- Charts of the Day

- Posts

- OpenAI funding questions put stress on AI rally.

OpenAI funding questions put stress on AI rally.

Apple regains safe-haven status as AI trade looks shakier.

We will be back on the 17th of November.

1. UK stocks are an attractive diversification to pricey tech names.

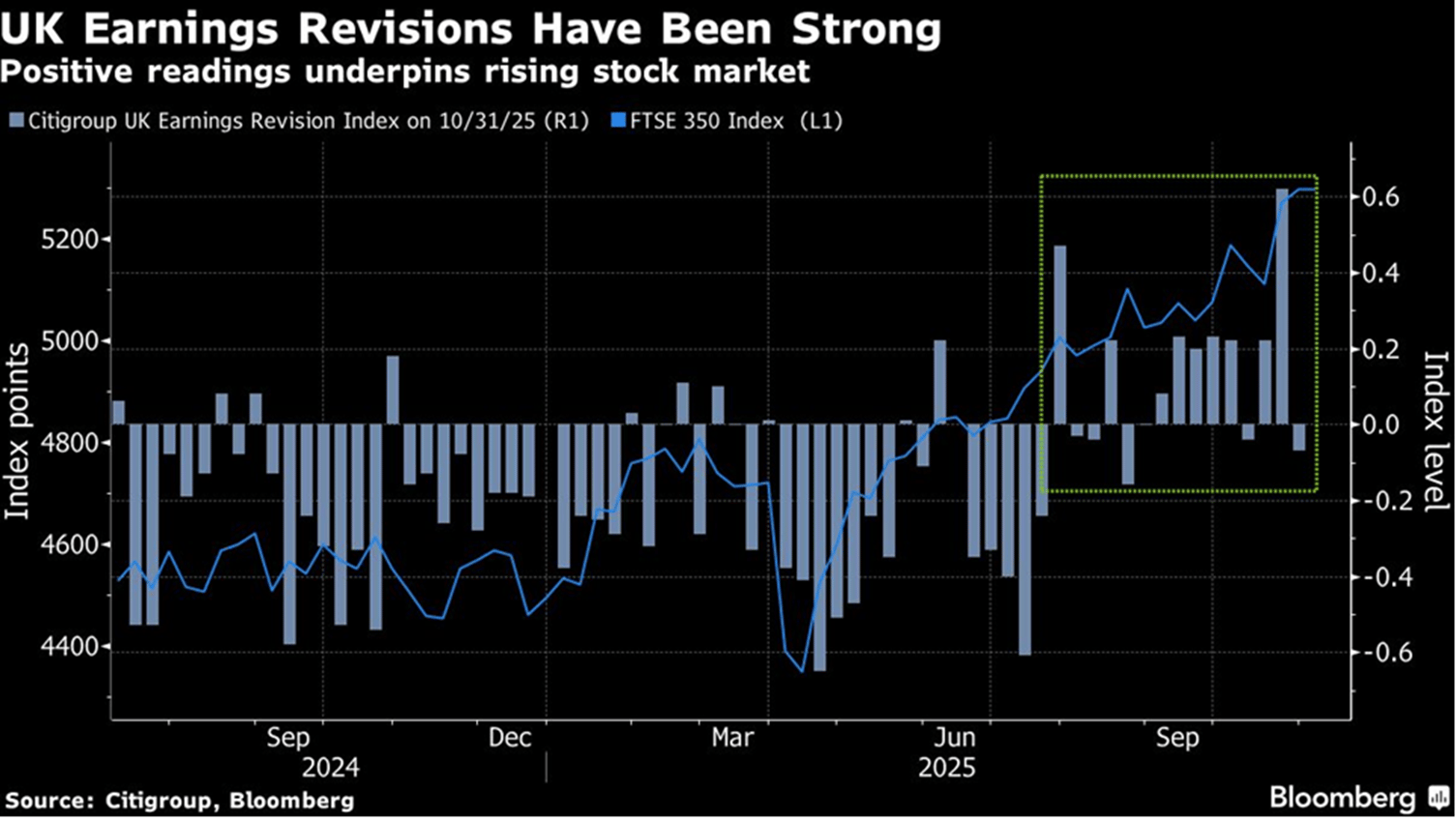

The FTSE 100 has surged 20% this year, beating the Euro Stoxx 50’s 16% gains, and proved more resilient than other European indexes in this week’s market wobble. A lack of tech exposure, along with value and defensive attributes have played in the London benchmark’s favor, supported lately by strong earnings revisions. Enticingly, it still offers a 35% discount to global peers, based forward P/E ratios.

“The defensively and commodity-tilted FTSE 100 remains a cheap and under-owned diversifier,” say Barclays strategists led by Emmanuel Cau. Cau and his team note investor sentiment toward the UK economy remains stubbornly bearish. That’s despite recent PMI and retail sales readings surprising to the upside, while promising signs on inflation have helped push gilt yields lower in the past few weeks.

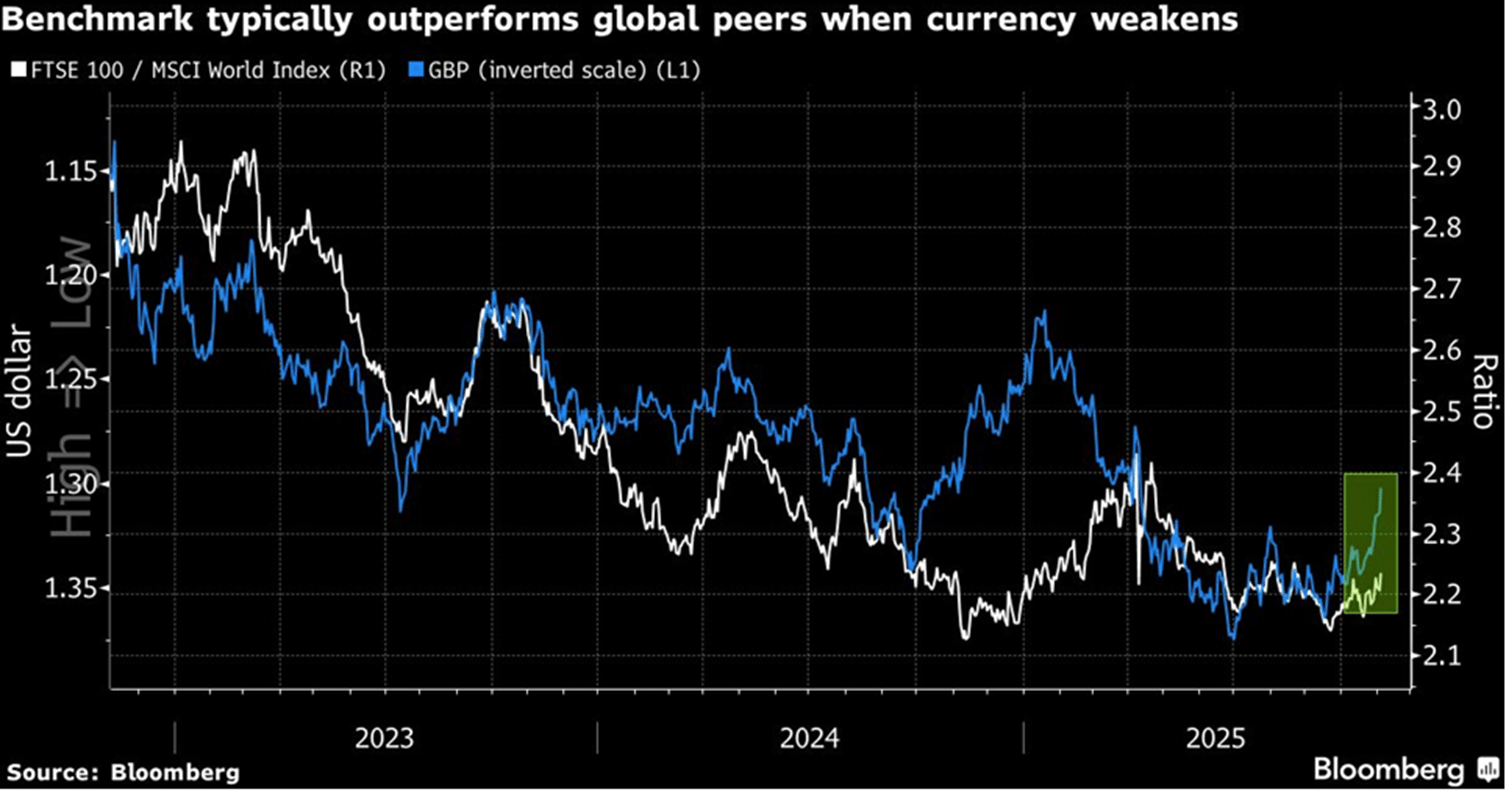

2. Pound weakness is a tailwind for the FTSE100.

Expectations of tighter fiscal policy and a more dovish BOE have weakened the pound. The British currency is down 5.3% against the dollar since a peak in July. That’s mechanically helping the FTSE 100, whose members generate 75% of their revenue outside the UK. A considerable amount of bad news is priced into UK shares and there is scope for them to move higher once the budget is out of the way and clarity improves.

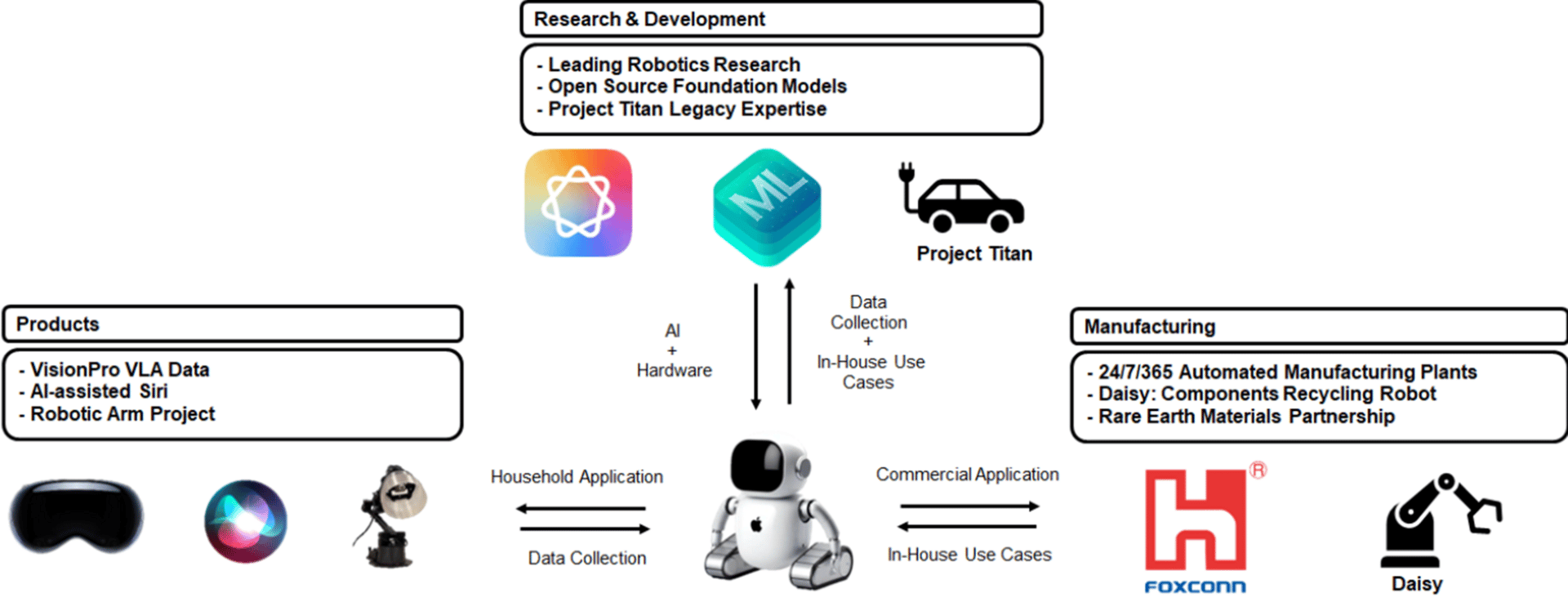

3. Apple can become a leading player in physical AI.

Apple's expertise in vertically integrating hardware, software, services and semiconductors, its learnings from manufacturing at scale for several decades, and its ability to collect and harness vast amounts of differentiated visual data across 2.3bn devices and over 1.4bn iPhones serves as the basis for its Robotics efforts. Yet in addition, Apple is investing in rare earth minerals, accelerating machine learning hiring, ramping robotics patent activity/research, and reportedly collaborating with leading physical AI companies (BYD) to accelerate its robotics efforts. With control over hardware, software and data, and the expertise in solving early robotics use cases within its own supply chain (Daisy), Apple is uniquely positioned to help lead the next wave of intelligent machines.

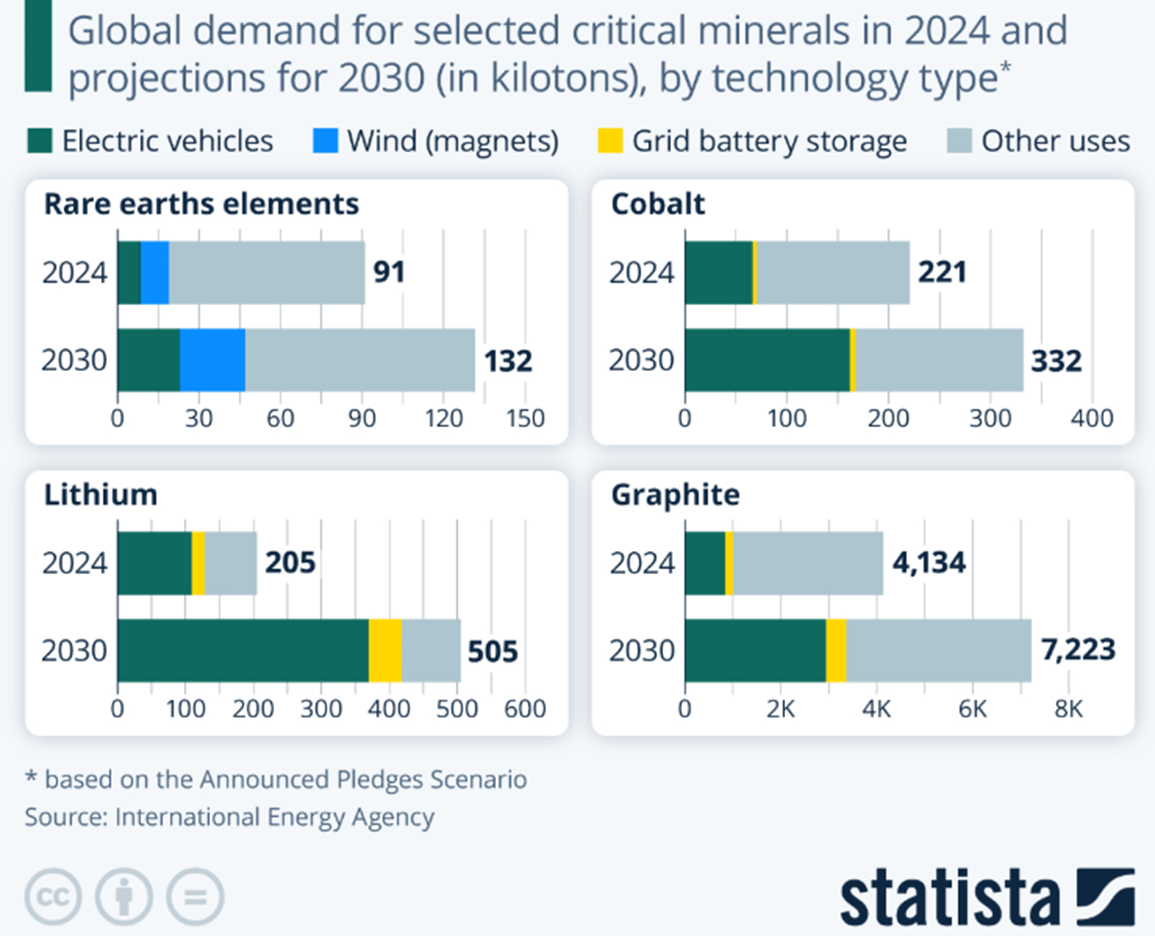

4. As the world accelerates its transition to clean energy, demand for critical minerals is set to explode.

By 2030, the International Energy Agency (IEA) projects that global demand for minerals like rare earths, cobalt, graphite and lithium could double or even triple (depending on different scenarios), driven by the rise of electric vehicles, renewable energy infrastructure and advanced electronics (AI). These minerals represent the backbone of modern industries - and geopolitical competition - while China currently controls the large majority of their supply chain.

As shown below, between 2024 and 2030, global lithium demand is projected to grow by 146 percent, while graphite and cobalt needs are expected to increase by 50-75 percent, according to the IEA's baseline scenario, mainly driven by electric vehicles and energy storage. Furthermore, the demand for rare earths, essential for permanent magnets used in wind turbines and electric motors, is projected to increase by 45 percent.

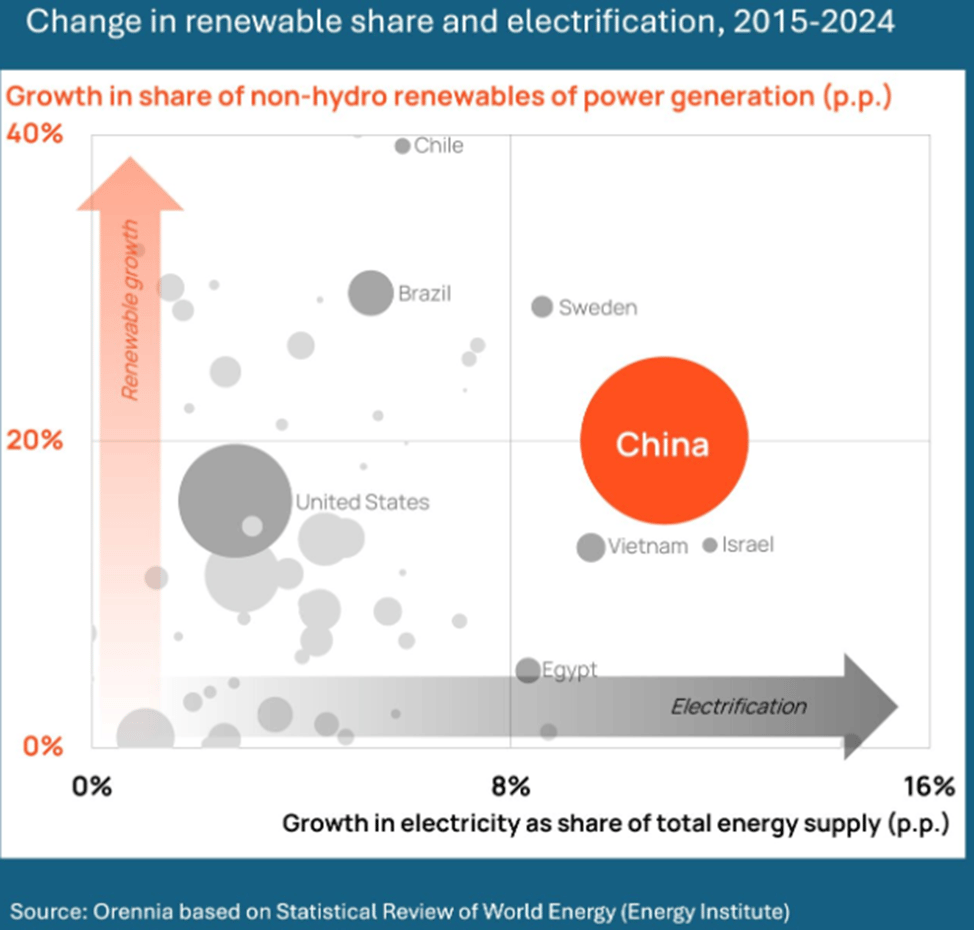

5. China is on track to become an electrostate.

Over the past decade, China has increased the share of electricity in its total energy consumption by around 10% - more than almost any other country. Its rapid growth in clean power, especially renewables, is unparalleled. No nation has invested more or built faster in this space.

Since 2019, China has been responsible for about 40% of all wind and solar capacity installed worldwide. Behind this expansion lies a clear strategy: harnessing renewables not only to strengthen energy independence but also to drive industrial leadership.

As a result, the share of China’s electricity generated from wind and solar has risen by nearly 20 percentage points in just ten years.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply