- Charts of the Day

- Posts

- TSMC results a boost for the entire chip industry.

TSMC results a boost for the entire chip industry.

AI is not going to kill software companies...

1. TSMC profit beat estimates in fresh sign of AI demand strength.

TSMC is the main supplier of chips to Nvidia, the leader in semiconductors used for AI applications. TSMC also makes the core processors inside Apple iPhones, Qualcomm mobile chipsets, and processors made by Advanced Micro Devices.

For the full year, TSMC executives told analysts they expect roughly 30% revenue growth, in line with consensus expectations. Shares moved to new all-time highs, boosting the entire chip industry, from Nvidia and AMD to ASML and Lam Research.

It helped save the market from its recent selloff and put a brighter outlook on next week's tech earnings.

2. Goldman survey shows a shift in regional preferences.

“Technology remains the top pick, but there is a decline in enthusiasm for the US market,” Goldman Sachs wrote.

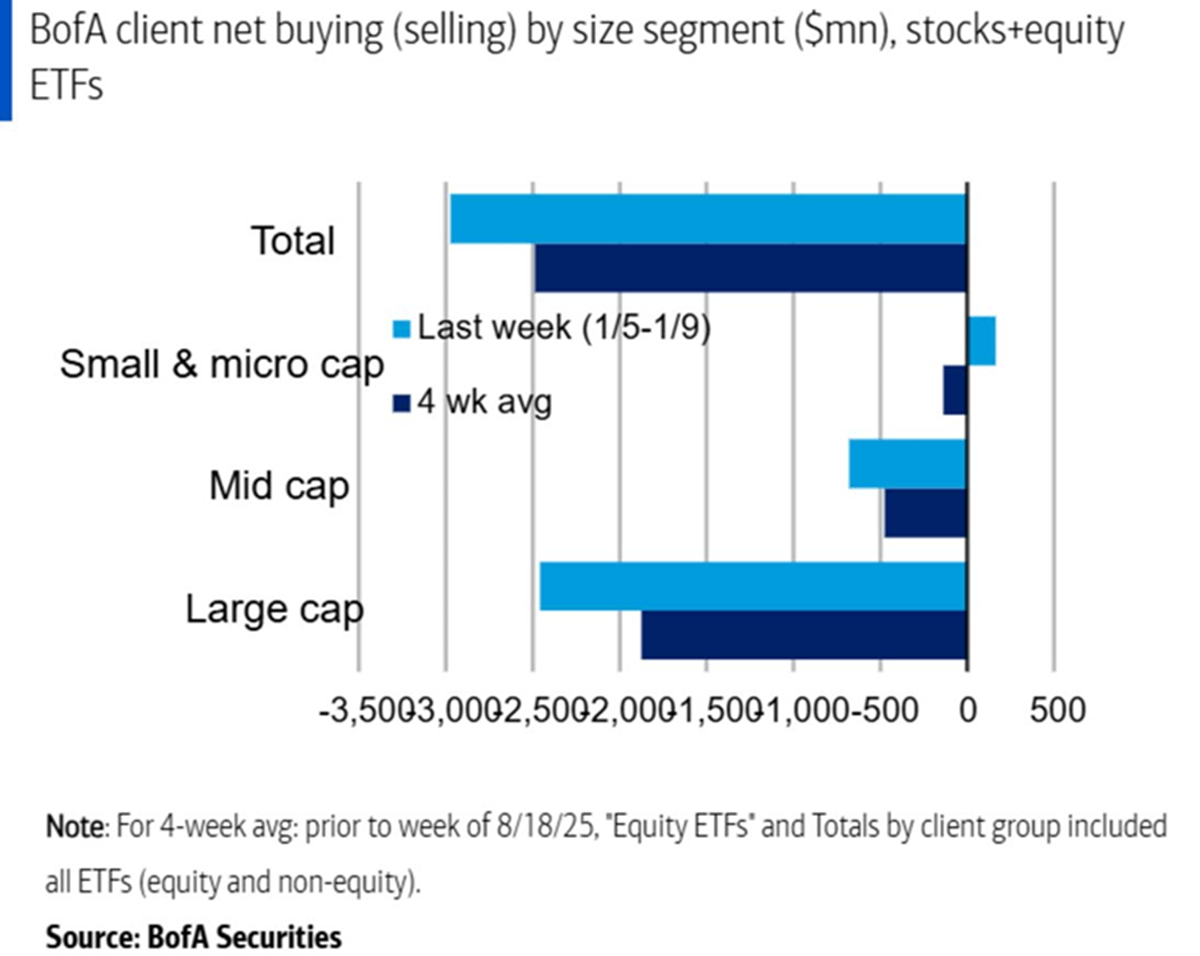

3. Bank of America clients sold US equities for the sixth straight week last week, led by large cap stocks.

4. Buy German domestic stocks for the boost from massive government spending plans.

The MDAX is the best proxy for “domestic” Germany, as encouraging economic readings support the investment case, the team says. “German construction PMI was the highest in 45 months, manufacturing order intake grew at the highest year-on-year-rate since 2011 — outside Covid — and industrial production is finally recovering.”

Accelerated spending by the German government is poised to quickly translate into even higher industrial order intake over the coming weeks, buoying sentiment and earnings, the Deutsche Bank strategists say.

Below: the long-term relative underperformance of the MDAX to the DAX offers catch-up potential, as government spending should feed into domestic stocks more powerfully than large caps.

5. AI is not going to kill software companies and we are buyers of SAP at these levels.

OpenAI’s Altman insisted in an interview that there is no evidence that AI coding tools are replacing software engineers. “We have badly underestimated how much additional software the world wants,” he said. “AI will make engineers more productive and lower the cost of creating software unlocking huge opportunities for economic growth.”

We expect SAP to deliver 12% growth in 2026 and 13% in 2027, with many years of further solid growth. We see the contribution from AI-related revenues remaining relatively small in the short term but becoming more instrumental to growth over 2028-2030.

The recent setback offers a compelling entry point with an average price target of 283 euros.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply