- Charts of the Day

- Posts

- Nvidia beat turns into major sell-off.

Nvidia beat turns into major sell-off.

Investor confidence remains shot to pieces.

Subscribe to receive these charts every morning!

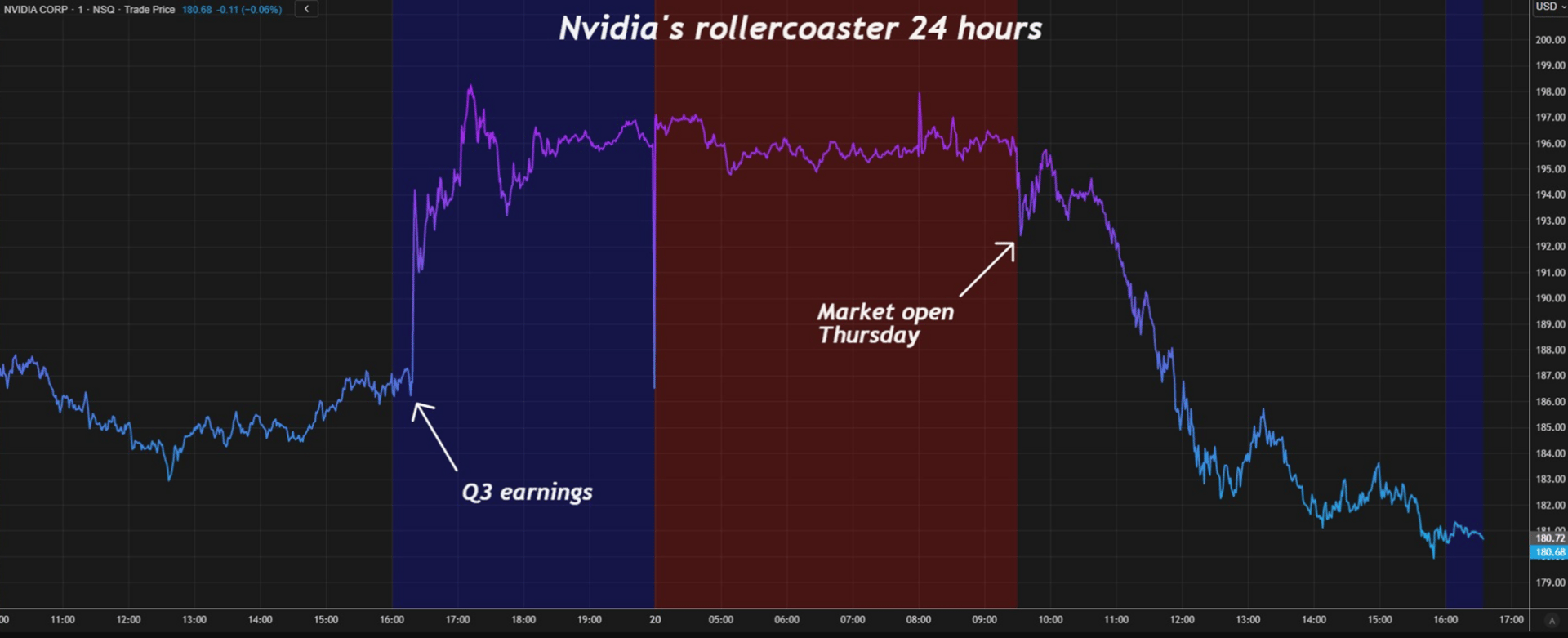

1. Nvidia and the whole market sold off, despite yet another beat.

With sales numbers in the $51B range for datacenters, in just three months, how can Nvidia not gain the good graces of the market?

Some reporters pointed out the Accounts Receivable line on the firm’s report, basically a record of value delivered to customers that the firm has not received payment for yet. Nvidia’s recorded $33.4B. That’s more than half of revenue to actually come in the door yet. Kimberly Forrest, chief investment officer and founder of Bokeh Capital Partners told Bloomberg: “It does beg the question: If things are flying off the shelves, then why aren’t you getting paid for it?”

There was also the macro environment to freak out over. September’s Jobs numbers showed a similar data duality as Nvidia’s report. Hirings were high, but so was unemployment, and traders said it was a bad sign.

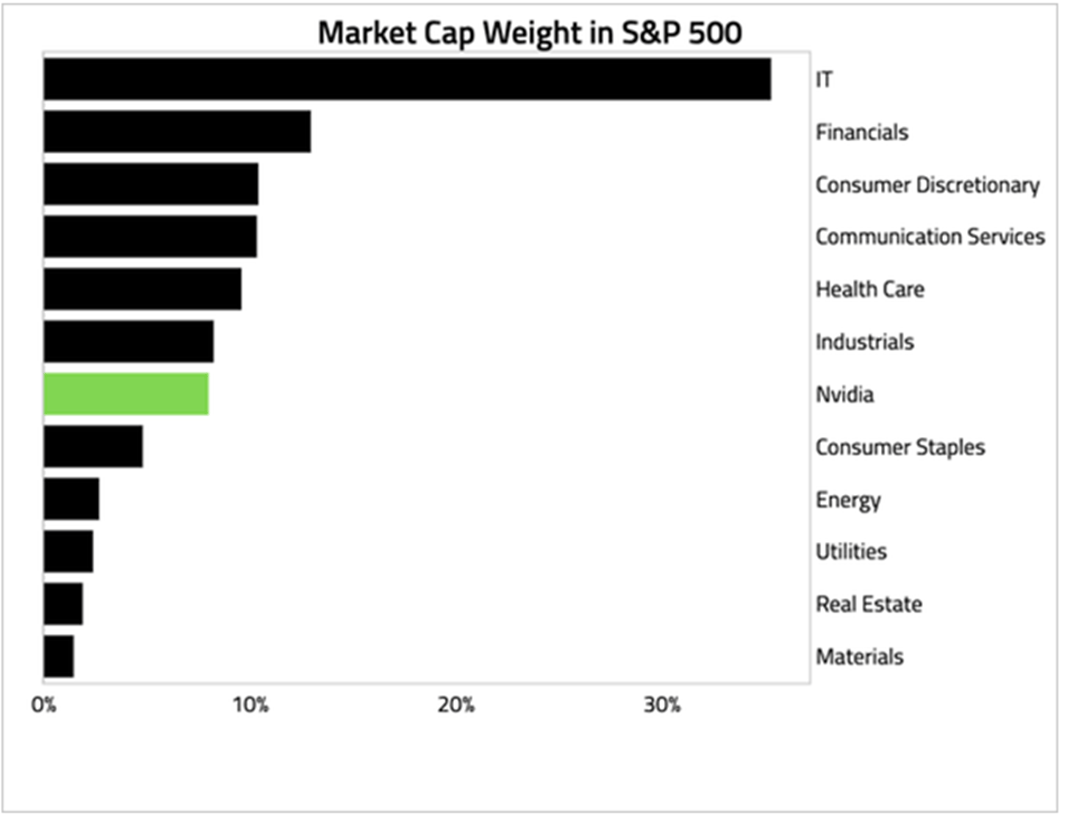

2. The sheer size of Nvidia has made it a formidable driver of market returns.

Within the S&P 500 Index, it commands an 8% weight, even larger than five entire sectors.

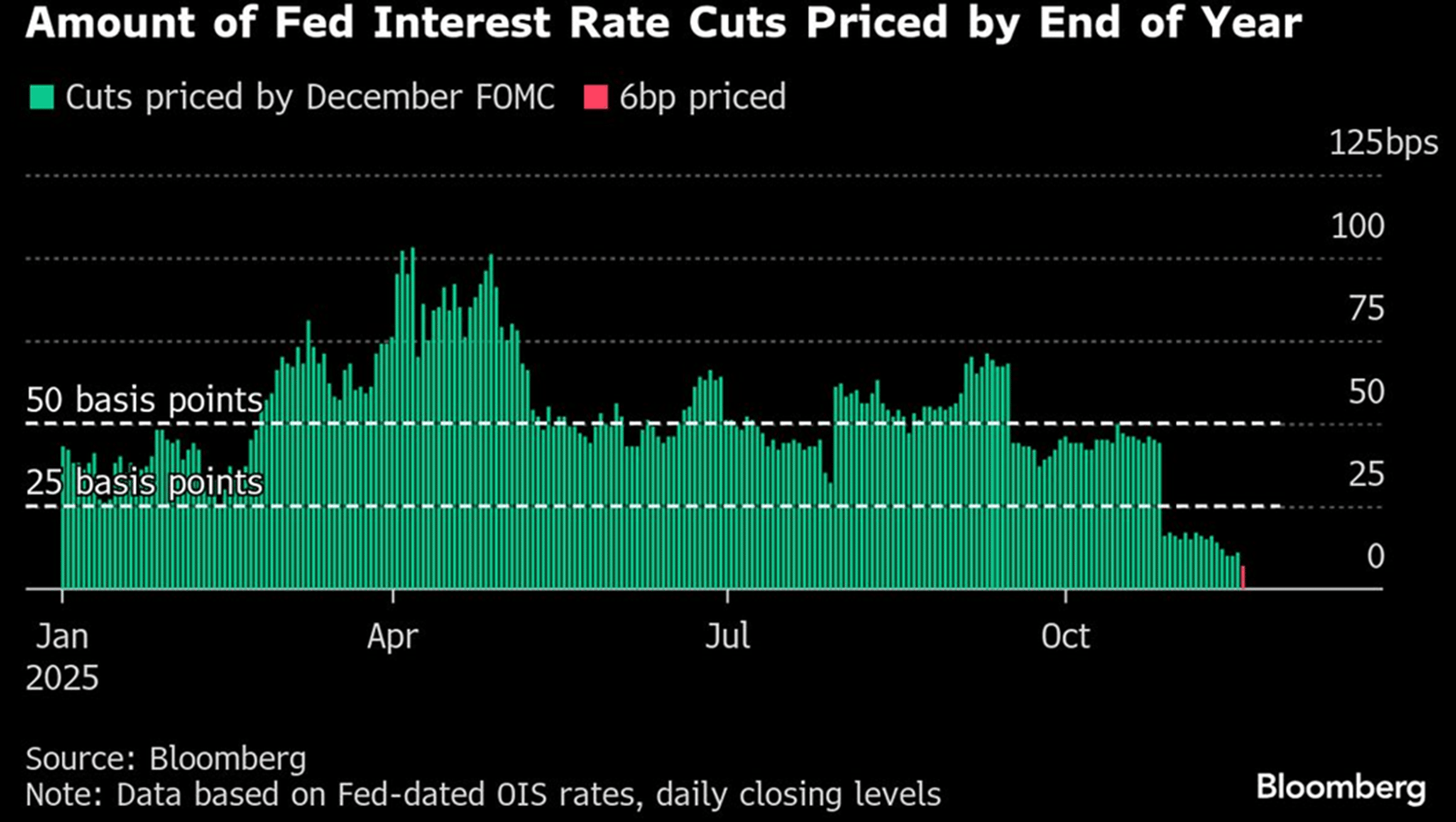

3. Odds of a rate cut have disappeared.

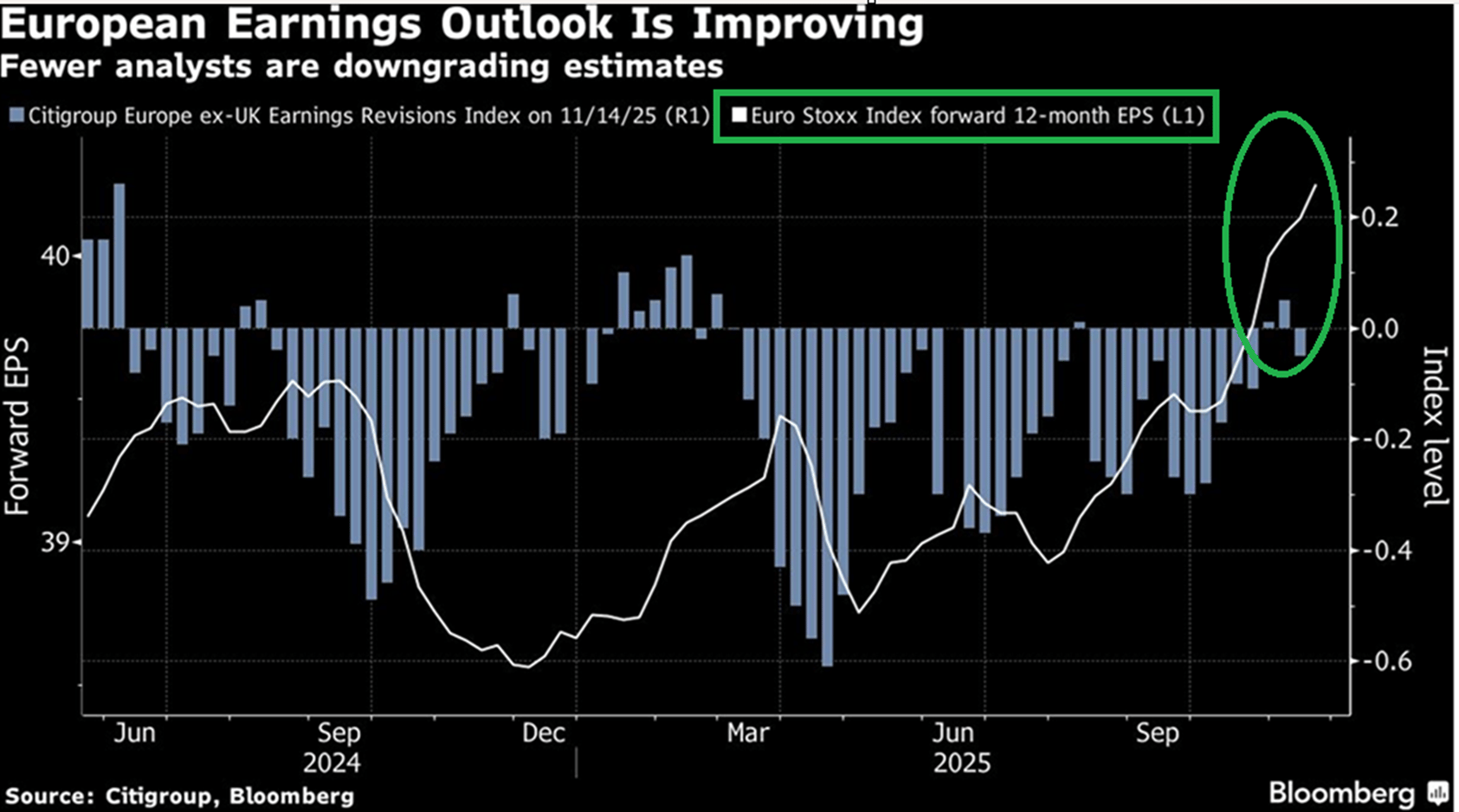

4. Europe’s economy-sensitive stocks will get a boost.

“I remain optimistic on European cyclical sectors,” says Panmure Liberum strategist Susana Cruz. “Even though geopolitical events will continue to add volatility, the outlook for European growth still looks encouraging. Germany is a game changer here, with spending only now starting to come through.”

Goldman Sachs strategist Guillaume Jaisson recently raised his 2026 earnings projections for the Stoxx 600, encouraged by better-than-expected business activity in the region. “We continue to recommend diversification into Europe, as this strategy has worked well this year despite the AI-driven narrative dominating markets,” Jaisson writes in a note.

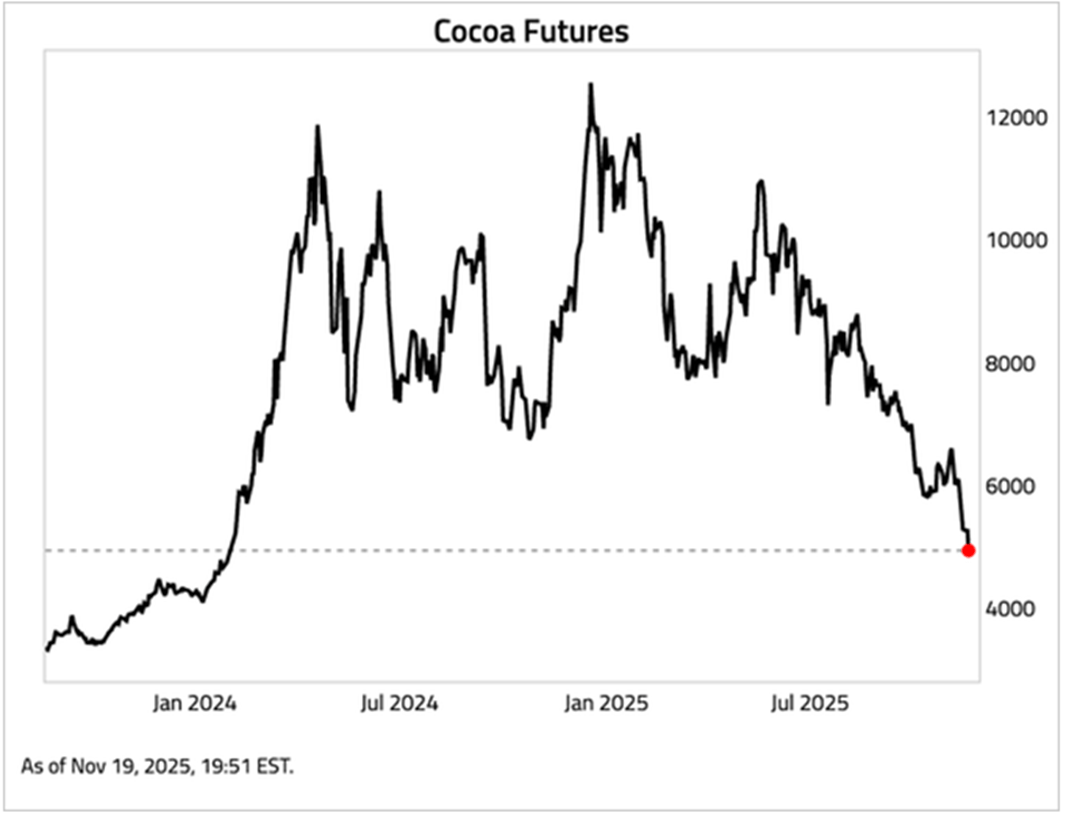

5. Cocoa plunged to the lowest level in nearly two years on the outlook for robust global supplies.

Barry Callebaut is up 60% sinds June.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply