- Charts of the Day

- Posts

- US jobless rate increased to 4.6%, the highest since 2021.

US jobless rate increased to 4.6%, the highest since 2021.

OpenAI to raise another $10 Billion from Amazon and use its AI chips.

1. Cash allocations at record lows.

Cash allocations have fallen to record low levels in Bank of America's latest fund manager survey, with relatively few investors expecting an economic or markets downturn in 2026.

2. Powell said the unemployment rate was now more important than payroll numbers.

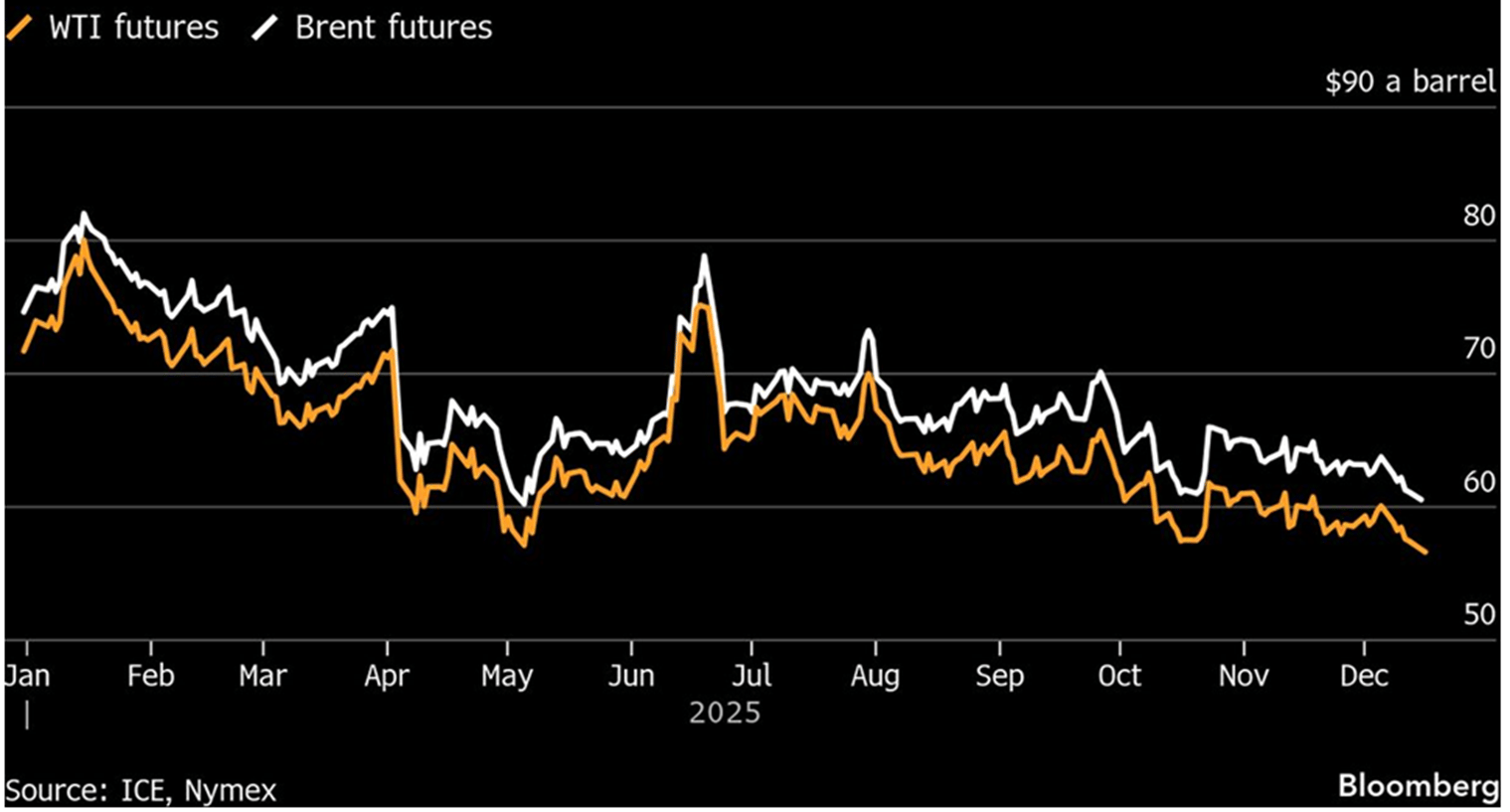

3. The prospect of a possible end to Russia’s war in Ukraine is sending oil lower.

US Oil dropped below $55 a barrel for first time since 2021. The Energy sector was the worst performing sector in the S&P 500 at -2%.

4. NATO expenditure on defense. (in billions)

5. “The UK is on its way to becoming a socialist paradise.

The only problem is that under socialism, everyone is equally poor, not equally wealthy.”

6. “UBS Is a highly attractive proposition”.

Bank of America upgrades the Swiss bank to “buy” with a price target of 48 CHF, adds to Europe 1 list of top ideas and names it among top 25 stocks for 2026.

“UBS is set to grow EPS at the fastest sequential pace of any bank globally”.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply