- Charts of the Day

- Posts

- Stocks struggle before long-awaited jobs data and Nvidia results.

Stocks struggle before long-awaited jobs data and Nvidia results.

The chip maker has beaten earnings estimates for nine consecutive quarters, will they do it again?

Subscribe to receive these charts every morning!

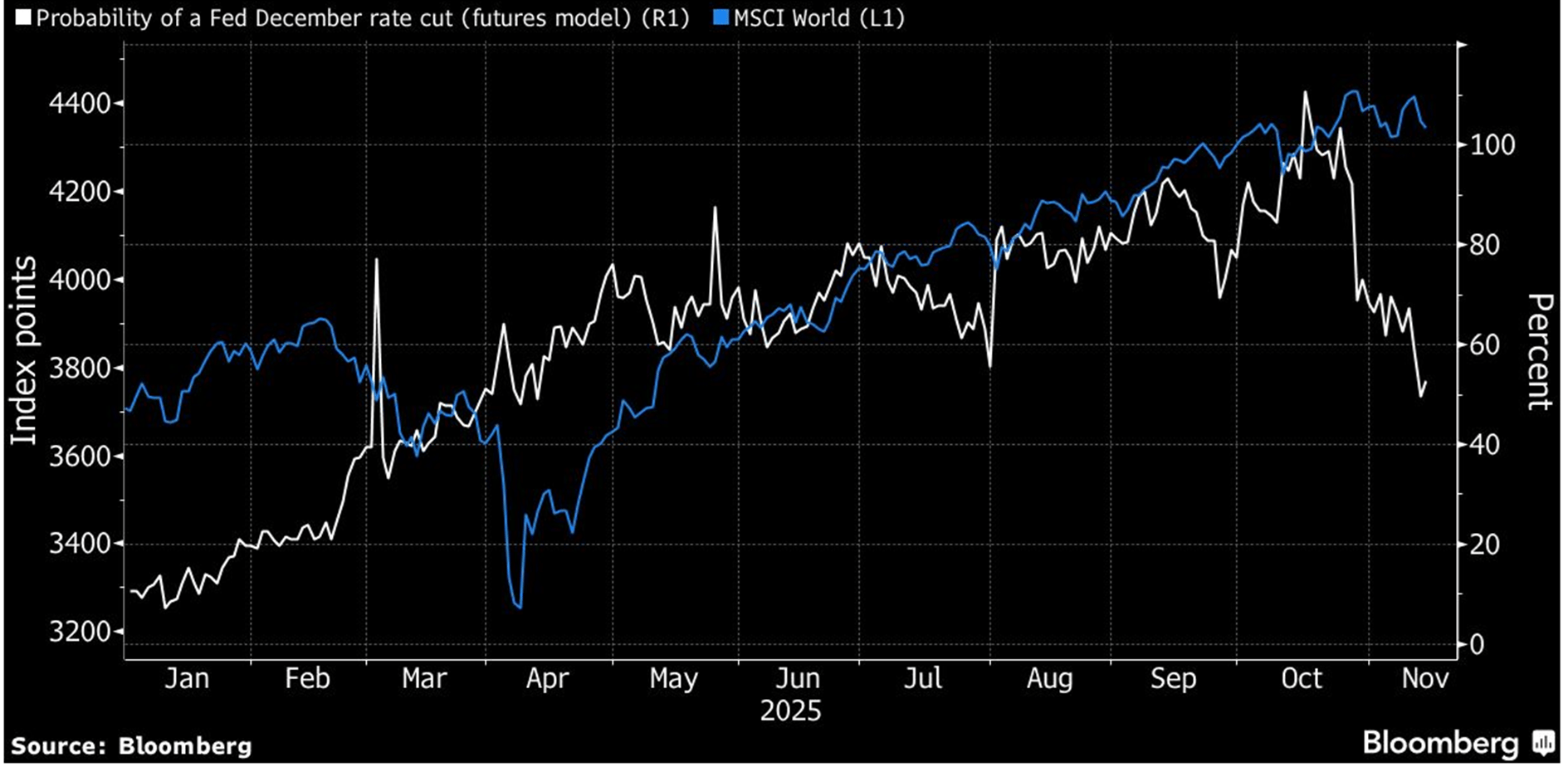

1. Stocks and rate cut probabilities.

Stocks have been priced for perfection, buoyed by a strong earnings season and confidence in rate cuts despite the sudden lack of US economic data. The tide is now turning and fast money players like hedge funds are taking risk off the table. Europe, as a more defensive and cheaper trade, is experiencing less pronounced selling. Since closing at a peak on Oct. 28, the S&P 500 has fallen over 2%, while the Stoxx Europe 600 is flat since.

US data should start to flow in as both the Fed dilemma — weaker job market vs high inflation — and as tech valuation fears remain strong,” say Natixis strategists Emilie Tetard and Florent Pochon. Nvidia’s earnings this week might be make-or-break for the momentum trade. Meanwhile, a FED cut is now pretty much a coin toss after being nearly fully priced in just a month ago.

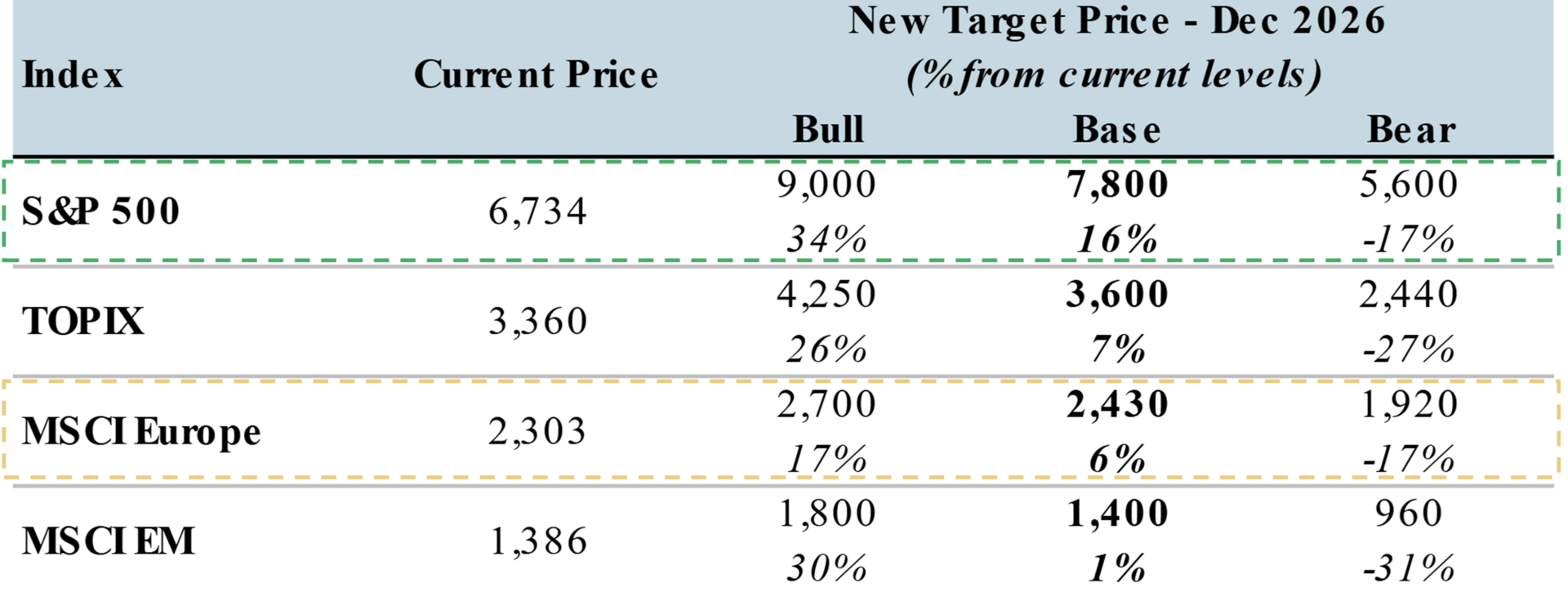

2. Morgan Stanley becomes top bull with call for 16% S&P rally.

“We Raise Our 12-Month S&P 500 Price Target to 7,800 (22x forward EPS of $356). This expectation incorporates higher-than-consensus EPS throughout our forecast horizon. We see 2025 EPS of $272 (12% growth), 2026 EPS of $317 (17% growth), and 2027 EPS of $356 (12% growth).

Key drivers of our bullish earnings/cash flow view include a return of positive operating leverage, greater pricing power, AI-driven efficiency gains, accommodative tax and regulatory policies that facilitate a public to private growth transition, and contained interest rates throughout the curve.”

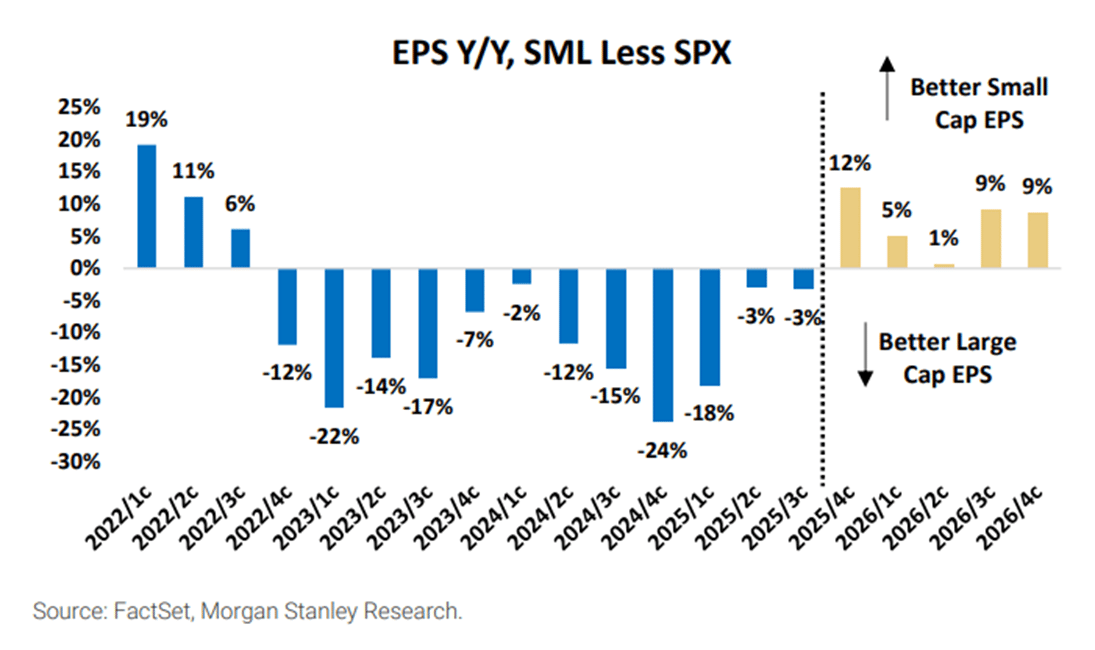

3. Morgan Stanley is also upgrading small caps to overweight relative to large caps.

“Small cap earnings revisions are now starting to turn higher against large caps, a key development we were waiting for before upgrading the group to overweight.” “Lastly, we'd note that small caps continue to trade at a significant valuation discount to large caps.”

Below: Small cap EPS growth set to outpace large cap growth in coming quarters.

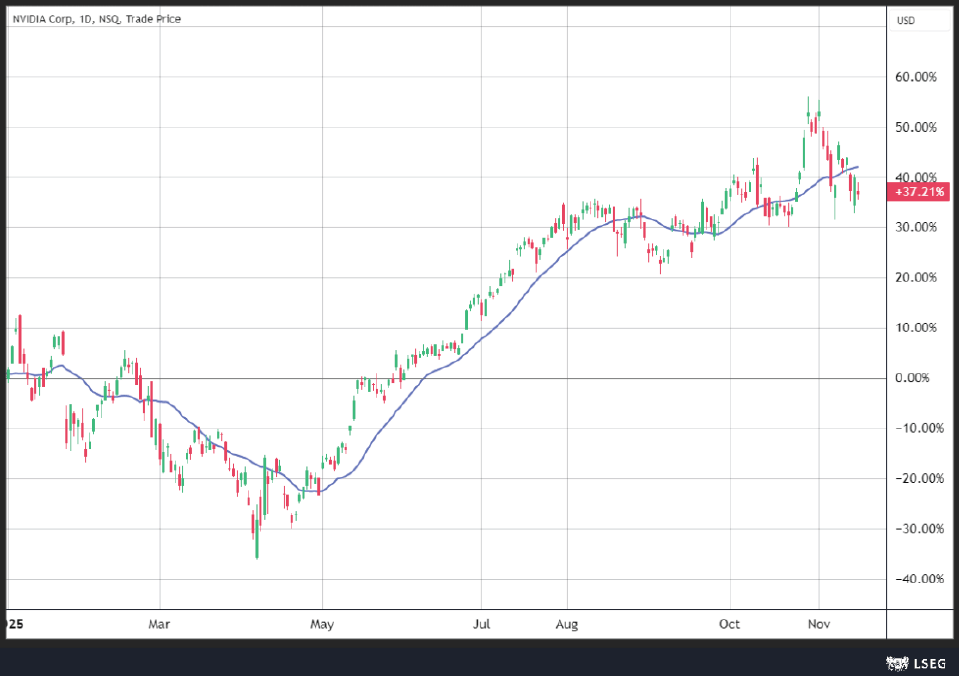

4. Nvidia earnings will be a test for the artificial-intelligence bull run.

Analysts on average expect the company to post a 53.8% year-over-year rise in fiscal third-quarter earnings per share, and they have been getting more optimistic about future revenue - leaving the company with a lot to beat.

Meanwhile, stock market bulls and bears are engaged in the great "GPU depreciation" debate, which involves Nvidia and other AI chips. Bears claim that the Magnificent-7 companies should be depreciating their Nvidia GPU chips over one to three years rather than longer.

"If depreciation schedules don't match real-world replacement cycles, companies may be overstating their profitability and underestimating the capital-consuming intensity of AI infrastructure," noted economist Ed Yardeni in a report. "Hyperscalers are stretching GPU depreciation schedules, a move that lowers expenses and boosts reported earnings," Yardeni added.

Below: Nvidia is up 37% for the year but was up more than 55% just two weeks ago.

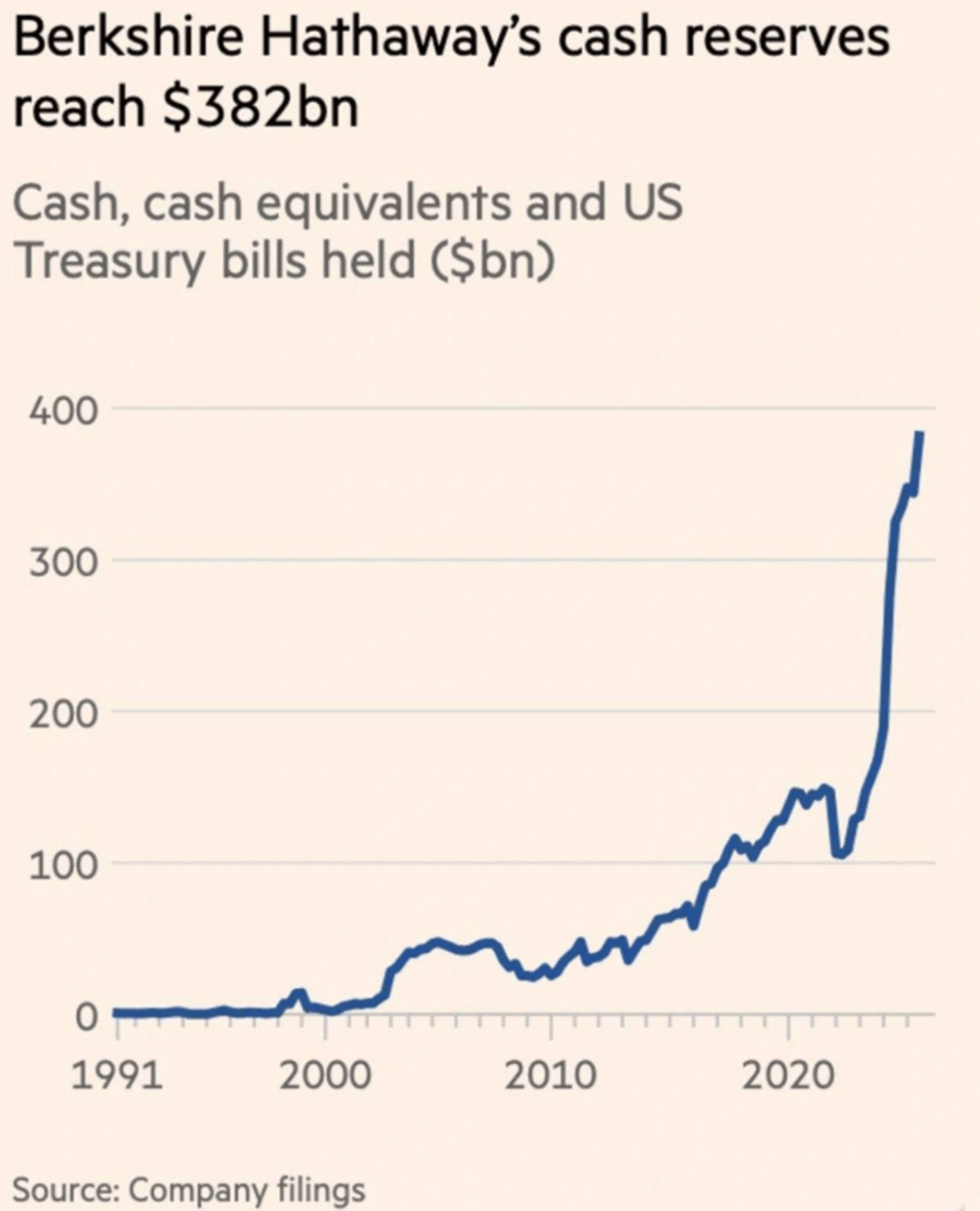

5. Warren Buffett’s Berkshire Hathaway revealed its Q3 portfolio moves, marking its 12th straight quarter as a net seller of stocks.

Berkshire added a new stake in Alphabet, scooping up ~25.5M shares valued at $4.34B. While the purchase is relatively small in the context of Berkshire's roughly $300 billion equity portfolio, it is a rare venture into the technology sector and a sign of confidence in Alphabet's hefty spending on AI infrastructure.

Berkshire looks to have chosen Alphabet as the bargain on offer in the wider AI trade. "We think Berkshire likely finds more comfort investing in Alphabet over other tech plays given the high free cash flow potential of its core business coupled with an attractive valuation at about 22 times 2027 EPS amid a healthy top-line growth trajectory, " wrote CFRA Research analyst Angelo Zino in a research note.

Apple was trimmed again, down to 238.2M shares from 280M.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply