- Charts of the Day

- Posts

- Now is not the time to get defensive on “defence”.

Now is not the time to get defensive on “defence”.

Based on prior peace talks, this is typically an opportunity to buy the dip.

1. Copper’s rally above $11,000 will be short-lived, Goldman says.

“Recent “breakout” of prices won’t last, due to ample supply.”

Separately, Goldman says it’s bearish across aluminum, iron ore, lithium for next year given strong supply growth.

2. Now is not the time to get defensive on “defence”.

“Upgrade momentum is building as consensus moves from 2% to 3% of GDP EU Defence spending and valuation does not look stretched in earnings growth adjusted terms. Based on prior peace talks, this is typically an opportunity to buy the dip.”

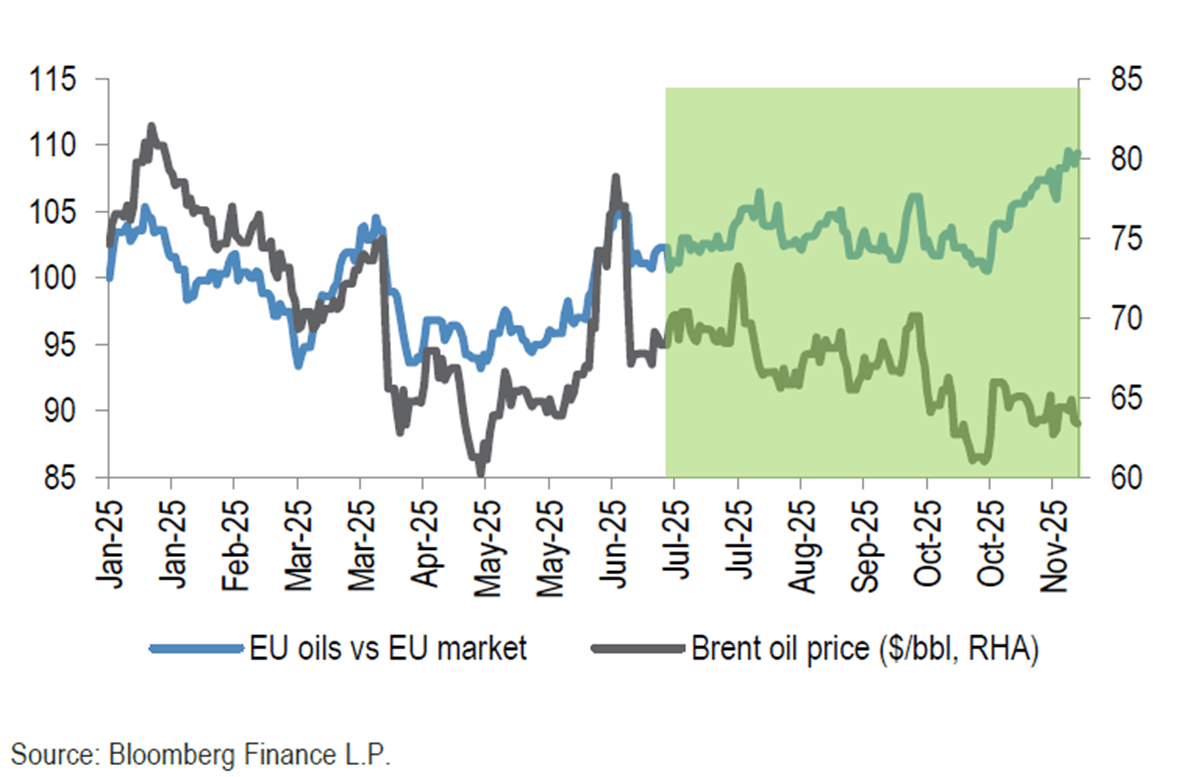

3. Be careful with oil stocks.

Equities have gone up while oil is going down…

4. Salesforce and its “Agentic enterprise”.

Agentforce alone has surged to a $540 million run-rate, growing an explosive 330% Y/Y.

Of course, that’s a tiny piece of Salesforce’s ~$41 billion revenue expected in FY26, but the momentum is critical here.

This is the “Agentic Enterprise” in action: moving from sidecar chatbots to autonomous agents embedded directly into sales and service workflows. Crucially, half of these bookings came from existing customers expanding their footprint, a classic signal of platform durability. Companies trying to build their own agents are hitting a wall on security and governance—driving them back to software platforms.

Salesforce is quietly solving the last-mile problem of AI: getting clean, harmonized data into agentic workflows.

5. Data center power demand starts accelerating from 2027 onwards.

6. Rheinmetall is a buy.

“Rheinmetall CEO sees decade-long boom regardless of Ukraine peace.”

Bloomberg News.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply