- Charts of the Day

- Posts

- New Year optimism gives way to jitters about the economy and geopolitics.

New Year optimism gives way to jitters about the economy and geopolitics.

Tech weakness offsets rally in Defense shares.

1. Trump demands $500 billion to boost US annual defense spending to $1.5 trillion.

European defense stocks (orange) have been outperforming US defense stocks since last year.

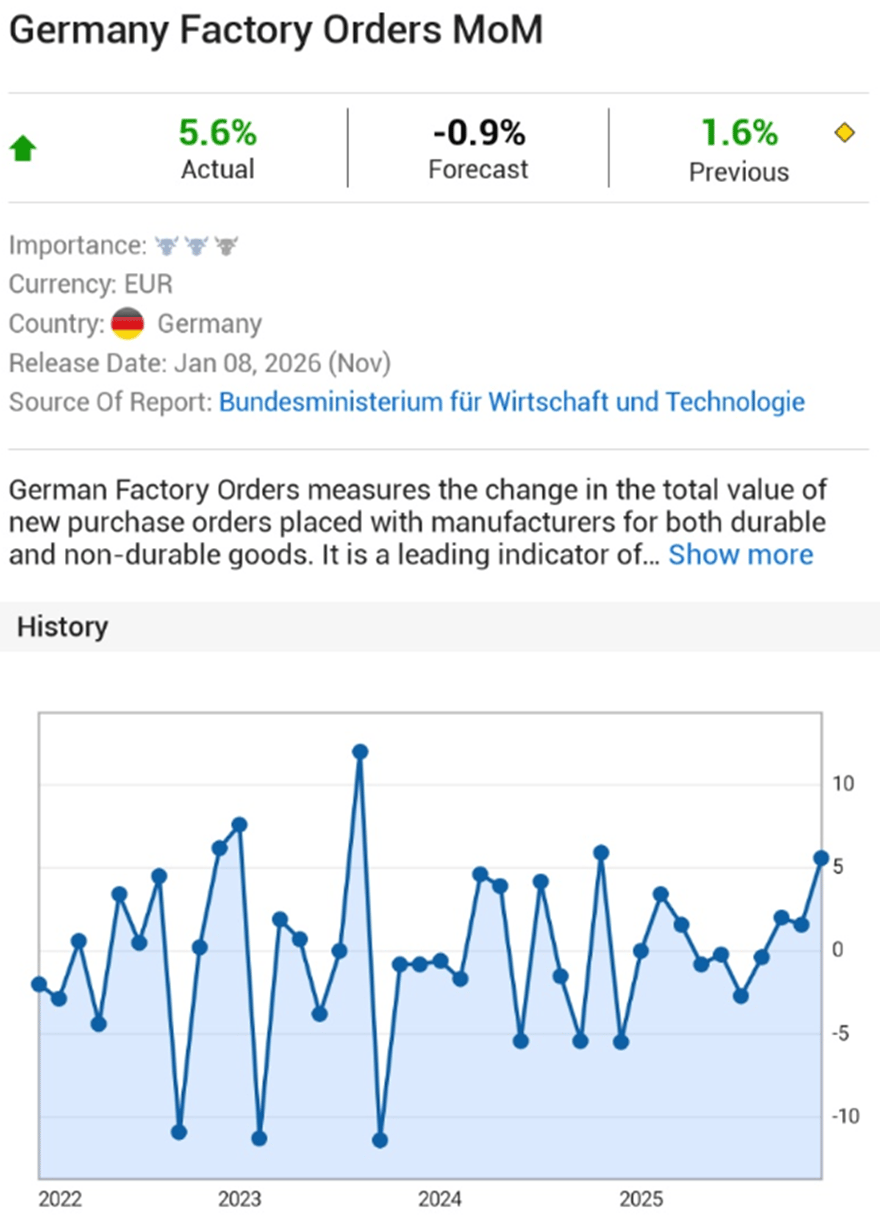

2. German factory orders jump in sign of recovery.

Factory orders rose 5.6% m/m when economists were expecting a fall.

Foreign orders swung to positive territory, with orders from within the eurozone and outside both rising. Domestic orders also jumped.

German factories are currently being bolstered by the rollout of a government spending package, which is projected to unlock up to 1 trillion euros for civil and defense projects in the country.

3. The so-called January effect is getting an additional boost from investor rotation.

European defense stocks are giving resurgent industrials a lift, while European tech stocks are advancing again thanks to demand for semiconductor names.

By contrast, some groups that rebounded in the past quarter, like luxury, food and beverages or energy, are under pressure from investors locking in gains from the relief rally.

A few key sectors are carrying on where they left off, with miners, utilities and health care still in favor after a strong finish to last year.

Below: European sector returns year-to-date.

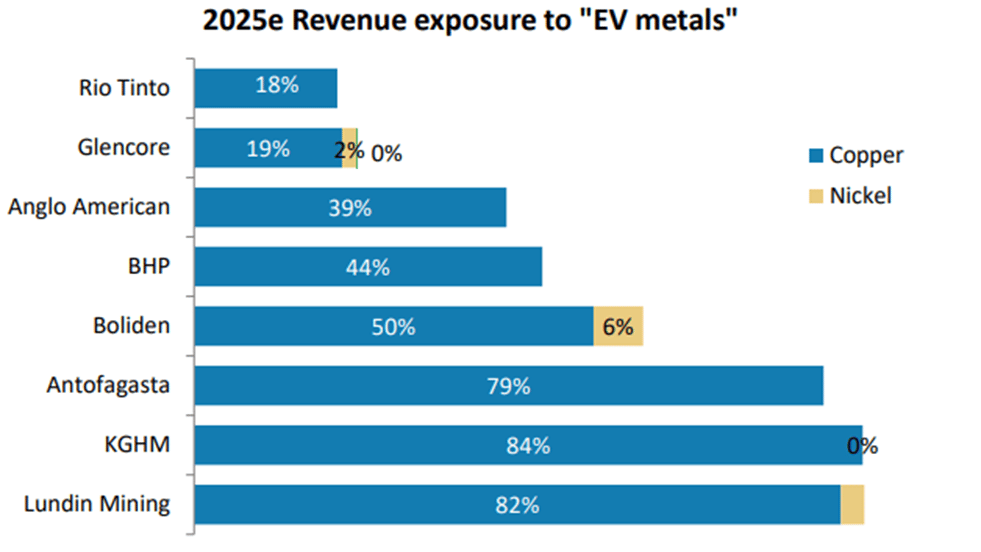

4. Commodities are hot.

Glencore and Rio Tinto have restarted talks over a potential merger, the Financial Times reports.

Below: Revenue exposure to “electrification” metals.

5. How to value something.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply