- Charts of the Day

- Posts

- Nvidia cannot keep up with expectations.

Nvidia cannot keep up with expectations.

It’s the most highly valued public company, but $50B in revenue does not put it even in the top 10 for traded companies.

Subscribe to receive these charts every morning!

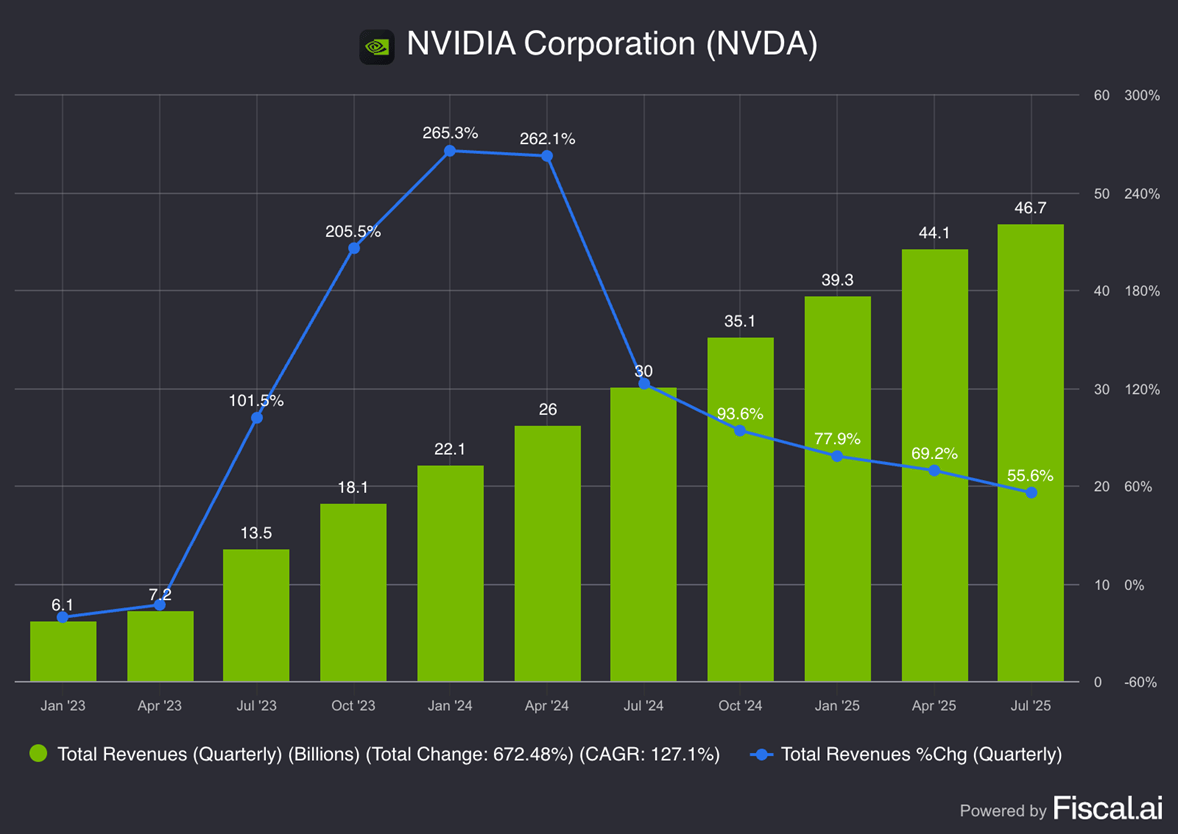

1. Nvidia cannot keep up with expectations.

The company’s nearly $50B in revenue looks fantastic, but it’s the most highly valued public company, and $50B in revenue does not put it even in the top 10 for traded companies. And compared to last year’s 100%+ jump in revenue, a 56% growth looks small for investors demanding more.

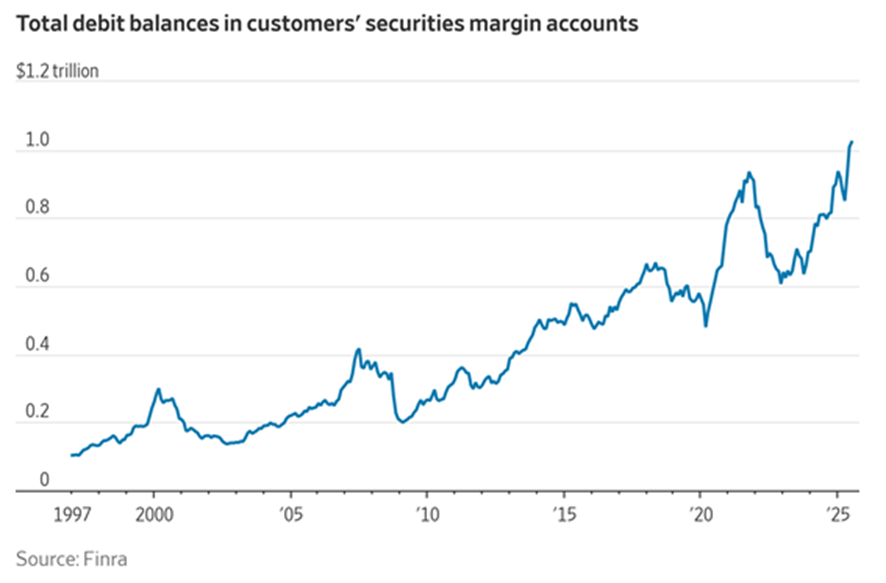

2. More borrowing by retail investors (in brokerage accounts) means they are getting overly bullish.

Borrowing that happens in brokerage accounts, often used to buy more stocks, was at an all-time high as of July, and topped $1 trillion for the first time ever as of June, according to tracking by Finra, which collects data from brokerages.

The inference is that more borrowing by investors means they are getting overly bullish. And that any correction will be magnified as investors are forced to roll back their borrowing.

Some especially quick rises in margin debt have preceded corrections.

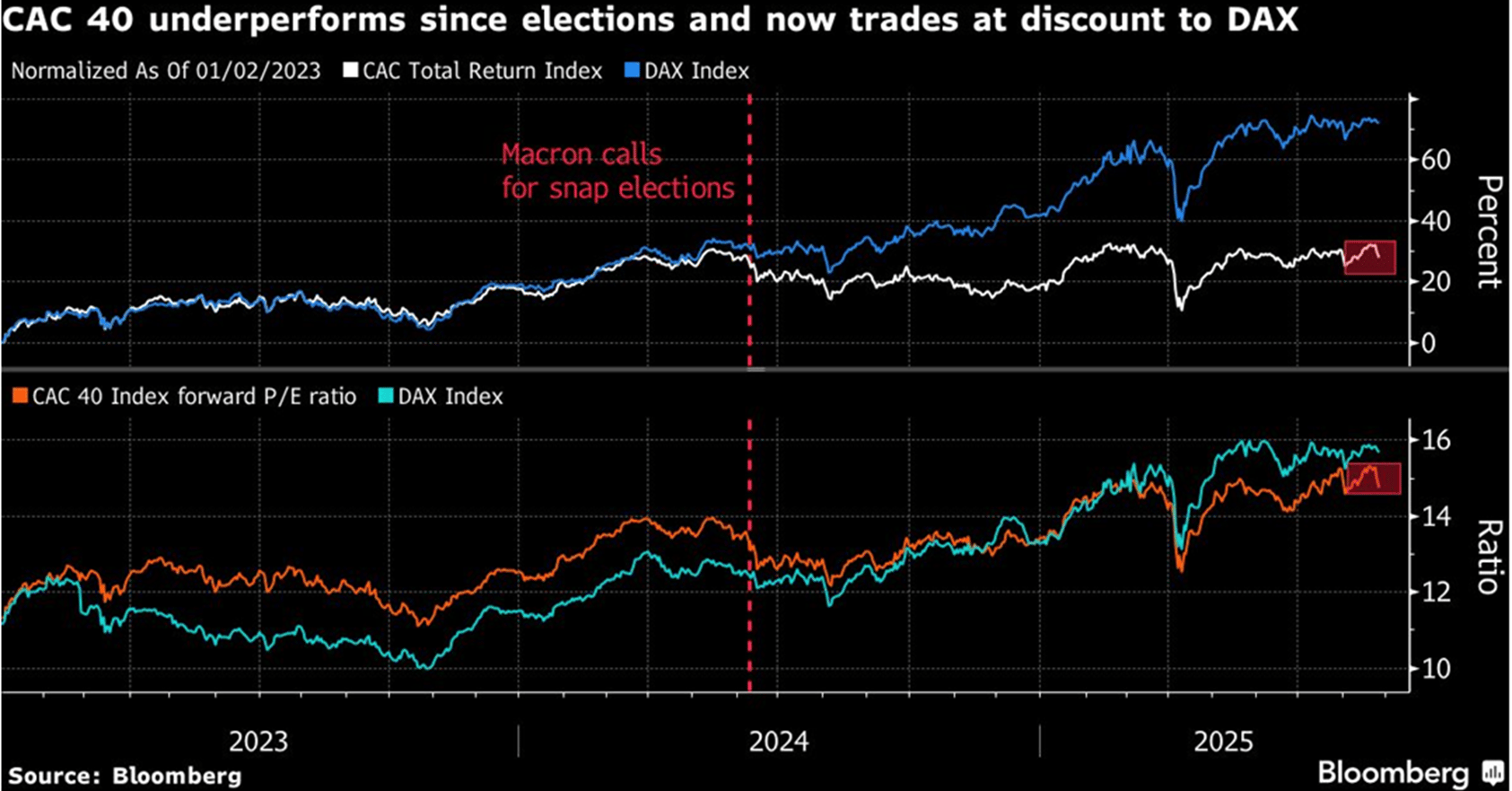

3. French stocks underperform for second year.

“It’s obviously going to be complicated in the short term,” says Jerome Legras, head of research at Axiom Alternative Investments. “That being said, it’s likely that politically, we go back to somewhat the same status-quo with a center-right or center-left PM who should be able to rollover the budget again.”

4. Never waste a good French crisis.

Quality stocks will allways bounce back with a vengeance.

Here is Engie…down to 13.5 over last summer’s political showdown…déjà vu!

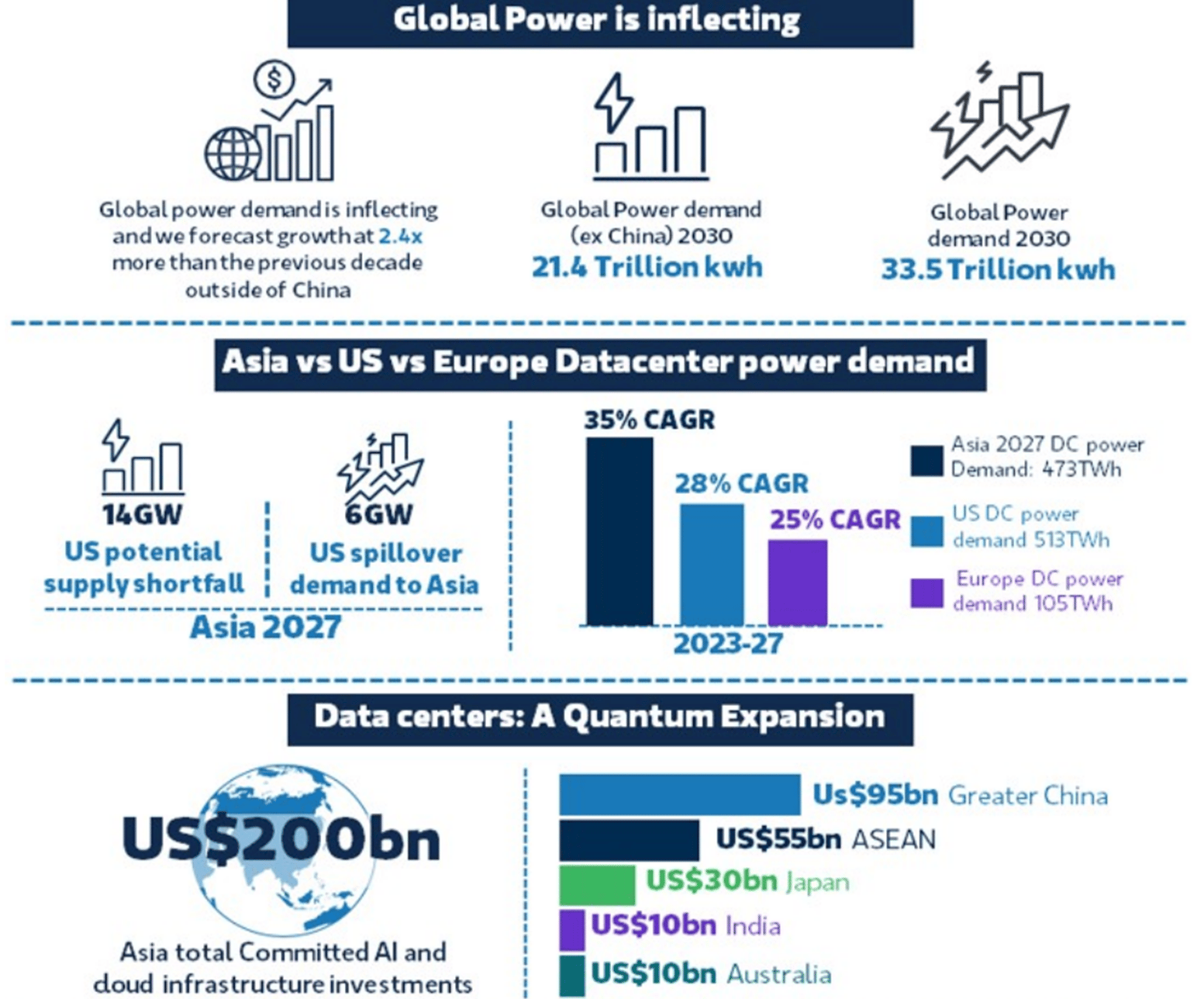

5. Global power demand is inflecting higher by datacenters, new supply chains and electrification of industry.

Source: MS

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply