- Charts of the Day

- Posts

- Rebound in sentiment following FED’s comments.

Rebound in sentiment following FED’s comments.

December interest-rate cut back on the table.

Subscribe to receive these charts every morning!

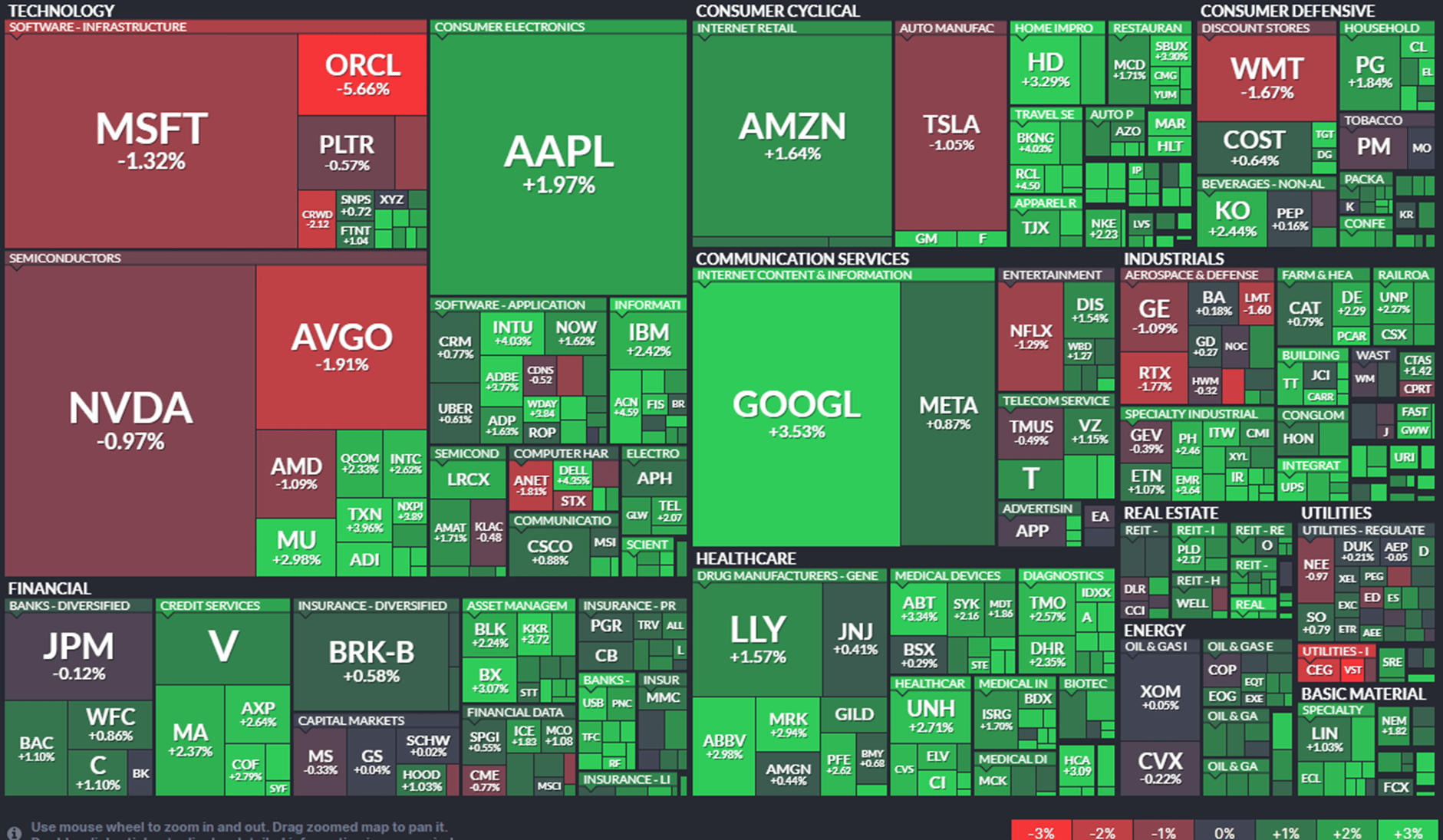

1. Every single sector closed in the green last Friday, and Thursday was just a bad dream.

Markets turned positive on growing expectations of a Federal Reserve rate cut scheduled for December 10th, after a series of mixed signals from policymakers.

New York Fed President John Williams suggested a cut could come in the near term, reinforcing investor bets that monetary easing is imminent. His comments contrasted with Boston Fed’s Susan Collins and Dallas Fed’s Lorie Logan, who both urged patience Friday, warning that inflation risks remain.

Odds for a December cut surged to 70% Friday morning, with traders rotating into rate sensitive sectors like real estate and utilities.

2. Nvidia’s cash pile keeps growing.

NVIDIA now has a Berkshire-style challenge to put its money to work. With a fast-growing pile of $61 billion in cash, the company is investing in the most important players in AI to secure future offtake and expand the CUDA ecosystem.

These deals ensure that the fastest-growing AI companies have the resources to scale, which reinforces NVIDIA’s long-term demand. Jensen Huang touched on the circular financing of customers:

“No company has grown at the scale that we’re talking about and have the connection and the depth and the breadth of supply chain that NVIDIA has. The reason why our entire customer base can rely on us is because we’ve secured a really resilient supply chain, and we have the balance sheet to support them.”

So there you go…Nvidia is the Central Bank of AI.

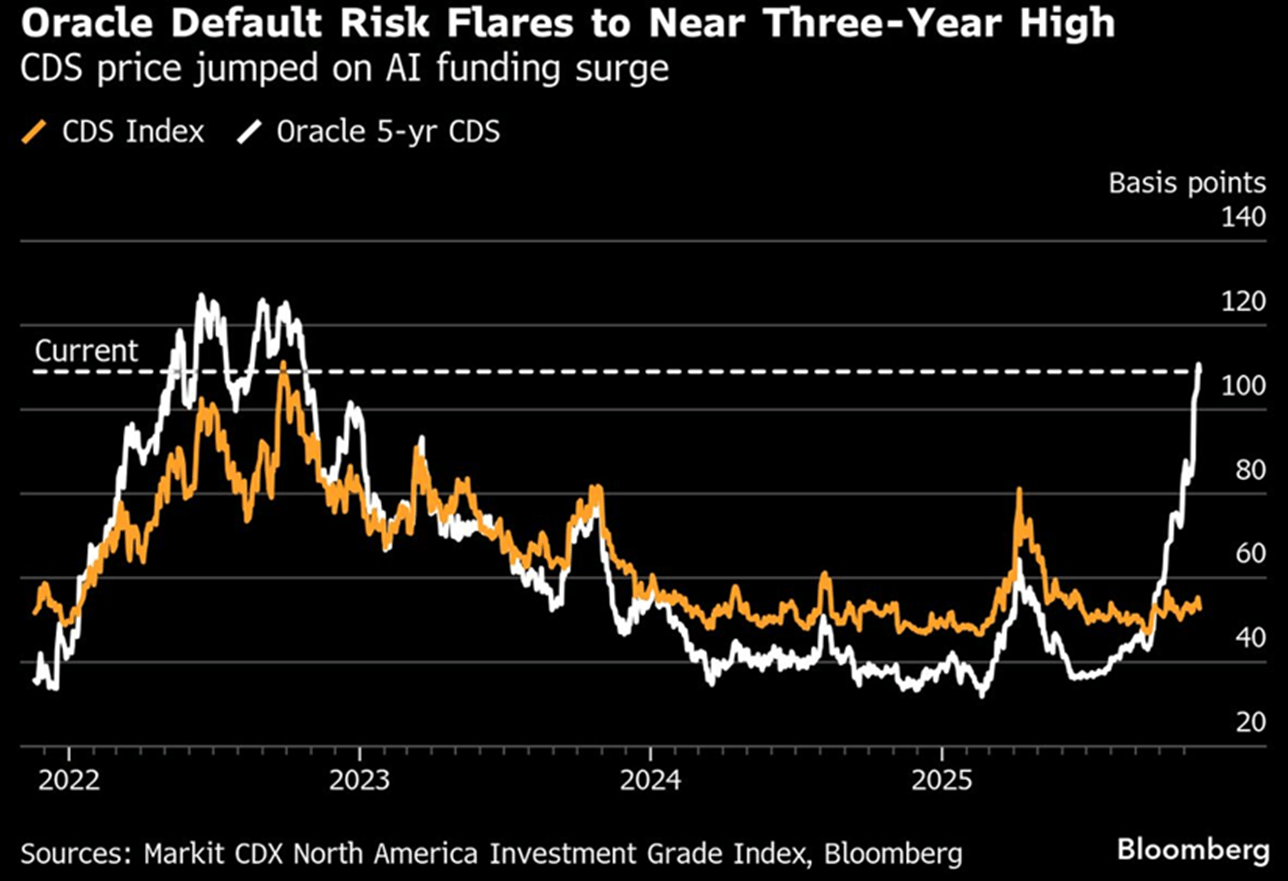

3. Oracle is emerging as the credit market’s barometer for AI risk and the price of the company’s credit default swaps have surged.

Oracle was -6% in Friday but big tech’s debt binge isn’t limited to just Oracle, with risks rising in the race to create an AI world.

4. European natural gas futures fell to an 18-month low as milder near-term weather forecasts and prospects of a Ukraine peace plan eased supply concerns.

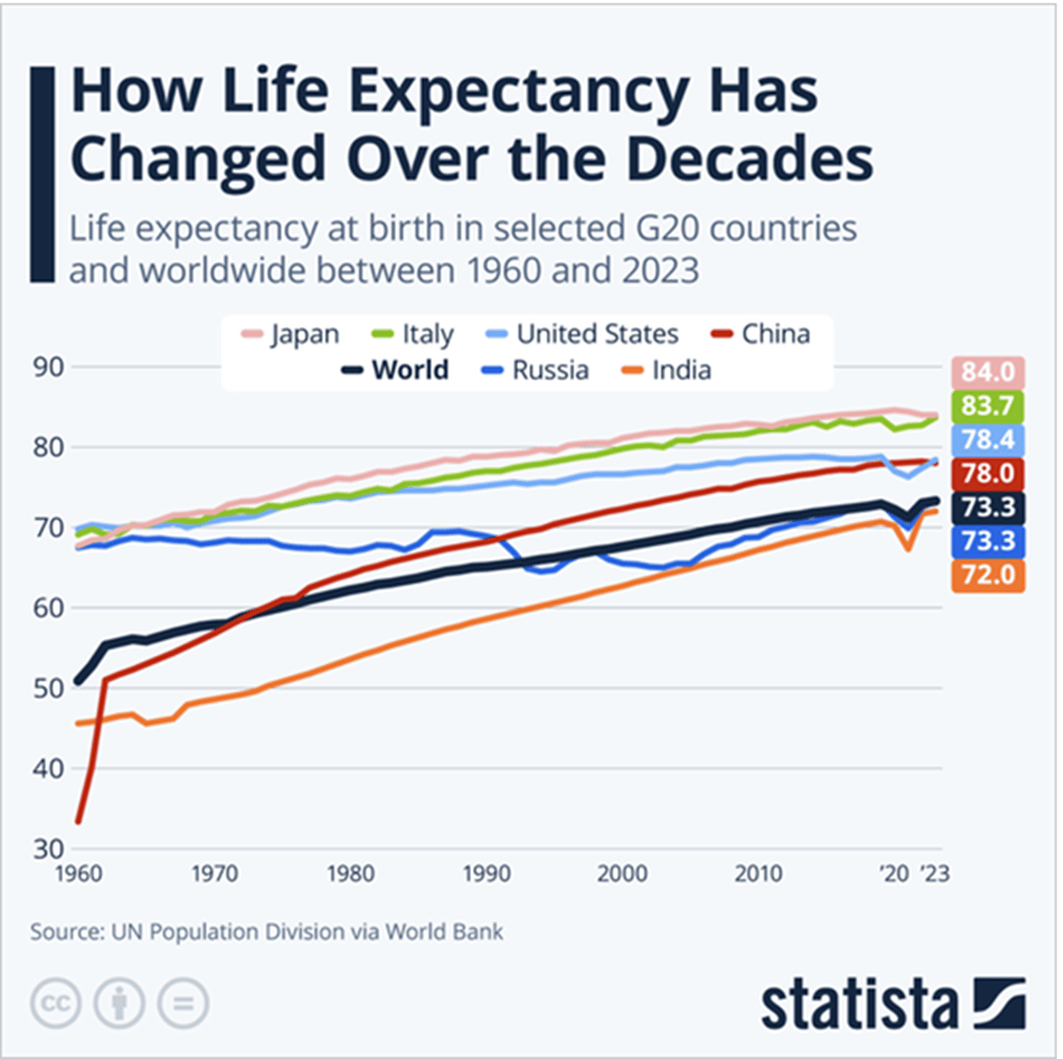

5. Global life expectancy has risen sharply since 1960, with Japan and Italy among the leaders.

China has seen the most dramatic gains, while the US continues to lag other advanced economies.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply