- Charts of the Day

- Posts

- "Sometimes, we see bubbles"

"Sometimes, we see bubbles"

'Big Short' Michael Burry bets against Palantir and Nvidia.

Subscribe to receive these charts every morning!

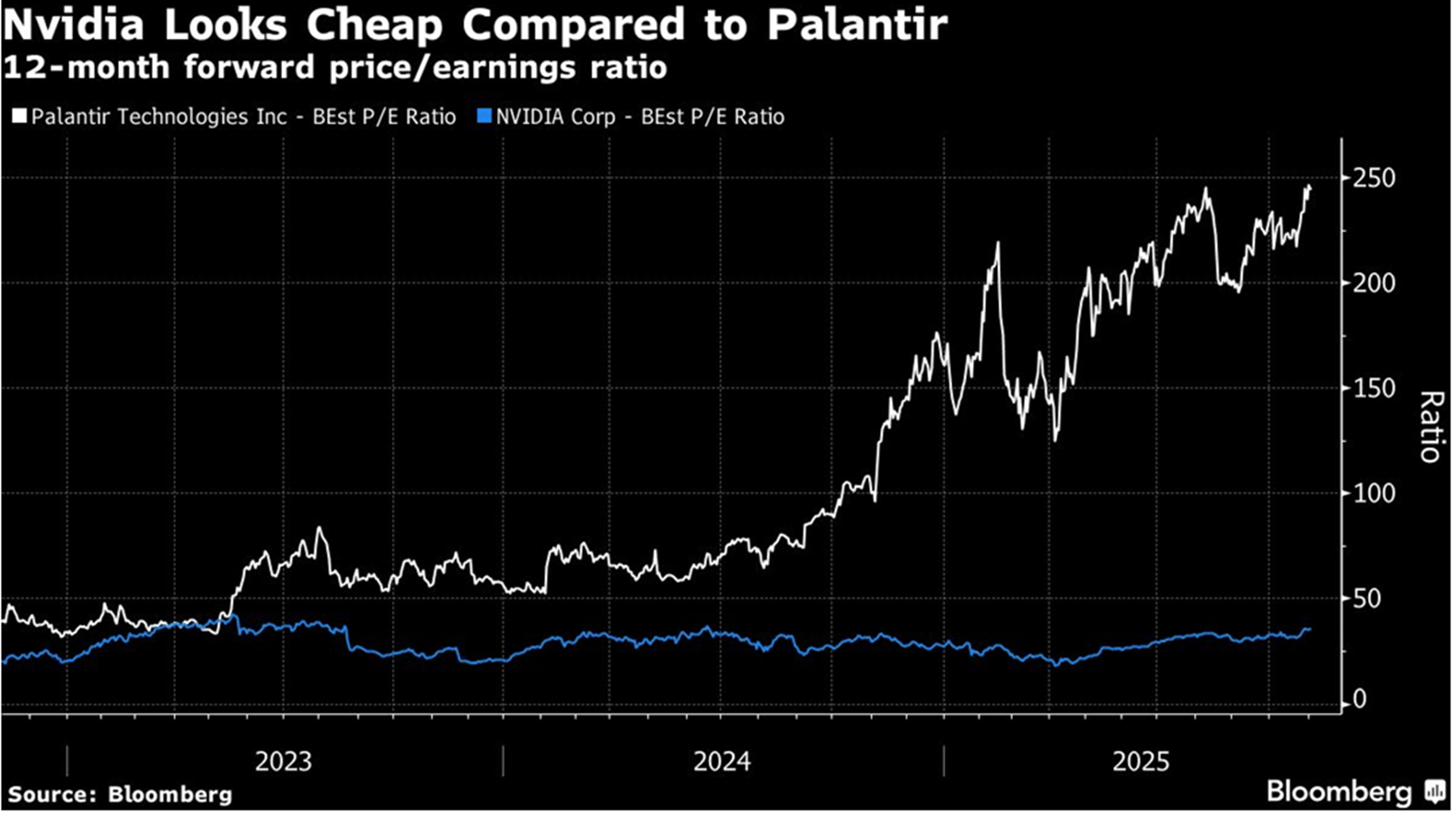

1. 'Big Short' Michael Burry bets against Palantir and Nvidia.

Burry's hedge fund, Scion Asset Management, made massive bearish wagers using put options on Nvidia and Palantir Technologies, according to a regulatory filing released Monday for the quarter ending September 30.

Burry rose to fame by betting on the mortgage crisis in the 2000s and was right, but has since made a name for himself by calling the end times a little more often than they actually occur.

"Sometimes, we see bubbles," he wrote yesterday.

In Jan 2023, he tweeted "sell," and the markets have been up 78% since then.

Below: Palantir trades at nearly 250 times its 12-month forward earnings estimates, compared with AI chip frontrunner Nvidia's 33.

2. AI may well be the productivity miracle that keeps the U.S. economy growing, but young Americans are cutting back.

Young Americans age 18 to 24 are cutting back on spending, with online and in-store purchases down 13% year-over-year, according to Circana. A combination of economic challenges is driving the decline. Young grads are having a much tougher time finding jobs. Student-loan payments are restarting for millions of borrowers. Over roughly the past year, credit-card delinquency rates have risen to their highest points since before the pandemic, and are highest for those 18 to 29, according to the New York Federal Reserve.

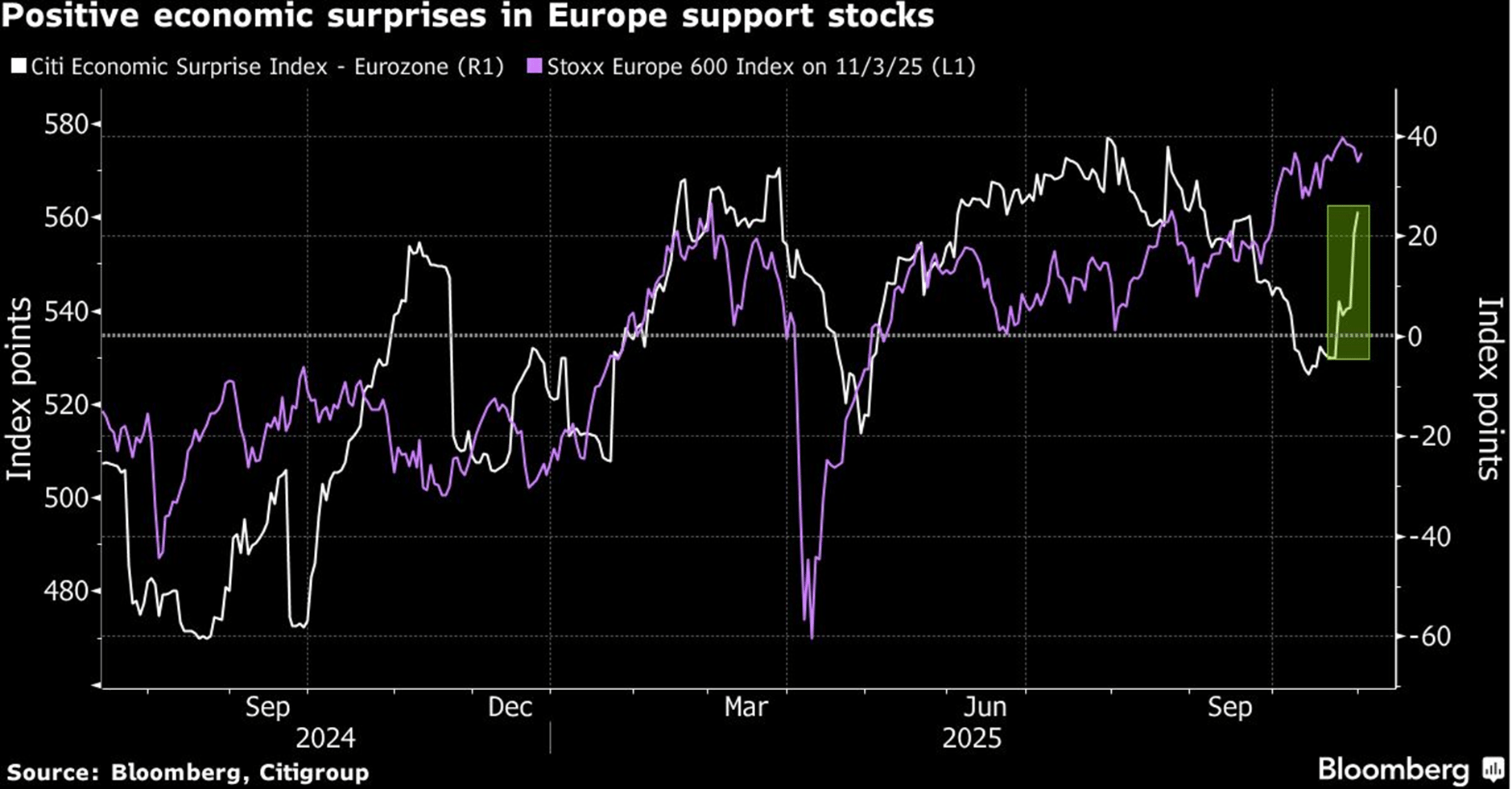

3. Any short-term weakness in European stocks is likely to be temporary.

Value and cyclical stocks are firmly in the driving seat, with financials the standouts, followed by industrials. Helpful monetary and fiscal policy alongside defense spending have boosted the market, as has a more modest impact from tariffs than expected.

Meanwhile, positive euro zone data surprises have surged this month.

4. Amazon is proving that rising CapEx is money well spent.

AWS growth just accelerated to 20% Y/Y, its best performance in nearly three years, showing that Amazon’s aggressive CapEx, now expected to reach $125 billion in FY25, is paying off.

The stock jumped as investors rewarded its tangible progress on AI monetization.

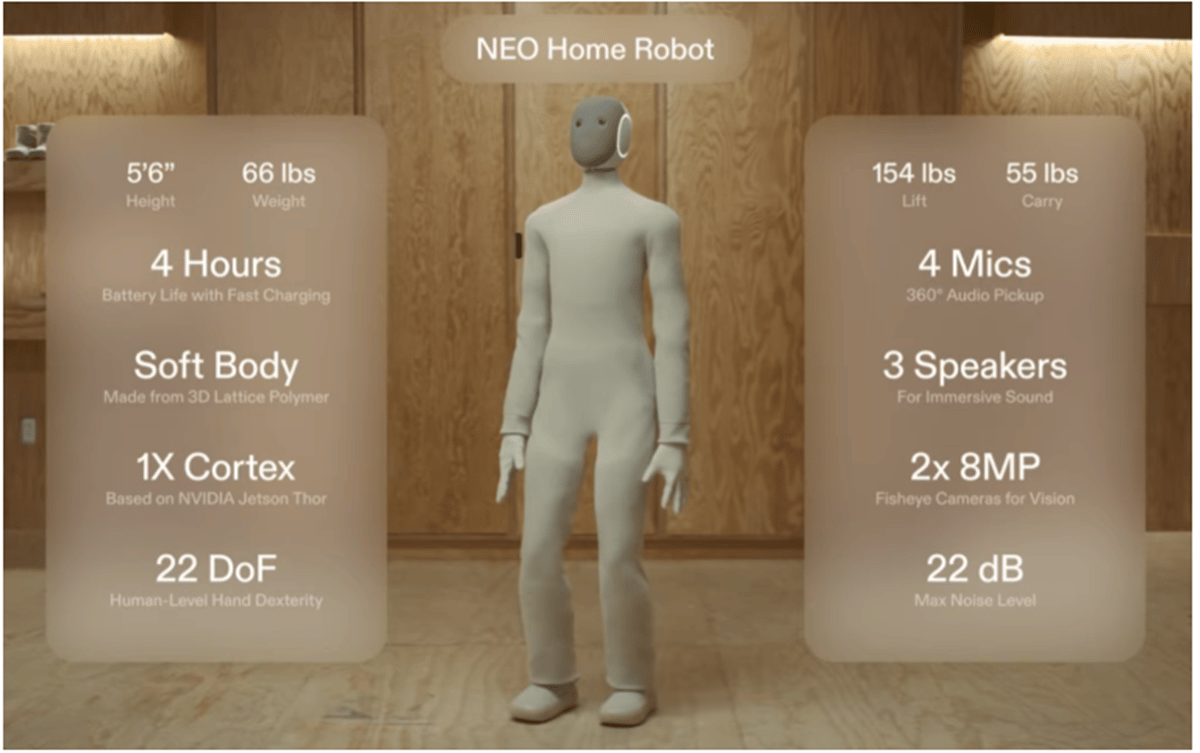

5. You can pre-order your robot now.

1X Technologies just made its NEO humanoid household robot available for pre-order on its website (www.1x.tech) for a subscription price of $499/month or a purchase price of $20,000 for a fully refundable deposit of $200. US deliveries are expected in 2026.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply