- Charts of the Day

- Posts

- US equity markets ended the week with gains after financials calmed down.

US equity markets ended the week with gains after financials calmed down.

US Stock Futures rise as China trade tensions cool.

Subscribe to receive these charts every morning!

1. Is this bull market still bulletproof?

US stocks powered through the “banking” uncertainty, particularly the Magnificent 7 group, which underpinned the market.

However, if volatility continues to remain elevated, there will be many market participants looking back at recent commentary on the AI valuation bubble for US equities.

UBS says hedge funds have around $46b to sell if the S&P 500 hits the 6,600-6,500 band.

2. Shares of Ray-Ban maker EssilorLuxottica soared after Meta AI glasses drive revenue beat.

"Seeing double," says J.P. Morgan in response to the earnings, referring to the annual double-digit growth in quarterly revenue.

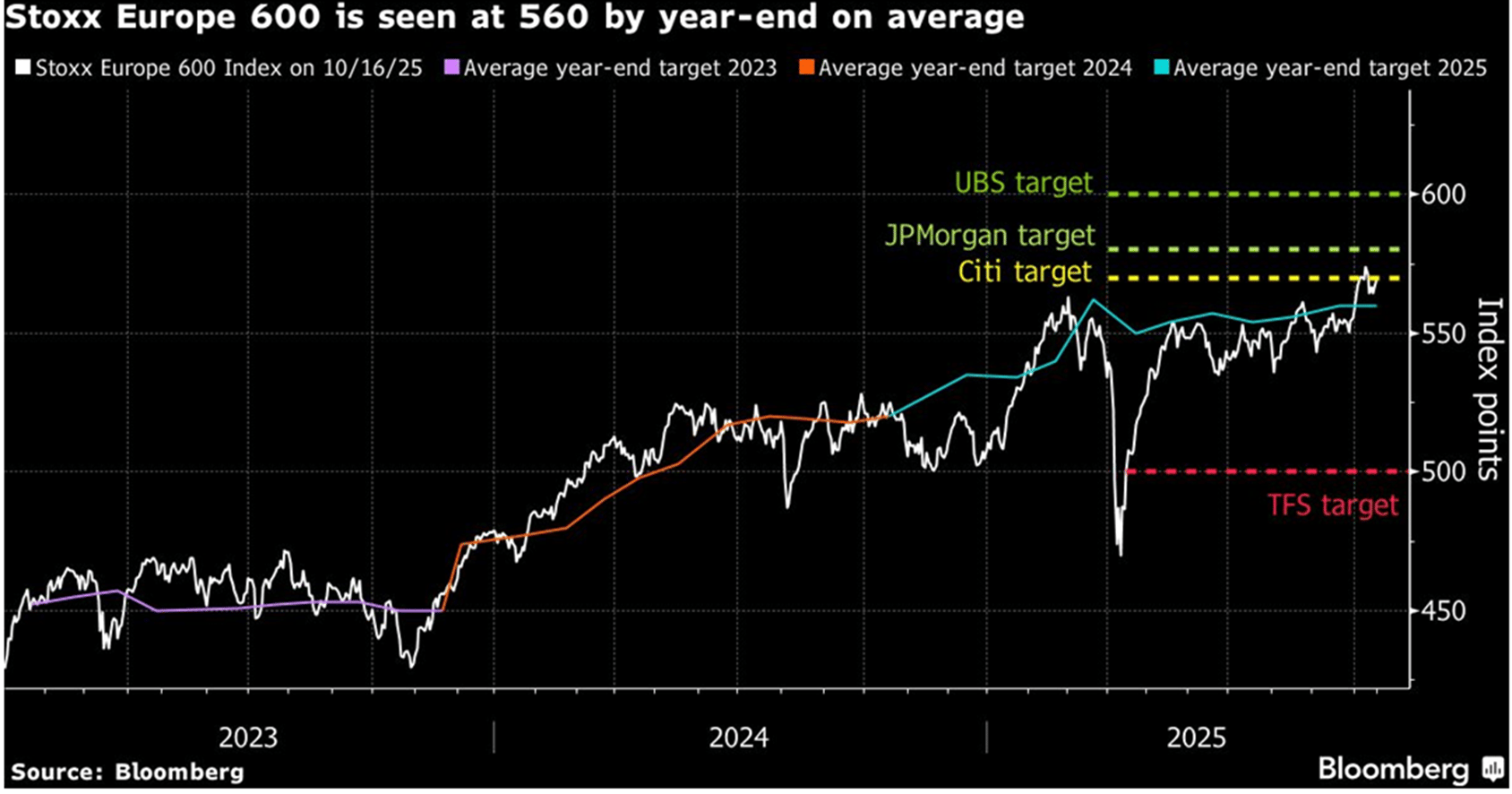

3. “The European stock rally has likely run its course as risks from trade tensions put a cap on further material gains.”

“We see only muted gains for Europe as the latest news out of China combined with the reporting season could be a source of volatility,” Citi strategist Beata Manthey says, adding that she’s more optimistic about the outlook into mid-2026.

“Key to sustained upside will be in earnings delivery.”

Still, there are reasons to be optimistic about equity gains in the short term. Investor positioning is by no means stretched, while equity valuations are roughly in line with a long-term average.

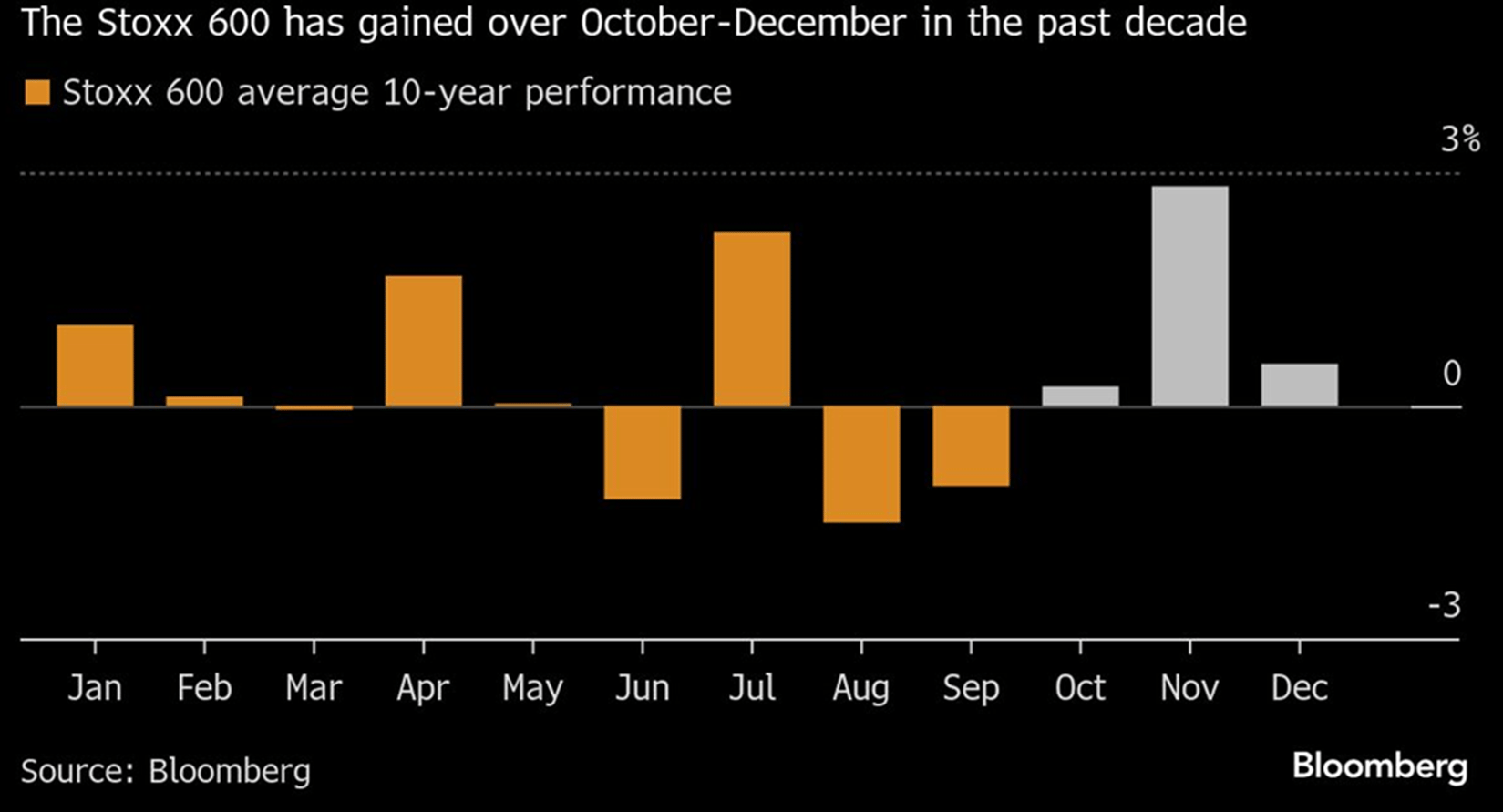

4. The final quarter is statistically good for European equities.

JPMorgan strategist Mislav Matejka upgraded euro-zone stocks earlier this month. While he left his year-end target unchanged at 580 — implying gains of about 2% more — he said he was “happy to take advantage” of sideways trading in regional stocks. “We are more optimistic on 2026 as some fiscal stimulus and still-accommodative monetary policy may support European equity indexes.”

Seasonal trends bode well for a year-end rally.

Data compiled by Bloomberg show the Stoxx 600 has gained an average 3.6% in the final three months of the year, its strongest quarterly performance over the past decade.

5. China’s restrictions on synthetic diamonds.

Last week, China placed export controls on a wide range of rare earths and industrial inputs.

But Beijing’s also restricted industrial-grade synthetic diamonds used in chip fabrication and precision manufacturing.

They can be important for wafer-slicing saws, polishing tools, and lithography optics, where extreme hardness and heat resistance are critical. Without them, producing advanced semiconductors and other high-tech components becomes significantly more difficult.

Also, diamonds don’t just have to make semiconductors — they could one day become them. A semiconductor is a material whose ability to conduct electricity sits between a conductor and an insulator (hence the name ‘semi’ in ‘semiconductor’), allowing precise control over electrical current. Diamond’s wide band gap and exceptional thermal conductivity make it theoretically better than silicon for handling high voltages and extreme heat.

China is the world leader in synthetic diamond production with roughly half of global output. It also dominates the manufacturing of key machinery such as high-pressure, high-temperature (HPHT) presses. This mix of capacity and machinery could let China squeeze parts of the chip supply chain.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply