the next few years.

TSMC has previously said it expects revenue from AI-related chips to double in 2025 and grow at a mid-40% annual growth rate for the next five years. TSMC also makes the core processors inside Apple iPhones, Qualcomm mobile chipsets, and processors made by Advanced Micro Devices.

Meanwhile, Vertiv came under pressure after Amazon unveiled custom cooling technology for Nvidia chips, raising concerns about competitive pressure in the AI data center space.

5. At the intersection of AI and defense.

The “ReArm Europe Plan” stresses how escalating tensions "have not only led to a new arms race but also provoked a global technology race."

The Commission has identified technologies like AI, quantum, biotech, robotics and hypersonic as "key inputs for both long term economic growth, and military pre-eminence." Improved decision-making speed, the ability to analyse large amounts of intelligence data, and better image processing and object detection capabilities were the top three priorities stated.

Here is an overview of European Aerospace & Defense companies' exposure to AI applications.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply