- Charts of the Day

- Posts

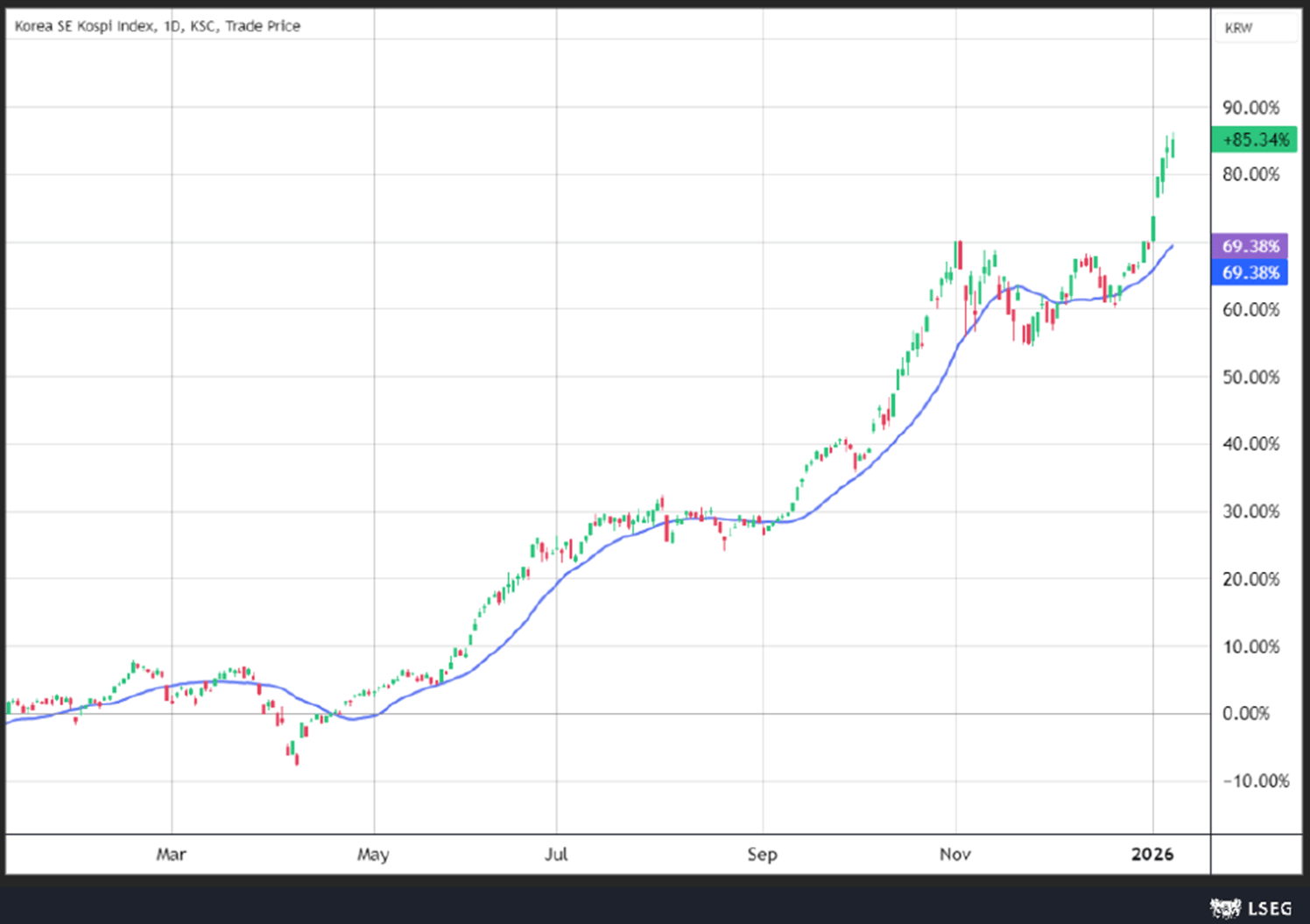

- Samsung’s strong earnings boost Korean stock market.

Samsung’s strong earnings boost Korean stock market.

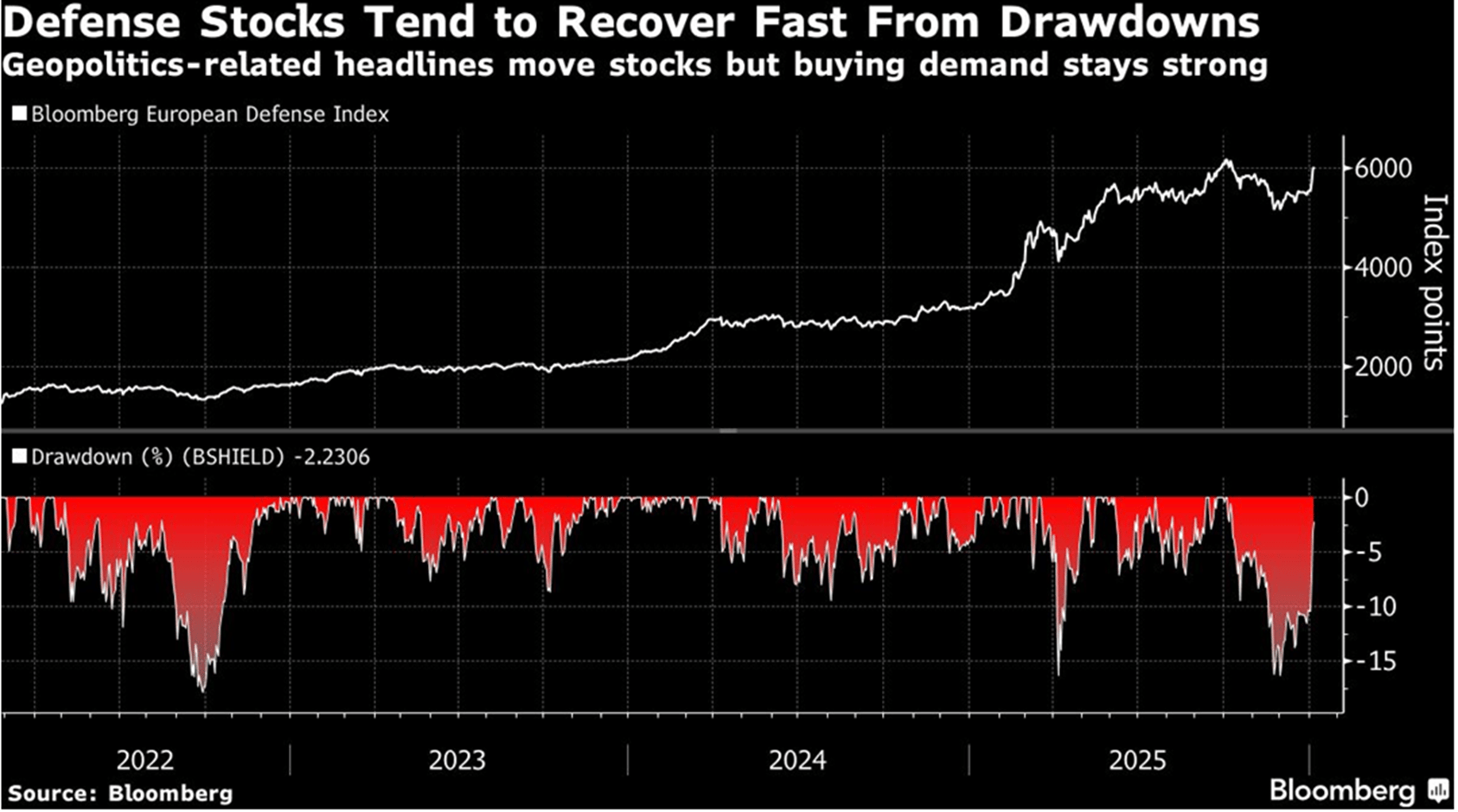

Global military risks boost European defense stocks.

1. Defense back in the spotlight.

The US intervention in Venezuela doesn’t move the needle for European defense companies but it matters as another datapoint in a more interventionist, less predictable world.

European military spending is likely to stay higher for longer and investors will be more inclined to see defense as a structural theme and not a cyclical one, she says. “Episodes like Venezuela tend to harden political resolve to meet or exceed NATO’s 2% of GDP target, replenish munitions, invest in air and naval power, and upgrade surveillance and cyber capabilities. Those are precisely the areas where many European defense groups specialize.”

Bernstein analysts also doubt that a Russia-Ukraine ceasefire will happen anytime soon, but acknowledge headlines on peace efforts will move shares. “Ceasefire or not, the spending needs to happen,” they say. “Fundamentals will be fueled by rich backlogs and growing budgets. In 2026, we model topline growth to remain as strong as in 2025 for the large caps (+9%), and accelerate again for Rheinmetall (+40%). We see most room for upgrades in Rheinmetall, Thales and Leonardo.”

2. Samsung’s strong earnings boost Korean stock market.

Samsung Electronics reported a significant increase in its fourth-quarter operating profit, more than doubling year-on-year to a record high. This growth was attributed to tight supply and rising demand driven by artificial intelligence, which boosted prices for traditional memory chips.

3. Goldman forecasts 20% gains for China stocks in 2026.

Corporate profits could potentially grow as much as 14 per cent, the US investment bank said, on the back of the artificial intelligence boom and listed companies’ international expansion, compared with 2025’s single-digits growth.

“The intersection of low to mid-teen trend earnings per share growth, mid-range but undemanding valuations, and generally low investor positioning points to a favourable risk reward for China equity,” the Goldman report said.

Chinese stocks are not expensive on a valuation basis, according to Goldman. The MSCI index is valued at 12.4 times estimated earnings for the following 12 months.

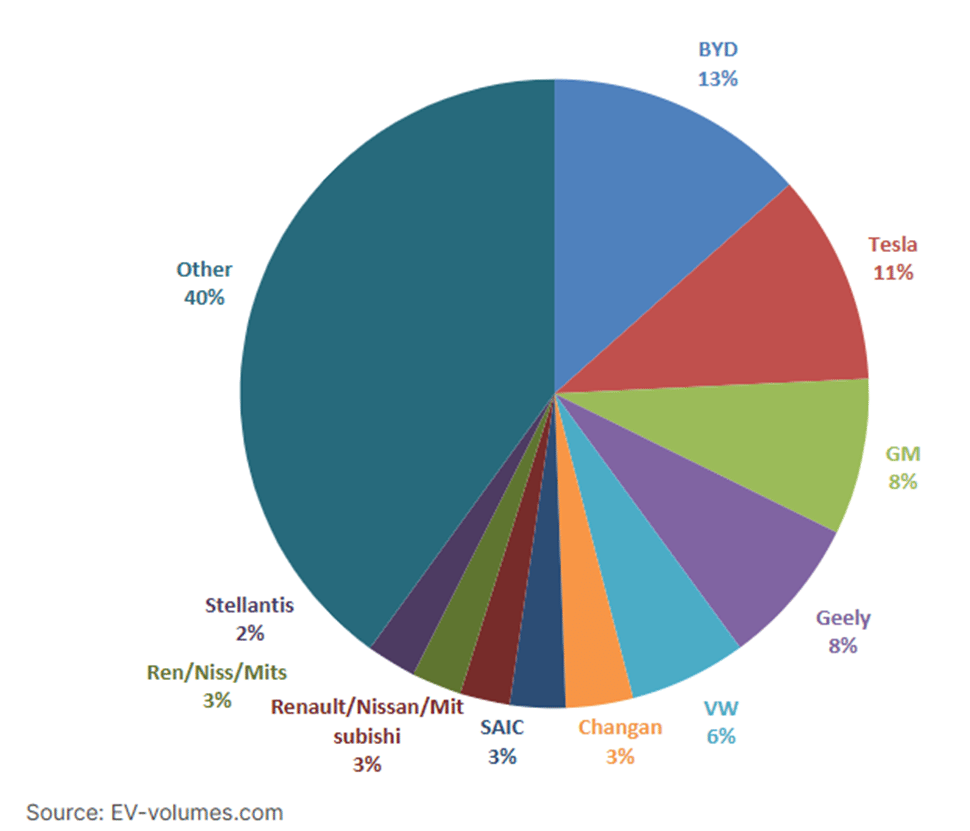

As a data point, China’s BYD surpassed Tesla to become the world’s largest electric-vehicle maker in 2025, while Tesla reported an 8.6% annual sales decline.

Below: Global EV Market Share

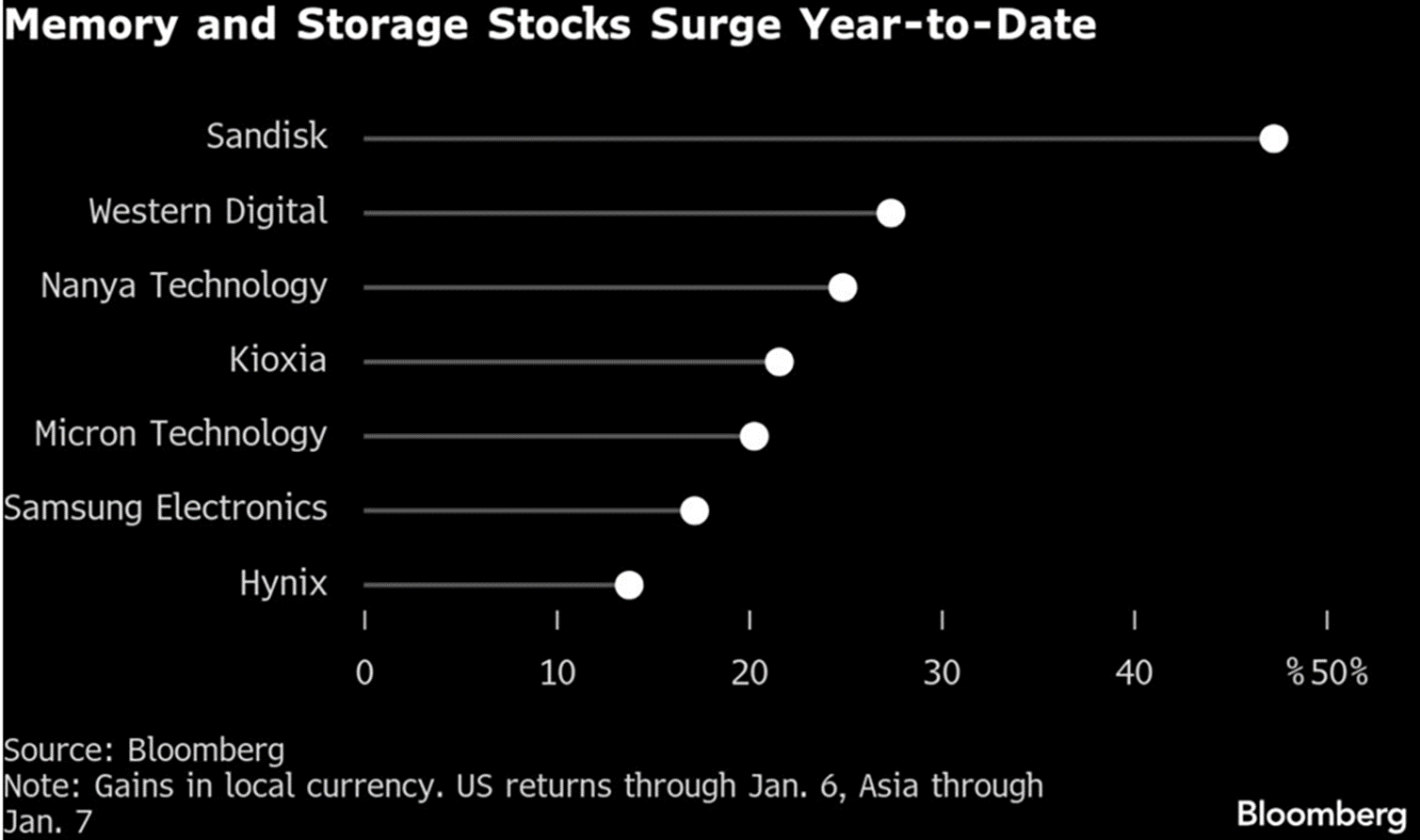

4. Memory bandwidth becomes the primary bottleneck for data center build-outs in the new year.

The rally is likely to continue: Samsung expects shortages to drive price hikes and DRAM specialist Nanya posted 445% year-on-year sales growth for December.

Here are some crazy YEAR-TO-DATE returns.

5. Mobileye surged after the self-driving car systems company agreed to acquire Israeli startup Mentee Robotics.

The company aims to integrate advancements in humanoid robotics with the existing expertise in automotive autonomy. Mobileye intends to leverage Mentee's groundbreaking work to create systems that understand context and interact naturally with humans, thus broadening the company's scope in Physical Artificial Intelligence.

The acquisition comes at a time when Mobileye is experiencing significant growth, with its automotive revenue pipeline projected at $24.5 billion over the next eight years, a 40% increase from January 2023.

Expanding into humanoids, MBLY significantly grows its TAM and can leverage a growth vector that is independent of the auto cycle.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply