- Charts of the Day

- Posts

- US inflation boosts sentiment.

US inflation boosts sentiment.

Federal Reserve expected to deliver at least two rate cuts this year.

1. US CPI annual inflation at 2.4%, below expectations of 2.5%.

The news boosted bets that the Federal Reserve will deliver at least two rate cuts this year.

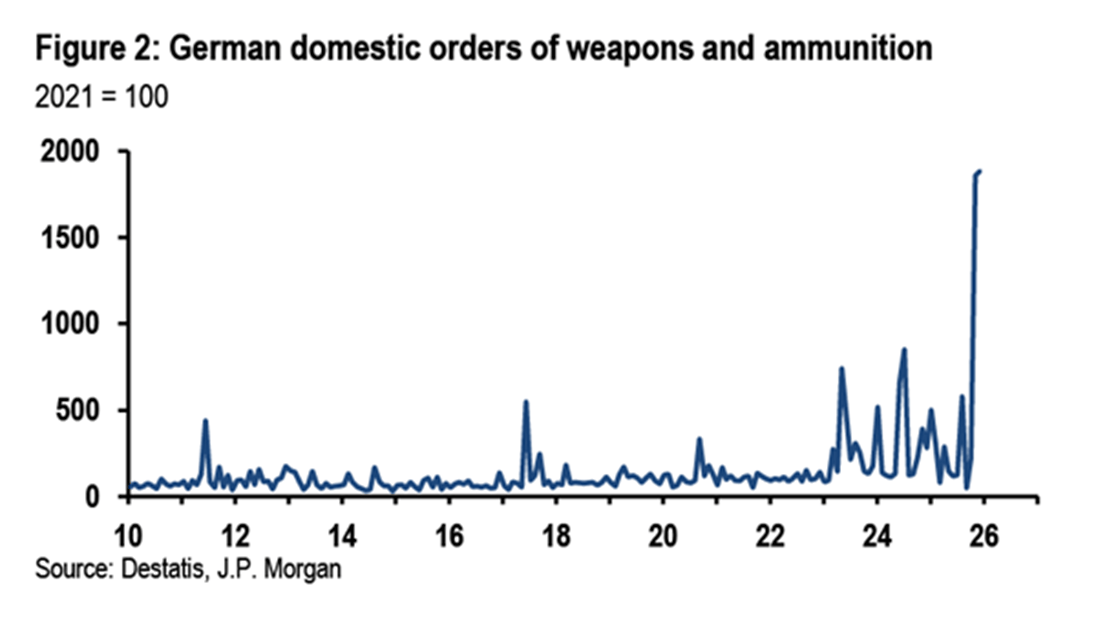

2. The fiscal boost in Germany is starting to gather pace.

Expansionary German fiscal policy is a key part of the Euro area growth forecast and German industrial orders are already seeing a boost from defense.

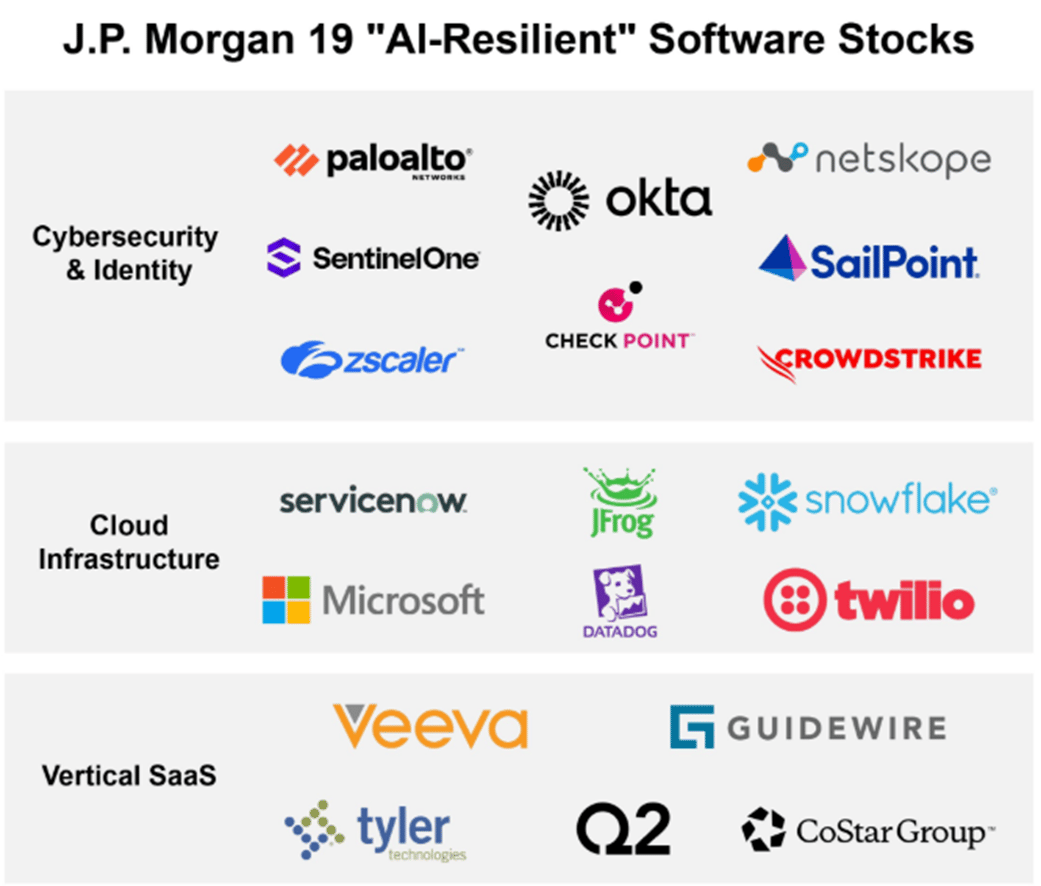

3. AI won’t disrupt all software. Some will benefit.

J.P. Morgan highlighted 19 “AI-Resilient” names positioned to benefit as AI scales.

Security. Infrastructure. Vertical data.

4. One of the beneficiaries of AI euphoria is China’s export.

US tech investment has boosted two key Chinese export categories — chips and power equipment.

Power equipment includes electrical swicthes, batteries, transformers, wires and cables.

China’s chip exports, though largely low-end, rose 27% in 2025 to $202 billion, making chips the country’s third-largest export after phones and computers.

As long as the AI boom keeps China’s exports humming, Beijing can afford to tolerate weak consumption.

5. Asia (ex China) industrial production growth has accelerated to 5.1%Y in Dec-25, the fastest pace since Jun-22.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply