- Charts of the Day

- Posts

- Rate cut delivered but FED is divided on what to do next.

Rate cut delivered but FED is divided on what to do next.

Oracle down 10% on revenues falling short and capex being much higher than expected.

1. Oracle is the canary in the coal mine for the debt-fueled AI spending spree.

Wall Street has become increasingly worried about the debt that Oracle is taking on to become a major partner to OpenAI, which itself is burning cash in pursuit of AI profits that have so far been elusive.

“The earnings are the worst of both worlds with revenues falling short and capex being much higher than expected, raising more anxieties in regards to its free cash flow and rising debt”.

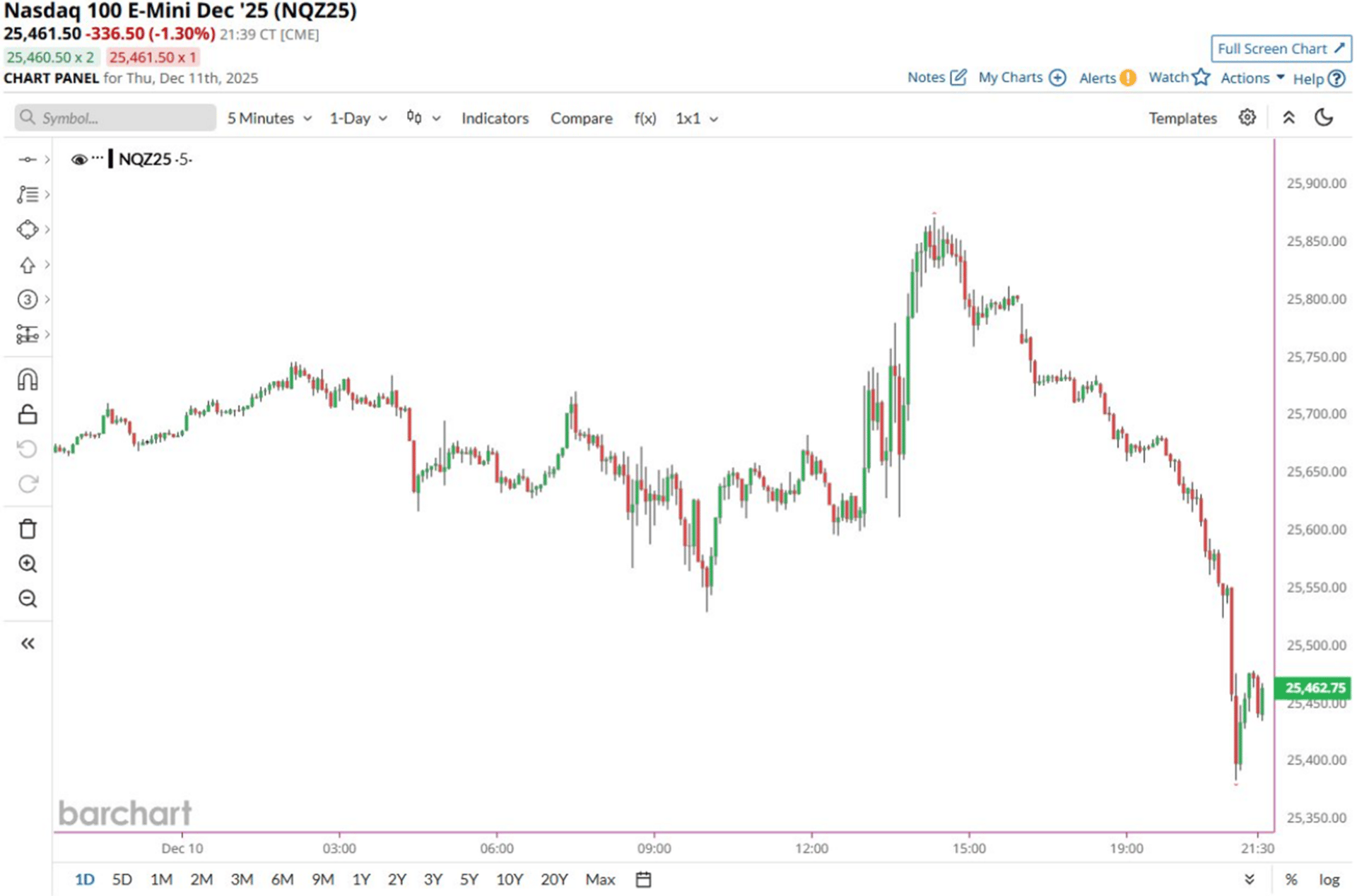

The Nasdaq future is getting hammered thanks to Oracle which was down 10% after market.

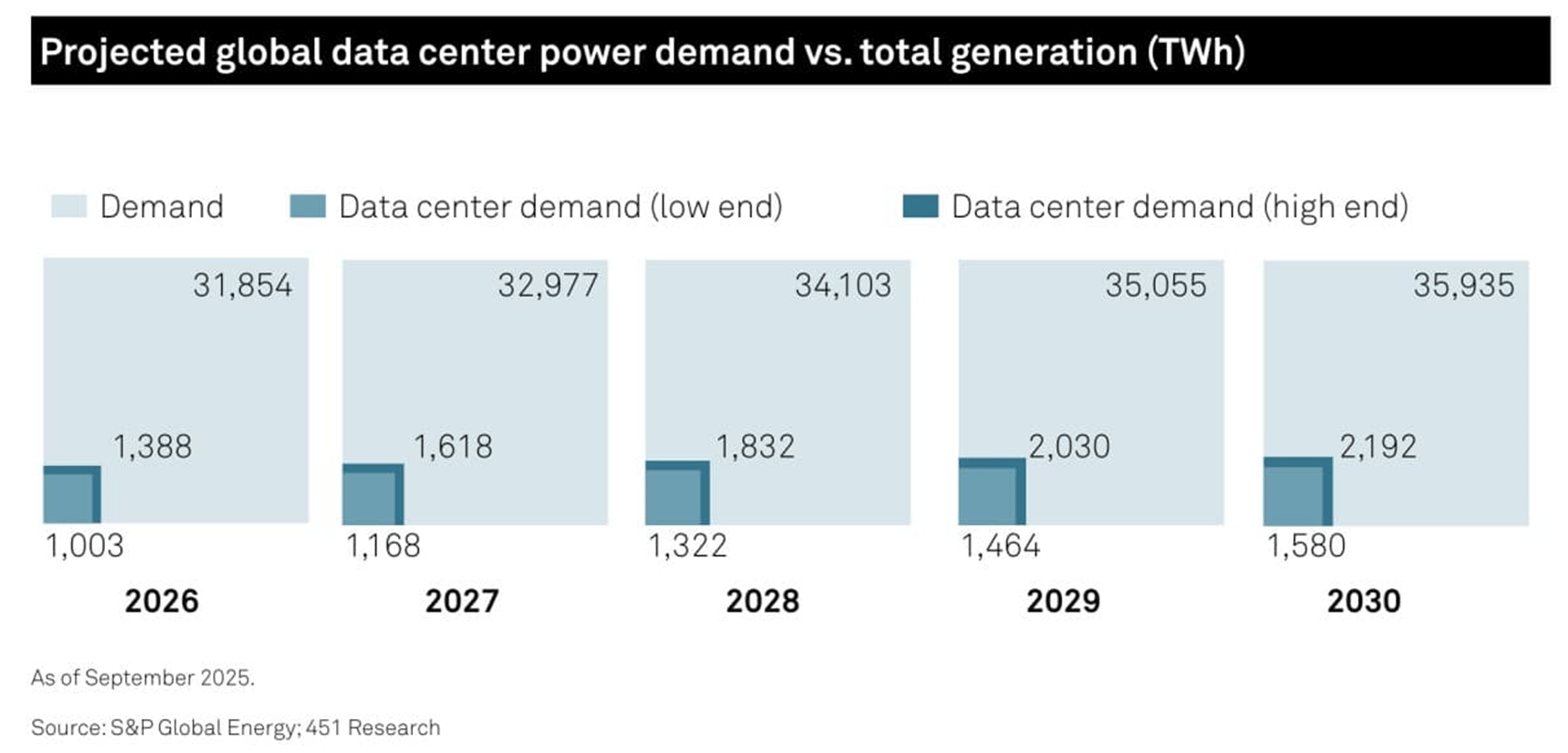

2. “Big Tech is becoming an electric utility with a side hustle in software.”

S&P projects that by 2030, global data center power demand could hit 2,200 terawatt-hours (TWh). To put that 2,200 TWh figure in perspective: that is roughly the total electricity consumption of India.

Analysts see a €584 billion grid infrastructure gap in Europe and a massive, multi-year order book. “For the last twenty years, we treated the grid like a static asset. We assumed the wires would just… work. But now, we are trying to shove gigawatts of wind power from the North Sea down to the data centers in Frankfurt, and we are realizing the pipes are too small. We aren't just replacing old lines, we are building high-tech energy superhighways.”

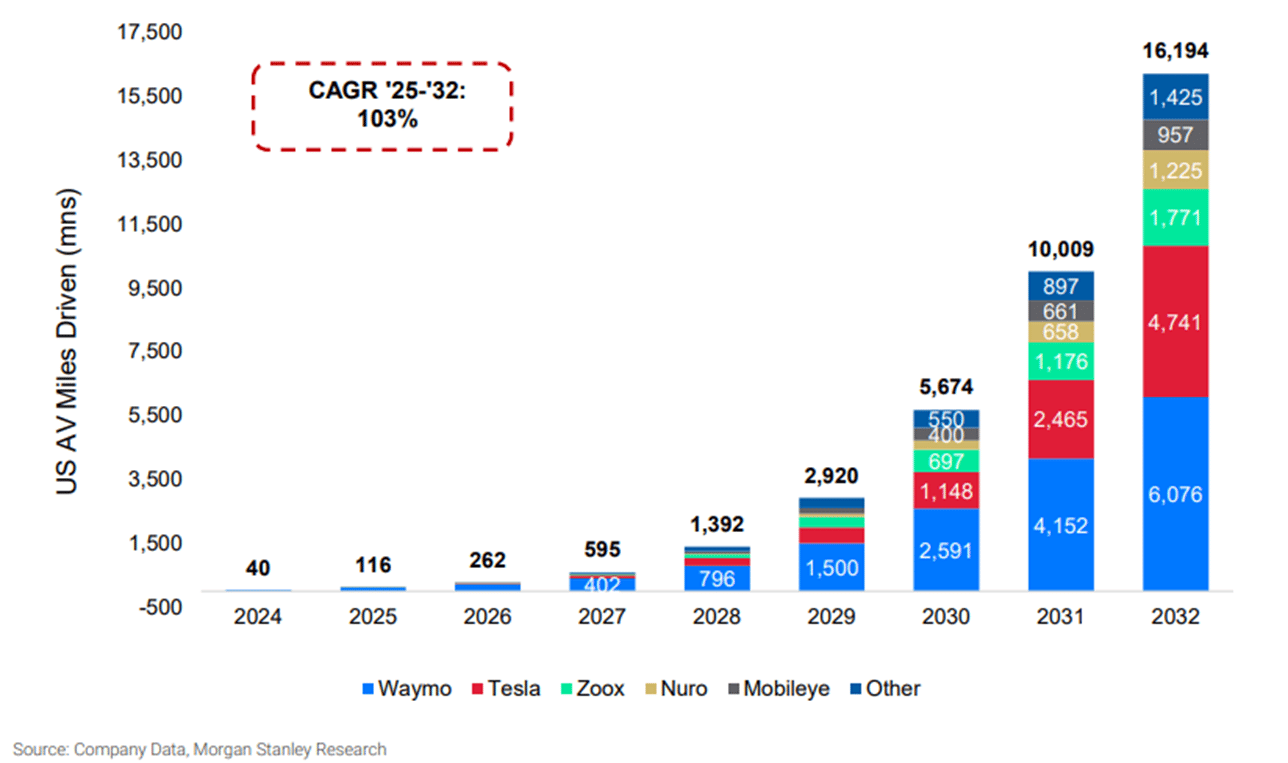

3. 2026 is set to be the autonomous driving inflection point.

Analysts expect “annual autonomous miles” to grow 140x from 2025 to 2032 , reaching 16bn miles. This means doubling every year!

However, this is still only 0.5% of total US miles driven.

Competition is set to evolve as Waymo and Tesla approach the autonomous market from two different angles. Waymo currently has a safety advantage, with redundant sensors, mapping and more restrictive geo-fences whereas Tesla has a cost per mile, production and install base advantage.

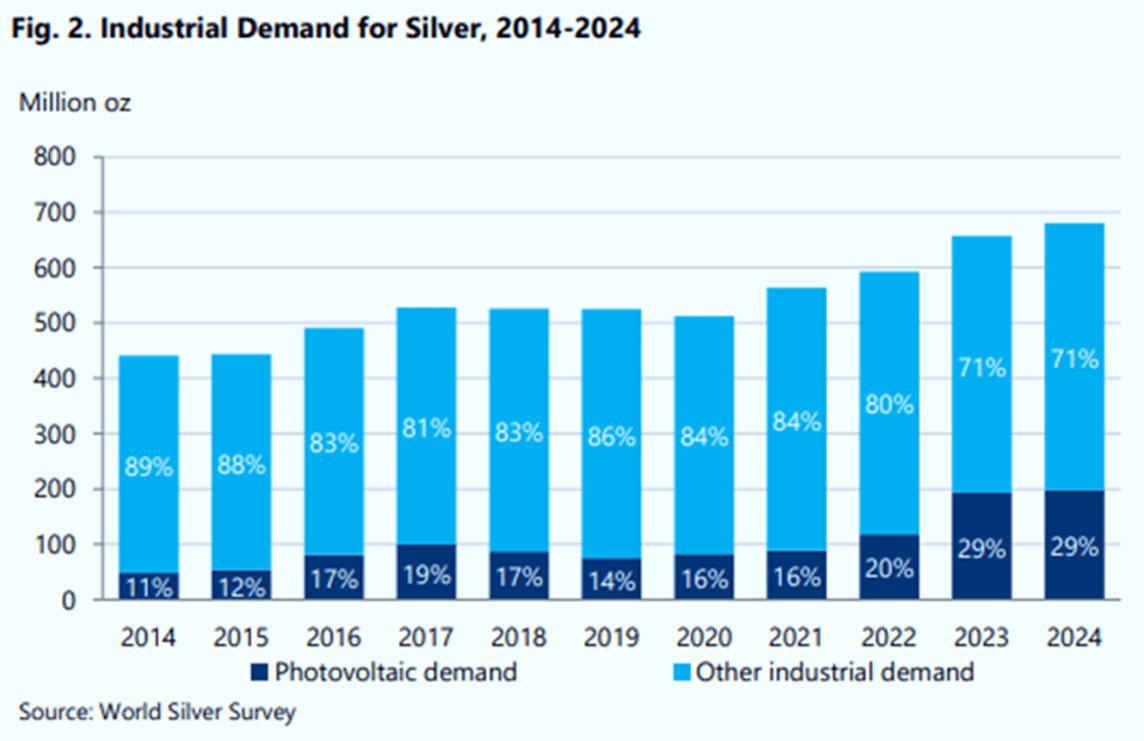

4. Silver usage in solar panels.

The large growth in photovoltaic installations in the past decade means that silver demand from photovoltaics has grown faster than demand from other industrial uses (e.g., demand for other electricals and alloys).

Silver demand for photovoltaics now makes up 29% of total industrial demand, while in 2014 it only make up made up 11%.

However, while photovoltaic installations are over tenfold higher than 10 years ago, silver demand from photovoltaics is only threefold higher, reflecting technological developments that have reduced the amount of silver required in PV cells.

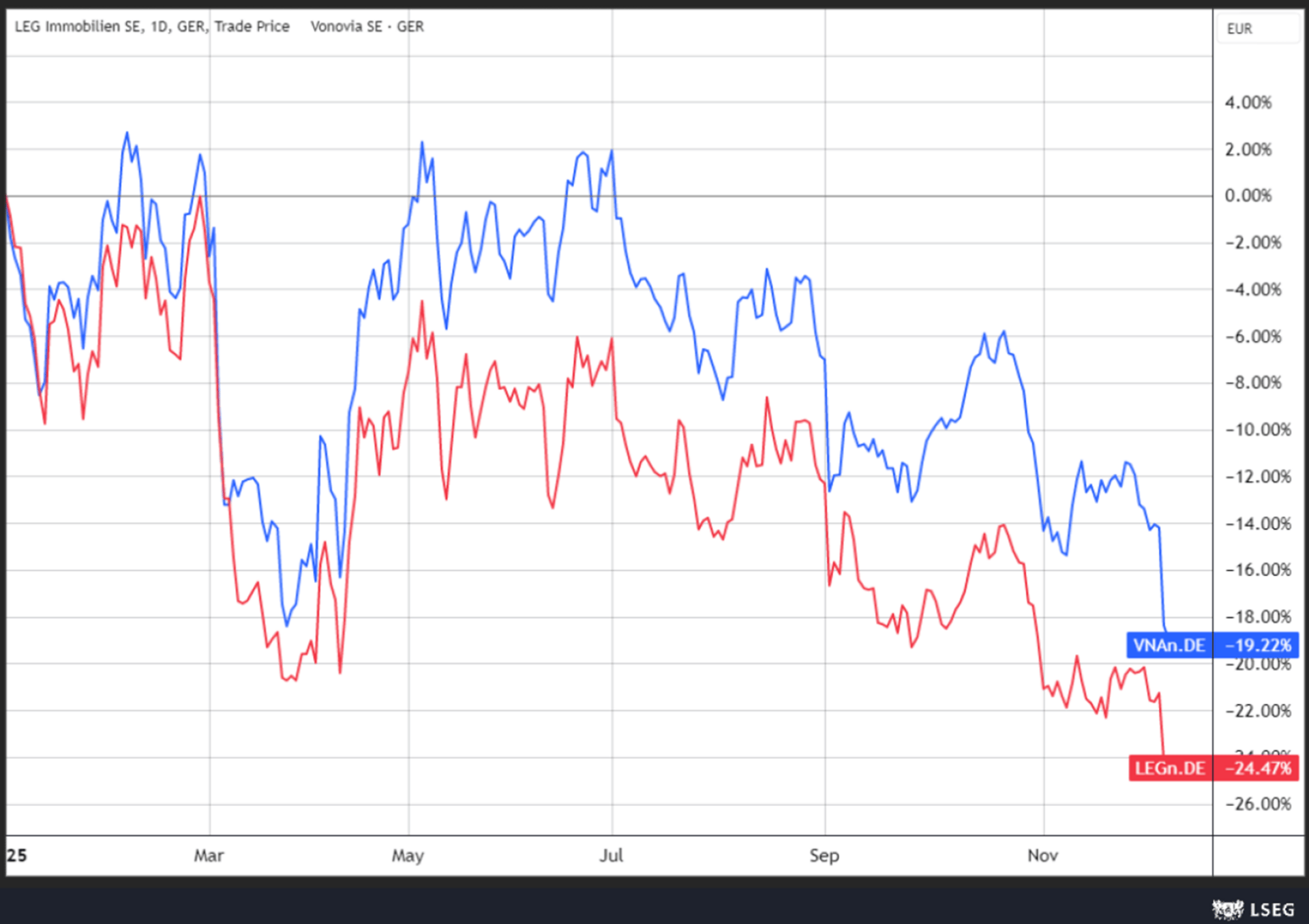

5. We’re bullish on European real estate!

A supportive interest rate environment is expected to support a recovery in real estate after 3 years of underperformance.

German residential is a particular bright spot as demand outstrips supply. As a result, German residential companies are flagging record low vacancy and accelerating rental growth. Vonovia may be too cheap to ignore with a NAV of €44.7 and the stock trading at €24.

German residential is down 20% year-to-date.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply