- Charts of the Day

- Posts

- Stocks retreat and Gold hits record as US begins government shutdown.

Stocks retreat and Gold hits record as US begins government shutdown.

US consumer confidence declines again as Americans fret over prices, job market.

Subscribe to receive these charts every morning!

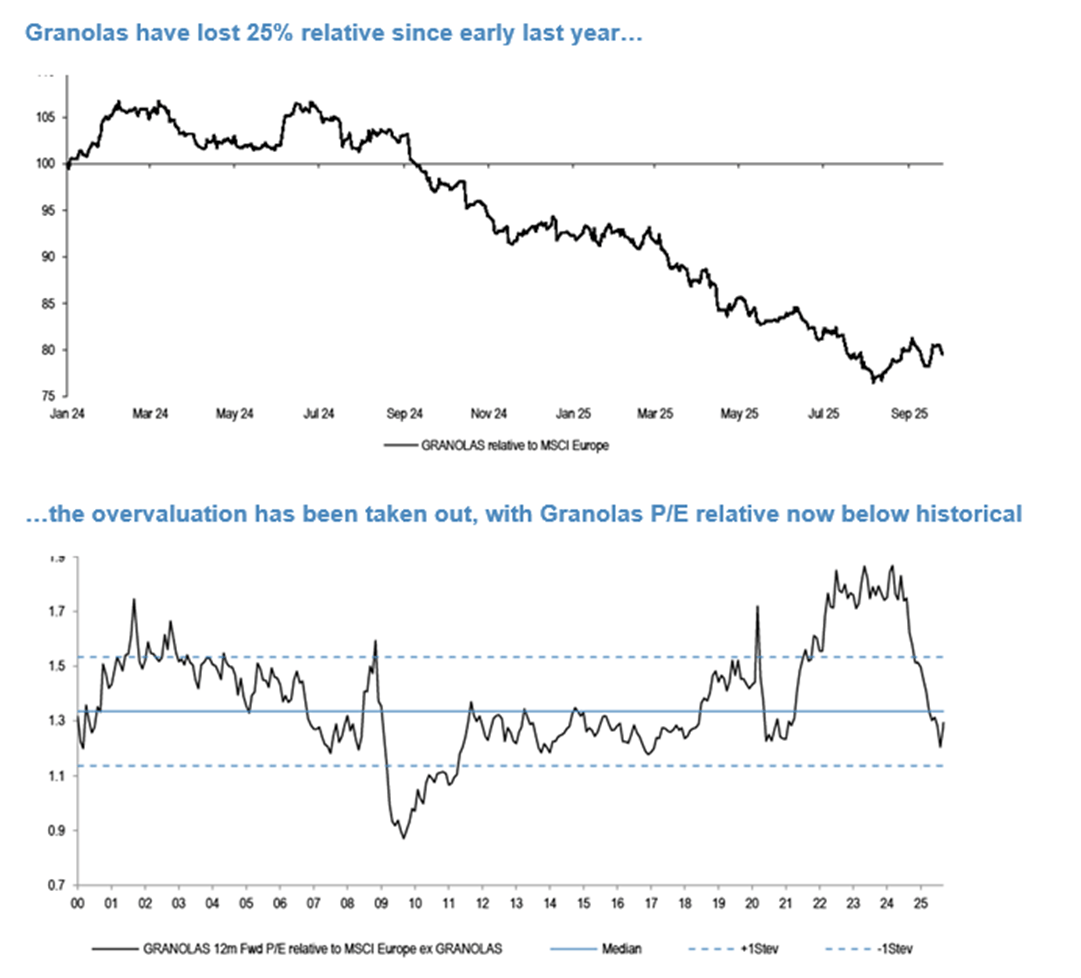

1. Granolas: Is this the bottom?

Europe's once-dominant "Granolas" - a group of 11 top stocks including ASML, Nestle, SAP and Novo Nordisk — have lost their shine, underperforming MSCI Europe by 25% since early 2024. But J.P.Morgan suggests the tide may be turning.

"Granolas have de-rated from trading outright expensive to trading on the cheap side of fair value," write JPM strategists led by Mislav Matejka, noting the group now trades at a 6% discount to its 10-year median PE valuation.

Despite price weakness, earnings have held up. JPM sees 2025 EPS growth at 8% for the group, versus flat for the broader market. It says cash flow trends are encouraging, buybacks have risen materially to 36 billion euros this year and dividend yields are set to rise to 3.1% by 2027.

The strategists acknowledge lingering concerns, especially in pharma, but argue much of the bad news is priced in. "Specifically for Pharma names, our analysts believe that the latest 100% tariffs news is manageable". Their overweights in the group are: ASML, Novo, AstraZeneca, SAP and Sanofi.

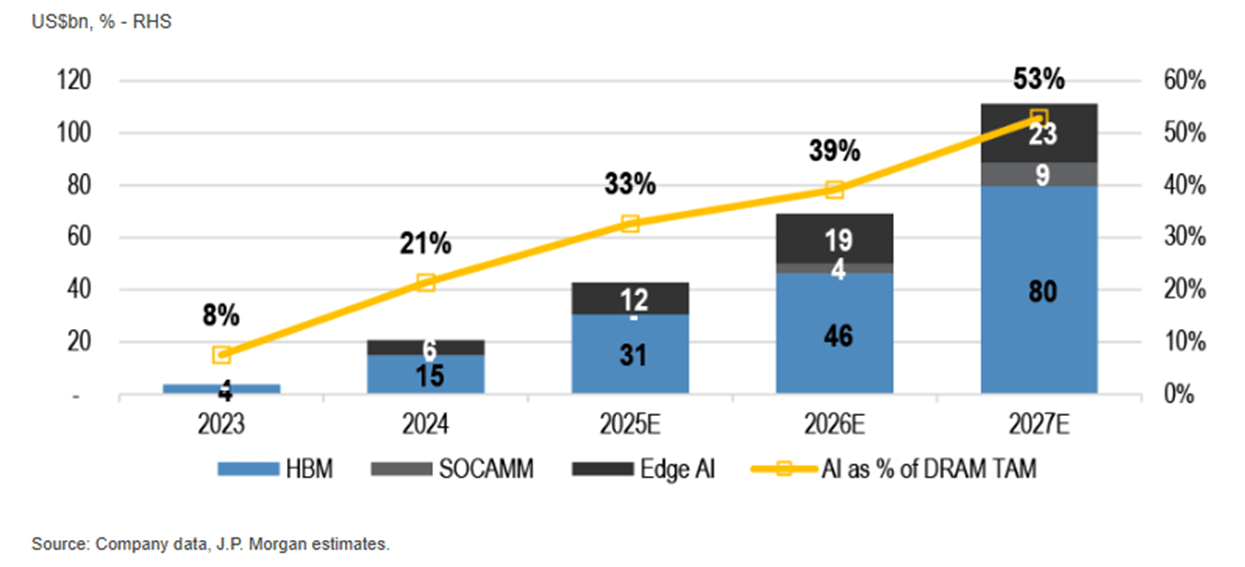

2. The HBM boom.

High-Bandwidth Memory (HBM) aka “Cloud Memory”.

AI remains the fastest growing application and it is important to note that edge AI is still at an early stage of development.

AI model optimization should support another wave of memory demand growth in the long-term as server memory will be used for AI inference / Agentic AI service launch.

Think of it like building a memory skyscraper right next to the processor, instead of a one-story warehouse far away. By stacking DRAM chips vertically, you get incredibly high bandwidth from a smaller footprint. Memory remains the gating factor for AI systems in the near term.

HBM inventory is tight, and gross margin is tracking to cross 50%. So, the memory up-cycle is here, led by HBM-driven DRAM. Micron and SK Hynix have gained a first-mover advantage against market leader Samsung by being faster to market with the latest generations of HBM.

Below: AI memory as a % of the total memory market.

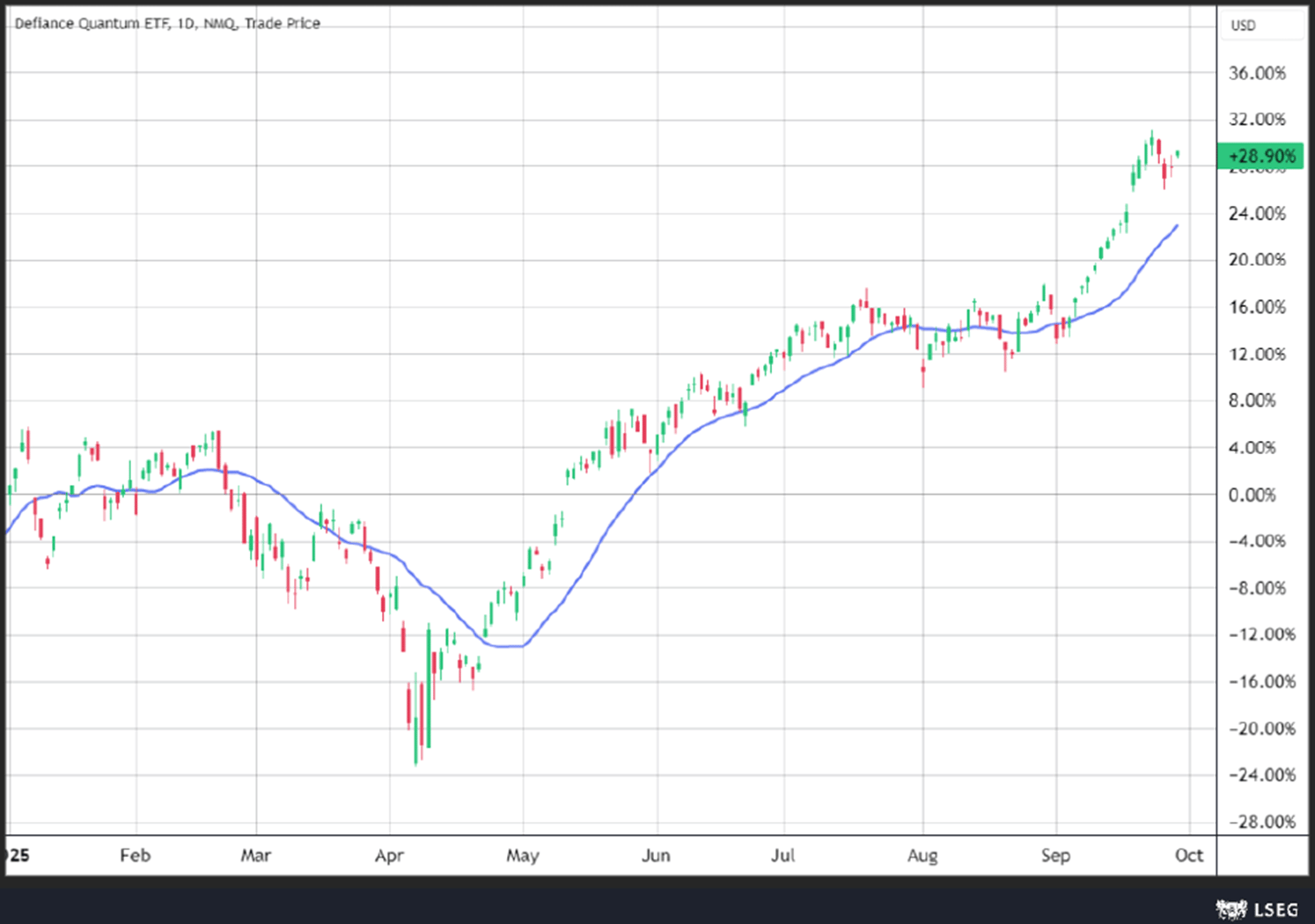

3. Bank of America is bullish on the long-term potential of quantum computing.

They say the market will grow from around $300 million last year to $4 billion by 2030 (that’s not exactly impressive).

However, it cautions that scaling challenges remain. "While the promise of quantum computing is real, there are technological impediments to scaling that are currently being worked on”. "Once these scaling hurdles are overcome (perhaps by 2030), we expect a much more meaningful inflection in revenues."

Investors seeking exposure can look to pure plays like D-Wave, Rigetti , IonQ and Quantum Computing, whose shares have surged between 21% and 220% in 2025.

Big tech players such as IBM, Google, Microsoft, NVIDIA, Amazon and Intel are also active in the space. IBM jumped 7% last week on an announcement from HSBC indicating that it had utilized IBM Heron quantum processors.

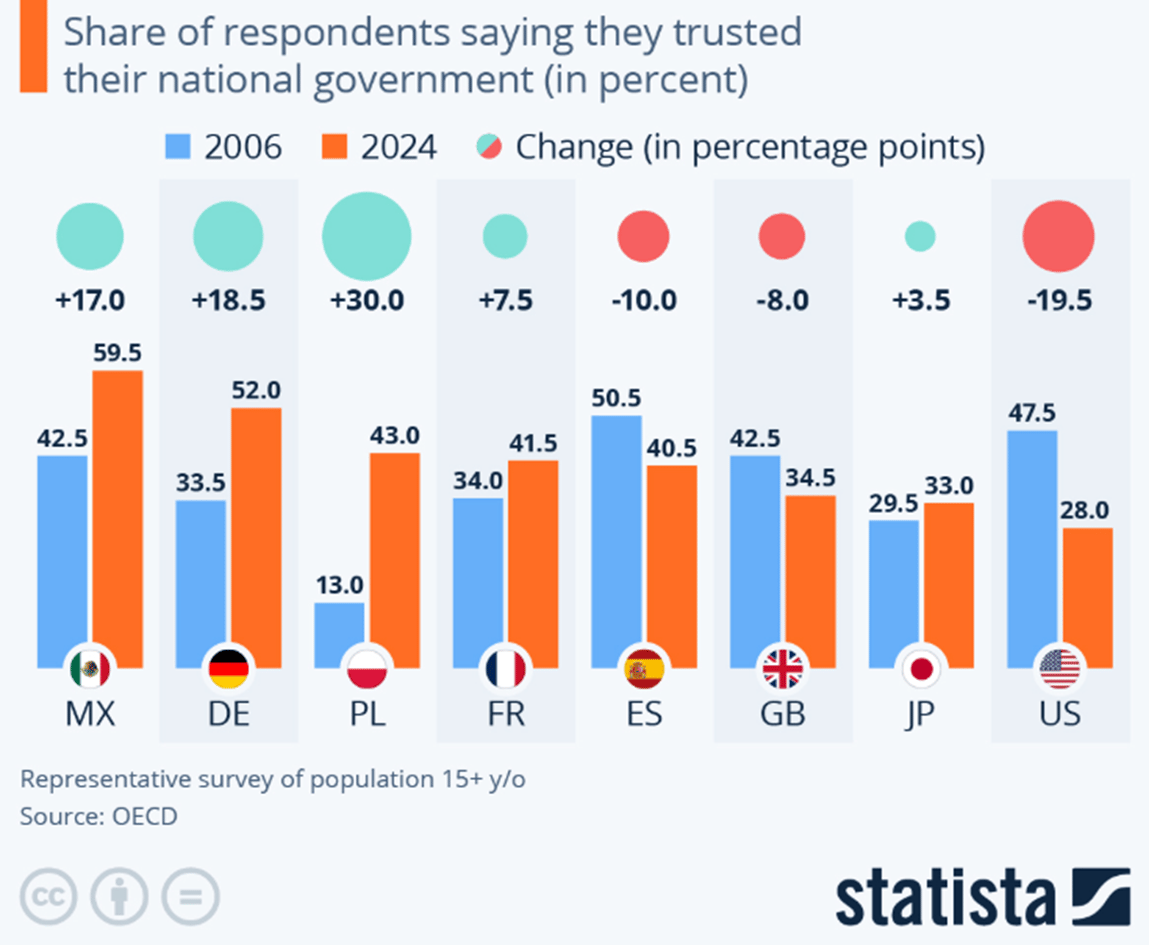

4. Loss of confidence in governments.

As the U.S. federal government is increasingly seen as dysfunctional, the U.S. experienced the lowest level of trust in its government of all OECD countries in 2024. It also saw one of the biggest decreases in this trust among its population since 2006. Trust in the U.S. federal government was down 19.5 percentage points between the two.

5. Welcome to the supercycle of the TIC sector.

The Testing, Inspection and Certification (TIC) industry plays a crucial role in ensuring quality, safety, and compliance across global supply chains and industries. However, many investors and prospective investors struggle to understand what the Testing and Inspection companies do, given the vast array of countries, industries and clients they serve – from electronics to clothing, and from offshore oil to aviation.

With strong structural growth drivers, attractive financial characteristics, and ongoing consolidation opportunities, this sector is well-positioned for continued growth and margin expansion. This aligns with our preference for defensive Quality in the current environment.

The largest players – SGS, Bureau Veritas, Intertek and Eurofins – are adapting their strategies to capitalize on accelerating trends such as cybersecurity, energy transition, supply chain reconfiguration. The Testing, Inspection and Certification market totals ~€300bn according to Bureau Veritas and this is forecast to grow at mid single digit per year to 2030.

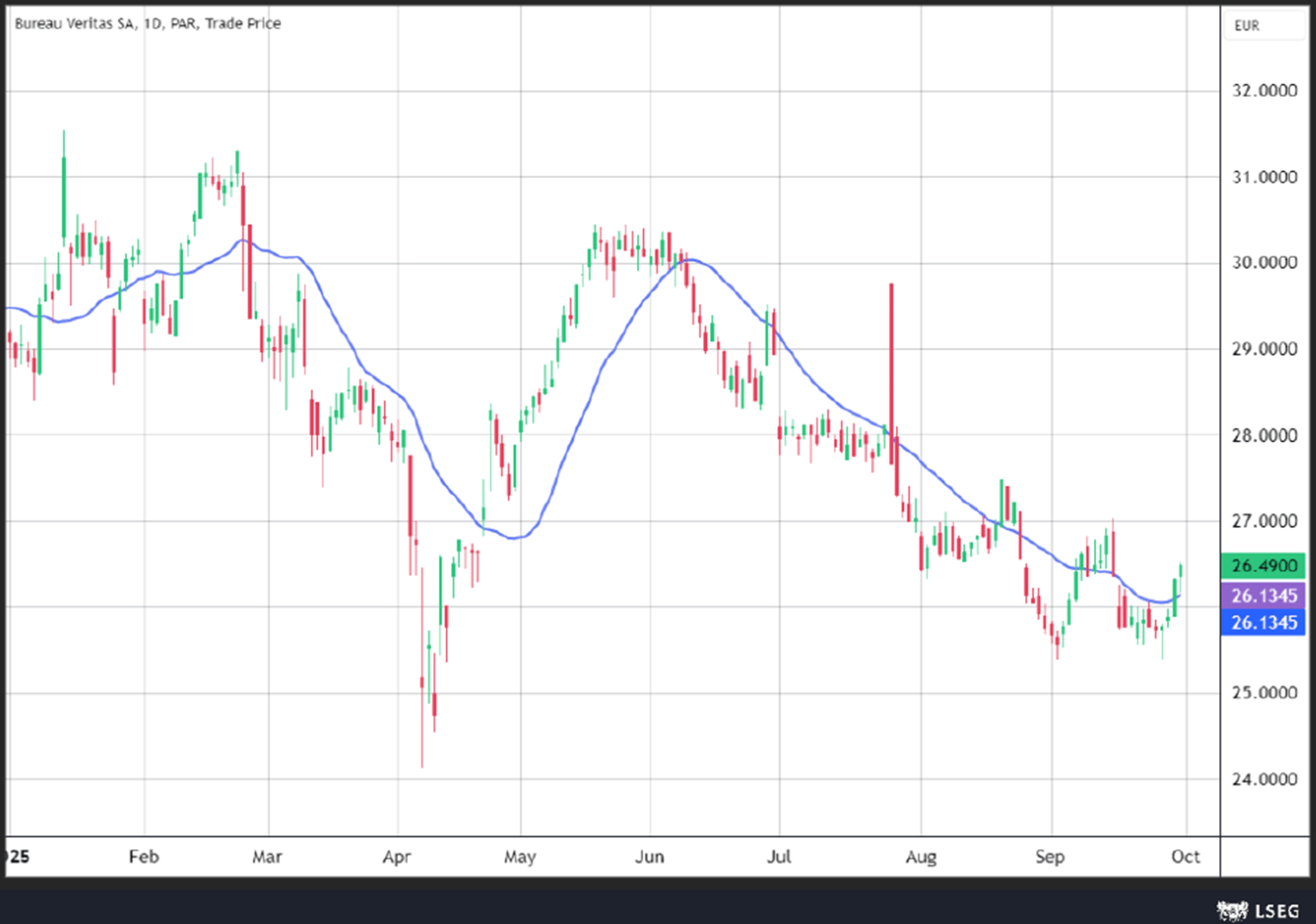

We like Bureau Veritas and see the company's Infrastructure, Industrial and Certification exposure as strongly geared into the themes of Energy Transition , (Powering) GenAI , Urbanization and Supply Chain Assurance and in this context, company guidance for mid to high single digit growth looks conservative.

Valuation: The shares have derated in recent weeks (versus SGS/Intertek flat) on French exposure. As a result, BVI now trades on a FY26e P/E of 16x, which compares to a 10-year historical average of 19x and peers SGS on 19x and Intertek on 17x.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply