- Charts of the Day

- Posts

- The job reports have turned negative, pointing to a continued weakening in the labor market.

The job reports have turned negative, pointing to a continued weakening in the labor market.

The S&P came within 100 points of an all-time high and all eyes are on the FED.

Subscribe to receive these charts every morning!

1. US private payrolls unexpectedly declined by 32K, the biggest drop in more than two and a half years.

The decline was driven entirely by a 120K job loss at small businesses.

The job reports have turned negative, pointing to a continued weakening in the labor market.

2. An update on US market concentration.

The top 10 largest companies continue to account for more than 40% of the S&P 500 market cap.

Mag 7 forward P/E is 48% higher than that of other S&P 500 members, suggesting the market continues to extrapolate the success of the largest companies forward.

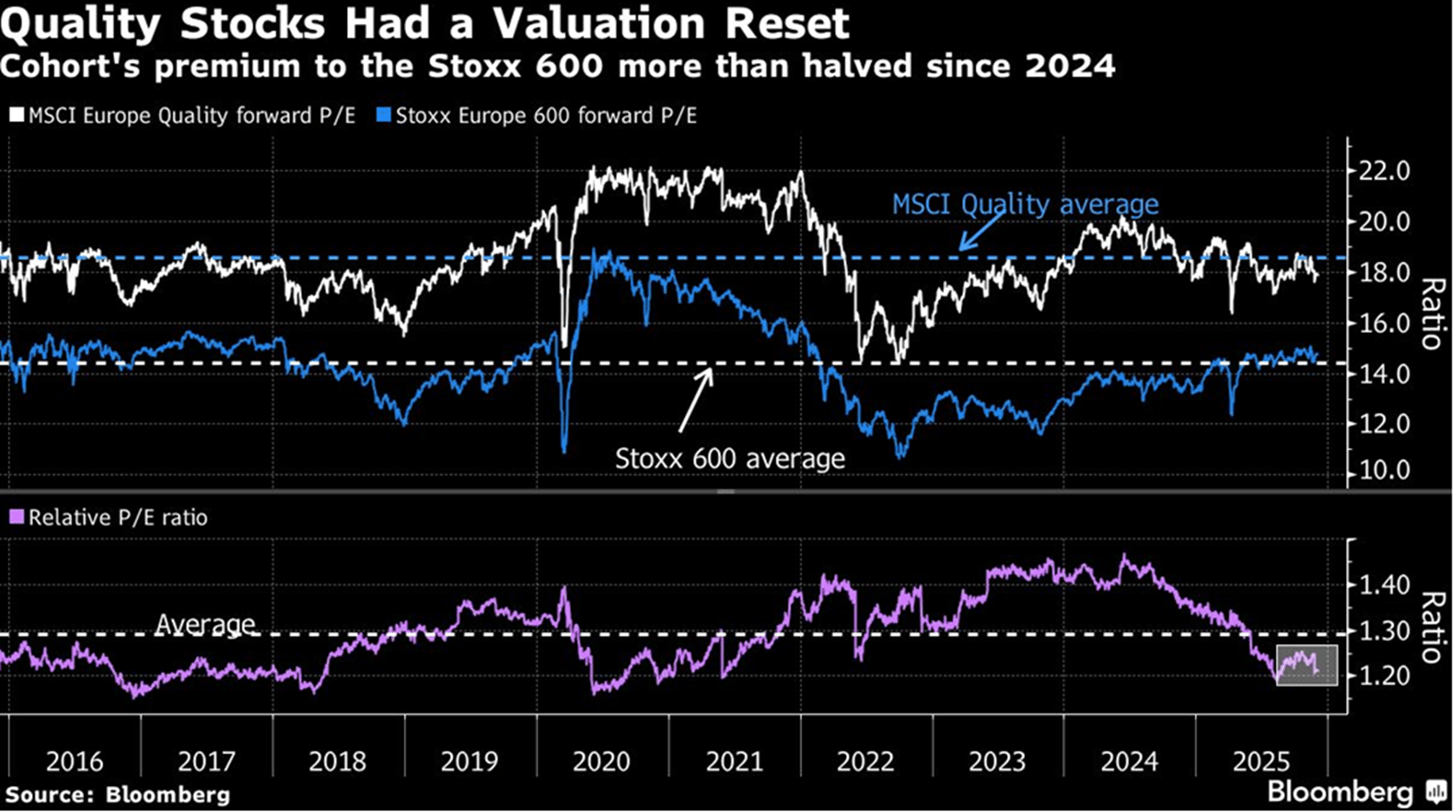

3. “2026 will be a year where we start to see the reemergence of quality growth names after a disappointing year.”

While quality shares historically commanded a lofty premium to the broader market, that metric’s now below the long-term average. Just last year, quality stocks were trading at a 45% forward P/E premium to the Stoxx 600. That premium has more than halved since.

For the strategists, the investment case for quality has strengthened as rising macro-economic risks could make defensive characteristics more appealing to investors.

Meanwhile, analysts at the bank are constructive on the theme, with buy ratings on half of the constituents in a Goldman Sachs Quality basket and more than 20% upside potential on 11 names: Admiral Group, Dassault Systemes, Elisa, Evolution, Experian, Novonesis, Partners Group, SAP, Sartorius Stedim Biotech, Sika, and Vestas. Many of these companies, which include the likes of Novo Nordisk, Beiersdorf, Adyen or Hermes, have heavy international exposure and their advance was capped by dollar weakness and tariff fears.

4. The US consumer keeps spending like there is no tomorrow.

Black Friday spending reached another all-time high.

5. Diagnostics as a growth engine.

Abbott Laboratories is a $220 billion medical device giant. But the company is far more than devices. Abbott also generates billions from diagnostics, nutrition, and established pharmaceuticals, making it one of the most diversified healthcare companies in the world.

Now Abbott is acquiring Exact Sciences, the maker of the blockbuster Cologuard colorectal cancer screening test, in a $21 billion all-cash deal expected to close in Q2 2026. The acquisition says a lot about where the diagnostics segment is headed.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply