- Charts of the Day

- Posts

- Slowing labor market boosts the case for the Federal Reserve to lower interest rates next week.

Slowing labor market boosts the case for the Federal Reserve to lower interest rates next week.

Robotics stocks up on report of White House boost.

Subscribe to receive these charts every morning!

1. Utilities remains a favorite sector into 2026 as rates go lower.

“Utilities are still undervalued and under-owned especially, relative to the growth and low risk on offer. Analysts expect the 'Powering AI' theme to support sector interest and further multiple expansion in 2026 whereas lower bond yields are helping the valuation of low duration cash flow. “

“Technically, the sector has broken out of its 5Y downtrend range relative to the European index as the market has transitioned to rewarding (rather than penalizing) the sector’s unique capex upswing cycle amid the broadening data center theme.”

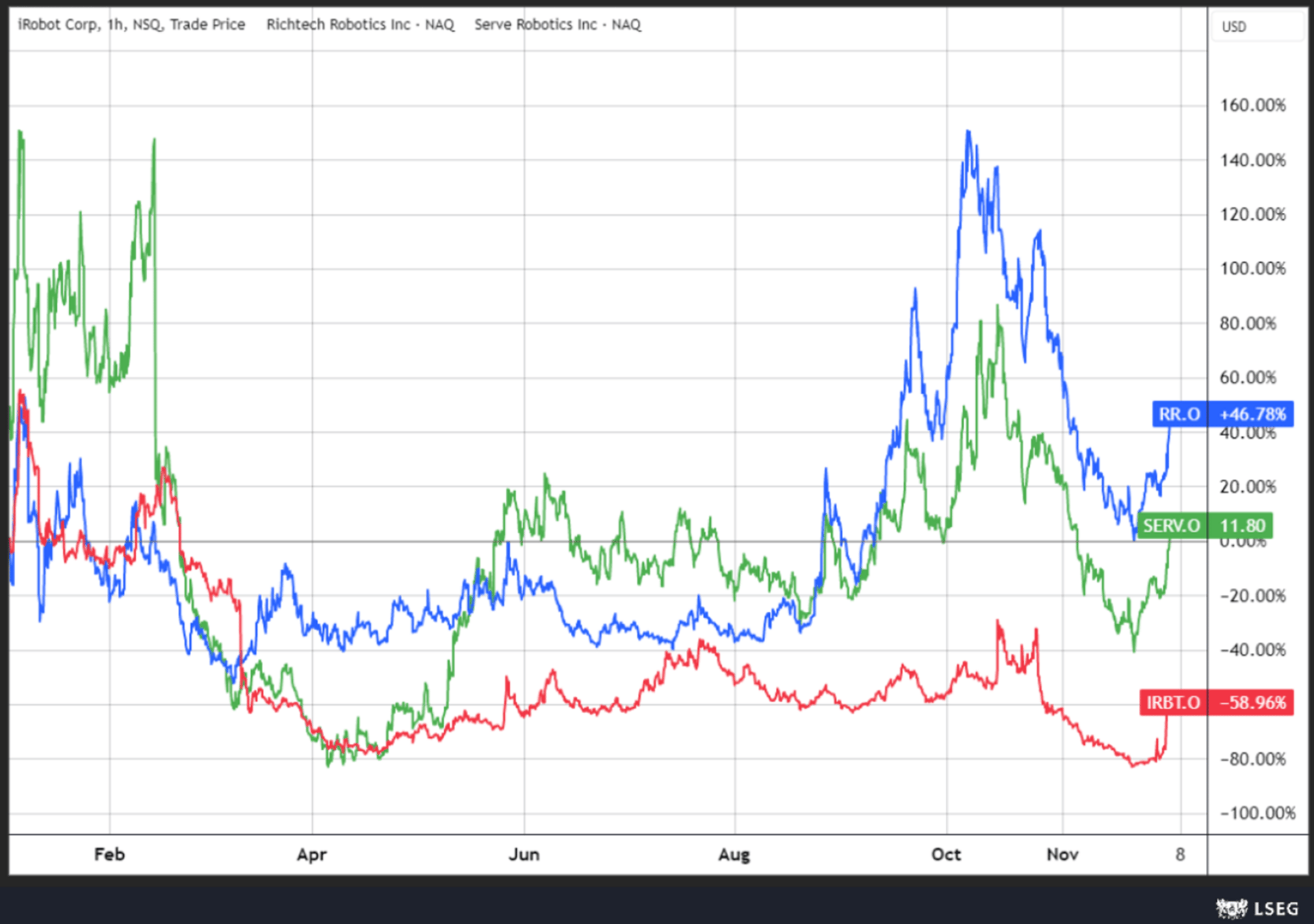

2. Robotics stocks up on report of White House boost.

The Trump administration is considering issuing an executive order on the technology next year, citing two people familiar. US Commerce Secretary Howard Lutnick has been meeting with CEOs in the industry and wants to accelerate the sector’s development, Politico reports, citing three people familiar with the discussions.

It’s been a rollercoaster year for some of these stocks.

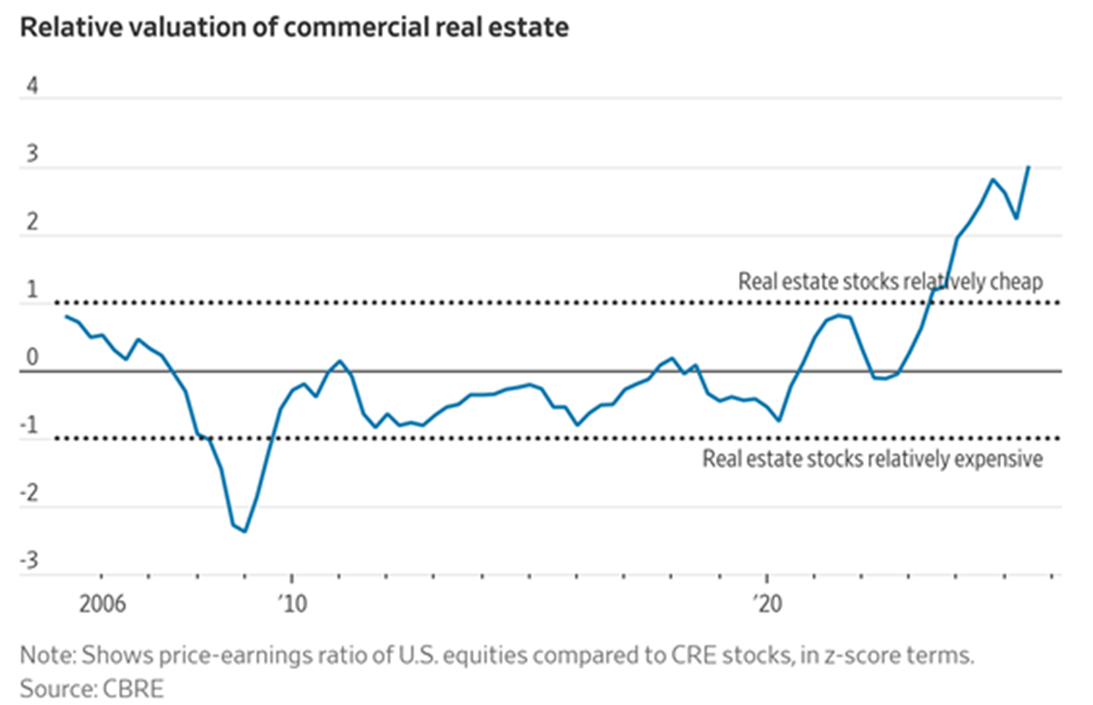

3. Real Estate is getting too cheap to ignore.

Property is one of the last assets in the U.S. that looks fairly priced and could turn out to be a place to hide if there is an artificial-intelligence bubble. U.S. commercial-real-estate values are still down 17% from their 2022 peaks on average, according to Green Street.

4. European banks versus the Magnificent 7.

Since the European Central Bank started raising rates in 2022, it’s hard to find a better thematic trade than euro-area banks. With returns of almost 300%, it beats even the Magnificent Seven over the period. A switch in rate policy only paused the rally, before the sector resumed its gains, powered by strong earnings growth and generous shareholder payouts.

5. …and there is a good chance they will continue to beat them.

Across Europe, banks are in stronger positions than they were before 2008, but their valuations remain below pre-crisis levels. The forward price-to-earnings ratio for the Stoxx 600 Bank index is around 9.5, making it the cheapest sector in Europe after autos.

“We enter 2026 with a continued and reconfirmed positive view on European banks operating in a ‘perfect’ environment,” said JPMorgan analysts led by Kian Abouhossein. The backdrop is underpinned by a solid macro outlook of improving GDP growth, stable rates, inflation and unemployment, as well as continued bottom-up strength with strong earnings growth and share buybacks, they say.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply